藉耶稣基督之名圈钱 德州诈骗客被判关到死

世界新闻网

11/04/2021

北德州一名基督教广播电台节目主持人,经营庞氏骗局(Ponzi scheme)大约十年后露馅,他于1日(周一)被法官判处第三个终身监禁。

现年80岁的威廉嘉勒格(William Gallagher),其实从2019年3月被捕后一直都待在监牢中,他因为同样的诈欺行为已被达拉斯法院判处25年徒刑,德州法院也已判了他30年。2019年8月,泰伦特县(Tarrant County) 法院对他提诉,这次的审判庭是为福和市一带的受害者讨回公道。

嘉勒格在一家基督教广播电台担任主持人,他每次节目收尾时,总说「星期天教堂见」(See you in church on Sunday),这成了听众百听不厌的口头禅,他还出版理财的书籍,譬如有一本名叫「耶稣基督,金钱大师」(Jesus Christ, Money Master)。他所成立的嘉勒格财务集团(Gallagher Financial Group)在电视台做广告,有许多年长者相信他是虔诚的基督徒,绝对不会骗他们的钱。

泰伦特县检察官办公室年长者财务诈欺小组(Elder Financial Fraud team)的组长萝莉瓦内尔(Lori Varnell)指出,这是她执法多年来所看到的最恶劣案例,嘉勒格在各教会的周日集会中与教友接触,这些已退休人士把钱交给他投资,少的有几万元,多的有60万元,最后却血本无归,有些人必须卖房,有的人跟子女讨钱过生活,有些人重回职场上班赚钱,他们损失的金钱总数达3200万元。

1920年代,查尔斯庞济(Charles Ponzi)在波士顿为他的投资公司做广告,宣称有丰厚的报酬率又没有风险,他把新投资人的钱拿来付老投资人的年度利息,经过几年名声越来越大,收到的资金越来越多,但庞氏骗局终究有爆发的一日,投资人失去资本,诈骗者入狱服刑,这种骗术如今就是以他为名。

Zelle scammers bilk bank customers out of thousands — how to avoid them

By Paul Wagenseil

9/03/2021

Scams involving Zelle payment service still happening

Two Chicago-area women say scammers bilked them out of $3,500 each by conning them over the phone and then using the Zelle mobile-payment system to withdraw money from their Bank of America accounts.

“It’s really distressing,” one of the women, Nausheen Brooks, told TV station WLS. “You save your hard-earned money to just be taken away from you.”

The scammers texted Brooks and the other woman, Darlene Chelsey, pretending to be Bank of America and asking them to verify purchases. Both women denied making the purchases in question, and then were called by persons claiming to be bank representatives. The scammers used what appeared to be legitimate Bank of America phone numbers.

The women were each told that there had been Zelle withdrawals from their accounts, but that the problems could quickly be fixed if they used their own mobile banking apps to transfer the money back to themselves.

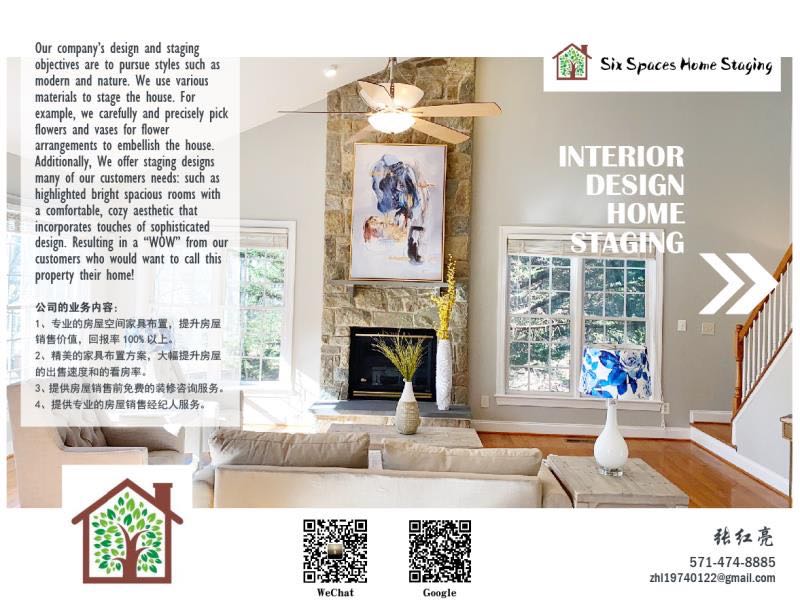

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

Brooks and Chelsey both did so, and the money disappeared. It seems that both their Zelle accounts had already been taken over by the scammers.

