秋叶看到饱 全美10条最佳赏枫公路之旅

世界新闻网

10/13/2022

秋天欣赏各种颜色的秋叶变化,不是新英格兰地区的专利,全美各地都有可以一路饱览美景的赏枫路线,例如太平洋西北地区(Pacific Northwest)、洛矶山脉(Rocky Mountains)、雪伦多亚河谷 (Shenandoah Valley)和上中西部(Upper Midwest)。

打算开车追枫的人,今年不妨改变路线,开上几千英里路,这才是真正喜好赏枫者会做的事。以下是Time Out网站精选出全美最佳的10条赏枫公路,在10月底前快准备上路吧。

另外,备好一顶帐篷、一辆单车,沿途随时可以停下来找个露营区休息一晚、或在单车步道上骑一小段舒活筋骨,让赏枫之旅更加自在惬意。

1. 哥伦比亚河 / 俄勒冈州

哥伦比亚河峡谷蜿蜒于华盛顿州与俄勒冈州,是一条绝美公路之旅。沿途可以看见冷杉、白杨树、枫树、梣木和松树,大片洒落的金黄,让人驻足河岸舍不得离去。

2. 太浩湖 / 加州

太浩湖西南边的落叶湖 (Fallen Leaf Lake) 名称来自于湖边有一大片的白杨木,每到秋天树叶转黄的时候,原本秀丽的湖光山色更让人为之惊艳。想一睹更多枫景,可以从89高速公路到Hope Valley,沿途有停车区和健行步道,可以欣赏秋天美丽的白杨木。

3. 帕罗宛 / 犹他

大自然画笔在秋天的南犹他州尽情挥洒,在开往锡达布雷克斯景观公路(Cedar Breaks Scenic Byway) 前,可在帕罗宛 (Parowan) 停留片刻,参观著名的天然圆形剧场,走上半英里路,便可以发现这个自然界奇观为秋天的黄叶打造了一个完美的背景。接着前往Markagunt High Plateau景观公路,可在Woods Ranch稍作休息,这里有大片白杨木与松树林,适合停下来野餐、呼吸新鲜空气。

4. 陶斯 / 新墨西哥州

位于新墨西哥州北边的桑格雷克里斯托山脉 (Sierra de la Sangre de Cristo) 的陶斯 (Taos),是在沙漠欣赏秋叶的另类选择。最方便的方法是开往Enchanted Circle Scenic Byway,一条83英里长的环形道路。正如路名「Enchanted」,这条令人沉醉的道路,两旁种满黄色与橘色的白杨木,周围环绕着新墨西哥州独特的高山、峡谷、高地等地理景观。

5. 亚斯本 / 科罗拉多州

前往亚斯本 (Aspen) 时,车子得开快一些 (安全同样重要),为何要这么赶?因为这座城市的斑烂秋色特别短暂,只有9月中到10月初。但如果赶上这片「金黄橱窗」(golden window),艳阳下迎风招展的成千上万株白杨木,绝对不会让你失望。

6. 圣胡安天际公路 / 科罗拉多州

秋天科罗拉多州另一条令人惊叹的公路之旅,圣胡安天际公路 (San Juan Skyway) 长236英里,虽一路得开上5至7小时,但绝对值得。这趟旅程可以经过古老的西部城镇杜兰戈(Durango),这条一英里造价高达百万美元的「百万高速公路」(Million Dollar Highway) 连接了锡尔弗顿(Silverton)到乌雷(Ouray)、泰勒瑞(Telluride) 和终点的梅萨维德国家公园 (Mesa Verde National Park)。

7. 奥札克高原 / 阿肯色州

在穿过阿肯色州的漫长旅程之后,进入密苏里奥札克高原 (Ozark Mountains) 的中心,这里在夏天时以大面积的湖泊而闻名。秋天时来到这里,靠近河岸、温泉、峡谷与岩壁的树林转变为金黄色与栗色,美不胜收。

8. 莱尔 / 伊利诺州

从芝加哥出发前往莱尔(Lisle),车程仅30分钟,可以发现一处拥有植物园区及室外博物馆的莫顿林园 (Morton Arboretum),这里种植了4200种树,随意选择园内步道健行,在占地1700英亩的土地上尽情探索花园、湿地和其他自然空间。

9. 威斯康辛德尔斯 / 威斯康辛州

每年秋天,在白色冬季尚未席卷中西部前,威斯康辛德尔斯 (Wisconsin Dells) 茂盛的菩提树、橡树和榆树,为大地妆点了更多颜色,早晨沿着当地河岸边的林荫小道而行,或前往德尔斯湖州立公园 (Devil’s Lake State Park)、甚至走访镜湖州立公园 (Mirror Lake State Park),可以捕获最美秋色。

