Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

Rents Continue Surging: Where They’re Rising the Most

By Sharon Lurye

10/30/2021

The COVID-19 pandemic sent rental prices tumbling as city dwellers fled for the hills, but the latest data shows those prices haven’t just recovered—they’re surging to a new all-time high.

Median rents jumped 13.6% compared with last year in the 50 largest metro areas of the U.S. as people start to return to cities, according to monthly rental report from Realtor.com®. Rents hit a median price of $1,654 in September, which means renters are paying $198 more compared with the same time last year and an extra $222 versus two years ago, before the pandemic began.

(Metros include the main city and surrounding towns, suburbs, and smaller cities.)

“It really highlights how challenging affordability is at this point,” says George Ratiu, manager of economic research for Realtor.com.

This surge in rent is coming at the same time that buying a house is getting less affordable, too. Home prices are at record highs and more people are returning to cities, which creates more competition and higher prices in the rental market.

In addition, the federal government ended its moratorium on evictions. This means the foreclosure rate is going up, so more people may be forced to sell their home and rent instead. It also means landlords have more power to kick out tenants and raise the rent on whoever moves in next.

However, the increase in rents does at least signal that the economy is recovering from COVID-19, as tenants come back to cities and support local businesses.

Growth was particularly high in metros such as Tampa, FL, which includes St. Petersburg, which has seen a whopping 33.3% increase in rental prices. Monthly rents were a median $1,800 in the Florida city.

“The rental market is as tough as the sales market,” says Alma Alexander, a Realtor who’s with Coldwell Banker in Tampa.

She says a growing economy and strong sports industry are attracting many people to the Tampa region. The pandemic also gave the area a boost as many folks in snowier areas who could work remotely headed for cheaper, sunnier parts of the country. But in cities across Florida, there’s simply not enough housing to meet the demand.

The other metro areas with the highest yearly growth in median rent were Miami, at 31.6%; Riverside, CA, at 26.5%; Phoenix, at 26.4%; and Las Vegas, at 25.9%.

The pandemic saw a particularly large exodus of renters from big tech hubs like Seattle and Austin, TX, since tech-related jobs are often well-suited for remote work. As of September, rents in those cities are largely back to normal, and in some cases even higher than they were at the beginning of March 2020.

In Seattle, for example, median rents dropped around $300 from March 2020 to January 2021, from $2,923 to $2,610. As of September, they’re back to almost the same price they were before, at $2,895 a month. In Austin, rents last month were around 20% higher than they were in March 2020, jumping from $1,367 to $1,647.

More people returning to these tech hubs is a good sign generally for big cities and the U.S.

“In a sense, they were bellwether markets for when rental housing would see a return toward some degree of normal,” says Ratiu.

Zillow’s zeal to outbid for houses backfires in flipping fumble

Patrick Clark and Noah Buhayal | Bloomberg

10/27/2021

Faced with the fastest-growing real estate prices in US history, Zillow Group has tweaked algorithms to enhance home flipping operations to offer higher offers.

It ended up with so many successful bids that I had to stop offering new offers for the property. Now, after buying more homes than ever in the third quarter, the company is tackling the unprocessed portion of homes that need to be repaired and sold in the face of unpleasant reality. The slowdown in price increases has cost many homes.

According to a YipitData survey, Zillow launched a record number of homes on the market in September, listing properties with the lowest markup since November 2018. According to Yipit, in the third quarter, prices fell by almost half of the US listing, indicating that inventories are lower than expected.

The shift is on display in places such as Atlanta and Phoenix, two markets where home prices are skyrocketing. Zillow’s approximately 250 active list in Phoenix is now on average 6% cheaper than the company paid for homes.

According to data compiled by Mike Delprete, a real estate technology strategist and scholar at the University of Colorado at Boulder, this represents a $ 29,000 discount on typical real estate.

“All the key indicators from Zillow over the last few months are totally meaningless,” said Del Prete. “It’s like making a decision a couple of months behind the market.”

Zillow’s newly discovered aggression was good for people like Abidemi Bolatiwa who were watching the process run in real time. According to real estate records, he sold his four-bedroom home in Phoenix to Zillow in late September for $ 531,300, paying a convenient fee that was cheaper than traditional agency fees.

Mr. Volatiwa also Opendoor Technologies, That would have paid him about $ 504,000. Ten days after Zillow bought the home, the property went public for $ 505,900. When it didn’t sell, the company cut another $ 11,000 to $ 494,900.

According to DelPrete’s analysis, Zillow’s biggest competitor, Opendoor, continues to sell more homes than it buys, while home sales in Phoenix are declining. It also performs well in Atlanta, where Opendoor lists homes with a premium of 6.5% of the purchase price compared to Zillow’s 1.3% spread.

