美国人平均年薪多少?华顿商学院教授:学生普遍高估

世界新闻网

01/21/2022

一般美国人平均年薪大概有多少?宾州大学华顿商学院(Wharton School at the University of Pennsylvania)法律研究暨商业道德教授妮娜‧史托明格尔(Nina Strohminger)指出,拿这个问题询问学生,结果有25%说美国人平均年薪应有超过六位数价码,一名学生甚至回答「80万元」,但实际数字为4万5000元左右。对于学生的理解与真实状况出现落差,她在推特发文写道:「真不知道该如何看待。」

史托明格尔19日在推特发文写道,华顿商学院学生对于一般美国民众年薪多少普遍高估,获得网友热烈回荡,成为推特热门话题。史托明格尔推文获得留言超过9600则,21万余网友按赞。哈佛大学(Harvard University)经济教授史蒂芬妮‧斯坦契瓦(Stefanie Stantcheva)便回应表示:「低收入民众觉得别人全是低收入,富人认为其他人也都很有钱。」

柏克莱加大(University of California-Berkeley)劳工研究与教育中心(Center for Labor Research and Education)主任贾克布斯(Ken Jacobs)接受华盛顿邮报专访时说,估算一般民众财务状况时,许多人通常以接近自身经验的角度思考,而不是基于现实。

贾克布斯:「年薪20万或10万元被视为普通薪资,这个想法满奇怪的,因为如此数字高估满多。」

华盛顿邮报报导,华顿商学院每学年学费约8万元,而学校座落的费城西部地区,当地居民平均年收入约3万4000元。

根据社会安全局(Social Security Administration,SSA)统计,去年美国民众平均年薪为5万3383元,年薪中位数则为3万4612元。

劳工部统计显示,2021年第四季美国劳工周薪中位数为1010元,换算大约等同年薪5万2520元。

华盛顿邮报分析,中产阶级(middle-class)在美国应该如何定义,近年来受到舆论热议,绝大多数民众自认属于中产阶级,但许多民众却说不出中产阶级的如何界定。

华盛顿邮报2017年报导指出,中产阶级家庭年收入为3万5000元至12万2500元之间。报导中写道,年薪10万元仍被列入中产阶级,但已经属于非常极端,「75%美国家庭年收入低于这个水平」。

「公职免学贷」计划修改 7万人受惠、减免近50亿元

世界新闻网

01/20/2022

免除部分美国人背负的高额学生贷款是拜登总统的主要政策之一;教育部20日宣布,「公职服务学贷减免」计划(Public Service Forgiveness Loan)修改后,约7万人的近50亿元学贷可望免除,最终将有55万人受益。

公职服务学贷减免计划是2007年提出,宗旨是吸引学生担任教师、警察、消防员、军人等公共服务工作,只要工作期间定期偿还,学贷十年后即可免除;但计划自运行以来,几乎没有任何人的学贷被联邦政府豁免。

教育部去年10月修改了免除学贷的标准,当时全国130万人试图通过这一计划豁免学贷;教育部表示,标准修改后,初期即有2万2000人可立即免掉学贷,2万7000人只要证明从事符合要求的工作也可免除,预计7万人将有资格免掉近50亿元的学贷。

教育部副部长卡瓦尔(James Kvaal)表示:「在公共部门供职十年的人,包括教师、护士、急救人员和军人等许多公职人员,都能得到我们的支持和依赖公职服务学贷减免计划,尤其是在疫情时期。如今拜登政府履职一年,对他们的支持将继续。」

拜登总统面临要求他利用行政权豁免4300万人联邦学贷的强烈呼声,他竞选时承诺每人豁免1万元学贷,如今却表示学贷豁免权属于国会;拜登19日在执政周年的记者会上被问到如何取消学贷时没有回答,但拜登政府将疫情期间暂停偿还学贷的期限延至5月1日。

学贷豁免计划是鼓励大学毕业生不受私营部门的高薪诱惑,而到公共部门就职,作为交换条件,联邦政府十年后将免除他们的学贷。

学贷减免计划貌似简单但运行复杂,对豁免资格的要求严格,多数人因为借贷的种类不符合规定而不能参加;许多人是10年后申请豁免时才发现不符资格,但又没有其他选择,只好重新制定偿还计划。

拜登上任以来,教育部已豁免67万5000人约150亿元的学贷,均为通过扩大运行各项债务豁免计划;教育部修改的「公职服务贷款减免」计划,是扩大运行学贷豁免计划的一部分。

You Might Finally Qualify for Student Loan Forgiveness

New Public Service Loan Forgiveness rules mean hundreds of thousands of borrowers could have their loans forgiven faster than expected.