10. 上半岛 / 密西根州

密西根的上半岛 (Upper peninsula) 邻近美加边境的三个大湖,拥有4百万英亩的保护林地;换言之,这里也是观赏秋叶的绝佳选择。一路可以造访20座州立公园,公园内的白蜡木、白杨树、山毛榉、桦树、枫树、橡树、梧桐和落叶松,尽情展现最美姿颜迎接访客。

硅谷 101 — 有趣的前沿科技深度视频

The US Is Officially A Banana Republic: The Top 1% Now Own More Wealth Than The Entire Middle Class

By Tyler Durden

10/11/2022

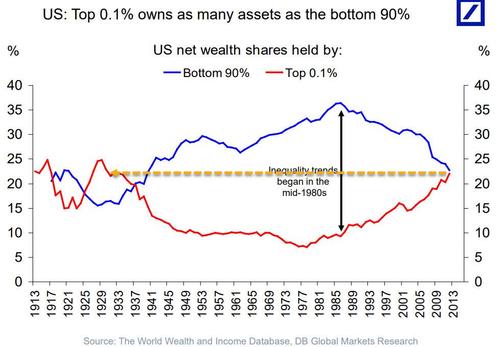

In some ways, we sympathize with Neel Kashkari’s fake “concern” about the unprecedented wealth inequality that has emerged in the US in recent years and which has resulted in a slow, methodical and relentless destruction of the US middle class … or rather make that precedented because there was another time when the top 0.1% had amassed as much wealth and it was just before the Great Depression.

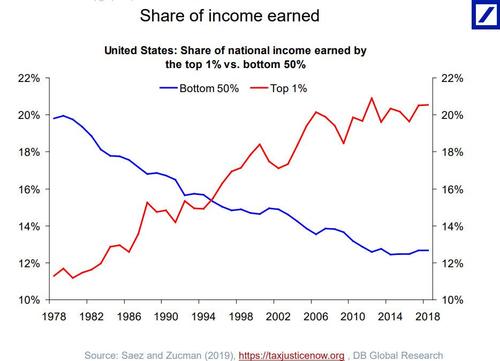

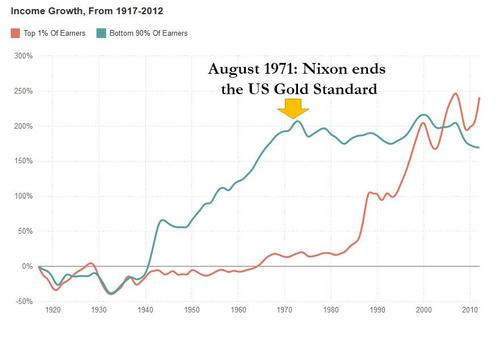

After all, who hasn’t seen charts such as these showing the tremendous divergence in income earned by America’s Top 1% at the expense of the middle and lower classes:

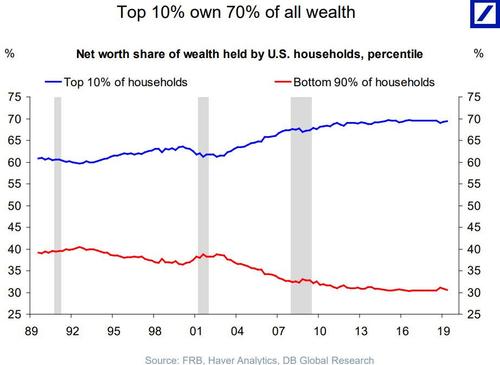

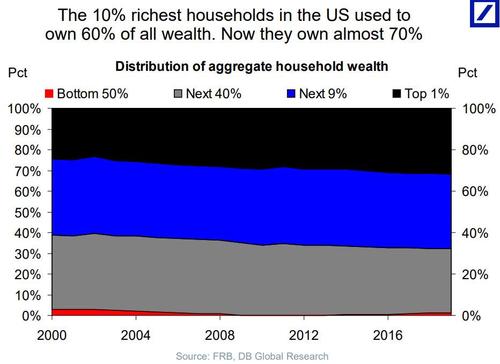

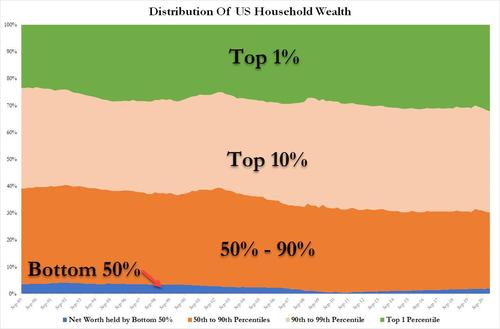

Or that the top 10% now own 70% of all the US wealth, the same as the middle and lower classes combined…

… up 10% from the 60% of wealth they controlled at the start of the century.

