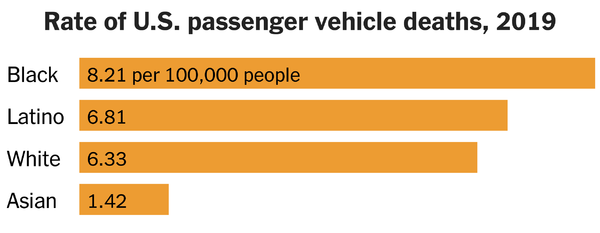

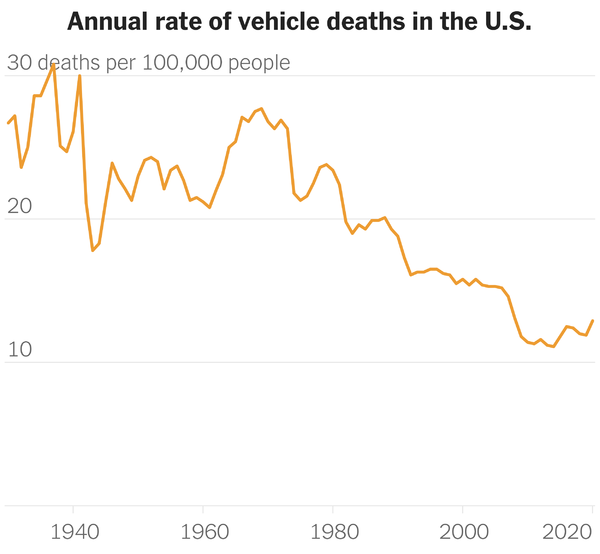

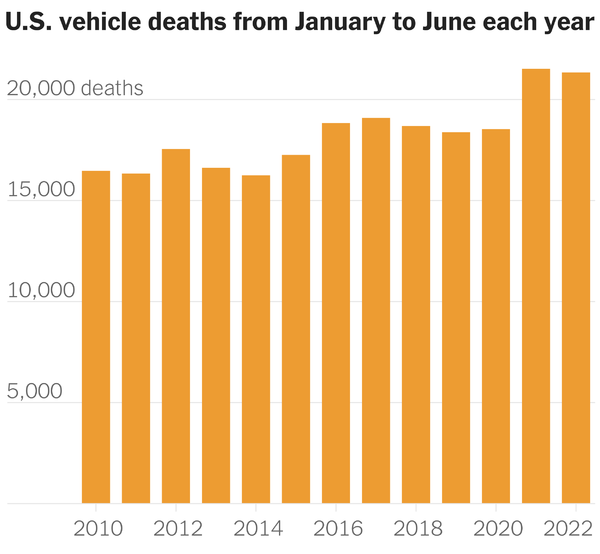

Not since the 1940sVehicle crashes seem as if they might be an equal-opportunity public health problem. Americans in every demographic group drive, after all. If anything, poor families tend to rely more on public transportation and less on car travel.Yet vehicle deaths turn out to be highly unequal. Lower-income people are much more likely to die in crashes, academic research shows. The racial gaps are also huge — even bigger on a percentage basis than the racial gaps on cancer, according to the C.D.C. Source: National Safety Council The unequal toll from crashes is particularly notable now because the U.S. is experiencing an alarming increase in vehicle deaths. Pete Buttigieg, the transportation secretary, recently called it “a national crisis of fatalities and serious injuries on our roadways.” And the toll is falling most heavily on lower-income Americans and Black Americans. The reasons for the increase remain somewhat mysterious, experts say. But the consequences are clear. More than 115 Americans have been dying on the roads on average every day this year.Today’s newsletter will explore the likely explanations for the increase, as well as its unequal impact and the potential solutions. Not so long ago, the trend in car crashes was a good-news story. The death rate began to fall in the early 1970s, thanks in large part to the consumer movement started by Ralph Nader. Cars became safer. States passed seatbelt laws. Drunken driving became less common. The declines continued into the early 2010s, as airbags became standard and vehicles began to include technology to prevent crashes.  But the situation changed around 2015, with the death rate mostly rising over the next several years. One reason seems to be distracted driving. By 2015, two-thirds of U.S. adults owned a smartphone, up from almost none in 2006.The U.S. has also been less aggressive about cracking down on speeding than Britain and some other parts of Europe, and vehicles here tend to be larger. “The engorgement of the American vehicle,” as Gregory Shill of the University of Iowa has called it, can kill pedestrians and people in smaller vehicles. These patterns help explain why death rates have fallen substantially more in other countries than in the U.S. during recent decades. As alarming as these trends were, the biggest increases have taken place more recently — since the pandemic. In the spring of 2020, as Covid was transforming daily life, vehicle crashes surged. By the start of this year, the death rate had jumped about 20 percent from prepandemic levels. It has been the sharpest increase since the 1940s.  Source:National Safety Council How did Covid lead to more crashes? At first, researchers thought that emptier roads might be the main answer. Open roads can encourage speeding, and speeding can be fatal. But even as traffic returned to near-normal levels last year, traffic deaths remained high. That combination weakens the empty-road theory, as Robert Schneider, an urban-planning expert at the University of Wisconsin-Milwaukee, said. The most plausible remaining theories tend to involve the mental health problems caused by Covid’s isolation and disruption. Alcohol and drug abuse have increased. Impulsive behavior, like running red lights and failing to wear seatbelts, also seems to have risen (as my colleague Simon Romero has reported). Many Americans have felt frustrated or unhappy, and it seems to have affected their driving.“ They’re a little bit less regulated — they might not be considering consequences,” Kira Mauseth, a clinical psychologist at Seattle University, has said. Frank Farley, a psychologist at Temple University, put it this way to The Los Angeles Times: “You’ve been cooped up, locked down and have restrictions you chafe at.” Ken Kolosh, who oversees data analysis at the National Safety Council, a nonprofit group, told me that researchers would need years to tease out all the causes. Confusingly, vehicle deaths did not surge in most other countries during the pandemic, suggesting that stress was a particularly American problem. “The world really felt upside down,” Kolosh said. One encouraging data point that’s consistent with this theory: The most recent data shows that vehicle deaths declined modestly this spring, as Covid restrictions continued to recede.  