By Mike Winters

10/07/2021

For years, the Public Service Loan Forgiveness (PSLF) program has struggled to actually forgive student loan debt. But yesterday, the Biden administration announced changes that will immediately erase student loan debt for roughly 22,000 borrowers—and will help hundreds of thousands more reach loan forgiveness sooner than expected. Here’s how the changes might affect your student loans.

Eased requirements for the PSLF program

In 2007, Congress created the federal student loan forgiveness program to encourage people to work in federal and local governments, public schools, and the military. In exchange for about 10 years of full-time service (or 120 student loan payments), the program forgives the remaining balance on federal loans—or at least, that’s how it’s supposed to work. However, according to a 2019 Government Accountability Office (GAO) report, this happens rarely, as it found only 1% of applicants were deemed eligible for student loan forgiveness.

Part of the problem is that the program has only been available to borrowers who have Direct Loans, a specific type of student loan managed by the federal government. One option has been to consolidate existing student loans into a Direct Loan, but that just set back borrowers even further, as previous payments for other loans don’t count towards the 120 payments needed to forgive the outstanding balance.

To that end, the Education Department is now offering a limited waiver that “allows all payments by student borrowers to count toward PSLF, regardless of loan program or payment plan.” All borrowers who currently have FFEL, Perkins, or other non-Direct Loans, can get this benefit of this limited waiver if they apply to consolidate into the Direct Loan program and submit a PSLF form by Oct. 31, 2022. Additionally, members of the military will be able to count deferment and forbearance while on active duty toward the loan forgiveness. The Education Department estimates this will help 550,000 student loan borrowers reach loan forgiveness sooner than expected.

How to apply for the PSLF waiver

The Education Department says it will be contacting borrowers and encouraging them to consolidate their loans or apply for the program by Oct. 31, 2022. To apply for the waiver, start by visiting StudentAid.gov/PSLFWaiver.

SNAP benefits increasing statewide

By Johan Sheridan

10/01/2021

ALBANY, N.Y. (NEWS10) — New Yorkers in the Supplemental Nutrition Assistance Program (SNAP) will reportedly see an increase of about $36 per family member starting next month.

According to the office of Gov. Kathy Hochul, all New Yorkers receiving SNAP benefits will get more money because of a federal cost adjustment. The new regular monthly amount attempts to better provide low-income individuals and families access to healthy foods.

“Now more than ever, New Yorkers are seeing their money for food stretched thinner and thinner, which in turn forces them into making food choices that are cheaper, but far less nutritious,” Hochul said in a statement. “This long-overdue increase in benefits will give households across New York State the purchasing power to buy nutritious foods, which in turn will ultimately result in healthier outcomes.”

In New York, the maximum benefit for a family of four will grow from $680 to $835. Nearly 3 million households throughout the state were in SNAP in July.

Hochul’s office says the boost in benefits brings in over $1.4 billion in federal funding to the state. According to federal estimates, every dollar of SNAP benefits spent results in about $1.59 in economic activity.

Last year, the USDA reevaluated the plan used to calculate SNAP benefits, resulting in the first cost adjustment in more than 45 years. The new plan also altered how eligibility is determined and the level of benefits received. The shift is meant to reflect changing dynamics in food sales and shoppers’ priorities over five decades.

The USDA evaluated current food prices, typically American diets, and nutritional value. The agency concluded that the cost of healthy, practical, and affordable food is 21% higher than SNAP benefits offered. Hochul’s office points out that studies consistently show that food benefit levels are too low to provide for a realistic, healthy diet, even with households adding funds to the pot.

USDA is permanently boosting food stamp benefits

By ASHRAF KHALIL and JOSH BOAK,

Associated Press

WASHINGTON — President Joe Biden’s administration has approved a significant and permanent increase in the levels of food aid available to needy families — the largest single increase in the program’s history.