Yet we find Kashkari’s “jaw-dropping” virtue signalling proposal to grant the Fed wealth redistribution power not only laughable but absolutely terrifying: after all it was the Fed’s ZIRP and QE that was behind the greatest wealth redistribution in the past decade…

… a redistribution that started almost 50 years ago, when Nixon decided to end the Fed’s biggest nemesis – the US gold standard – launching an unprecedented increase in income growth for the “Top 1%”, even as the income of the “Bottom 90%” has remained unchanged ever since 1971.

For those confused, Rabobank’s Michael Every put it best: of course the Fed can redistribute wealth but “that redistribution has been from the poor and middle-class to the rich, not the other way round.“

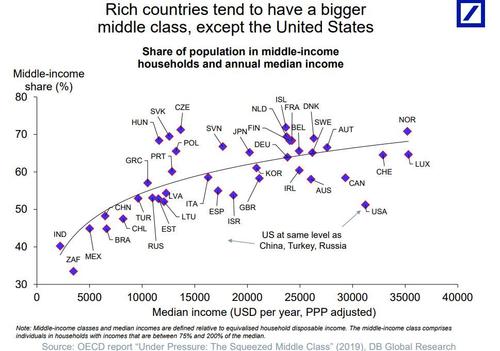

Unfortunately, as we showed back in November 2019, it may already be too late to fix the US: as the following stunning chart shows, the US is already effectively a banana republic if one defines such a nation as one which has a small but ultrapowerful and unaccountable kleptocracy which gets richer year after year by stealing from the rapidly shrinking middle class.

Here is the problem: while the US has one one of the highest median incomes in the entire world, with only three countries boasting a higher income, it is who gets to collect this money that is the major problem, because as the chart also shows, with just a 50% share of the population in middle-income households, the US is now in the same category as such “banana republics” as Turkey, China and, drumroll, Russia.

What is just as stunning: according to the OECD, more than half of the countries in question have a more vibrant middle class than the US.

Alas, since November 2019 it has only gotten worse… much worse because as a result of the unprecedented wealth redistribution unleashed by the covid pandemic, America’s has truly cemented its banana republic status as the wealth of the top 1% exploded as a direct result of the Fed pumping trillions into the stock market and levitating asset values, while the lower and middle classes stagnated.

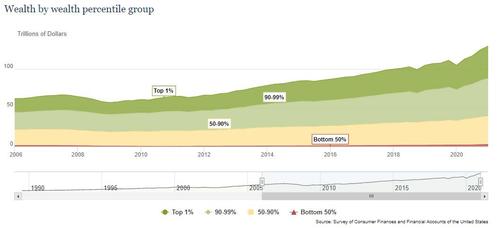

Two weeks ago, when discussing the latest US record household net worth number, which hit an all time high of $142 trillion or up $31 trillion since Covid, we showed that it would be great if this wealth increase was spread evenly across most Americans, but unfortunately, most Americans have not benefited from recent gains in wealth.

Indeed, the latest data as of Q1 shows that the top 1% accounts for over $41.5 trillion of total household net worth, with the number rising to over $90 trillion for just the top 10%. Meanwhile, the bottom half of the US population has virtually no assets at all. On a percentage basis, just the Top 1% now own a record 32.1% share of total US net worth, or $45.6 trillion. In other words, the richest Americans have never owned a greater share of US household income than they do, largely thanks to the Fed. Meanwhile, the bottom 50% own just 2% of all net worth, or a paltry $2.8 trillion. They do own most of the debt though…

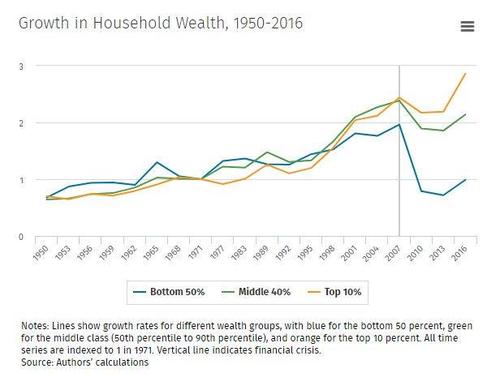

And the saddest chart of all: the wealth of the bottom 50% is virtually unchanged since 2006, while the net worth of the Top 1% has risen by 132% from $17.9 trillion to $41.5 trillion.