The scene of a collision in Manhattan this month. Dakota Santiago for The New York Times An unequal pandemic …Still, the surge in crashes has become one more way that the pandemic has hurt lower-income Americans and people of color the most — as did the early wave of Covid deaths and the consequences of closed schools. As I mentioned above, vehicle fatalities have long been unequal. Poorer people are more likely to drive older cars, which can lack safety features. Low-income neighborhoods are also much more likely to have high-speed roads running through them. “We have systematically put these arterial roadways in areas where people had less political power to fight back,” Rebecca Sanders, the founder of Safe Streets Research & Consulting, said. The pandemic probably exacerbated the gaps because many professionals have begun working from home, while many blue-collar Americans kept driving, biking or walking to work. Some lower-income workers also drive as part of their jobs.… and some solutions Even if the full explanation of the surge in crashes is murky, many experts believe that the most promising solutions remain clear.“ Making streets safer doesn’t require designing new solutions in laboratories,” John Rennie Short, of the University of Maryland, Baltimore County, has written. Jeffrey Michael, another expert, told The Washington Post, “This is an issue for which answers are known.” Those answers include: stricter enforcement of speed limits, seatbelt mandates and drunken-driving laws; better designed roads, especially in poorer neighborhoods; more public transit; and further spread of safety features like automated braking. Continuing to leave behind the disruptions of Covid — and the loneliness and stress they have caused — seems likely to help, too. |

How to save on a car and home insurance bundle

8/12/2022

Don’t overpay for your car and home insurance

If you own a car and a house, you’re already paying for two separate insurance policies — likely with two different companies. Those premiums can add up quickly.

Luckily, there’s a simple way to cut down on insurance costs. By bundling your car and home insurance with the same company, you may be able to reduce your rates by as much as 25 percent. That could be serious cash back in your pocket each month.

If you aren’t already bundling your car and home insurance, here’s what you should know.

Car and home insurance bundle: How does it work?

Bundling your car and home insurance policy (or a car and renter’s insurance policy) is one of the easiest ways to save money each month. This involves getting multiple insurance policies with the same company, which can help lower your premiums by as much as 25 percent.

Having more than one policy with the same insurer indicates loyalty, and insurance companies often reward customers for their loyalty.

Not only can you save money, but bundling also simplifies your finances because you’ll work with a single insurance company for multiple policies.

But while bundling has its advantages, insurance premiums can increase from year to year. For this reason, it’s smart to periodically shop around and compare bundles with other companies.

Who has the best car and home insurance bundle?

Even though many car and home insurance companies offer bundles, no single insurer is the best. One study found that State Farm, Allstate, and USAA tend to offer the biggest bundling discounts. But different factors influence your premium, so shopping around is the only way to find the best rate.

Factors that impact your insurance rates

Your risk level — and the projected cost to repair or replace your car — ultimately determines your auto insurance premium. For example, premiums are higher for newer and luxury cars. Likewise, younger drivers typically pay more for car insurance compared to older drivers.

Additionally, some states charge male drivers higher premiums. And you might pay more for car insurance if you live in a high-crime area.

