冠病病例激增 好市多再次发出限购通告

文 / 李月霞

9/23/2021

(早报讯)由于供应链延误以及冠状病毒疫情加剧,美国多地消费者恐慌抢购生活用品,会员制连锁集团好市多(Costco)宣布限制一些基本家用产品的购买量。

路透社引述好市多首席财务官理查德·加兰蒂说,公司将限制顾客购买如卫生纸、纸巾、瓶装水和需求量很大的清洁产品等,但他没有说明限购量。

加兰蒂周四(9月23日)在财报后的电话会议上说,公司希望确保商店里有必需品。他说,公司去年发出限购通告是因为清洁用品短缺,但今年尽管供应商库存充足,但运输问题导致它们向商店交货延迟。

疫情致港口拥堵以及劳动力和货运成本上升,集装箱、卡车、司机到各种原材料的短缺令零售连锁店承受压力。好市多已提醒消费者,某些商品可能会延误。

去年,在疫情导致的严格封锁期间,好市多也对关键商品采取限购措施。

Costco brings back purchase limits on toilet paper, cleaning supplies and more

By Melissa Repko

9/24/2021

KEY POINTS

- Costco Chief Financial Officer Richard Galanti said the retailer is bringing back purchase limits on household essentials such as toilet paper, bottled water and cleaning supplies.

- The membership-only warehouse chain said it wants to make sure those items stay on shelves as it copes with supply chain challenges, from shipping delays to truck driver shortages.

- The retailer saw strong demand for home furnishings, sporting goods and jewelry in the fiscal fourth quarter — even selling some rings in the $100,000 range, Galanti said.

Josh Edelson | AFP | Getty Images

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

Costco Chief Financial Officer Richard Galanti said Thursday the company wants to make sure it has essential items at stores, even as shipping delays and truck driver shortages make it hard to keep them on shelves.

During an earnings call, he said the retailer is “putting some [purchase] limitations on key items.” Those include toilet paper, paper towels, bottled water and high-demand cleaning products. He did not specify how many of each item customers will be able to buy.

The new product limits are prompted by a different challenge than the ones in earlier phases of the pandemic, when stores saw unusually high demand for paper products and antibacterial wipes as customers stockpiled those goods.

“A year ago there was a shortage of merchandise,” Galanti said. “Now they’ve got plenty of merchandise but there’s two- or three-week delays on getting it delivered because there’s a limit on short-term changes to trucking and delivery needs of the suppliers, so it really is all over the board.”

The membership-only warehouse chain beat analysts’ expectations on Thursday for the fiscal fourth quarter, which ended Aug. 29. Yet, Galanti said, the pandemic has challenged Costco’s supply chain and increased its costs, as it has at other retailers.

Costco is placing earlier orders to get what it needs, Galanti said. He added the company has chartered three ocean vessels for the next year to transport containers between Asia and the U.S. and Canada. Each ship can carry 800 to 1,000 containers at a time, he said.

As early as August, there had been some social media posts about product limitations for some of its private-label products. This week, the retailer warned some customers that they may see delays when they placed an online order for toilet paper — a household item that has become synonymous with stockpiling. That delay was first reported by Fox Business, which saw it mentioned in a purchase order confirmation email.

Galanti said on Thursday that demand was strong for jewelry, home furnishings, pharmacy and sporting goods during the latest three-month period. He said the retailer — best known for big and bulky — “sold a couple of rings in the $100,000 range.”

Costco’s shares were up less than 1% on Thursday evening. As of the market’s close, the stock had gained 20% this year, bringing its market value to $200.16 billion.

FedEx, UPS rate rises are making online shopping more expensive

FedEx and UPS also have added a series of surcharges and other higher fees

By Paul Ziobro

9/21/2021

Shipping rates are going up faster than they have in nearly a decade, increasing pressure on merchants to raise prices or find other ways to offset higher costs.

FedEx Corp. on Monday said shipping rates would go up an average of 5.9% next year across most of its services, the first time in eight years that it or rival United Parcel Service Inc. has strayed above annual increases of 4.9%.

UPS is expected to release its rate increase for 2022 in the coming weeks. The two carriers have moved in lockstep with their annual price increases since at least 2010, according to Transportation Insight LLC, a supply-chain management and logistics firm.

