What are real estate closing costs and how much will you pay?

By Zach Wichter

4/18/2021

Closing costs are the thousands of dollars in fees associated with a mortgage, typically amounting to 2 percent to 5 percent of the loan principal. There are various closing cost components and they vary from state to state. Some closing-related items can be negotiated by the borrower.

Closing costs usually include an appraisal, credit check and title search, and you don’t only have to pay them when you buy a house. If you refinance your mortgage or tap your home equity, you’ll have to pay closing costs again.

How much you’ll pay in closing costs depends on the price of the home and the location. The average total for closing costs on single-family homes in the U.S. in 2019 was $5,749, including taxes,, according to ClosingCorp, a real estate data firm. A survey by the firm determined that the highest closing costs were usually paid on the coasts, including the District of Columbia ($25,800), Delaware ($13,273), New York ($12,847), Washington ($12,406) and Maryland ($11,876). States with lower closing costs included Indiana ($1,909), Missouri ($2,063), South Dakota ($2,159) and Iowa ($2,194).

How to estimate your closing costs

Homebuyers typically pay 2 percent to 5 percent of the purchase price of their home in closing costs, says Jackie Boies, senior director of housing and bankruptcy services for Money Management International, a Sugar Land, Texas-based nonprofit debt counseling organization. For a $200,000 mortgage, in addition to your down payment, you should expect to pay another $4,000 to $10,000 in closing costs.

These will largely be broken down into two categories: property-related fees, which cover expenses your lender incurs in evaluating the property you’re financing, and mortgage-related fees, which cover the cost of processing your application.

Fees vary widely and are based on a number of factors including location and value of your loan, so it’s best to talk to your lender and go over your mortgage documents carefully to understand what you should expect to pay.

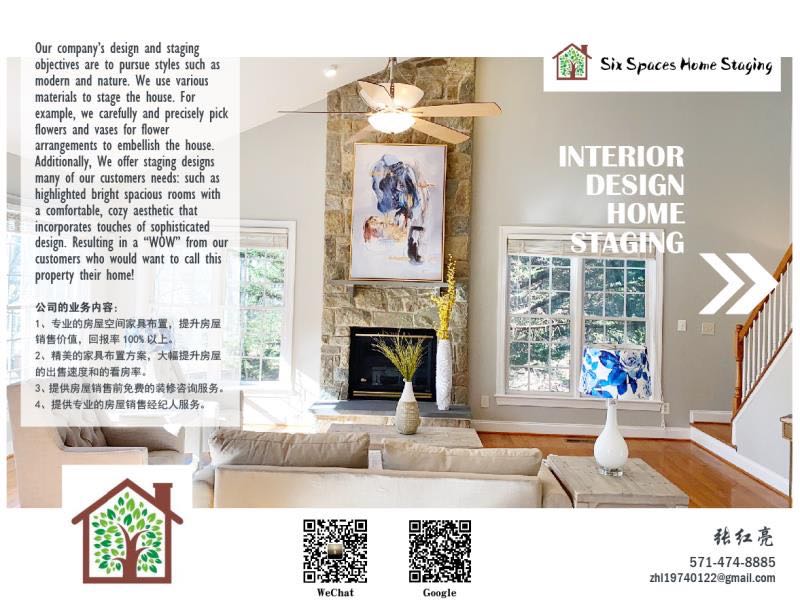

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

Property-related fees

Appraisal fee: The appraisal fee pays for a licensed professional to determine what the home is worth before a lender will extend a mortgage offer. Estimating the market value of a single-family home will typically range from $300 to $450 or more for a larger home.

Home inspection fee: separate from the appraisal, it’s usually a good idea to get a professional inspection of the property you’re about to buy. Those also usually run a few hundred dollars.

Title search: If you’re buying other than a new property, lenders will send someone to search local property records for the title of the home to make sure there aren’t any issues with ownership or liens. The fee is around $450.

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

Title insurance: Lenders require obtaining title insurance in case there are issues with ownership after the sale. This protects the lender and the cost is usually 0.50 percent to 1 percent of the loan amount. The homeowner may wish to purchase title insurance to protect their financial interest in the property and that’s an additional cost.

Mortgage-related fees

Credit report fee: The credit report fee is what the lender charges to check your credit score and obtain a credit report. The fee is $25 or more per individual borrower on the loan.

Origination fee: Lenders sometimes charge a fee for initiating the loan. It can range up to about $125.

Application fee: Some lenders charge a fee of several hundred dollars to process the application.

Underwriting fee: This may also be called an administrative or processing fee and it covers costs to evaluate and verify your mortgage. This might be around 0.5 percent of the loan amount. You may also need to pay some other charges, known as points, upfront. Many mortgages allow the borrower to pay points to lower the interest rate on the loan.

Local fees

Some cities and states can charge additional fees. Purchasing a home in Chicago, for example, means a transfer tax paid by the buyer of $7.50 per $1,000 sales price, says Esther Phillips, senior vice president of Chicago-based Key Mortgage Services.

Legal fees

For most property deals, you’ll need to be represented by a lawyer at your closing. Many real estate lawyers charge by the hour, and rates can vary widely.

Closing documents

Once you apply for a mortgage, you’ll receive a loan estimate and a closing disclosure from your lender. The loan estimate will tell you approximately what all the costs of your mortgage will be, including closing fees, your payment, taxes and insurance and other home-related expenses.

After you settle on a lender, you’ll get a closing disclosure, which will provide much of the same data as your loan estimate, but with the exact numbers you can expect to pay out at the closing and after.

These documents will really be the best way to get a handle on what your closing costs will be.

How to avoid some closing costs

While you can’t avoid paying all the closing costs, there are some that can be negotiated, potentially saving you money. Shop mortgage lenders to compare these fees, some of which vary by lender, Boies says.

“Many fees are not set in stone and the lender has some latitude to adjust them, but you’ll need to ask about each one individually,” Boies says. “If a fee isn’t clear, ask the lender what it covers specifically and if it doesn’t make sense, ask for the fee to be waived.”

Who pays closing costs?

While most fees are traditionally paid by the buyer and some by the seller, some can be negotiated, depending upon the market. Many buyers believe the only fee that sellers ever pay is the broker’s commission, but savvy real estate shoppers can sometimes negotiate some of the other costs into the seller’s corner. It’s not unusual for buyers to persuade sellers to share some expenses that are paid in advance, including tax and insurance escrow deposits, flood and hazard insurance premiums, property taxes and per-diem interest.

“If the seller is urgent about selling the home, he or she may be willing to take on more of the (buyer’s closing) costs,” Boies says. In a buyer’s market the seller may be more willing to pay more of the buyer’s closing costs than they otherwise would.

How to budget for closing costs

It’s a good idea to consult a lender before you start looking at homes to understand what all your costs will be. That’s why a mortgage preapproval is recommended.

Since a number of factors, such as the type of loan, type of property, type of occupancy and your credit score can determine what your closing costs may be, try to be as specific as you can with the mortgage providers, says Brett Warren, director of residential mortgage lending for Hyperion Bank in Philadelphia.

“Closing costs are often higher than most borrowers initially assume they are,” Warren says.

Budgeting for closing costs in addition to the down payment is also helpful, says Kurt Westfield, a managing partner at WC Equity Group, a Tampa, Florida-based real estate services company.

The key is to be patient and prepared since the homebuying process can be lengthy.

“Don’t rush into what will likely be the largest purchase of your life,” Boies says. “Many borrowers are unprepared for the actual cost of purchasing a home and deplete their savings to cover the closing costs.”

Source: https://www.bankrate.com/mortgages/what-are-closing-costs/