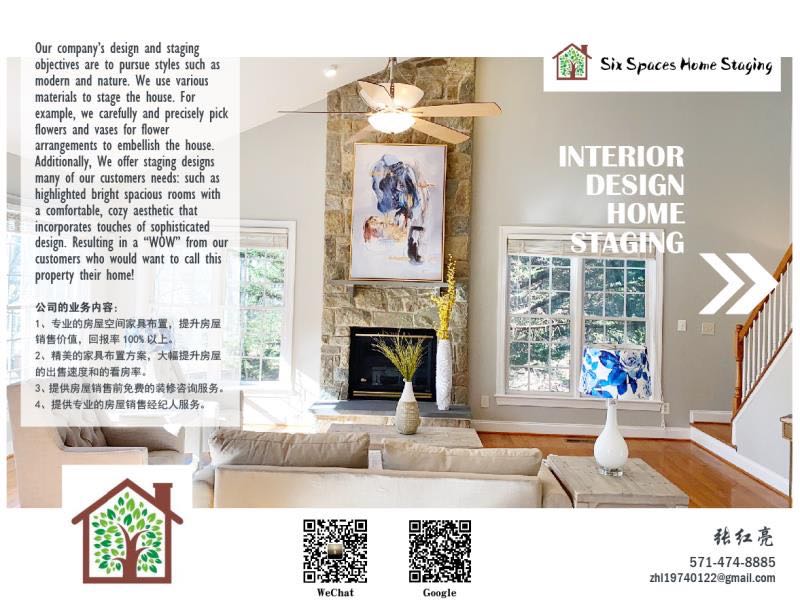

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

10 of the Best Home Staging Tips

By Laura Mueller

5/14/2021

When you’re selling your home, you want it to look its absolute best for the potential buyers who walk through the door. That’s where home staging comes in.

Home staging is a method of decorating meant to highlight your home’s most impressive assets and help buyers imagine themselves moving in and living there. Do it right, and you should have no problem selling your home quickly.

According to the National Association of Realtors’ 2017 Staging Stats report, 49% of buyers’ agents believe that home staging has an effect on how a buyer views the home, with 77% saying that it makes it easier for buyers to visualize the property as their own. On the sellers’ agent side, 21% report that home staging increases the value of a home between 6% and 10%, and 39% note that it greatly decreases the total amount of time a home is on the market.

With so much to gain, it makes sense for sellers to put time and effort into staging their home, and fortunately, many of the best staging tips don’t require spending a lot of money. Whether you’re just getting ready to sell or are trying to add new life to a stagnant listing, take a look at these 10 home staging tips and make changes that can help your home sell faster and for more money.

1. Stage where it counts

Not all rooms are considered equal when it comes to home staging. You want to focus your efforts on the rooms that have the biggest potential to influence buyers’ decisions, and spend less time on the rooms that won’t make much of a difference.

Per the NAR report mentioned above, the rooms that hold the most importance for buyers are the living room, master bedroom, and kitchen. These are the rooms that you want to focus the most on when you’re staging a home. Don’t worry as much about the rooms that have less influence, such as guest bedrooms, children’s bedrooms, and bathrooms.

2. De-personalize the space

One of the primary objectives of home staging is to help prospective buyers visualize the space as their own. The fastest way to accomplish this is to set as blank of a canvas as you can. You want the home to have style and charm, but it should be devoid of personal touches that suggest this home belongs to the seller, not the buyer.

Start by removing any personal photos, making sure to take down both framed photos on walls and surfaces and anything that’s hanging on your fridge. Keep clothes stored away and out of sight, and clear bathroom counters of personal items, like toothbrushes and contact solution. Remove anything overtly religious as well. While it’s true that de-personalizing your home makes it a little weird to live in, it is extremely useful for helping buyers better connect with the property.

3. Get rid of clutter

Clutter takes up space, and space is what sells. Make your home look bigger and more desirable by editing down to just the basics. You don’t have to get rid of things forever, but you should certainly be packing them up and getting them out of the house. This includes any un-seasonal clothes (no need to crowd your front hall closet with winter coats in the summer), most of your décor (you can keep a few select pieces if they’re subtle or minimalistic), papers, games, and pretty much anything else that you don’t need on a day to day basis. Buyers will be opening your closets to look at their storage potential, so take your time there removing as many miscellaneous and non-crucial items as you can. The less clutter you’ve got in the space, the bigger it will look and the more appealing it will be to buyers.