“They definitely had access to the account if the money was wired to herself,” Bogdan Bodezatu, a threat researcher with Bitdefender, told WLS. He added that the scammers may have gotten access to the accounts due to data breaches at other websites, which can compromise reused passwords.

How to avoid Zelle scams

Avoiding Zelle scams is like avoiding many other online scams. Create strong, unique passwords for any account that involves money, especially banking accounts, and use one of the best password managers to keep all of them straight.

Don’t trust anyone who calls or texts you and wants you to perform a financial transaction, even if that person appears to be from your bank. Instead, call the bank yourself using a number that you look up.

Don’t give out one-time-use verification codes to anyone, even if they claim to be from your bank. And again, never reuse passwords for sensitive accounts.

Years of Zelle scams

Sadly, this is not a new occurrence. Zelle-based scams have been happening for years — we first wrote about them in April 2018.

The earliest scams involved crooks getting people to pay for non-existent items through Zelle, then discovering they couldn’t get their money back because unlike with a credit-card, the money is withdrawn immediately from your bank account.

Later, people who’d never even signed up for Zelle were scammed out of thousands of dollars by crooks who set up accounts in their names and drained their bank accounts.

That’s because Zelle is owned by seven of the largest U.S. banks, including Bank of America, and used by hundreds more banks. Anyone who has an account with those banks is eligible for a Zelle account, and many banks build Zelle right into their own mobile apps.

These most recent scams seem to involve persons whose accounts have already been hijacked, perhaps through password reuse. (If you use a password on more than one account, then a compromise of any one of those accounts compromises them all.)

Why Zelle is vulnerable

The real problem is that Zelle uses email addresses and phone numbers to identify account holders, and neither was ever designed to be foolproof. Both email addresses and phone numbers can be easily “spoofed” by cheap software.

Many banks do text a one-time code to customers to verify certain transactions, yet not only can text messages be intercepted, but scammers can con customers into revealing texted codes.

Another issue is that Zelle has direct access to bank accounts. Venmo, which is not affiliated with the banks, makes users create a separate account that is linked to a credit card or into which the users deposit money. This creates a buffer between Venmo transactions and their bank accounts.

We’ve reached out to Zelle to ask if the company has made any security improvements in the past three years, and whether Zelle would consider setting up a “staging” account to act as a buffer, similar to the way Venmo operates. We’ll update this story when we receive a response.

In the meantime, one thing does appear to have changed: Both Brooks and Chelsey had their $3,500 losses covered by Bank of America. That’s a better outcome than some of the earliest Zelle scam stories, in which the victims were essentially told by the banks that they should have read the fine print.

That fine print, by the way, still says that the bank isn’t legally liable if you transfer money via Zelle to the wrong people.

Update: Zelle responds

In response to our inquiries, Zelle provided this statement.

“Phishing Scam: This is an example of a phishing scam where the scammer spoofed the Bank of America phone number and attempted to convince the individual to provide their personal information, not a breach of Bank of America or Zelle security.

We’d like to remind consumers that your bank will never call you to ask for sensitive information and they would not ask a customer to transfer funds between accounts in order to prevent fraud. Hang up and call your bank at the phone number listed on the back of your bank-issued debit card or on the bank’s official website if you must provide information over the phone.

In-App Notifications: When consumers send money using Zelle within their mobile or online banking experience, they are sending money directly from their bank account to another person’s bank account, typically within minutes when both users are already enrolled.

When sending money there is a final prompt requiring the sender to confirm the mobile number or email address being used and that it belongs to the intended recipient. This prompt provides the first name of the person who the mobile number or email is enrolled to and an alert that the payment cannot be cancelled once sent.

Consumer education: Zelle is working to address an acute need for financial education. Through our Pay It Safe initiatives, we have partnered with organizations to offer free financial education to consumers through modern banking courses and consumer protection resources.

Through a strategic partnership with EVERFI — the leading social impact education technology company — we have reached more than 60k students in 47 states. Results show that high school students achieved a 39% average knowledge gain after taking the Zelle Money Moves: Modern Banking & Identity Protection course.

In addition, we are working with Cybercrime Support Network to spread awareness and educate consumers and small businesses on avoiding financial fraud and scams.”

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

北美法律公益讲座安排

时间:周二到周五 晚间

5:30-7:00(西部)

8:30-9:30(东部)

重播:第二天

上午9:00(西部时间)

中午12:00(东部时间)

周二: 遗嘱和授权书(Lisa讲)

周三: 数据泄露和个人身份保护&事业机会说明会

周四:北美常见法律问题(讲员Irene )

周五:小企业法律和员工福利(晶旌)

Zoom 6045004698,

密码:请扫码进群

另外:周三6:30(西部时间)美国专场

定期邀请美国律师联合讲座

Zoom 951 9092 9213

密码:请扫码进群