The move away from a 4.9% annual increase shows how the pricing power has shifted to carriers like FedEx, UPS, and the U.S. Postal Service, which have seen demand for their shipping capacity and home delivery soar during the pandemic. The higher-than-normal rate hike also is a sign of inflation reverberating across the global supply chain.

“The carriers are incredibly bullish and confident that they are holding all the cards and that they have the leverage to squeeze more margin out of their customers than ever before,” said Trevor Outman, co-chief executive of Shipware LLC, a shipping consulting firm.

FedEx and UPS had dropped hints to shippers that the annual rate increase would be higher than before. Previously, some shippers would negotiate clauses into contracts that their annual rate increase would come in around 2.5% to 3%, half of the public rates. In recent weeks some large shippers have received contract renewals that would cap their annual increase at 5%, according to shipping consultants.

FedEx’s new rates will go into effect Jan. 3. They will rise an average of 5.9% for FedEx Express shipments in the U.S. and on FedEx’s Ground and Home Delivery service, which skew more heavily toward e-commerce shipments.

FedEx said the higher rates are due to the “challenging operating environment” and will allow the company to continue to invest in its network, including enhancing service, maintaining its fleet and technology innovations.

Online sellers have already had to cope with price increases during the pandemic. Shortly after lockdowns began last year, both FedEx and UPS approached several large shippers with new contracts that imposed double-digit cost increases through a combination of higher rates and fewer discounts. With capacity tight across all carriers, some either accepted the new terms or tried to switch their business to other carriers.

FedEx and UPS also have added a series of surcharges and other higher fees for items like large packages throughout the pandemic that have further increased shipping costs.

Those include big surcharges during the holiday season, when some shippers could be hit with fees from $1.15 to $6.15 a package if their weekly shipping levels are a certain multiple higher than they were pre-pandemic. As recently as 2017, UPS’s holiday surcharges were just 27 cents on ground packages and rose up to 97 cents for some air shipments.

FedEx on Monday also said it would raise the fuel surcharge it applies to all shipments starting Nov. 1. The company said the tight labor market and shift in shipping volume have required more frequent changes to its network and repositioning of aircraft, vehicles, and other equipment, increasing its total fuel usage.

That follows a recent adjustment by UPS to its fuel surcharges that raised the cost for many shippers.

The higher rates come amid new focuses at the major carriers. UPS Chief Executive Carol Tomé is using a mantra of “better, not bigger” across the shipping giant to focus on more profitable shipments instead of shipping more packages. In doing so, larger shippers that have historically won bigger shipping discounts are seeing their rates rise, and UPS is filling its network with more small- and medium-size shippers that have higher profit margins.

FedEx, meanwhile, is pivoting more into shipping e-commerce packages, even after severing ties with Amazon.com Inc. before the pandemic. It plans to spend $7.2 billion on capital expenditures to build out capacity to handle the added volume.

The combination of increased parcel rates, as well as cost pressure from labor and other supply-chain inflation, could lead retailers of all sizes who have counted on online sales for growth to re-evaluate some of their longstanding offerings, according to shipping consultants. Free shipping could go away or the threshold to avoid shipping fees could rise. Costs online and in store could diverge. Some merchants may elect to sell some large items only in-store.

“Something has to change,” said Hannah Testani, CEO of Intelligent Audit, a freight audit, and analytics company. “It’s not feasible for anyone to have the built-in profitability to withstand these cost increases.”

Some shippers are instituting fees to offset rising costs. The online sports merchandise retailer Fanatics Inc. recently added a $1.99 handling fee to help cover some of the warehousing and packaging costs. A Fanatics spokesman declined to comment.

Online sellers may have a hard time abandoning free shipping, though, especially since Amazon continues to set the floor on what shoppers want.

“It’s a real dilemma,” said John Haber, a president of parcel consulting at Transportation Insight, “because you have to compete with Amazon and Amazon is not going to stop offering free shipping.”

Shippers can shift some packages to the U.S. Postal Service, which this year has already installed 61 of a planned 112 new machines to sort packages and improve on last year’s service.

Another strategy includes using more regional carriers like Lasership Inc., Lone Star Overnight Inc., and OnTrac. Since none of them have nationwide coverage, using them could include opening a distribution center closer to their region or have retailers truck packages into the states where regional carriers operate.

