中风的因素可能藏在早餐?多吃4种食物改善脑血管健康

11/15/2022

为了防止脑中风,很多人会定期观测血压、做健康检查确认胆固醇指数。但你可能不会注意到,中风的因素,可能就藏在你的早餐里!营养师表示,预防脑中风要看的可不只是胆固醇,还有饱和脂肪酸、钠摄取量,包括盐、酱油及所有调味料。

脑中风可分为出血性中风与缺血性中风两种。前者多因长期血压控制不良导致,后者主要为动脉硬化,造成血管逐渐阻塞所致。营养师指出,中风绝对不是只有胆固醇那么简单,大家时常会忽略,上班、上学前买的早餐,虽然方便,但其实非常不健康,长期下来会害你的血压失控,脂肪量以及糖分也爆表。

大约有40%的中风属于「出血型」,也就是说血管破裂造成中风,而「血压控制不佳」就是发病的主因,与饮食中的盐分与调味料多寡影响最直接。医生指出,中式早餐常会盐分太高的问题。常见的烧饼油条,每一人份含有约45cc的油脂和逼近2公克的盐分。如果天天吃,胆固醇指数与血压渐渐飙高!特别是现在外面天气热,室内外温差大、高压力、过度疲劳、情绪起伏过大及饮酒过量等,若是坐冷气房办公的小资族,室内外温差导致血管异常收缩,就有可能出现出血性脑中风。

西式早餐中最爱的火腿、热狗,配上大杯冰奶茶都有机会让你的血管阻塞!60%的中风则是属于血管栓塞型脑中风(或称缺血性中风),发生的原因就是太多高热量、高脂肪的食物,让血管堵住了。西式早餐搭配的热狗、火腿、烟肉等高盐又加工的再制品,脂肪含量也比较高,营养师建议要多加避免。另外简单方便的包子、萝卜糕、蛋饼等,则属于黄灯区,建议偶尔吃即可。

早餐的饮料则可以选无糖红茶、无糖豆浆、无糖乳酪或低脂鲜奶,若需要提神可以选美式咖啡、拿铁,至于奶精为基底的传统奶茶,也是高饱和脂肪酸的食物,要尽量避免。

若想要降低风险,多数人会联想到少吃「胆固醇」食物,例如内脏、海鲜,但其实先改善饱和脂肪酸、盐分摄取超标、改掉不良饮食,率先避开危机;营养师也建议多吃以下四种食物,进一步改善血压及脑血管健康:

1. 含镁食物/豆类、全谷类:镁是维持人体生命活动的必需元素,具有调节神经和肌肉活力的作用。此外,镁也是高血压、高胆固醇、高血糖的克星,可多吃深绿色蔬菜、豆类、全谷类,适量进食坚果等以取得。2. 含钾食物/深色蔬菜:芹菜、菠菜、空心菜、川七、苋菜、茼蒿、山药、韭菜、番薯叶等都是高钾蔬菜,多吃能达到体内钠离子和钾离子平衡。以烫青菜形式摄取时记得少加酱料。3. 含钙食物/牛奶、豆腐:当身体缺乏钙质时,体内钙离子失衡,可能引起血管平滑肌细胞收缩增强,增加血管阻力(血压)。多吃含钙食物,如牛奶、乳酪、小鱼干、豆腐、黑芝麻等,能相对稳定血压。4. 水溶性膳食纤维/秋葵、山药:富含水溶性膳食纤维的食物具有稳定血压的功能,如秋葵、山药、南瓜、海藻、苹果、燕麦、红萝卜、椰菜花、香蕉、奇异果等很丰富,可多多摄取!「想要保护脑血管健康,明天起将油腻的早餐改成不加油条的紫米饭团,或是不加沙拉酱、蔬菜加倍的总汇三文治吧!」

收到「纾困款免税」先别丢 IRS来信非诈骗

世界新闻网

01/08/2022

为协助纳税人申报去年联邦所得税,国税局(IRS)计划自本月下旬起,寄发2021年政府发放第三次纾困支票相关信函;民众在接下来几周可望收到此信,收到时毋须惊讶,也不要把这封信丢弃。

国税局新闻稿指出,标注为6475号「您的第三次经济影响付款」信函,将书明在2021年收到的纾困金额和任何额外付款(plus-up payments);「这些信件可以协助纳税人或其税务专业人员准备2021年联邦纳税申报单。」