Starting in October, average benefits for food stamps — officially known as the Supplemental Nutrition Assistance Program, or SNAP — will rise more than 25 percent above pre-pandemic levels. The increased assistance will be available indefinitely to all 42 million SNAP beneficiaries.

The increase coincides with the end of a 15 percent boost in SNAP benefits that was ordered as a pandemic protection measure. That benefit expires at the end of September.

Agriculture Secretary Tom Vilsack said that with the change, the U.S. “will do a better job of providing healthy food for low-income families.”

The aid boost is being packaged a major revision to the USDA’s Thrifty Food Plan, which estimates the cost to purchase groceries for a family of four and guides the way the government calculates benefits. In practical terms, the average monthly per-person benefits for qualified recipients will rise from $121 to $157.

The increase is projected to cost an additional $20 billion per year, but it won’t have to be approved by Congress. A farm law passed in 2018 by the then-GOP led Congress and signed by former President Donald Trump already directed the department to reassess the Thrifty Food Plan.

“Whether you’re a Republican or a Democrat, I think there’s a shared understanding of the importance of this program,” Vilsack said in a conference call with reporters.

The increase is part of a multi-pronged Biden administration effort to strengthen the country’s social safety net. Poverty and food security activists maintain that longstanding inadequacies were laid bare by the COVID-19 pandemic, presenting an opportunity to make generational improvements that reach beyond the current public health crisis.

Activists say the previous levels of pre-pandemic SNAP assistance simply weren’t enough, forcing many households to choose cheaper, less nutritious options or simply go hungry as the funds ran low toward the end of the month.

Vilsack said the increased funding will allow families to “be able to make healthy choices” all month long.

The changes are not directly connected to the COVID-19 pandemic, but Vilsack said the crisis helped underscore the importance of the food assistance program.

“A lot of people who thought they’d never take part in the SNAP program found themselves in need,” he said. “The pandemic sort of shocked people out of the belief that this was a program for someone else.”

Federal Communications Commission

Emergency Broadband Benefit

The Emergency Broadband Benefit is an FCC program to help families and households struggling to afford internet service during the COVID-19 pandemic. This new benefit will connect eligible households to jobs, critical healthcare services, virtual classrooms, and so much more.

About the Emergency Broadband Benefit

The Emergency Broadband Benefit will provide a discount of up to $50 per month towards broadband service for eligible households and up to $75 per month for households on qualifying Tribal lands. Eligible households can also receive a one-time discount of up to $100 to purchase a laptop, desktop computer, or tablet from participating providers if they contribute more than $10 and less than $50 toward the purchase price.

The Emergency Broadband Benefit is limited to one monthly service discount and one device discount per household.

Who Is Eligible for the Emergency Broadband Benefit Program?

A household is eligible if a member of the household meets one of the criteria below:

- Has an income that is at or below 135% of the Federal Poverty Guidelines or participates in certain assistance programs, such as SNAP, Medicaid, or Lifeline;

- Approved to receive benefits under the free and reduced-price school lunch program or the school breakfast program, including through the USDA Community Eligibility Provision in the 2019-2020 or 2020-2021 school year;

- Received a Federal Pell Grant during the current award year;

- Experienced a substantial loss of income due to job loss or furlough since February 29, 2020 and the household had a total income in 2020 at or below $99,000 for single filers and $198,000 for joint filers; or

- Meets the eligibility criteria for a participating provider’s existing low-income or COVID-19 program.

How to Apply

The online application for the Emergency Broadband Benefit Program is experiencing high demand. We appreciate your patience as we actively work to resolve any connectivity issues users may encounter.

Apply Now

There are three ways for eligible households to apply:

- Contact your preferred participating broadband provider directly to learn about their application process.

- Go to GetEmergencyBroadband.org to apply online and to find participating providers near you.

- Call 833-511-0311 for a mail-in application, and return it along with copies of documents showing proof of eligibility to:

Emergency Broadband Support Center

P.O. Box 7081

London, KY 40742

After receiving an eligibility determination, households can contact their preferred service provider to select an Emergency Broadband Benefit eligible service plan.

Get More Consumer Information

Check out the Broadband Benefit Consumer FAQ for more information about the benefit.

Which Broadband Providers Are Participating in the Emergency Broadband Benefit?

Various broadband providers, including those offering landline and wireless broadband, are participating in the Emergency Broadband Benefit. Find broadband service providers offering the Emergency Broadband Benefit in your state or territory.