Zillow representatives declined to comment.

The company said on October 18th: It will stop making new offers to buy a home Reduce your share by 9.4% while processing the backlog. However, analysts most often shrugged off operational stumbling blocks and stocks recovered from these losses. The home flipping business dating back to 2018 is not yet profitable.

“Prices turned them on, they were a bit flatfoot, and probably a little too aggressive about bidding,” said Brad Ericsson, an analyst at RBC Capital Markets. “They probably don’t care so much. Making money isn’t that important at this stage of the game.”

Zillow and Opendoor are practicing a high-tech spin of home flipping called iBuying. Both companies use software-based algorithms to predict changes in home prices. They charge a fee instead of a typical real estate agent’s fee and pitch to their customers about the convenience of the service. Buying thousands of homes every quarter is a complex process and requires a lot of precision to do it right.

Rich Barton, CEO of Zillow, emphasizes that it is important to make competitive offers to reach the scale needed to make a profit in the business. He lamented in an August call with investors that soaring home prices have widened the spread between the cost of Zillow buying and repairing homes and the cost of selling real estate. rice field. As a result, the company, which purchased 3,800 units in the second quarter, has set a goal of purchasing 5,000 units a month by 2024 and is offering more offers.

“We saw a rapid increase in conversions throughout the quarter as we improved the strength of our offers,” he said.

Zillow and Opendoor are practicing a high-tech spin of home flipping called iBuying. Both companies use software-based algorithms to predict changes in home prices.

Richard Flor talked to a realtor this summer about listing a three-bedroom, three-bathroom rental for about $ 390,000 in the western suburbs of Phoenix, Tolleson, Arizona. Instead, he sold it to Zillow in September for about $ 412,000 and paid 1% of the service.

He then saw Zillow make a minor repair and relist the house for $ 387,000 two weeks later.

“I was wondering,’How do they make money,’” Flor said. “Maybe they know what I don’t know.”

Here’s why Zillow won’t be buying any more homes to renovate and resell this year

By JOE HERNANDEZ

10/20/2021

Al Bello/Getty Images

The real estate website Zillow announced it would stop buying and renovating homes through the end of the year as it works through a backlog of properties and it deals with worker and supply shortages.

“We’re operating within a labor- and supply-constrained economy inside a competitive real estate market, especially in the construction, renovation and closing spaces,” Jeremy Wacksman, Zillow’s chief operating officer, said in a statement.

“We have not been exempt from these market and capacity issues and we now have an operational backlog for renovations and closings,” he added.

Through its Zillow Offers program, the company buys homes directly from sellers, completes the necessary upgrades and lists them for sale. This lets sellers avoid having to do repairs or set up showings themselves, the company says.

Zillow, which is known for its online real estate listings, told shareholders that it purchased 3,805 homes through the program in the second quarter of this year, a major increase over previous years.

Zillow Offers, which launched in 2019, sold 2,086 homes and made a gross profit of $71 million over the same period.

The company announced on Monday that it wouldn’t sign any new contracts to buy homes through the end of 2021. Zillow said that it would still market and sell homes through the program and that it would also continue to buy houses with contracts that have already been signed but have yet to close.

The construction industry was one of many that were hit hard by the COVID-19 pandemic, which saw the cost of building materials soar. Meanwhile, the demand for homes — as well as their price tags — has surged.

While the astronomical prices of wood have decreased from their recent highs, other materials such as steel and piping remain costly or in short supply. On top of that, there is a serious shortage of construction workers.

Both the construction of new homes and the authorization of building permits fell in September compared with the previous month, according to the U.S. Census Bureau.

In an interview with Marketplace Morning Report last month, Associated Builders and Contractors economist Anirban Basu said the coronavirus was still causing problems in the housing industry. “The spread of the delta variant globally has increased supply chain issues. It means higher prices for inputs; it raises the cost of delivering construction services,” Basu said.

诚招美国和加拿大法律服务代理

因公司发展需要,诚招美国和加拿大法律服务代理。

要求:

懂英语、或西班牙语、或法语。

能合法工作有社安号或工号。

无需改行, 可以兼职。

大学生和有销售经验优先考虑。

自雇生意公司发美国报税1099,加拿大T4A

有意了解详情, 请扫码加微信, 非诚勿扰!

Zillow slams the brakes on home buying as it struggles to manage its backlog of inventory

By Anna Bahney, CNN Business

10/18/2021

Zillow will stop buying homes through Zillow Offers for the rest of the year, as the company’s iBuying program goes from full speed to full stop.

The company announced on Monday it would not contract to buy any more homes in 2021 in order to work through the backlog of homes it has already bought.