4. Clean like you’ve never cleaned before

Spring cleaning has nothing on the cleaning you should do when you’re putting your home on the market. You want every square inch to shine, from the baseboards to the corners of your ceilings and everywhere in between. A squeaky clean home suggests to buyers that the current tenants took good care of the property, a notion that extends beyond the kitchen counter tops to the entire house. If you’ve neglected certain tasks, like cleaning the inside of your refrigerator or regularly dusting your window blinds, now is the time to tackle them.

The cleaning you’ll do for staging purposes has similar steps to the deep clean you do when you move into a new home, so start with those and add on as you need to.

5. Patch and repair

Home staging is a good time to tackle the tiny nicks, scratches, holes, and other impurities that signal neglect to buyers. Start with a melamine foam eraser pad and go room to room removing any scuffs from walls. Keep an eye out for any areas that could use a little TLC, then spackle and caulk as necessary. You may need to do some paint touch ups too, if you notice areas where previously applied paint has chipped. Just like with cleaning, the purpose is as much about showing potential buyers that you’ve put effort into maintaining the property as it is about making the place look nice.

6. Go neutral

This staging tip is a bit more time and cost intensive, but it can make a major difference when it comes to your sale price and time on the market. Bright colors on walls help people express their personality in their homes, but they can be a major turn-off for buyers. When you’re staging your home to sell, one of the very best things you can do is paint over any garish colors with neutrals, like gray, white, and taupe. Bold colors can distract from a room’s assets, and like photos and clothes, are bold signifiers not of the home’s future, but of its past. Buyers might want bright colors themselves, but a neutral home gives them the option to do that – or not.

7. Make a good first impression

The first thing a buyer is going to see when they walk up to your house is the front entrance, so you want it to make a strong positive impression. Remove any sort of seasonal decorations, which can date a house in both pictures and during viewings. If you have a front stoop, consider power washing it, or at least scrubbing off any dirt. Then add a touch of hominess with a simple doormat and perhaps a potted plant or two, provided they are in perfect condition (a dead or dying plant will do you no favors). Keep the space simple but welcoming to start buyers off on the right foot and suggest good things to come inside.

8. Focus on fresh

While too many extraneous items in a home can detract from its perceived value, a few healthy, well-placed plants and flowers can add life and freshness into the space. Space them out so as not to clutter any one particular area, but try to have a couple fresh items in areas that matter. Place a vase full of big, bright flowers in the center of your kitchen table, a small potted plant or some succulents in the living room, and perhaps a larger potted plant in the corner of the living room as well. Don’t have the time or green thumb to maintain fresh plants? Fake plants will set the same atmosphere with less work.

Another aspect of freshness is making sure there are no odors. A deep clean should take care of any lingering smells, but also be sure to always clear out your trash bin before showings so buyers aren’t hit with any offensive scents. You may want to install a small scented plug-in in a couple of rooms too (or just one may be okay, depending on the size and layout of your home). If you do that, keep it on a low setting – you want the smell to be pleasant, but subtle.

9. Let there be light

Dark rooms are sad rooms. Brighten up by letting as much light shine in the house as possible. Open the blinds on all of the windows, which in addition to letting in more light will also make rooms seem bigger. (If your yard needs a bit of work, keep blinds down but open the slats to get a similar effect without showcasing any problem areas.) Turn on all the lights in your house for showings, including lamps and closet lights. This well help make your home more welcoming, and also saves buyers from having to stumble around figuring out which switches turn on which lights.

10. Rearrange your furniture

You want there to be as much open, walkable space as possible. This helps buyers navigate the space, and also helps them better visualize their own furniture in each room. Put extraneous furniture in storage to get it out of the way, focusing on getting rid of any oversized pieces, damaged pieces, and those that that don’t match the rest of the room. With the furniture that’s left, rearrange it to make the room look and feel as spacious as possible.

Staging a home to sell doesn’t require spending a lot of money – just making smart decisions. Your agent should be able to help you make specific changes that will add value to your home and entice the buyers who come for viewings. Once you know you’ve done everything you can to show your home in the best light possible, you can sit back and wait for the right buyer to stop by.

Source: https://www.moving.com/tips/10-best-home-staging-tips/

如何计算一个投资房产的租金回报率?