Things that can influence your insurance premium include:

- Location

- Driving history

- Insurance/claims history

- The type of car

- Vehicle ownership status

The same general principle goes for homeowners insurance: The more at-risk your home is for disasters like fire and flooding, the more it will cost to insure.

Insurance providers take these factors into consideration when rating customers. The less risky your rating, the less you’ll pay for your can and homeowners insurance coverage.

What if I already have car and home insurance with separate companies?

There’s a good chance that you already have multiple insurance policies with different providers. You might ask: Can I switch in the middle of my policy and bundle with another company?

The short answer is yes. Whether you have car, home, or renter’s insurance, you don’t have to wait until your policy expires to get a new one.

But although you can switch at any time, canceling insurance mid-policy could result in a penalty or fee. This fee is typically 10% of your remaining premium, although some companies don’t charge cancellation fees.

Canceling insurance mid-policy could result in a penalty or fee. To avoid a penalty, shop for car and home insurance bundles when at least one of your policies is up for renewal.

To avoid a penalty, shop for car and home insurance bundles when at least one of your policies is up for renewal. Policies typically renew every six months or once per year, and you’ll receive a renewal letter from your insurance provider in advance. This provides time to shop around and compare rates.

To compare rates, contact your current providers and request a rate quote for bundling your car and home insurance (or another policy). Also, contact a few other providers for free quotes.

Once you purchase your new policy, contact your former insurer and cancel your old policy. The cancellation process varies. Some companies allow over-the-phone cancellations, whereas others require faxing or mailing in a cancellation form.

More ways to save on car insurance

The average cost for full coverage car insurance is over $1,000 per year on average. These policies offer different types of protection, for example:

- Liability: Covers damages you cause to another driver’s car

- Collision: Covers damages to your own car

- Comprehensive: Covers non-crash-related damages to your car

Your specific coverage levels, your history as a driver, and your vehicle determine your car insurance rate. Even so, you can take steps to lower your premium.

1. Shop around

Car insurance rates (as well as home insurance rates) vary from provider to provider. So it’s important to shop around and compare premiums with different insurers. Ideally, you should get at least three rate quotes.

It’s estimated that price shopping saves customers hundreds of dollars each year — and the savings could be even bigger if you have poor credit or an imperfect driving record, in which case the difference in rates may be more extreme.

When you’re shopping around, make sure each of your car insurance quotes contains the same types and levels of coverage, as well as the same deductible. This will give you the most accurate side-by-side comparison so you know which company is truly the cheapest.

2. Ask about discounts

Insurance discounts also vary from one company to the next, so ask your agent about their specific offers. To save money, take advantage of as many discounts as possible.

Discounts you might not know about include:

- Low mileage discount: If you drive less than a certain number of miles per year (often 7,500 to 12,000), your provider might discount your car insurance premium. This discount could reduce your insurance rate by as much as 30%

- Good driver discount: You might receive a discount (up to 20%) if it’s been more than three years since your last accident, speeding ticket, or other traffic violation

- Defensive driver discount: Most insurance companies give discounts when a driver takes a defensive driving class. This discount can range from 5% to 10%

- Military and federal worker discount: If you’re in the military or a federal worker, you might qualify for insurance savings up to 15% or more

- Anti-theft discount: Installing safety devices like an alarm system, steering wheel lock, and brake locks reduces the likelihood of theft, and you might save up to 15% per year

- Good student discount: Younger drivers typically pay higher auto insurance rates. However, some providers offer good student discounts. This is available to high school and college students (between the ages of 16 and 24) with a GPA of 3.0 or higher. They can save around 10% to 15% off their premium

3. Raise your deductible

Your insurance deductible is what you pay out of pocket before your insurance provider pays out on a claim. Average deductibles can range from $500 to $1,000. In general, the lower your deductible is, the higher your insurance premium will be. Therefore, increasing your deductible can reduce your monthly insurance rate substantially.

4. Maintain good credit

Good credit isn’t only beneficial when applying for loans. It can also result in lower insurance premiums. Pay your bills on time, dispute errors on your credit report, and pay down credit card balances to help improve your credit score and lower your car and home insurance rates.

Your next steps

Bundling car and homeowners insurance can save you, well, a bundle. So it’s worth it to shop around and see which companies offer the biggest bundling discounts.

If you’re just preparing to buy a home, it’s a perfect time to compare insurers. You might find a good deal by bundling with your current auto insurance company. Or you might save more by choosing a homeowners insurance company with a lower rate and moving your auto policy to that provider.

Remember that you’re free to cancel an insurance policy at any time and if you can find a better rate, it’s often worth your while.