The “iBuyer” model used by Zillow and other real estate companies entails purchasing homes directly from sellers, and then re-listing the properties after doing minor work. But thanks to the current shortage on labor and materials, Zillow can’t close, renovate and resell the homes fast enough.

“We’re operating within a labor- and supply-constrained economy inside a competitive real estate market, especially in the construction, renovation and closing spaces,” said Jeremy Wacksman, Zillow’s chief operating officer, in a statement.

“Pausing new contracts will enable us to focus on sellers already under contract with us and our current home inventory,” said Wacksman.

Zillow will still market and sell the homes it has acquired through Zillow Offers, which has been on a purchasing tear this year. It bought 3,805 homes in the second quarter — a record high for the company and more than double the number of homes bought in the first quarter, according to a note to company shareholders.

Zillow, known for its online real estate listings, introduced an iBuyer program, Zillow Offers, in 2018 and now operates in 25 cities. Like other iBuyers — such as Opendoor, RedfinNow and Offerpad — Zillow Offers uses data and algorithms about the property and the market to make a cash offer on an off-market home, and buys directly from the homeowner.

IBuyers appeal to home sellers because closings can take place anywhere from 7 to 90 days after the contract is signed and can provide some certainty and control over the sale of their home without the hassle of finding an agent and prepping the house for market. According to Zillow, the fee to the seller for Zillow Offers averages 5%, but can vary based on market conditions.

Home purchases by iBuyers now account for about 1% of the market, according to a report from Zillow. The share is still a tiny part of the whole market, but shows tremendous growth over the past few years as the iBuyer share in some cities, like Phoenix, Atlanta or Charlotte, North Carolina, now tops 5%.

Zillow wasn’t alone among iBuyers in buying a lot of homes this year. IBuyers bought more houses, at higher prices, in the second quarter of this year than in any other quarter, according to research from Mike DelPrete, an independent real estate technology strategist and scholar in residence at the University of Colorado Boulder. That has surprised some skeptics who did not think the iBuyer model would be appealing to home sellers in a hot market.

His research suggests that sellers are drawn to the certainty and ease of iBuying and the market conditions fueled its growth.

Zillow’s move to halt purchases is surprising, he said, particularly because it is so sudden.

“iBuyers have access to a tremendous amount of data, they can see months into the future and plan their inventory,” said DelPrete. “So the fact that Zillow didn’t see this coming and wasn’t able to make adjustments before it had to resort to an iBuying lockdown is pretty surprising.”

This shift, he said, demonstrates how difficult this business model is to scale up. Large iBuyers need to be skilled at both managing billions of dollars in capital, but also the logistical specifics of prepping a home for sale, down to drywall and painting and closing deals.

“There is only so much that technology can do,” said DelPrete. “At the end of the day you need people to process a lot of transactions.”

However, the halt appears to be a Zillow-specific problem, not an iBuyer industry problem, DelPrete said.

“Zillow just kept barreling down and now they’ve hit this wall,” he said.

This is not the situation a growth-focused company wants to be in, he said.

“If you’re trying to be number one in the market, slamming on the brakes is one of the worst things you can do,” said DelPrete. “You want to make some adjustments before you get to that point — slow down, switch gears. This is not the preferred outcome for Zillow.”

Opendoor, the leading iBuyer ahead of Zillow at a distant second, said in a statement it is still open for business.

‘Insatiable demand’ for warehouse space continues in NJ

Rents surge to record high as developers scour state for booming logistics industry

By JON HURDLE

10/16/2021

Rents surged and vacancies dropped to a record low for warehouses and other industrial buildings in north and central New Jersey from June to September, a new report said Wednesday, as demand from e-commerce continued to fuel the state’s red-hot market for logistics space.

The asking price for industrial rents rose 15.6% to a record $10.72 per square foot while vacancies fell to 3.4% from 3.8% only three months earlier. For warehouses, which account for about three-quarters of the overall industrial market, the vacancy rate was even lower, at 2.9%, according to the report from Newmark, a commercial real estate company.

As in the first half of 2021, the growth was again driven by very strong demand from logistics companies for space to store and distribute an avalanche of goods ordered online.

“Insatiable demand from ecommerce, corresponding with a long-term shift in consumer spending habits towards online spending and away from traditional retail stores remains a key driver of leasing activity,” the report said.

Demand for logistics space has been strong for five years but was fueled further over the past year by online shopping during the pandemic. It has also been driven by the state’s proximity to Port Newark-Elizabeth where one of the nation’s largest volumes of consumer imports enters the country, and by New Jersey’s position at the heart of the populous Northeast market.