调查:全球每两人有一人因冠病大流行而收入减少

文 / 陈慧璋

5/03/2021

(早报讯)研究显示,全世界每两个人就有一人因冠病大流行而收入下降,其中低收入国家的人受失业或削减工时的打击最大。

路透社报道,以美国为基地的民调公司盖洛普(Gallup)对117个国家与地区的30万人进行调查,结果发现,在有工作的参与调查者中,半数人的收入因为疫情而减少,这换算为全球16亿名成年人。

研究人员发表声明说:“以全球占比来看,泰国民众受影响的占比最高(76%),而瑞士民众的占比最低(10%)。

在玻利维亚、缅甸、肯尼亚、乌干达、印度尼西亚、洪都拉斯和厄瓜多尔,超过70%的被调查者说,他们的净收入比冠病大流行暴发前来得少;美国的这一数字降至34%。

调查也发现,全球工人都受到冠病危机的冲击,但对女性的冲击最大,因为从事零售业、旅游业和食品服务业等低薪且不稳定的工作者以女性占大多数。

上周四由国际非营利组织乐施会(Oxfam)进行的另一项研究表明,冠病大流行导致全球女性蒙受了8000亿美元(约1.06万亿新元)的收入损失。

盖洛普的调查还发现,超过一半的受访者说,他们在疫情期间暂时停止了工作或业务,这相当于全球约17亿名成年人。

在印度、津巴布韦、菲律宾、肯尼亚、孟加拉、萨尔瓦多等57个国家中,超过65%的受访者表示,他们已经没有工作好一段时间。

较少受访者表示暂停工作的国家主要都是发达及高收入的国家。

在奥地利、瑞士和德国,只有不到十分之一的参与调查者表示暂时停止工作;美国的这一数字为 39%。

What Collapsed the Middle Class?

By CHARLES HUGH SMITH

02/11/2021

The middle class has already collapsed, but thanks to debt and bubbles, this reality has been temporarily cloaked.

What collapsed the middle class? In many ways the answer echoes an Agatha Christie mystery: rather than there being one guilty party, a number of suspects participated in the collapse of the middle class.

Can we consolidate these dynamics into a few core causal factors? I’ve made the case in the pst few posts that yes, we can: many of these causes are part of a single dynamic, the decapitalization of the middle class and the decay of the ladder of social mobility which enabled tens of millions of workers to transform their wages into productive capital via saving and investment in their own human capital, their own enterprises and assets that earn income.

The Top 10% Is Doing Just Fine, The Middle Class Is Dying on the Vine (2/4/21)

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

The second primary dynamic is the substitution of debt and speculation for earned income and productive capital. As the purchasing power of the bottom 90%’s wages declines, the status quo has substituted debt for income and speculation for investing in productive capital.

Debt and the Demise of the Middle Class (2/9/21)

This dynamic incentivizes debt, speculation and consumption rather than producing, savings and investments in human and productive capital. The source of this incentive structure is the maximization of corporate profits earned by banks loaning money to the middle class and by selling the middle class on superfluous consumption being the signifier of “success” rather than production being the signifier of “success”.

In reality, what counts is agency (control of one’s life, having a voice in governance) and ownership of productive capital. Becoming a debt-serf to buy more stuff and grab a few chips in the speculative casino sacrifices both agency and the acquisition of productive capital. But this sacrifice is oh-so profitable to the financier purveyors of debt and speculative gambles in the casino.

The third dynamic is globalization, and specifically the tyranny of global markets. Global banks and corporations are ideally placed to profit from the arbitrage of labor, environmental regulations, currencies, corruption (dear in some places, cheap in others) and the price of debt and risk.

Wage earners have no such leverage. In effect, all the risks of competition are eliminated for corporate monopolies and cartels while the risks are transferred to workers who face a global race to the bottom in wages, opportunity and income security.

The fourth dynamic is speculative bubbles put many assets out of reach of the bottom 90% who have only their wages and savings. The winners in speculative bubbles are those fortunate enough to have bought homes, bonds, rental properties, land, etc. decades ago when a house could be had for three times median income and bonds paid solid, above-inflation returns.

The bottom 90% attempting to find productive assets at affordable prices now are out of luck. Consider a 900 square foot home built in 1916 in the desirable San Francisco Bay Area community of Albany, CA. The house sold for $135,000 in 1996, 3.8 times the national median household income.