Broadband providers can find more information about how to participate here.

Source: https://www.fcc.gov/broadbandbenefit

Evictions During COVID-19: Landlords’ Rights and Options When Tenants Can’t Pay Rent

Tips, resources, and advice for landlords whose tenants aren’t able to pay the rent due to the coronavirus outbreak.

By Ann O’Connell, Attorney

11/01/2020

Many renters are facing financial challenges resulting from coronavirus-related business shut-downs, furloughs, layoffs, and stay-at-home orders. The longer this crisis goes on, the more likely it is that many will not be able to pay their rent. When renters default on rent, landlords suffer, and might not be able to meet their own financial obligations, such as making the mortgage payments on the rental property.

Here are some suggestions about how landlords can mitigate the financial impact of tenant defaults during the COVID-19 outbreak.

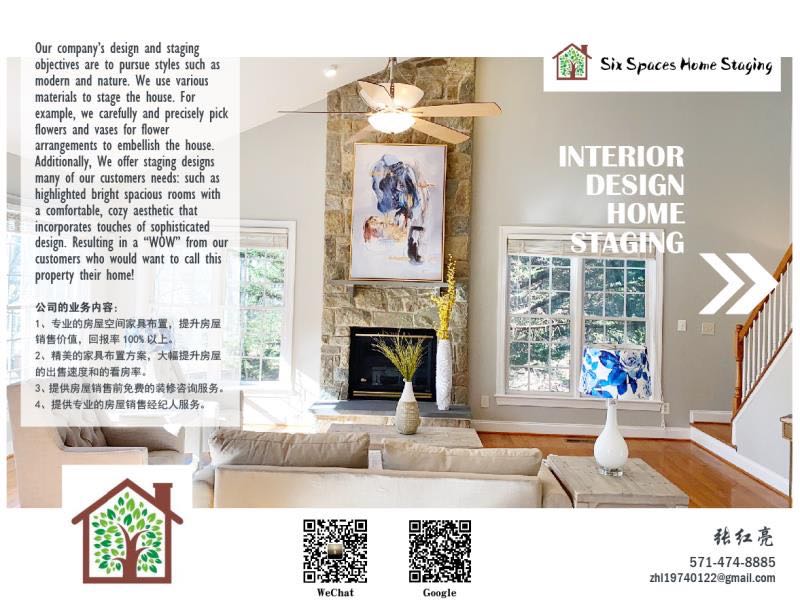

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

Terminations and Evictions

Under normal circumstances, when tenants don’t pay rent, landlords have the option of terminating the tenancy (by serving the tenant with either a pay rent or quit notice or an unconditional quit notice, depending on the applicable laws). When tenants don’t pay the rent or move out by the deadline given in the notice, landlords can then file an eviction lawsuit to have the tenants physically removed from the rental.

However, health and safety concerns due to COVID-19 have led many states, cities, counties, and courts to place moratoriums on evictions. The scope of these temporary bans on evictions varies greatly: some have banned any and all action relating to evictions, while others simply postpone hearings on evictions until the court can arrange a hearing via telephone or video.

If you are a landlord in an area with an eviction moratorium, you might still be able to file eviction papers with the court, but your case might not be heard for a while. However, even if there are no bans in place, evicting tenants who can’t pay the rent due to the coronavirus crisis probably shouldn’t be your first recourse. Aside from optics (you don’t want to get a reputation as the ruthless landlord who booted tenants out of their home in the middle of a stay-at-home order), if you remove tenants right now, you’re going to be faced with having to disinfect the rental, advertise the rental, screen new prospective tenants (of which there might be very few), sign a new lease or rental agreement, and get the new tenants moved in—all while taking measures to abide by emergency guidelines and health and safety measures.

Consider the following options instead.

Evaluate Your Personal Financial Situation

Take a moment to evaluate your own finances. As dire as it sounds, it might be time to take stock of what could happen in a worst-case scenario. Most landlords have likely considered the situation where tenants don’t pay rent, as this can happen at any time. But there’s no denying that this is a different situation—what will happen if your tenants can’t pay for a long time, and your options for finding new (paying) tenants are slim?

Your assessment of how this worst-case scenario will affect your ability to pay your mortgage (if any) and your personal bills will inform how you respond when your tenants can’t pay their rent.

