Fang (Winnie) Schreck | United Real Estate

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

IRS:海外银行资产和金融账户申报10月15日截止

来源: 华人生活网

10/06/2021

很多华人即便入了美国国籍,但是在中国依旧有银行存款账户,也有人还有一些海外的生意。

大家要注意了,以下情况是要提交《国外银行和金融帐户报告》的。

在一个或多个帐户中有经济利益、有签字权或有其他权力,这些帐户包括在美国境外的银行帐户、经纪帐户、共同基金或其他金融帐户;日历年内任何时候所有外国金融帐户的总价值超过 1万 美元。

国税局(IRS)10月1日提醒美国公民、税法定义居民和任何境内法人实体,提交《国外银行和金融帐户报告》(FBAR) 的延期截止日为今年10 月15日。正常来说申报人若错过今年早些时候的 4 月 15 日年度截止日期,会被自动延期至 10 月 15 日提交FBAR,不需要申请延期。

国税局表示,申报人若受自然灾害影响,FBAR到期日可以要求进一步延长。重要的是,申报者须查看相关的FBAR 救援通知以获取完整信息。

目前由于1万美元这个界限的存在,国税局鼓励美国税务居民或拥有外国帐户的实体(即使是拥有相对较小的帐户),核查他们是否应就此报告申报。

美国税务居民指的是美国公民、居民或任何境内法人实体,例如合伙企业、公司、有限责任公司、遗产或信託。

国税局表示,申报人不应将FBAR与他们的联邦所得税申报表一起提交。

2020年FBAR必须以电子方式提交给金融罪行加强执法网络 (FinCEN),并且只能通过BSA电子申报系统网站递交。无法通过电子方式提交FBAR的纳税人必须致电金融罪行加强执法网络(FinCEN),美国境内拨打800-949-2732,美国境外拨打 703-905-3975。

凡未及时提交FBAR者,可能受到严重的民事和刑事处罚,可能导致罚款或监禁。

但若国税局确定延迟提交的原因合理,则不会惩罚那些延迟提交的FBAR 、报告外国帐户的人。

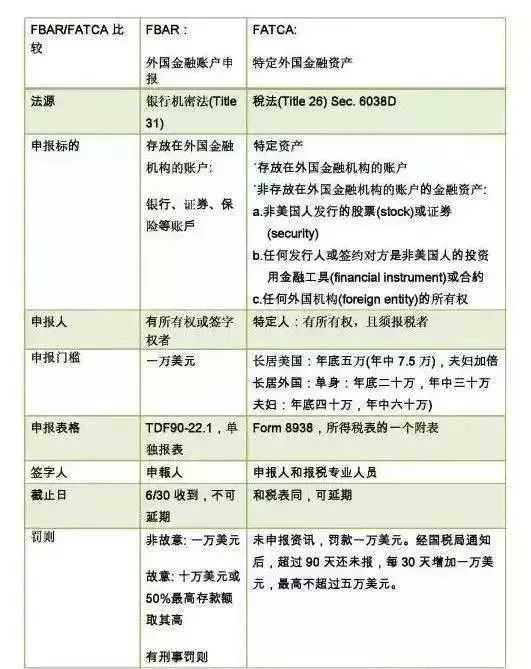

也有民众此前询问为什么经常看到5万美元的门槛,为什么此文中又说1万美元。这其实就是肥爸与肥咖的区别!