All of which brings us to the latest update from the Fed on Household Wealth distribution published on Friday and covering the second quarter of 2021, and which revealed yet another jawdropping fact about America’s full transformation into a banana republic.

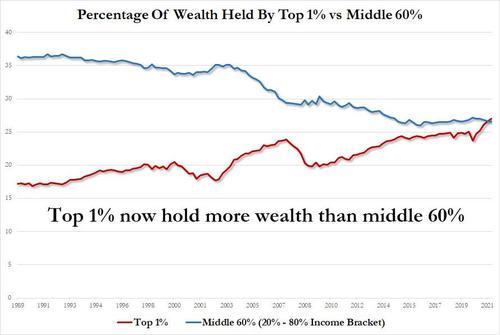

According to the Fed data, which breaks down the distribution of wealth according to income quintile (or 20% bucket) with a special carve out for the top 1%, the middle 60% of US households by income (those in the 20% to 80% income range) – a measure economists use as a definition of the middle class – saw their combined assets drop from 26.7% to 26.6% of national wealth as of June, the lowest in Federal Reserve data, while for the first time the super rich had a bigger share, at 27%.

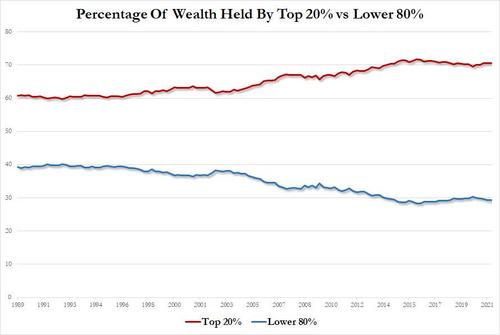

While especially true for the top 1%, it is all the rich that have benefited at the expense of the extinction of the US middle class – as the next chart shows, over the past 30 years, 10 percentage points of American wealth has shifted to the top 20% of earners, who now hold 70% of the total. The bottom 80% are left with less than 30%.

Some context: while “middle class” is a fluid concept, many economists use income to define the group. The 77.5 million families in the middle 60% make about $27,000 to $141,000 annually, based on Census Bureau data. As Bloomberg notes, their share in three main categories of assets – real estate, equities and private businesses – slumped in one generation. That made their lives more precarious, with fewer financial reserves to fall back on when they lose their jobs.

On the other end, the top 1% represents those 1.3 million households out of a total of almost 130 million, who roughly make more than $500,000 a year. The concentration of wealth in the hands of a fraction of the population is at the core of some of the country’s major political battles. It was also made possible entirely by the Fed, which as Stanley Druckenmiller said back in May echoing what we have said since our inception back in 2009, has been the single “greatest engine of wealth inequality” in history (to which we would also add the end of the gold standard under Nixon).

“If the economic system isn’t working for the clear majority of the population, it will eventually lose political support,” Nathan Sheets, newly appointed chief economist at Citigroup Inc., said by email. “This observation is motivating many of the economic reforms that the Biden Administration is putting forward.”

And while Joe Biden is seeking to “bolster” working- and middle-class families with a $3.5 trillion package before Congress that includes assistance with child care, education and health care paid for with tax increases on high-income individuals, what he will do is make the rich even richer as the Fed will have to monetize all those trillions in new debt, boosting risk asset prices even higher, and while the middle class spends any one-time fiscal stimulus merely to cover soaring costs of everyday items like rent and gas, it is the top 1% who will benefit the most again as they stock portfolios hit new all time highs.

It’s not just stocks that have benefited the super rich: housing has too. While a generation ago, the middle class held more than 44% of real estate assets in the country, it is now down to 38%. The pandemic generated a boom in housing values that has benefited most those who owned real estate in the first place. It also led to soaring rents this year, which hurt those who can’t afford a house. The self-feeding loop was yet another source of wealth transfer for the wealthier.

So the next time someone abuses the popular phrase “they hate us for our [fill in the blank]”, perhaps it’s time to counter that “they” may not “hate” us at all, but rather are making fun of what has quietly and slowly but surely become the world’s biggest banana republic?

And it has not Russia, nor China, nor any other foreign enemy to blame except one: the Federal Reserve Bank of the United States.