Then Housing Bubble #1 boosted the value to $542,000 in 2004, 12.2 times the national median household income. Housing Bubble #2 has pushed the value to slightly over $1 million, 14.5 times the national median household income. Only those inheriting wealth (or who chose wealthy parents), those earning over $250,000 annually or speculators who just scored big gains in bitcoin or GameStop could afford this very small, modest house.

That’s what speculative bubbles do to the middle class: they leave them behind forever. Those who bought 25 years ago entered the top 10% in wealth due to the bubblicious increase in the value of their home. A few winners in the casino who sold at the top might have edged into the top 10%, but the vast majority of gamblers in the casino cannot compete with the insiders, manipulators and pros, so they lose ground. This is why the bottom 90% collect an insignificant 3% of all income from capital.

Jay Taylor and I discuss The Upcoming Revolt of the Middle Class (22 min)

These four primary dynamics manifest in the following ways. Each one helps generate a two-tier Neofeudal Economy of a Financial Aristocracy and its top 9.9% technocrat class who own virtually all the productive capital and the bottom 90%, a disenfranchized ALICE (assets limited, income constrained, employed) workforce.

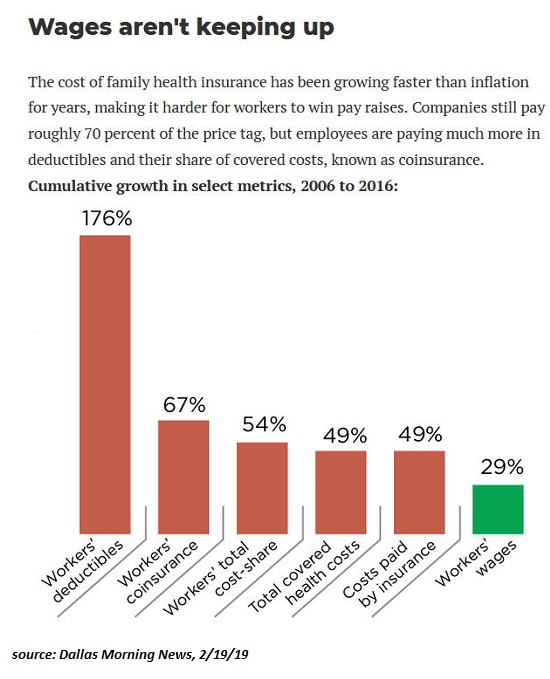

1. The shifting of pension and healthcare costs and risks from the state and employers to employees. (see chart below)

2. The decline of safe, secure high-yielding investments as central banks have driven savers into risky, crash-prone speculative assets such as stocks and junk bonds.

3. The decline of scarcity value in college diplomas that were once the ticket to middle class security. How Many Slots Are Open in the Upper Middle Class? Not As Many As You Might Think (March 30, 2015).

4. The inexorable rise in big-ticket costs: higher education, healthcare and housing. Even as wages stagnate, these costs continue rising, claiming an ever-larger share of household incomes, leaving less to save/invest.

5. The transition from a stable economy with predictable returns to a financialized boom-and-bust economy that wipes out middle class wealth in the inevitable busts but does not rebuild it in the booms.

6. The regulatory and administrative barriers to self-employment, forcing most of the workforce into wage-slavery and/or dependence on the state. Endangered Species: The Self-Employed Middle Class (May 2015).

7. The rising exposure of the U.S. workforce to highly educated, lower-cost competing workforces in a globalized economy.

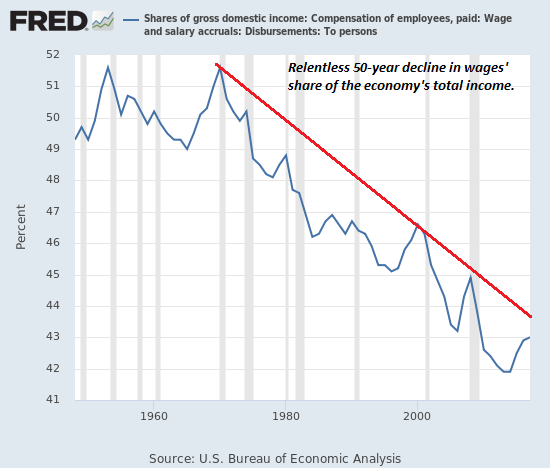

8. The decline of labor’s share of the U.S. economy: the slice of the pie distributed to earned income has been declining for decades.