By Willy Rong

3/07/2021

一直以来都有人问我,如何计算一个投资房产的租金回报率?我答过,但总是似是而非。

今天就这个问题给出我的计算公式Return Of Investment (ROI),仅供大家参考。

这个问题要从两方面讨论,看你是全额现金买房?还是贷款80% 买房?

(全额现金买投资房产)租金回报率 = (12月的租金 – 一年的各种花费)/ 买房价

(贷款80%买投资房产)租金回报率 = (12月的租金 – 一年的各种花费和贷款 )/ (

20%首付+ Closing Cost )

我们还是以一个$38万美元买房实例来计算,比较直观:

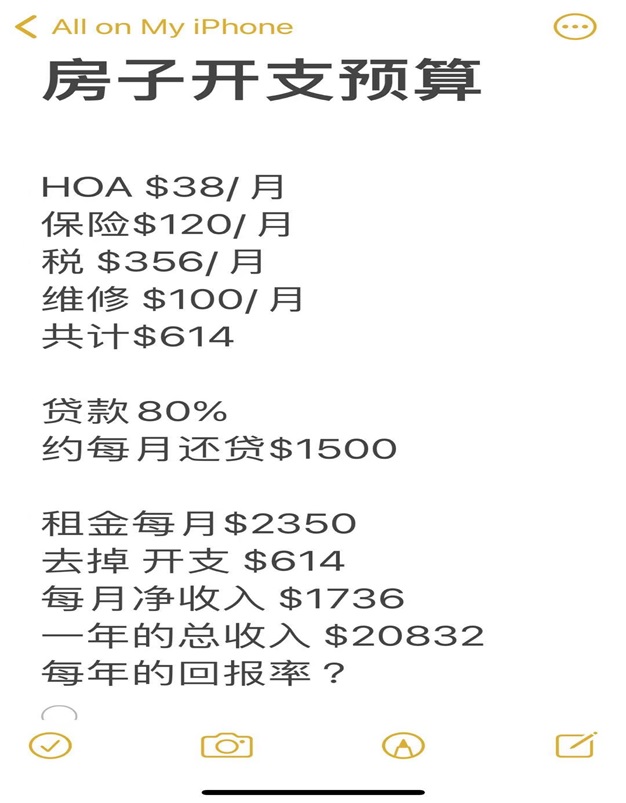

房子开支预算:

HOA $38/月; 保险 $120/月; 税 $356/月; 维修 $100/月。

共计 $614。

贷款 80%, 约每月还贷$1500;

租金每月$2350;去掉开支 $614; 每月净收入 $1736;

一年的总收入 $20832。

问:一个$38万美元的房产,每年的回报率?

(全额现金买投资房产)租金回报率 = (12月的租金 – 一年的各种花费)/ 买房价

$38万美元房子的租金回报率 = 一年的总收入 $20832 / 买房价$380,000 = $0.0548

全额现金$38万美元房子的租金回报率一年约为:5.5%;

(贷款80%买投资房产)租金回报率 = (12月的租金 – 一年的各种花费和贷款 ) / (

20%买房首付 + Closing Cost)

$38万美元贷款80%房子的租金回报率 = (一年的总收入$20832 – $18000) / (首付 $

76000 + $5000 Closing Cost ) = $0.0349

$38万美元贷款80%买投资房产的租金回报率一年约为:3.5%.

这个$38万美元的房子在最好学区,房子升值潜力大!

考虑到加上房子产权equity 上涨的因素,一年在6%-8%。所以要加上一个Equity 增值

率,换句话说,是用$81000 买了一个$38万美元的房产,是用杠杆买的房子。

这里有2个概念:一个是租金回报率;一个是Equity 回报率;

利用杠杆买房,就要让银行在这个房子上也赚一些钱,所以贷款租金回报率3.5%.要低

于全额现金租金回报率5.5%,这个逻辑是对的,那个2% 回报率的差让银行赚去了。

什么是智慧?智慧就是解决问题的能力!