本月截止的是FBAR,也就是华人常说的肥爸。

“肥爸”﹙FBAR, Report of Foreign Bank and Financial Accounts ﹚是奥巴马政府于2009年5月发布税制改革“绿皮书”(The Green Book)中规定的,目的为严查美国境外所得税申报,以确定纳税人的境外所得完整申报,包含所有境外金融机构之账户,原先要求于2009年9月23日前需补申报海外账户。

后来,为了打击海外逃税,IRS又制定了“肥咖”(FATCA, Foreign Account Tax Compliance Act﹚。要求全世界各国银行交出美国税务居民金额美金5万以上的账户资料,企图在未来十年内追回估计超过85亿美元的海外逃税。两者在申报上也有许多区别:

1 美元=6.47人民币

IRS: Oct. 15 FBAR extension deadline nears for foreign bank and financial account holders

IR-2021-196, October 1, 2021

WASHINGTON — The Internal Revenue Service reminds U.S. citizens, resident aliens and any domestic legal entity that the extension deadline to file their annual Report of Foreign Bank and Financial Accounts (FBAR) is Oct. 15, 2021.

Filers missing the April 15 annual due date earlier this year received an automatic extension until Oct. 15, 2021, to file the FBAR. They did not need to request the extension.

Filers affected by a natural disaster may have their FBAR due date further extended. It’s important filers review relevant FBAR Relief Notices for complete information.

Who needs to file?

The Bank Secrecy Act requires U.S. persons to file an FBAR if they have:

- Financial interest in, signature authority or other authority over one or more accounts, such as a bank account, brokerage account, mutual fund or other financial account located outside the United States, and

- The aggregate value of all foreign financial accounts exceeds $10,000 at any time during the calendar year.

Because of this threshold, the IRS encourages U.S. persons or entities with foreign accounts, even relatively small ones, to check if this filing requirement applies to them. A U.S. person is a citizen or resident of the United States or any domestic legal entity such as a partnership, corporation, limited liability company, estate or trust.

How to file

Filers do not file the FBAR with their federal income tax return. The 2020 FBAR must be filed electronically with the Financial Crimes Enforcement Network (FinCEN) and is only available through the BSA E-Filing System website. Those who are unable to e-file their FBAR must call FinCEN at 800-949-2732, or from outside the U.S. at 703-905-3975.

Avoid penalties

Those who don’t file an FBAR when required may be subject to significant civil and criminal penalties that can result in a fine and/or prison. The IRS will not penalize those who properly reported a foreign account on a late-filed FBAR if the IRS determines there was reasonable cause for late filing.

FBAR resources on IRS.gov:

- How to report foreign bank and financial accounts

- International Taxpayers

- IRS FBAR Reference Guide PDF

- FAQs About International Individual Tax Matters

- FinCEN’s website Reporting Maximum Account Value

To help avoid delays with tax refunds, taxpayers living abroad should visit Helpful Tips for Effectively Receiving a Tax Refund for Taxpayers Living Abroad on IRS.gov.

Events…

预告一周北美法律公益讲座安排

10/04/2021

时间:周二到周五 晚间

5:30-7:00(西部时间)8:30-9:30(东部 时间)

重播:第二天

上午9:00(西部时间)

中午:12:00(东部时间)

周二: 蒋律师讲遗嘱和需要注意的问题

周三: 数据泄露和个人身份保护&事业机会说明会

周四:北美常见法律问题案例分享(主讲:Joanna,Irene)

周五:律师讲人身伤害如何索赔

Zoom 6045004698

密码:请扫码进群索取

另外:周三6:30(西部时间)美国专场(Michael Wang 主讲)

Zoom 95190929213

密码请扫码进群索取。

IRS: Report of Foreign Bank and Financial Accounts (FBAR)

Every year, under the law known as the Bank Secrecy Act, you must report certain foreign financial accounts, such as bank accounts, brokerage accounts and mutual funds, to the Treasury Department and keep certain records of those accounts. You report the accounts by filing a Report of Foreign Bank and Financial Accounts (FBAR) on FinCEN Form 114.

Who Must File

A United States person, including a citizen, resident, corporation, partnership, limited liability company, trust and estate, must file an FBAR to report:

- a financial interest in or signature or other authority over at least one financial account located outside the United States if

- the aggregate value of those foreign financial accounts exceeded $10,000 at any time during the calendar year reported.