9. The share of the earned-income slice going to the top 5% is rising.

10. The wealth of the middle class is tied up in the family home, a non-income producing asset prone to the wild swings of housing bubbles and busts. Stagnation Nation: Middle Class Wealth Is Locked Up in Housing and Retirement Funds (October 25, 2017).

The middle class has already collapsed, but thanks to debt and bubbles, this reality has been temporarily cloaked. All bubbles pop and all excessive debt ends in default. When these inevitably occur, the reality can no longer be hidden.

Source: http://charleshughsmith.blogspot.com/2021/02/what-collapsed-middle-class.html

哈佛教授沃尔特:四个要点说明美国的好运即将用尽

文章来源: 星岛日报

01/31/2021

《外交政策》杂志近日刊出美国哈佛大学国际关系教授沃尔特的评论认为,美苏上个世纪冷战的结果是出现了短暂的单极世界,全世界已没有任何强大的竞争对手能挑战美国,可今天还是这样吗?美国人现在还能继续认为世界就是他们的囊中之物吗?不管他们表现得如何不负责任,事情总是会好起来?可能是,但也可能不是。以下为沃尔特的论点,以四个原因解释为什么说美国的好运可能正在耗尽:

首先,美国自建国以来所享有的自由安全已不像过去那么稳固。举个现成的例子:在不到一年的时间里,新冠病毒的致死人数已超过了美国在一战、朝鲜战争和越南战争期间的战死人数总和。而且我们还得知,有一股外国势力(一般认为是俄罗斯)最近非法侵入了大量政府信息系统,其中许多系统还是美国国家安全体系的一部分。

第二大隐忧是中国,这是一个比前苏联更强大的对手。从1776年到上世纪90年代中期,美国人可能收获到了一长串胜利,但自那以后,中国的成绩单更为亮眼。中国的经济规模将很快大幅超过美国,它早已远离毁灭性战争的威胁,其统治精英也相信他们注定会成为本世纪的一大(如果不是唯一的)领导力量,他们的制度模式总体运行良好,他们充分参与关键国际机构的活动中并出现在这个世界的每一个地区。

质疑美国是否会持续走运的第三个依据是,美国人已开始自己伤害自己。伤害清单很长:故意制造出来的两极分化以及由此产生的政治僵局使得美国难以及时采取行动去应对重大问题;对“自由”盲目崇拜以至于数百万美国人认为在疫情期间拒不佩戴口罩不是愚蠢的行为而是英雄壮举等等。

还有气候变化。如果大气层继续升温,那么无论多么有利的地缘政治条件都无法拯救美国。拥有一个庞大的经济体、一群训练有素的科学家和工程师以及一个具有创新能力的私人部门,可能有助于美国以各种方式减轻、适应和调整环境问题带来的压力,但他们所要应对的挑战却每年都会变得更加严峻。

VOICE

America’s History of Luck Is Running Out

The country’s rise was fueled by fortunate circumstances that seem unlikely to last much longer.

BY STEPHEN M. WALT | DECEMBER 23, 2020

The United States is the luckiest country in modern history. It began as a set of marginal European outposts, separated from the settlers’ home countries by a difficult sea voyage. When the colonies gained independence, they were weak, poor, and fractious. But in less than a century and a half, those 13 original colonies had expanded across North America, survived a civil war, driven other great powers from the Western Hemisphere, and created the world’s largest and most dynamic economy. That ascent didn’t stop until the end of the 20th century, when victory in the Cold War left the United States alone at the pinnacle of power. For a little while.

Americans like to attribute this remarkable story to their ancestors’ virtues, the enlightened wisdom of the Founding Fathers, and the intrinsic merits of America’s peculiar blend of liberal democratic capitalism. But in addition to the considerable cruelty displayed toward the native population and the slaves imported from Africa, good fortune played a major role as well.