- If your financial situation looks grim: If your ability to pay the mortgage on your rental property hinges on month-to-month rental income, you should take actions to prevent your own default This includes options discussed below, such as contacting your lender and proactively seeking arrangements with tenants that allow them to make at least partial payments.

- If you have a few months’ reserves: If your personal reserves or financial position won’t feel too much of a pinch if tenants aren’t able to pay rent for a while, you still might have to make some compromises to retain good tenants. If you have tenants who have previously been reliable and are simply finding it hard to make ends meet currently, do what you can to take some pressure off them—see the discussion below about working out a temporary solution with tenants.

Try to Work Out a Temporary Solution With Tenants

Depending on how desperately you need to receive income from your rental, you have a few options for working with tenants who aren’t able to pay rent because of COVID-19. Consider the following possible arrangements.

- Forgive rent. If your situation allows for it, you could waive rent for a month, with an agreement to revisit the payment arrangement on a certain date. A landlord in Bakersfield recently did this for his tenants.

- Postpone rent. You could offer to postpone rent payments for a month, with an agreement that it will be repaid. Your repayment arrangement could state that the rent owed could be spread out over time, paid all at once, or paid when (if) a stimulus check

- Reduce rent. If you can, consider dropping the rent temporarily to a level that enables you to meet your obligations but forgoes profit for the time being. For example, if you normally collect $1200 a month, but your mortgage is $900 a month, you could temporarily drop rent to $900 to make sure you at least don’t get in trouble with your lender.

Before deciding to make any of these adjustments, try talking to your tenants. Ask them straight out what they think they can make work. If you’re able to accommodate their suggestions, chances are higher that they will do everything they can to hold up their end of the bargain. Be sure to put any agreements in writing, preferably as an addendum to your current lease or rental agreement that includes all details of the arrangement.

Look for Outside Assistance

Even if you think you can float a month or two without rental income, you still might want to consider taking some measures now to protect your position in the event that the coronavirus crisis lasts longer than your cushion can handle. If you’re already feeling the pinch, take these actions immediately.

Attend to Your Mortgage

At this point in the COVID-19 crisis, most private lenders are willing to work with borrowers to ensure that they don’t lose their homes. Call your lender directly and ask what steps it is taking to assist borrowers who can’t meet their mortgage obligations due to the coronavirus pandemic.

- If your loan is owned by Fannie Mae or Freddie Mac, you might be able to delay making payments for a certain period of time without incurring late fees or getting hit with a credit score penalty.

- Look into your options under the Coronavirus Aid, Relief, and Economic Security Act.

- The Federal Housing Administration (FHA) has put in place a foreclosure moratorium for single family homeowners with FHA-insured mortgages.

- Visit your state’s website to find out if the state is offering assistance to homeowners. For example, New York has announced a delay of mortgage payments for 90 days. Many other states are postponing any foreclosure actions indefinitely. Find your state’s website at State and Government on the Net.

Look Into Property Tax Breaks

Some states and counties are extending the deadline for paying property taxes, or cancelling late fees and interest. Check your county’s tax assessor’s website to see if this is an option where your property is located.

Seek a Loan

Consider seeking a loan from family, friends, or private lenders. The U.S. Small Business Administration might be another source of assistance—its disaster loan assistance web page has a wealth of information. You can also contact your regular bank or credit union and inquire about what assistance it can offer.

Research Options for Your Renters

Some areas are beginning to offer rent vouchers or emergency funds to renters in need. For example, the Pennsylvania Apartment Association is collecting donations for funds to give to renters who can’t pay rent. Currently, renters’ needs are getting a lot more attention in the press than landlords’ needs, and there are already a lot more resources being made available for renters. It’s in your best interest to research these options and bring them to your renters’ attention—do what you can to help your tenants pay you.

Landlords are getting squeezed between tenants and lenders

By ANNE D’INNOCENZIO

NEW YORK (AP) — When it comes to sympathetic figures, landlords aren’t exactly at the top of the list. But they, too, have fallen on hard times, demonstrating how the coronavirus outbreak spares almost no one.

Take Shad Elia, who owns 24 single-family apartment units in the Boston area. He says government stimulus benefits allowed his hard-hit tenants to continue to pay the rent. But now that the aid has expired, with Congress unlikely to pass a new package before Election Day, they are falling behind.

