挥别一次性塑料袋 美国华盛顿州全面使用环保袋

中央社

10/01/2021

美国华盛顿州禁用一次性塑料袋的命令今天生效。消费者自行携带和重复使用的袋子与种类没有限制,商家提供的塑料袋和大型纸袋则必须是环保材质,且要顾客买单。

从今天开始,在华盛顿州购物,由商家提供的大型纸袋和环保厚塑料袋必须对消费者收取8分美元的费用。不管纸袋或塑料袋都必须以环保材质制成。

其中,塑料袋要具备一定的厚度。2022年7月1日之前,塑料袋的制材至少得含20%环保再生材质。明年7月之后,塑料袋必须有40%回收材质的成分。至于纸袋必须以40%的环保材质制成。不管塑料袋或纸袋都得标明「可重复使用」。

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

华盛顿州于2020年立法通过全州禁用一次性塑料袋的命令。运行面因为新冠病毒疫情推迟。华州生态部表示,这项禁令将减少污染,并提高环保物品的使用率。

华盛顿州的城市如西雅图、奥林匹亚(Olympia)、塔科马(Tacoma)和艾德蒙兹(Edmonds)等城市对禁用非环保塑料袋的命令早已提前开跑。今起实施的州级命令,位阶高于地方命令,相关政策与收费表准适用华州各地。

所有零售店、市场、便利商店、餐厅、临时的店铺和活动摊位,只要有食物或商品贩售的地方都必须遵守相关规定。

不在此限的是散装消费性产品、生鲜农产品、冷冻食物、肉类、鲜花和盆栽、熟食、烘培点心和处方药的包装袋。另外,报纸袋、信封、干洗衣物袋、垃圾袋和宠物垃圾袋等免除于这项禁令。商家可免费提供小型纸袋给消费者,小纸袋也必须由环保材质制成。

从今天开始,任何人都可以检举华州不守塑料袋禁令的商家,重复违规的业者将面临250美元罚款。华州政府允许商家把既有的塑料袋存货消耗完,前提是提供10月1日之前的发票凭证。

为鼓励民众自行携带环保塑料袋和纸袋,商家不能代为支付相关费用,而要由用户付费。

Goodbye, single-use plastic bags. Here’s what you need to know about Washington’s ban

By Amanda Zhou

10/01/2021

Get your canvas tote bags ready. Washington state’s ban on single-use plastic bags takes effect Friday.

Certain carryout bags will be permitted, such as large paper bags and thick reusable plastic bags, but will cost customers an 8-cent fee per bag. The bags must be made with a certain amount of recycled content, and green or brown compostable bags are also allowed for use.

The Washington Legislature passed the statewide ban during the 2020 legislative session, but its implementation was delayed due to the pandemic. The Department of Ecology says the ban will reduce contamination in recycling and compost systems and promote the use of recycled goods.

The ban is intended to encourage customers to bring and reuse their own bags when shopping.

Local bans are already in place in cities in Washington, including Seattle, Olympia, Tacoma and Edmonds. The new state requirements will override local laws, to create consistent policy and fees across the state.

Who is banned from using single-use plastic bags?

All retail, grocery and convenience stores as well as restaurants, temporary stores or events where food or goods are sold.

There are exceptions for consumer bulk items, produce, frozen food, meat, flowers and potted plants, prepared food or bakery items and prescription drugs.

Also exempt from the plastic ban: newspaper bags, envelopes, door hangers, dry-cleaning bags and bags sold in packages for food storage, garbage or pet waste. Small paper bags can also be supplied without a cost to the customer, though they also must be made up of a certain amount of recycled contents.

The plastic bag ban also does not apply to food banks and customers purchasing items using a food assistance program.

How is this being enforced?

The Department of Ecology said it will have a reporting form starting Oct. 1, where any person can report a business. The department says it intends to seek voluntary compliance, though businesses that repeatedly violate the rule may face a $250 fine.

Businesses are allowed to use up their existing inventories of plastic bags, though the Department of Ecology says they may need to provide invoices to prove they were purchased before Oct. 1.

Where does the money go?