While the boom has created thousands of jobs, including some 50,000 at Amazon alone, it has also sparked protests and lawsuits in some communities where residents fear that local roads will be choked by new truck traffic, and that remaining rural enclaves will be occupied by giant warehouses that may cover a million square feet or more.

In the Legislature, public concern that warehouses affect areas beyond the towns where they are built has also spawned a bill co-sponsored by Senate President Steve Sweeney (D-Gloucester) that would require towns facing a warehouse application to alert neighboring municipalities and try to win their support for the project.

Numbers show big-time growth

The new data shows the boom is only accelerating. Industrial space under construction, almost all of which was for warehouses, rose to 13.9 million square feet in the latest quarter from 13.4 million in the second quarter of 2021. Despite a supply shortage, the amount of industrial space leased in the first three quarters of this year, 28 million square feet, exceeded that for all of 2020.

In another key indicator of the strength of demand, net absorption — the difference between the amount of industrial property that became occupied during the quarter, and that which became vacant — jumped to 4.7 million square feet in the latest quarter from 3.1 million square feet in the previous three months.

“It’s remarkable to me that it keeps going up,” said Tim Evans, director of research at New Jersey Future, a nonprofit that advocates for “smart growth.” He said the warehouse boom can’t be fully explained by the surge in online shopping during the pandemic, and may have also been fueled by an increase in the volume of imported goods arriving at Port Newark-Elizabeth from Asia since the Panama Canal was widened to accommodate bigger ships in 2016.

Evans predicted that the continued high demand for warehouse space will result in both vacant and previously developed land being obtained for an industry that wants to be as close to the port as it can. That process may involve “second-generation” redevelopment of sites that first held factories, then became office parks, and would now be occupied by warehouses.

“As factories close to the port get used up, they might start buying second-generation redevelopment sites like office parks,” he said.

The report said there’s a “widening imbalance” between supply and demand, especially in sub-markets where available land is limited. They include the Meadowlands, where rents jumped 28.5% in the latest quarter compared with a year earlier. The report predicted that the sharply higher rents there will spur developers to redevelop land or reuse existing buildings.

Major transactions included 840,000 square feet leased to Peloton, the fitness equipment maker, at Linden; 511,000 square feet in Warren County to Alan Ritchey, a logistics provider, and 326,000 square feet in the Meadowlands taken by TJ Maxx, a clothing retailer.

In the warehouse sector specifically, the highest asking rent among 21 local markets was $14.73 per square foot in the Meadowlands, followed by $14 in the market around New Jersey Turnpike Exit 12 where the vacancy rate was virtually nonexistent at 0.1%.

No end in sight

There’s no sign that high rents and low vacancy rates will let up any time soon, given continuing high demand from logistics companies, the report said. It forecast that developers will continue to encounter rising construction costs, shipping delays and labor shortages.

“In the coming months, robust demand from ecommerce and logistics companies is expected to maintain a record low vacancy rate, driving further growth in warehouse rents,” it said.

Micah Rasmussen, a Rider University professor who led a successful campaign against a planned warehouse in Upper Freehold earlier this year, said people should consider whether New Jersey is getting over-developed — in light of the ongoing warehouse boom and the devastating flooding caused by Tropical Storm Ida.

“I think the shortcomings of our over-development became much clearer to a lot of people during Ida,” he said. “We need to rethink what we’re doing, and given what’s happening in the market, it seems like the perfect time for us to do that.”

In N.J., the fall housing market is starting to look better for buyers

BY ALICIA SMITH

10/08/2021

The red hot residential real estate market is beginning to cool slightly, and this trend is expected to continue for the remainder of the year.

Low interest rates, low inventory, and buyers looking to leave urban areas, such as New York City, for more space in the suburbs, were largely driven by cheap interest rate rates and low stock levels in New Jersey City.

However, according to Jeffrey Otteau, a real estate economist and president of the Otteaux Group, the home buying demand is running at slowed pace in New Jersey four months later.

He explained that Its not that it’s collapsing, he said. It’s normalizing.

According to Otteau’s data, contract sales were down statewide by 12 percent in June, 22 percent on July, 16 percent, and 22 cents in August for the first three weeks of September.

Sales are lowering, according to him, because home prices have risen so much that they are unaffordable even with low interest rates. And urban flight in the middle of the epidemic, which brought city-dwellers who wanted more room to the suburbs, has ended.

Migration from the city to the suburbs is now reversing as cities renown, Otteau said. As employers are advising workers to return to the office, were starting to see housing shift back in toward the city.

According to Otteau’s data, contract sales in Hudson County have risen by 35% every year to date, according to him.

And according to New Jersey Realtors August report, closed sales in Hudson County were up 17.1% in August alone, despite closed doors falling by 10% statewide.