能够把一个复杂问题简单化,用直白的方式讲清楚,这也是智慧。

现在亚特兰大地区(佐治亚),一个房子的租金回报率大概在3% ~ 6%左右,真心话,

投资房净租金回报率6%是一个不错的回报。

你若嫌上面二手房一年的租金回报率还低,你可以全现金买126包租5年的项目,一年的

租金回报率为净6%。

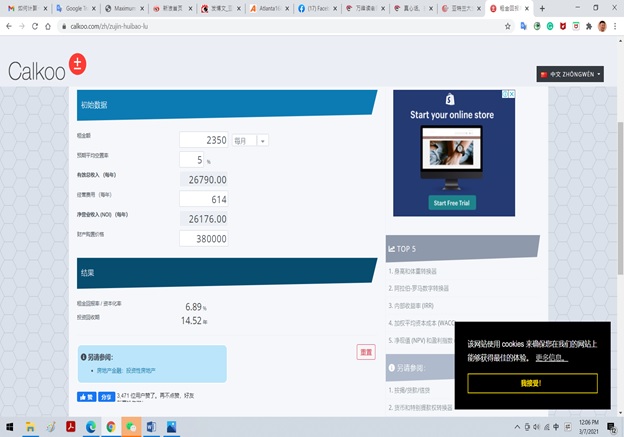

下面是在网上找到的租金回报率计算器,大家可以去练习:

租金回报率

https://www.calkoo.com/zh/zujin-huibao-lu

提示:算大账不算小账,可能公式不够严谨,但逻辑是对的。

Source: http://www.mitbbs.com/article_t/Georgia/31320547.html

How to Calculate ROI on a Rental Property

Why it’s important to know a property’s ROI before buying real estate

By JEAN FOLGER

3/07/2021

One of the main reasons people invest is to increase their wealth. Although the motivations may differ between investors—some may want money for retirement, others may choose to sock away money for other life events like having a baby or for a wedding—making money is usually the basis of all investments. And it doesn’t matter where you put your money, whether it goes into the stock market, the bond market, or real estate. https://66fb8f8f96c41eb6be84c3a0428532d2.safeframe.googlesyndication.com/safeframe/1-0-37/html/container.html

Real estate is tangible property that’s made up of land, and generally includes any structures or resources found on that land. Investment properties are one example of a real estate investment. People usually purchase investment properties with the intent of making money through rental income. Some people buy investment properties with the intent of selling them after a short time.

Regardless of the intention, for investors who diversify their investment portfolio with real estate, it’s important to measure return on investment (ROI) to determine a property’s profitability. Here’s a quick look at ROI, how to calculate it for your rental property, and why it’s important that you know a property’s ROI before you make a real estate purchase.

KEY TAKEAWAYS

- Return on investment (ROI) measures how much money, or profit, is made on an investment as a percentage of the cost of that investment.

- To calculate the percentage ROI for a cash purchase, take the net profit or net gain on the investment and divide it by the original cost.

- If you have a mortgage, you’ll need to factor in your downpayment and mortgage payment.

- Other variables can affect your ROI including repair and maintenance costs, as well as your regular expenses.

What Is Return on Investment (ROI)?

Return on investment measures how much money, or profit, is made on an investment as a percentage of the cost of that investment. It shows how effectively and efficiently investment dollars are being used to generate profits. Knowing ROI allows investors to assess whether putting money into a particular investment is a wise choice or not.

ROI can be used for any investment—stocks, bonds, a savings account, and a piece of real estate. Calculating a meaningful ROI for a residential property can be challenging because calculations can be easily manipulated—certain variables can be included or excluded in the calculation. It can become especially difficult when investors have the option of paying cash or taking out a mortgage on the property.

Here, we’ll review two examples for calculating ROI on residential rental property: a cash purchase and one that’s financed with a mortgage.

The Formula for ROI

To calculate the profit or gain on any investment, first take the total return on the investment and subtract the original cost of the investment.

Because ROI is a profitability ratio, the profit is represented in percentage terms.

To calculate the percentage ROI, we take the net profit, or net gain, on the investment and divide it by the original cost.

For instance, if you buy ABC stock for $1,000 and sell it two years later for $1,600, the net profit is $600 ($1,600 – $1,000). ROI on the stock is 60% [$600 (net profit) ÷ $1,000 (cost) = 0.60].

Calculating ROI on Rental Properties

The above equation seems simple enough, but keep in mind that there are a number of variables that come into play with real estate that can affect ROI numbers. These include repair and maintenance expenses, and methods of figuring leverage—the amount of money borrowed with interest to make the initial investment. Of course, financing terms can greatly affect the overall cost of the investment.