Generally, an account at a financial institution located outside the United States is a foreign financial account. Whether the account produced taxable income has no effect on whether the account is a “foreign financial account” for FBAR purposes.

But, you don’t need to report foreign financial accounts that are:

- Correspondent/Nostro accounts,

- Owned by a governmental entity,

- Owned by an international financial institution,

- Maintained on a United States military banking facility,

- Held in an individual retirement account (IRA) you own or are beneficiary of,

- Held in a retirement plan of which you’re a participant or beneficiary, or

- Part of a trust of which you’re a beneficiary, if a U.S. person (trust, trustee of the trust or agent of the trust) files an FBAR reporting these accounts.

You don’t need to file an FBAR for the calendar year if:

- All your foreign financial accounts are reported on a consolidated FBAR.

- All your foreign financial accounts are jointly-owned with your spouse and:

- You completed and signed FinCEN Form 114a authorizing your spouse to file on your behalf, and your spouse reports the jointly-owned accounts on a timely-filed, signed FBAR.

Note: Income tax filing status, such as married-filing-jointly and married-filing-separately has no effect on your qualification for this exception.

The FBAR Reference Guide PDF) and FBAR instructions PDF provide more detailed information. The FBAR webinar explains how to calculate the aggregate value of your accounts to figure if you need to file an FBAR.

When to File

The FBAR is an annual report, due April 15 following the calendar year reported.

You’re allowed an automatic extension to October 15 if you fail to meet the FBAR annual due date of April 15. You don’t need to request an extension to file the FBAR.

If you are affected by a natural disaster, the government may further extend your FBAR due date. It’s important that you review relevant FBAR Relief Notices for complete information.

For certain employees or officers with signature or other authority over, but no financial interest in certain foreign financial accounts, the 2018 FBAR due date is deferred to April 15, 2020. See Notice 2018-1 PDF.

How to File

You must file the FBAR electronically through the Financial Crimes Enforcement Network’s BSA E-Filing System. You don’t file the FBAR with your federal tax return.

If you want to paper-file your FBAR, you must call FinCEN’s Regulatory Helpline to request an exemption from e-filing. See Contact Us below to reach this Helpline. If FinCEN approves your request, FinCEN will send you the paper FBAR form to complete and mail to the IRS at the address in the form’s instructions. IRS will not accept paper-filings on TD F 90-22.1 (obsolete) or a printed FinCEN Form 114 (for e-filing only).

If you want someone to file your FBAR on your behalf, use FinCEN Report 114a PDF, Record of Authorization to Electronically File FBARs, to authorize that person to do so. You don’t submit FinCEN Report 114a when filing the FBAR; just keep it for your records and make it available to FinCEN or IRS upon request.

Keeping Records

You must keep records for each account you must report on an FBAR that establish:

- Name on the account,

- Account number,

- Name and address of the foreign bank,

- Type of account, and

- Maximum value during the year.

The law doesn’t specify the type of document to keep with this information; it can be bank statements or a copy of a filed FBAR, for example, if they have all the information.

You must keep these records for five years from the due date of the FBAR.

Exception: An officer or employee who files an FBAR to report signature authority over an employer’s foreign financial account doesn’t need to personally keep records on these accounts. The employer must keep the records for these accounts.

Penalties

You may be subject to civil monetary penalties and/or criminal penalties for FBAR reporting and/or recordkeeping violations. Assertion of penalties depends on facts and circumstances. Civil penalty maximums must be adjusted annually for inflation. Current maximums are as follows:

| U.S. Code citation | Civil Monetary Penalty Description | Current Maximum |

|---|---|---|

| 31 U.S.C. 5321(a)(5)(B)(i) | Foreign Financial Agency Transaction – Non-Willful Violation of Transaction | $12,921 |

| 31 U.S.C. 5321(a)(5)(C) | Foreign Financial Agency Transaction – Willful Violation of Transaction | Greater of $129,210, or 50% of the amount per 31 U.S.C.5321(a)(5)(D) |

| 31 U.S.C. 5321(a)(6)(A) | Negligent Violation by Financial Institution or Non-Financial Trade or Business | $1,118 |

| 31 U.S.C. 5321(a)(6)(B) | Pattern of Negligent Activity by Financial Institution or Non-Financial Trade or Business | $86,976 |

Criminal penalty maximums are provided in the FBAR Resources below.