Irene Barnaby of Compass in downtown Jersey City said she’s seeing buyers who were renting in the area and want to profit from low interest rates, international buyers, and some of the situations when people who fled Hudson County” traffic now want back.

One couple she worked with sold their three-bedroom apartment in downtown Jersey City and moved to Maplewood in May 2020. They called her about 6 months ago and stated they sold their Maplewood house and were returning to Jersey City.

They missed the vibrancy and being in the center of the action, and having access to New York City, Barnaby stated.

People who are buying in Hudson County still want space, she added. The majority of people are searching for two or more bedrooms and want some sort of outdoor space. She said, “One-bedrooms are difficult to sell,” and she remarked.

Another factor slowing home sales overall is that home prices rose 12% in 2020 and are on the verge of risen 17 percent this year, according to Otteau, stating that prices grew an average of about 3% for each of the previous 7 years.

House prices can only rise as fast as salaries, he said. Banks won’t lend buyers enough money to afford a house after ten years of that (faster than salary growth). There must be a correction to follow, if home prices rise faster than salaries.

Otteau predicts a price increase of 5% in 2022 and regress of 5 percent in the 2023.

However, he said, it’s still a good moment to purchase. He explained, “You’re going to get a lower interest rate now than in the future,” he added.

According to Reuters, American Federal Reserve policymakers may be able to raise interest rates next year.

According to Otteau’s statistics, the highest segment of the housing market is homes in the $1 million to $2.5 million sales range, which is responsible for approximately 45 percent of sales, followed by the $600,000 to $1 millions sales spectrum, with 30 percent sales.

Those buyers are chasing up and, in the process of purchasing, they’re also increasing the inventory of homes on the market because they sell their existing homes.

People were concerned about job security, so they didn’t want to take on a larger mortgage, Otteau said, because trade-up buyers were not selling last year. They were concerned that strangers gathered across their houses in the middle of a health crisis.

However, the trade-up market hasn’t completely exploded.

Missy Iemmello, office manager for Weichert Realtors in Morris Plains, whose 120 agents work in the Morris, Sussex, Warren, Bergen, and Essex counties, said in September that she saw a rise in inventory that quickly slowed.

We were all delighted. We believed they’ve been anticipating this year, Iemmello added. Then it was simply a short blimp, all of oh, this was subsequently merely en route to victory.

Hurricane Ida, according to Iemmello, stopped the trend.

People got water where they never had water before, she explained. I believe we should see inventory numbers increase in the following weeks.

Frustrated House Hunters Are Giving up on Buying Only to Face an Expensive Rental Market

By Aly J. Yale

9/22/2021

Cramped in a one-bedroom, new parents Kristina and David Mahon were desperate to buy a larger home. But after scouring the Pompano Beach, Florida market for nearly a year (and losing out on 20 houses in the process), the pair eventually gave up.

Now, the couple — with a 10-month old baby in tow, no less — are renting, a decision Kristina says they felt “forced” into.

“I feel like I’m wasting money for something that’s not mine,” Kristina says. The rental“options were very limited, and the prices were on the high side of what we were comfortable spending on a rental.”

The Mahons’ is a common storyline these days, according to those in the industry. Burned-out house hunters are tired of bidding wars, rising prices and dwindling options and are bowing out of the purchase market, opting to rent instead.

“It’s common given the current market and environment that we are in,” says Kaley Tuning, the Native Realty agent who worked with the Mahons. “It just becomes frustrating for the everyday buyer. I’ve had buyers bid upwards of $40,000 over asking price and still get outbid.”

Unfortunately, the pivot to renting isn’t always easy. While the move may afford frustrated buyers time to wait out the competitive housing market, it often means entering an equally hot rental scene — one where rising rents and dwindling supply are growing concerns.

According to Realtor.com, median national rents grew a whopping 11.5% between August 2020 and August 2021. And rent applications? Those are up as much as 95% in some cities, according to apartment listing platform RentCafe.

For hopeful homeowners, it’s made for a unique catch-22 that’s as frustrating as it is costly.

Rents are on the rise

It’s no secret the housing market’s been hot this year. The purchase market has boomed in nearly every corner of the nation since last spring. Home prices are up 17% over the year, and inventory, while improving, is still near record lows.

The rental picture has been more mixed, though. At the start of the pandemic, vacancies in big cities rose and prices dropped, while demand for suburban rentals skyrocketed. Now, rents are bouncing back across the country, reaching well above pre-pandemic levels in many areas.

According to Realtor.com, the typical rent now clocks in at $1,633 per month — $169 more than this time last year and almost $200 more than 2019’s numbers. And in nearly half of the country’s biggest cities? Monthly starter home payments are more affordable than average rents.