Americans were fortunate that North America was rich with natural resources and fertile land, traversed by navigable rivers, and had a mostly temperate climate. And from the very beginning, the United States benefited from rivalries among the existing great powers. France backed the American Revolution in order to weaken its British rival, and the new nation doubled its territory when Napoleon needed money to wage war in Europe and was willing to sell the Louisiana Purchase at a bargain price. War in Europe also helped the United States survive its foolish decision to invade Canada in the War of 1812; Britain was too busy defeating Napoleon to turn its full strength against its obnoxious former colonists. The United States gradually attracted more attention as it expanded across the continent and took Texas, New Mexico, Arizona, and California from Mexico, but the European powers spent most of the time competing with each other and for the most part left the United States alone. By 1900, British concerns about a rising Germany led them to abandon their territorial claims in the Pacific Northwest and South America and appease the United States. And at that moment, the Monroe Doctrine of 1823 became a reality.

Indeed, no other great power has enjoyed the so-called free security that America has possessed since its founding. Apart from Britain, every other major power has been invaded at least once in the past 200 years, and several of them have been conquered and at least temporarily occupied. Even Britain lost some 50,000 civilians to German bombings during World War II. Foreign troops last occupied U.S. soil during the War of 1812, and the continental United States was effectively unscathed during the two world wars that decimated Europe and Asia during the 20th century. That free security also permitted the United States to be the last major power to enter both wars, to suffer the fewest losses, and to emerge in a dominant position when the fighting stopped.

To be sure, U.S. leaders also made some smart decisions that took advantage of these lucky breaks. They adopted a constitution that privileged individual freedom and spurred the creation of a boisterous capitalist economy. They opened the continent to immigrants from all over the world and managed to contain the frictions that waves of immigrants occasioned. And while the shameful legacy of slavery continues to blight the American experience, the North’s victory in the Civil War prevented a permanent division of the continent and allowed the reunited country to reach its full power potential.

Since becoming a great power, the United States has also been fortunate in its choice of enemies. Imperial Germany was a daunting military power, but its armed forces had been depleted by the time the American Expeditionary Force arrived in 1918. The Nazi Wehrmacht was even more capable, but Adolf Hitler was an incompetent strategist, and the Soviet Union did most of the work to defeat Germany anyway. Imperial Japan’s economy was roughly a fifth the size of America’s in 1941, its wartime leadership was deeply divided, and it already had thousands of troops bogged down fighting in China. World War II in the Pacific was hardly a cakewalk, but the outcome was not in doubt once the United States mobilized for war.

The Soviet Union was by far America’s most formidable adversary, but the deck was still heavily stacked in America’s favor. The Soviet economy was significantly smaller, its allies were much weaker and less reliable, and it faced serious rivals on several frontiers while America sat unthreatened in the Western Hemisphere. The Soviet command economy was a wonderland of waste and inefficiency, and Soviet leaders had to devote a much higher percentage of GDP to defense just to keep the United States in sight. Mikhail Gorbachev’s belated efforts to reform the system failed, and the Soviet Union collapsed not with a bang but with a whimper.

The result was a brief unipolar moment when the United States faced no serious rivals and both politicians and pundits convinced themselves that America had found the magic formula for success in an increasingly globalized world. The hubris of the 1990s was to be expected, perhaps: No other country could claim such a long and mostly unbroken run of success, where ill fortune never seemed to hold the country back for long.

Is this still the case today? Can Americans continue to assume that the world is their oyster and that things will always turn out right no matter how irresponsibly they seem to behave?

Maybe, but maybe not. Here are four reasons why the United States’ luck just might be running out.

First of all, the free security that the nation has known since its founding is not quite as profound as it used to be. Don’t get me wrong: Having no serious enemies nearby is still a considerable benefit, and those two vast oceanic moats still protect the United States from a fair number of potential problems. The Pentagon is formally the “Defense Department,” but America’s armed forces don’t spend much time or money defending U.S. soil directly. Instead, they go into harm’s way in order to try to shape political conditions in a host of faraway places. Why can they do that? Because Americans don’t have to worry about an invasion from Canada or Mexico—or anybody else.

Unfortunately, 2020 has given us a grim reminder that the protection the United States once enjoyed is not as ironclad as it once was. Case in point: In less than a year, the coronavirus has killed more Americans than World War I, the Korean War, and the Vietnam War combined. As I write this, the daily death toll in the United States is larger than the number of Americans killed on 9/11. Distance still matters, but it does not protect against every danger.

We also learned last week that a foreign power (generally believed to be Russia) has hacked into a vast array of government computer systems, including many that are part of the U.S. national security establishment. The full extent of the damage is still unknown, but the incident illustrates another vulnerability that distance cannot diminish. The United States is still fortunate to be located where it is, but that advantage is not as great as it once was.