Filing Delinquent FBARs

Filing an FBAR late or not at all is a violation and may subject you to penalties (see Penalties above). If you have not been contacted by IRS about a late FBAR and are not under civil or criminal investigation by IRS, you may file late FBARs and, to keep potential penalties to a minimum, should do so as soon as possible. To keep potential penalties to a minimum, you should file late FBARs as soon as possible.

Follow these instructions to explain your reason for filing late. If you’re participating in an optional program to resolve FBAR noncompliance, such as Delinquent FBAR Submission Procedures or Streamlined Filing Compliance Procedures , follow the instructions for those programs.

Representation for FBAR Issues

You can file Form 2848, Power of Attorney and Declaration of Representative, if the IRS begins an FBAR examination as a result of an income tax examination (Title 26). Complete Line 3, acts authorized, as follows:

- Under Description of Matter – Matters relating to Report of Foreign Bank and Financial Accounts or “FBAR Examination”

- Under Tax Form Number – FinCEN Form 114

- Under Year(s) or Period(s) – applicable tax year(s)

(Note: Disregard previous guidance to complete Line 5a, additional acts authorized.)

Don’t use Form 2848 if a related income tax examination doesn’t apply. You may use a general power of attorney form executed under applicable state law.

FBAR Resources

- FBAR Reference Guide PDF

- Webinar: Reporting of Foreign Bank and Financial Accounts on the Electronic FBAR

- FBAR fact sheet

Note: Civil penalty maximums in these materials are no longer current, as these amounts are adjusted annually for inflation. See Penalties above for more information.

Contact Us

Can’t find the answer to your question in online information? Contact us.

| Contact | Business Hours | Help Offered | |

|---|---|---|---|

| IRS FBAR Hotline | 866-270-0733; or if calling from outside the United States, 313-234-6146 | Monday – Friday, 8 a.m. to 4:30 p.m. EST | General questions: FBAR filing requirements Filing methods |

| FinCEN’s BSA E-Filing Help Desk | See FinCEN’s website for contact information | Monday – Friday, 8 a.m. to 6 p.m. EST | Technical questions about BSA’s E-Filing System |

| FinCEN’s Regulatory Helpline | See FinCEN’s website for contact information | Leave a message for a return call | E-filing exemptions to allow FBAR paper-filingQuestions about BSA regulations |

IRS: Expanded tax benefits help individuals and businesses give to charity during 2021; deductions up to $600 available for cash donations by non-itemizers

IR-2021-190, September 17, 2021

WASHINGTON — The Internal Revenue Service today explained how expanded tax benefits can help both individuals and businesses give to charity before the end of this year.

The Taxpayer Certainty and Disaster Tax Relief Act of 2020, enacted last December, provides several provisions to help individuals and businesses who give to charity. The new law generally extends through the end of 2021 four temporary tax changes originally enacted by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Here is a rundown of these changes.

Deduction for individuals who don’t itemize; cash donations up to $600 qualify

Ordinarily, individuals who elect to take the standard deduction cannot claim a deduction for their charitable contributions. The law now permits these individuals to claim a limited deduction on their 2021 federal income tax returns for cash contributions made to certain qualifying charitable organizations. Nearly nine in 10 taxpayers now take the standard deduction and could potentially qualify to claim a limited deduction for cash contributions.

These individuals, including married individuals filing separate returns, can claim a deduction of up to $300 for cash contributions made to qualifying charities during 2021. The maximum deduction is increased to $600 for married individuals filing joint returns.