The hot housing market has a lot to do with this spike in rent costs. With rising home prices and limited for-sale listings, more and more buyers are stepping back. This puts pressure on rental inventory and drives up rents.

As Lisa Harris, an agent at RE/MAX Center in Braselton, Georgia, explains, “Fewer homes listed for sale and much higher prices for them have kept many want-to-be buyers in their rental units, taxing the rental supply.”

The pandemic plays a role, too. Eviction bans have kept many non-paying renters in place, tying up units for much of the last year. While the CDC’s eviction moratorium was shot down late last month, the experience has made many landlords warier than ever.

“Not only have the prices increased, but the demand on tenant screening seems to be getting much more stringent,” Harris says. “Landlords are seeking tenants with higher credit scores, higher deposits, no pets, a clean criminal history and more.”

The trickle-down of higher rents

Alex Lashner, like the Mahons, has experienced the difficult rental market firsthand. She even had to expand her rental search to account for price increases and is now looking as far as 90 minutes from her office just to stay on budget.

“I’m hoping it will be a short-term sacrifice so I can buy closer to my workplace a few years down the line,” she says.

Lashner was originally looking to buy her first home somewhere in Bucks County, Pennsylvania, but due to the competitiveness of the market — and her refusal to waive contingencies or overpay (as many buyers are forced to do lately), she lost out on every property she bid on. She finally opted to rent, only to find rising prices there, too.

“I’m frustrated that buying a three-bedroom home in my budget is cheaper than renting when you compare the monthly costs of a mortgage, property taxes and HOA fees versus the rental costs for a two-bedroom or even a one-bedroom apartment,” Lashner says. “That’s where my real sticker shock is.”

Rising rents are more than just a budgetary strain for hopeful buyers, though. They also make it harder to save, which could push back those homebuying goals even further. The Mahons are one household in that camp, something Kristina calls “frustrating.”

“Instead of us paying down our own mortgage and building equity, we are paying someone else’s mortgage,” she says. “For the next year or as long as we are renting, we will not be able to save as much as we had hoped.”

Buyers who are forced to sign long-term leases have another dilemma, too: What if mortgage rates go up?

Interest rates have been hovering near historic lows for months now and have played a major role in boosting buyer demand. Kristi Nowrouzi, a mortgage loan officer with Geneva Financial, says many buyers who have backed out of the market recently are concerned those conditions could change.

“There’s a fear of missing out on the low-interest-rate environment,” Nowrouzi says. “Inflation is blowing up and who knows what rates will look like next year at the end of an annual lease agreement.”

What’s the solution?

One option for buyers facing sky-high rents is to opt for a month-to-month lease. The flexibility usually comes with a slightly higher monthly rent, but it ensures you can act quickly should the right house hit the market.

“By doing a month-to-month lease, even though rent might be slightly higher than signing a long-term lease, they can be ready to take action,” says Shmuel Shayowitz, president and chief lending officer at Approved Funding, a mortgage lender in New Jersey. “They can also continue to actively look for homes and, even if pricing doesn’t soften, be in a better position to act.”

Fortunately, strategies like this might not be necessary for long. Buyers still face plenty of challenges, but recent data points to growing housing supply — particularly in the starter home segment. Existing home sales have also slowed, falling 2% in August, and price growth has decelerated as well. According to Realtor.com, 17% of all listings had price reductions in August.

“The market is absolutely shifting now, and prices are decreasing a bit and sellers aren’t getting as high price per square feet as they were a few months ago,” Nowrouzi says.

A completely cooled-off market, though? That could be a long way in the future. Until then, Tuning says, “Patience is a virtue.”

为解住严重宅荒 美联邦政府要盖10万户平价宅

来源:经济日报

9/02/2021

在美国房价持续高涨之际,白宫官员表示,美国政府为纾解严重住宅荒,将采取一系列立即可实施的步骤,以现有经费和权力,在未来三年兴建、销售10万户平价住宅。

路透引述官员说法报导,这套计划最快1日宣布,将聚焦于扩大对个人和非营利机构销售房屋,同时对大型投资人买房设限。第2季全美各地每售出六户住宅,就有一户被投资大户买走。

美国房屋需求在新冠肺炎疫情爆发初期激增,反映民众为居家办公和学习购置更宽敞的房子。但待售屋不足和供应链瓶颈把房价推得更高,租金行情跟着水涨船高,加重家庭财务负担。白宫官员说,全美平价住宅估计短缺多达400万户。

白宫官员表示,美国总统拜登(专题)已提议,斥资逾3,000亿美元增建200万户平价住宅,这项措施是3.5兆美元基础建设投资案的一部分,正在国会审议中。但拜登希望推动立即可行步骤。