Businesses will collect and keep bag fees to cover the cost of providing the bags. The charge is taxable and businesses are not allow to cover the cost of the bags for the customer. Businesses are allowed to charge more than 8 cents per bag.

Are there requirements for the bags that are allowed?

Yes. Thick plastic bags must be a certain thickness and contain a minimum of 20% post-consumer recycled content until July 1, 2022. After that date, the bags must be made from 40% recycled content.

Paper bags must be made of 40% recycled content. Both plastic and paper bags must be labeled as “reusable.”

Compostable film bags must meet the requirements outlined by the state Legislature. However, the Department of Ecology does not recommend the use of compostable bags since most facilities do not accept them.

There are no restrictions on what kinds of bags customers can bring and reuse.

Fairfax County board passes 5-cent tax on plastic shopping bags

InsideNoVa Staff

9/16/2021

The Fairfax County Board of Supervisors this week voted 9-1 to approve a 5-cent tax on plastic bags at grocery stores, convenience stores and drugstores.

The tax will go into effect Jan. 1, 2022.

Supervisor Pat Herrity of the Springfield district cast the only dissenting vote.

The Virginia General Assembly approved legislation in 2020 allowing localities to impose a 5-cent tax on disposable plastic bags at grocery, convenience and drug stores, with some exceptions.

The state code requires retailers to collect the tax proceeds in a similar manner to sales and meals taxes. Through Dec. 31, 2022, retailers can keep 2 cents from the tax collected on each bag, with the retailers’ share dropping to 1 cent starting Jan. 1, 2023.

Revenues from such taxes must be for specific activities like environmental cleanup, pollution mitigation and providing reusable bags to people on federal food support programs, according to a staff report to the Fairfax County Board of Supervisors prepared by Fairfax County Executive Bryan Hill.

The Virginia Department of Taxation created a fiscal impact statement with the legislation that said the tax could generate between $20.8 million and $24.9 million in revenue statewide based on similar taxes in Montgomery County, Md., and Washington, D.C.

Hill’s report said that Montgomery County, which has about 1 million residents, received about $2.61 million in revenue in 2017. Hill’s report noted that the revenue would decline over time as customers start using reusable bags, although it will take several years.

He wrote that it would be difficult to estimate potential revenues because Virginia’s legislation applies only to certain retailers while Montgomery County’s applies to virtually all and doesn’t have certain exemptions.

Earlier this year, Prince William County supervisors began drafting a similar plastic bag tax but decided to wait until after the fiscal 2022 budget was passed.

Fairfax County, Vienna Real Estate Taxes Over Last 40 Years

By David Swink

7/10/2021

This FCTA board member has lived in the same southwest Vienna rambler since Dec 1975 — with no improvements made which would alter its accessed value for tax purposes. So my home can serve as a baseline for judging the actual growth of real estate taxes in both Fairfax County and Town of Vienna for the period from 1976 onward.

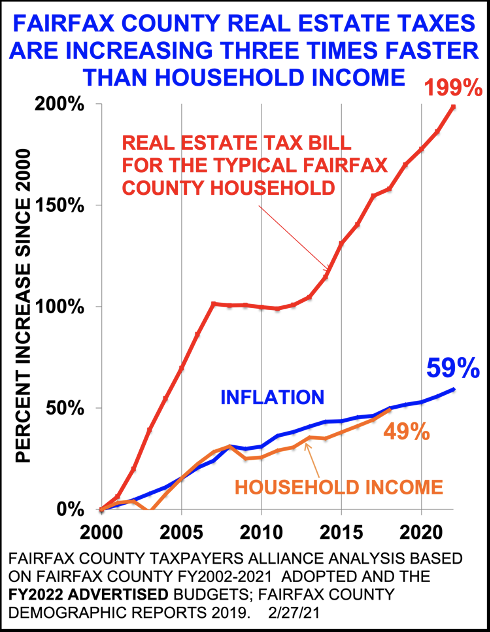

We’re all familiar with FCTA’s graph of Fairfax County real estate tax increases since FY2000. But here is raw data going back another 25 years — in actual dollars (not noting inflation).