ROI for Cash Transactions

Calculating a property’s ROI is fairly straightforward if you buy a property with cash. Here’s an example of a rental property purchased with cash:

- You paid $100,000 in cash for the rental property.

- The closing costs were $1,000 and remodeling costs totaled $9,000, bringing your total investment to $110,000 for the property.

- You collected $1,000 in rent every month.

A year later:

- You earned $12,000 in rental income for those 12 months.

- Expenses including the water bill, property taxes, and insurance, totaled $2,400 for the year. or $200 per month.

- Your annual return was $9,600 ($12,000 – $2,400).

To calculate the property’s ROI:

- Divide the annual return ($9,600) by the amount of the total investment, or $110,000.

- ROI = $9,600 ÷ $110,000 = 0.087 or 8.7%.

- Your ROI was 8.7%.

ROI for Financed Transactions

Calculating the ROI on financed transactions is more involved.

For example, assume you bought the same $100,000 rental property as above, but instead of paying cash, you took out a mortgage.

- The downpayment needed for the mortgage was 20% of the purchase price, or $20,000 ($100,000 sales price x 20%).

- Closing costs were higher, which is typical for a mortgage, totaling $2,500 up front.

- You paid $9,000 for remodeling.

- Your total out-of-pocket expenses were $31,500 ($20,000 + $2,500 + $9,000).

There are also ongoing costs with a mortgage:

- Let’s assume you took out a 30-year loan with a fixed 4% interest rate. On the borrowed $80,000, the monthly principal and interest payment would be $381.93.

- We’ll add the same $200 per month to cover water, taxes, and insurance, making your total monthly payment $581.93.

- Rental income of $1,000 per month totals $12,000 for the year.

- Monthly cash flow is $418.07 ($1,000 rent – $581.93 mortgage payment).

One year later:

- You earned $12,000 in total rental income for the year at $1,000 per month.

- Your annual return was $5,016.84 ($418.07 x 12 months).

To calculate the property’s ROI:

- Divide the annual return by your original out-of-pocket expenses (the downpayment of $20,000, closing costs of $2,500, and remodeling for $9,000) to determine ROI.

- ROI = $5,016.84 ÷ $31,500 = 0.159.

- Your ROI is 15.9%.

Home Equity

Some investors add the home’s equity into the equation. Equity is the market value of the property minus the total loan amount outstanding. Keep in mind that home equity is not cash-in-hand. You would need to sell the property to access it.

To calculate the amount of equity in your home, review your mortgage amortization schedule to find out how much of your mortgage payments went toward paying down the principal of the loan. This builds up the equity in your home.

The equity amount can be added to the annual return. In our example, the amortization schedule for the loan showed that a total of $1,408.84 of principal was paid down during the first 12 months.

- The new annual return, including the equity portion, equals $6,425.68 ($5,016.84 annual income + $1,408.84 equity).

- ROI = $6,425.68 ÷ $31,500 = 0.20.

- Your ROI is 20%.

The Importance of ROI for Real Estate

Knowing the ROI for any investment allows you to be a more informed investor. Before you buy, estimate your costs and expenses, as well as your rental income. This gives you a chance to compare it to other, similar properties.

Once you’ve narrowed it down, you can then determine how much you’ll make. If, at any point, you realize that your costs and expenses will exceed your ROI, you may need to decide whether you want to ride it out and hope you’ll make a profit again—or sell so you don’t lose out.

Other Considerations

Of course, there may be additional expenses involved in owning a rental property, such as repairs or maintenance costs, which would need to be included in the calculations, ultimately affecting the ROI.

Also, we assumed that the property was rented out for all 12 months. In many cases, vacancies occur, particularly in between tenants, and you must account for the lack of income for those months in your calculations.

The ROI for a rental property is different because it depends on whether the property is financed via a mortgage or paid for in cash. As a general rule of thumb, the less cash paid up front as a downpayment on the property, the larger the mortgage loan balance will be, but the greater your ROI.

Conversely, the more cash paid upfront and the less you borrow, the lower your ROI, since your initial cost would be higher. In other words, financing allows you to boost your ROI in the short term, as your initial costs are lower.

It’s important to use a consistent approach when measuring the ROI for multiple properties. For example, if you include the home’s equity in evaluating one property, you should include the equity of the other properties when calculating the ROI for your real estate portfolio. This can provide the most accurate view of your investment portfolio.