这套新计划将涵盖乡村与都会地区的住宅建案,重点摆在平价房市,希望能协助房屋自有率偏低的有色人种族群。

此计划将由美国住宅与都市发展部(HUB)部长法吉(Marcia Fudge)宣布,具体行动由该部、财政部及房贷机构房利美(Fannie Mae)与房地美(Freddie Mae)等联邦监管机构共同规划。“两房”合计占全美11兆美元房贷市场的一半。其中,一大关键步骤是重启曾由财政部与HUB合办但在2019年结束的“风险分摊计划”,该计划让各州住宅金融机构能扩大提供低利贷款,促进兴建平价住宅。

此计划也将提高组合屋及二至四户多户型不动产的供应量,希望透过房地美扩大融资达成目标。同时也将采取行动,限制对大型投资人销售一些由联邦住宅管理局(FHA)提供担保的不动产。

拜登政府另打算与各州和地方政府合作运用现有联邦资金,并协助减少排他性分区(exclusionary zoning)等阻挠提高住宅供应量的做法。

White House tackles housing shortage with plan for 100,000 affordable homes

By Andrea Shalal

9/02/2021

WASHINGTON, Aug 31 (Reuters) – The Biden administration is taking steps to address a severe housing shortage in the United States by creating and selling 100,000 affordable homes over the next three years using existing funds, the White House said on Wednesday.

The moves will focus on boosting home sales to individuals and non-profit organizations, while limiting sales to large investors, who scooped up one in six homes sold in the second quarter, according to a White House statement.

Demand for housing soared early in the pandemic as Americans sought more spacious accommodations for home offices and home schooling, but a shortage of homes for sale and supply chain bottlenecks have driven housing prices sharply higher.

Rental prices, which typically follow the lead of house prices, are also a big concern, given that even before the pandemic 11 million families – or nearly a quarter of all renters – were already spending more than half their income on rent, according to the White House.

The United States has an estimated shortage of as many as 4 million affordable housing units, White House officials say.

U.S. President Joe Biden has proposed spending over $300 billion to add 2 million more affordable housing units as part of a $3.5 trillion investment package being considered by Congress, but wanted to push forward with immediate steps that could be taken now, the White House said.

The plans will cover rural and urban housing projects, with a focus on aiding communities of color, where home ownership rates have lagged historically.

U.S. Housing and Urban Development (HUD) Secretary Marcia Fudge will announce the measures after touring a new five-story affordable housing complex in Philadelphia on Wednesday.

Fudge called the initiatives “significant downpayment” on Biden’s commitment to boost the supply of affordable rental housing, expanding access to capital for state Housing Finance Agencies, empowering local communities to build more affordable housing and promoting equitable housing policies.

Specific actions are planned by Fudge’s department, the U.S. Treasury and agencies such as Fannie Mae and Freddie Mac, which will increase financing opportunities to enable more Americans to purchase homes, the White House said.

One key step is the revival of a joint Treasury-HUD “Risk Sharing Program” that ended in 2019 and that will enable state housing financing agencies to provide more low-cost capital for affordable housing development.

The plans will also boost the supply of manufactured housing and 2-4 unit properties by expanding financing through Freddie Mac, while taking steps to limit the sale of some U.S. Federal Housing Administration-insured properties to large investors.

Investor purchases, which have been as high as one in every four homes in some communities, have driven up prices for lower-cost houses and triggered fierce competition for starter homes, the White House said.

The administration also plans to work with state and local governments to leverage existing federal funds, and help reduce exclusionary zoning and other practices that have discouraged efforts to boost the supply of housing, the official said.

The Federal Housing Finance Agency “will begin to study the interaction between exclusionary zoning and our regulated entities,” said acting Director Sandra L. Thompson.