Heading into a New England winter, Elia is worried about such expenses as heat and snowplowing in addition to the regular year-round costs, like fixing appliances and leaky faucets.

Elia wonders how much longer his lenders will cut him slack.

“We still have a mortgage. We still have expenses on these properties,” he said. “But there comes a point where we will exhaust whatever reserves we have. At some point, we will fall behind on our payments. They can’t expect landlords to provide subsidized housing.”

The stakes are particularly high for small landlords, whether they own commercial properties, such as storefronts, or residential properties such as apartments. Many are borrowing money from relatives or dipping into their personal savings to meet their mortgage payments.

The big residential and commercial landlords have more options. For instance, the nation’s biggest mall owner, Simon Property Group, is in talks to buy J.C. Penney, a move that would prevent the department store chain from going under and causing Simon to lose one of its biggest tenants. At the same time, Simon is suing the Gap for $107 million in back rent.

Michael Hamilton, a Los Angeles-based real estate partner at the law firm O’Melveny & Myers, said he expects to see more retail and other commercial landlords going to court to collect back rent as they get squeezed between lenders and tenants.

Residential landlords are also fighting back against a Trump administration eviction moratorium that protects certain tenants through the end of 2020. At least 26 lawsuits have been filed by property owners around the country in places such as Tennessee, Georgia and Ohio, many of them claiming the moratorium unfairly strains landlords’ finances and violates their rights.

Apartment dwellers and other residential tenants in the U.S. owe roughly $25 billion in back rent, and that will reach nearly $70 billion by year’s end, according to an estimate in August by Moody’s Analytics.

An estimated 30 million to 40 million people in the U.S. could be at risk of eviction in the next several months, according to an August report by the Aspen Institute, a nonprofit organization.

Jessica Elizabeth Michelle, 37, a single mother with a 7-month-old baby, represents a growing number of renters who are afraid of being homeless once the moratorium on evictions ends.

The San Francisco resident saw her income of $6,000 a month as an event planner evaporate when COVID-19 hit. Supplemental aid from the federal government and the city helped her pay her monthly rent of $2,400 through September. But all that has dried up, except for the unemployment checks that total less than $2,000 a month.

For her October rent, she handed $1,000 to her landlord. She said her landlord has been supportive but has made it clear he has bills to pay, too.

“I never had an issue of paying rent up until now. I cry all night long. It’s terrifying,” Michelle said. “I don’t know what to do. My career was ripped out from under me. It’s gotten to the point of where it’s like, ‘Am I going to be homeless?’ I have no idea.’”

Some landlords are trying to work with their commercial or residential tenants, giving them a break on the rent or more flexible lease terms. But the crisis is costing them.

Analytics firm Trepp, which tracks a type of real estate loan taken out by owners of commercial properties such as offices, apartments, hotels and shopping centers, found that hotels have a nearly 23% rate of delinquency, or 30 days overdue, on their loans, while the retail industry has a 14.9% delinquency rate as of August.

The apartment rental market has so far navigated the crisis well, with a delinquency rate of 3%, according to Trepp. That’s in part because of the eviction moratorium, along with extra unemployment benefits from Washington that have since expired.

“There are bad actors, but the majority of landlords are struggling and are trying to work with a bad situation,” said Andreanecia M. Morris, executive director of HousingNOLA, a public-private partnership that pushes for more affordable housing in the New Orleans area.

Morris, who works with both landlords and tenants, said that government money wasn’t adequate to help tenants pay their rent, particularly in expensive cities. She is calling for comprehensive rental assistance.

She fears that residential landlords will see their properties foreclosed on next year, and the holdings will be bought by big corporations, which are not as invested in the neighborhoods.

Gary Zaremba, who owns and and manages 350 apartment units spread out over 100 buildings in Dayton, Ohio, said he has been working with struggling tenants — many of them hourly workers in restaurants and stores — and directs them to social service agencies for additional help.

But he is nervous about what’s next, especially with winter approaching and the prospect of restaurants shutting down and putting his tenants out of work. He has a small mortgage on the buildings he owns but still has to pay property taxes and fix things like broken windows or leaky plumbing.

“As a landlord, I have to navigate a global pandemic on my own,” Zaremba said, “and it’s confusing.”