The second cause for concern is China, which is a far more formidable rival than the Soviet Union ever was. Americans may have racked up a long winning streak from 1776 to the mid-1990s, but China boasts a much better record since then. China’s economy will soon be substantially larger than that of the United States, it has stayed out of ruinous wars, its ruling elites believe they are destined to be a (if not the) leading power in this century, their model of single-party state capitalism has generally worked well, and they are fully engaged in key international institutions and in every region in the world. While the Trump administration has been busy flirting with various forms of protectionism, China has been negotiating and signing new trade and investment deals. Beijing’s mishandling of the coronavirus outbreak allowed it to spread abroad, but its subsequent response (and the cooperation of the population) has kept its own death toll below a reported 5,000 lives (in a country of 1.4 billion people). As a result, the Chinese economy is back open for business. The United States had more time to prepare for the pandemic, but the number of dead is well over 300,000, and the U.S. economy is still devastated by lockdowns and other pandemic-related restrictions.

The challenge China poses could be overstated. China’s per capita income is still significantly lower than America’s, and its new power surplus (i.e., the amount of wealth that can be mobilized to shape events elsewhere once domestic needs are met) is smaller. Its splashy Belt and Road Initiative hasn’t gone nearly as well as Xi Jinping hoped, and its recent embrace of belligerent “wolf warrior” diplomacy and its heavy-handed approach toward dissidents, trading partners, and its Uighur minority have sparked growing concerns about China’s long-term intentions. Even so, only an incurable optimist would assume that China will fall by the wayside as readily as America’s earlier rivals did.

A third reason to wonder about the United States’ continued good fortune is the series of wounds Americans decided to inflict on themselves. The list is long: the ; the deliberately manufactured polarization and the resulting gridlock that makes timely action on vital issues difficult to impossible; the fetishizing of “liberty” to the point that millions of Americans think refusing to wear a mask in the middle of a pandemic is not stupid but heroic; the enduring public prominence of a phalanx of liars, charlatans, and trolls who have built lucrative careers spewing a toxic blend of falsehoods and hatred; the pervasive influence of well-funded lobbying organizations whose commitment to truth is paper-thin; the distorting impact of money in U.S. politics and a ramshackle electoral system that increasingly enshrines minority rule; and a foreign-policy elite that is largely free from accountability and seems incapable of learning from past mistakes. I could go on, but you get the idea.

And then there’s climate change. The atmosphere doesn’t care what you or I happen to think about this problem; it’s going to follow the laws of physics and chemistry no matter what we choose to believe. Humans are free to deny the reality of climate change, but the planet isn’t paying attention. Favorable geopolitics won’t rescue the United States if the atmosphere keeps heating up (though some other countries will face even greater hardships), and having big-deck aircraft carriers, sophisticated ballistic missiles, state-of-the-art anti-submarine warfare or cyberwarfare capabilities, and the other trappings of a modern great power won’t help on this front either. A large economy, well-trained scientists and engineers, and an innovative private sector may help the country mitigate, adapt, and adjust in various ways, but the challenges they will have to address grow ever more daunting each year. When you marry what is happening to the planet to the political dysfunctions discussed above, it’s easy to imagine how the United States’ long run of good fortune could come to a sad end in a generation or two.

Am I being too gloomy? I hope so. The United States retains many strengths—especially in science and technology—and its potential rivals face serious problems of their own. A return to the unchecked primacy of the 1990s is not in the cards, but intelligent reforms could go a long way to preserving the security and prosperity of the country along with its core political values. The imminent departure of the Worst President Ever will surely help.

Branch Rickey famously remarked that “luck is the residue of design.” Americans should no longer assume that success is simply their birthright or that Otto von Bismarck was right when he reportedly quipped that there is “special providence for fools, drunkards, and the United States of America.” If Americans want to enjoy a future as favorable as their past, it will take a willingness to work together that has gone missing for a couple of decades. If they can’t bring it back, the United States’ long run of luck is likely to come to an end.

Stephen M. Walt is the Robert and Renée Belfer professor of international relations at Harvard University.

Source: https://foreignpolicy.com/2020/12/23/americas-history-of-luck-is-running-out/