Cash contributions to most charitable organizations qualify. However, cash contributions made either to supporting organizations or to establish or maintain a donor advised fund do not qualify. Cash contributions carried forward from prior years do not qualify, nor do cash contributions to most private foundations and most cash contributions to charitable remainder trusts. In general, a donor-advised fund is a fund or account maintained by a charity in which a donor can, because of being a donor, advise the fund on how to distribute or invest amounts contributed by the donor and held in the fund. A supporting organization is a charity that carries out its exempt purposes by supporting other exempt organizations, usually other public charities. See Publication 526, Charitable Contributions for more information on the types of organizations that qualify.

Cash contributions include those made by check, credit card or debit card as well as amounts incurred by an individual for unreimbursed out-of-pocket expenses in connection with the individual’s volunteer services to a qualifying charitable organization. Cash contributions don’t include the value of volunteer services, securities, household items or other property.

100% limit on eligible cash contributions made by itemizers in 2021

Subject to certain limits, individuals who itemize may generally claim a deduction for charitable contributions made to qualifying charitable organizations. These limits typically range from 20% to 60% of adjusted gross income (AGI) and vary by the type of contribution and type of charitable organization. For example, a cash contribution made by an individual to a qualifying public charity is generally limited to 60% of the individual’s AGI. Excess contributions may be carried forward for up to five tax years.

The law now permits electing individuals to apply an increased limit (“Increased Individual Limit”), up to 100% of their AGI, for qualified contributions made during calendar-year 2021. Qualified contributions are contributions made in cash to qualifying charitable organizations.

As with the new limited deduction for nonitemizers, cash contributions to most charitable organizations qualify, but, cash contributions made either to supporting organizations or to establish or maintain a donor advised fund, do not. Nor do cash contributions to private foundations and most cash contributions to charitable remainder trusts.

Unless an individual makes the election for any given qualified cash contribution, the usual percentage limit applies. Keep in mind that an individual’s other allowed charitable contribution deductions reduce the maximum amount allowed under this election. Eligible individuals must make their elections with their 2021 Form 1040 or Form 1040-SR.

Corporate limit increased to 25% of taxable income

The law now permits C corporations to apply an increased limit (Increased Corporate Limit) of 25% of taxable income for charitable contributions of cash they make to eligible charities during calendar-year 2021. Normally, the maximum allowable deduction is limited to 10% of a corporation’s taxable income.

Again, the Increased Corporate Limit does not automatically apply. C corporations must elect the Increased Corporate Limit on a contribution-by-contribution basis.

Increased limits on amounts deductible by businesses for certain donated food inventory

Businesses donating food inventory that are eligible for the existing enhanced deduction (for contributions for the care of the ill, needy and infants) may qualify for increased deduction limits. For contributions made in 2021, the limit for these contribution deductions is increased from 15% to 25%. For C corporations, the 25% limit is based on their taxable income. For other businesses, including sole proprietorships, partnerships, and S corporations, the limit is based on their aggregate net income for the year from all trades or businesses from which the contributions are made. A special method for computing the enhanced deduction continues to apply, as do food quality standards and other requirements.

Keep good records

The IRS reminds individuals and businesses that special recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction. Usually, this includes obtaining an acknowledgment letter from the charity before filing a return and retaining a cancelled check or credit card receipt for contributions of cash. For donations of property, additional recordkeeping rules apply, and may include filing a Form 8283 and obtaining a qualified appraisal in some instances.

For details on how to apply the percentage limits and a description of the recordkeeping rules for substantiating gifts to charity, see Publication 526, available on IRS.gov.

The IRS also encourages employers to help get the word out about the advance payments of the Child Tax Credit because they have direct access to many employees and individuals who receive this credit.

For more information about other Coronavirus-related tax relief, visit IRS.gov/coronavirus.