A column is provided showing the County real estate tax percent increase from the previous year. Another column shows Vienna’s real estate tax as a percentage of the county’s, to see if Vienna’s numbers track with those of the county. So what does one notice? Even without a graph, one can deduce the following:

- Both Fairfax County and Vienna taxes “took off” after year 2000, leveled during the Great Recession, and are now back on full throttle.

- The Vienna percentage is fairly consistently in the low-to-mid 20’s, and thus seems more tied to county increases than to actual need.

- Oddly, the raw tax increase (not adjusted for inflation) from 1976 to 2013 is precisely a factor of 6.18 for both the county and Vienna.

BOS Chairman Year Fx Co Tax Yr-Yr Vienna Tax Vn/Fx

Jack Herrity-R 1976 $821.72 - $170.01 20.69%

" 1977 $857.91 +4.44% $177.50 20.69%

" 1978 $872.97 +1.76% $175.66 20.12%

" 1979 $884.27 +1.29% $178.00 20.13%

" 1980 $980.98 +10.94% $197.47 20.13%

" 1981 $1077.23 +9.81% $235.42 21.85%

" 1982 $1164.02 +8.06% $261.31 22.45%

" 1983 $1164.02 0 $261.31 22.45%

" 1984 $1217.13 +4.56% $275.10 22.60%

" 1985 $1216.67 -0.04% $288.85 23.74%

" 1986 $1232.69 +1.32% $292.19 23.70%

" 1987 $1354.12 +9.85% $318.01 23.48%

Audrey Moore-D 1988 $1554.41 +14.79% $358.71 23.08%

" 1989 $1752.93 +14.79% $412.45 23.53%

" 1990 $1913.03 +9.13% $482.57 25.23%

" 1991 $1779.11 -7.00% $464.81 26.13%

Tom Davis-R 1992 $1826.46 +2.66% $471.23 25.80%

" 1993 $1824.27 -0.12% $471.23 25.83%

" 1994 $1824.27 0 $471.23 25.83%

Kate Hanley-D 1995 $1886.98 +3.44% $487.43 25.80%

" 1996 $2000.07 +5.99% $487.43 24.37%

" 1997 $1998.44 -0.08% $503.67 25.20%

" 1998 $1998.44 0 $503.67 25.20%

" 1999 $1998.44 0 $503.67 25.20%

" 2000 $2123.17 +6.24% $534.67 25.18%

" 2001 $2441.63 +15.00% $595.04 24.37%

" 2002 $2955.38 +21.04% $695.52 23.53%

" 2003 $3185.20 +7.78% $754.46 23.69%

Gerry Connolly-D 2004 $3413.19 +7.16% $799.73 23.43%

" 2005 $3753.75 +9.98% $825.00 21.98%

" 2006 $4281.44 +14.07% $894.73 20.90%

" 2007 $4281.44 0 $959.12 22.40%

" 2008 $4425.59 +3.37% $1004.77 22.70%

Sharon Bulova-D 2009 $4396.65 -0.65% $958.76 21.81%

" 2010 $4294.60 -2.32% $950.56 22.13%

" 2011 $4690.11 +9.21% $1045.56 22.29%

" 2012 $4658.44 -0.68% $1029.02 22.09%

" 2013 $5080.52 +9.06% $1051.02 20.69%

" 2014 $5547.46 +9.19% $1139.88 20.55%

" 2015 $5783.11 +4.25% $1165.95 20.16%

" 2016 $6243.39 +7.96% $1212.57 19.42%

" 2017 $6422.76 +2.87% $1244.72 19.38%

" 2018 $6837.56 +6.46% $1299.92 19.01%

" 2019 $6984.07 +2.14% $1327.77 19.01%

Jeff McKay-D 2020 $7159.35 +2.51% $1361.09 19.01%

" 2021 $7452.66 +4.10% $1413.05 18.96%

Numbers for future years will be added to the table as they become available. Also, information such as the political make-up of the Fairfax County Board of Supervisors for each period may be added. Enjoy.

— David Swink, FCTA board member / Updated 2021-07-10