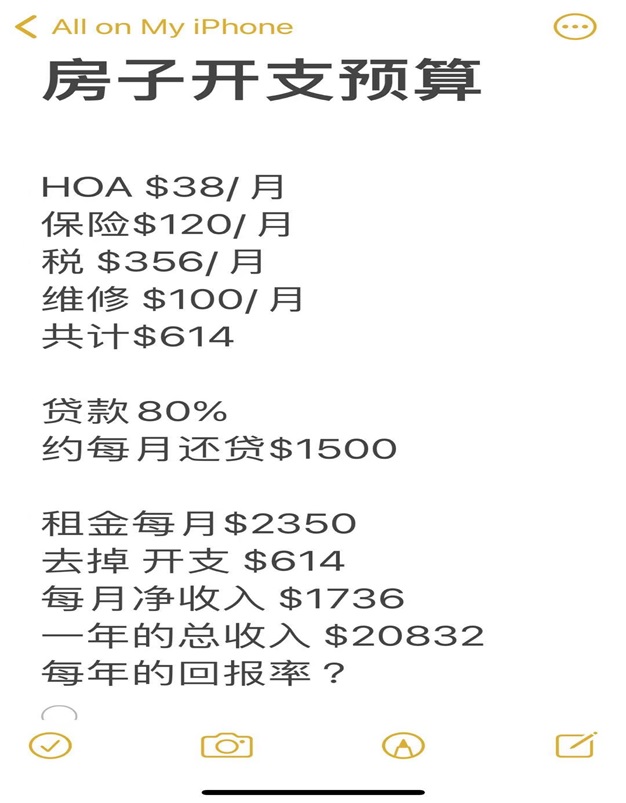

如何计算一个投资房产的租金回报率?

By Willy Rong

3/07/2021

一直以来都有人问我,如何计算一个投资房产的租金回报率?我答过,但总是似是而非。

今天就这个问题给出我的计算公式Return Of Investment (ROI),仅供大家参考。

这个问题要从两方面讨论,看你是全额现金买房?还是贷款80% 买房?

(全额现金买投资房产)租金回报率 = (12月的租金 – 一年的各种花费)/ 买房价

(贷款80%买投资房产)租金回报率 = (12月的租金 – 一年的各种花费和贷款 )/ (

20%首付+ Closing Cost )

我们还是以一个$38万美元买房实例来计算,比较直观:

房子开支预算:

HOA $38/月; 保险 $120/月; 税 $356/月; 维修 $100/月。

共计 $614。

贷款 80%, 约每月还贷$1500;

租金每月$2350;去掉开支 $614; 每月净收入 $1736;

一年的总收入 $20832。

问:一个$38万美元的房产,每年的回报率?

(全额现金买投资房产)租金回报率 = (12月的租金 – 一年的各种花费)/ 买房价

$38万美元房子的租金回报率 = 一年的总收入 $20832 / 买房价$380,000 = $0.0548

全额现金$38万美元房子的租金回报率一年约为:5.5%;

(贷款80%买投资房产)租金回报率 = (12月的租金 – 一年的各种花费和贷款 ) / (

20%买房首付 + Closing Cost)

$38万美元贷款80%房子的租金回报率 = (一年的总收入$20832 – $18000) / (首付 $

76000 + $5000 Closing Cost ) = $0.0349

$38万美元贷款80%买投资房产的租金回报率一年约为:3.5%.

这个$38万美元的房子在最好学区,房子升值潜力大!

考虑到加上房子产权equity 上涨的因素,一年在6%-8%。所以要加上一个Equity 增值

率,换句话说,是用$81000 买了一个$38万美元的房产,是用杠杆买的房子。

这里有2个概念:一个是租金回报率;一个是Equity 回报率;

利用杠杆买房,就要让银行在这个房子上也赚一些钱,所以贷款租金回报率3.5%.要低

于全额现金租金回报率5.5%,这个逻辑是对的,那个2% 回报率的差让银行赚去了。

什么是智慧?智慧就是解决问题的能力!

能够把一个复杂问题简单化,用直白的方式讲清楚,这也是智慧。

现在亚特兰大地区(佐治亚),一个房子的租金回报率大概在3% ~ 6%左右,真心话,

投资房净租金回报率6%是一个不错的回报。

你若嫌上面二手房一年的租金回报率还低,你可以全现金买126包租5年的项目,一年的

租金回报率为净6%。

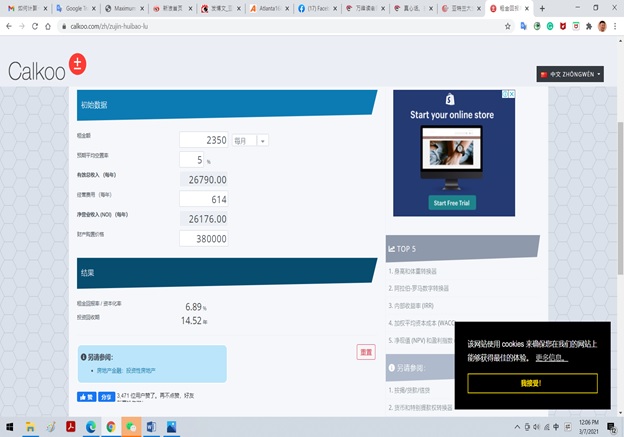

下面是在网上找到的租金回报率计算器,大家可以去练习:

租金回报率

https://www.calkoo.com/zh/zujin-huibao-lu

提示:算大账不算小账,可能公式不够严谨,但逻辑是对的。

Source: http://www.mitbbs.com/article_t/Georgia/31320547.html

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com