纳税人可以用它来确定,自己是否可以在申报2021年纳税单时申请「纾困退税抵免」(recovery rebate credit);有资格获得第三次纾困款、但实际收到金额与IRS信上写明的金额不同时,即可利用此项抵免来弥补差额。

纾困支票所得不必扣税,但仍需要在2021年纳税单中申报。

2021年纾困支票从去年3月开始发放给符合条件的受助人,符合条件的民众和每一位家属可以收到高达1400元纾困款;若符合发放条件者没有收到纾困金,或自身情况发生变化,例如在2021年生小孩,还可能有资格领到更多的纾困金。

与此同时,许多家庭可能已经收到或即将收到另一封有关2021年儿童抵税额(CTC)的信件。标注为6419号信函将包含有关CTC付款的重要信息;例如全家已预先收到多少金额,以及每月入帐款项是按多少名合格儿童数量计出。

国税局表示,「收到这些预付款项的家庭,应将自己2021年收到的预付款数额,与国税局信函中提到的儿童抵税额相互核对,才能在2021报税申报正确金额。」

符合资格却没有收到预付款项的家庭,可以在今年纳税时申领这笔款项。

You may receive a letter from the IRS about stimulus checks — here’s what it means

By Alicia Adamczyk

01/08/2022

Don’t be surprised if you receive a letter from the IRS in the coming weeks.

You’re not in trouble. The agency is simply sending out information about the third stimulus checks, which were disbursed in 2021. The letters are slated to start being mailed in late January.

When you get one, don’t throw it away just yet. “These letters can help taxpayers, or their tax professional, prepare their 2021 federal tax return,” the IRS said in a release.

Labeled Letter 6475, “Your Third Economic Impact Payment,” the correspondence will include how much you received in stimulus money in 2021, including any so-called plus-up payments.

You can use it to figure out if you can claim the Recovery Rebate Credit on your 2021 tax return. This credit will make up the difference between the amount of the third stimulus check you were eligible for, and how much you actually received.

Stimulus checks are not taxable, but they still need to be reported on 2021 tax returns, which need to be filed this spring.

The 2021 stimulus checks were disbursed to eligible recipients starting in March of last year. They are worth up to $1,400 per qualifying taxpayer and each of their dependents. Eligible recipients might qualify for more money if they never received a stimulus check at all, or if their circumstances changed. For example, if you had another child in 2021, they would qualify for their own payment.

Additionally, many families have received or will receive another letter about the 2021 child tax credit (CTC) payments. Labeled Letter 6419, it will include crucial information about the CTC payments, such as how much your family received in advance and how many qualifying children the monthly deposits were based on.

“Families who received advance payments need to … compare the advance payments they received in 2021 with the amount of the child tax credit they can properly claim on their 2021 tax return,” the agency said.

Families can also use the IRS’s CTC Update Portal on IRS.gov to find the same information about their payments.

Remember: Households that did not receive the advance payments, or did not receive as much as they were eligible for, can claim the money on their returns this year.

您的税档变了吗?IRS因通胀上调联邦收入税门槛

来源:美国中文网

11/10/2021

周三国税局(IRS)宣布,2022年联邦收入税的边际税率不变,但是考虑到通货膨胀,每档税率对应的收入区间将有所上调,另外最高抵免额度也有所提高。

2022年,调整后的个人报税者边际税率为:

10%: 不超过$10,275的收入部分

12%: $10,275到$41,775之间的收入部分

22%: $41,775到$89,075之间的收入部分

24%: $89,075到$170,050之间的收入部分

32%: $170,050到$215,950之间的收入部分

35%: $215,950到$539,900之间的收入部分

37%: 超过$539,900的收入部分

(以上收入均指调整后的应缴税收入)

夫妻合报的边际税率如下:

10%: 不超过$20,550的收入部分

12%: $20,550到$83,550之间的收入部分

22%: $83,550到$178,150之间的收入部分

24%: $178,150到$340,100之间的收入部分

32%: $340,100到$431,900之间的收入部分

35%: $431,900到$647,850之间的收入部分

37%: 超过$647,850的收入部分

(以上收入均指调整后的应缴税收入)

调整后,夫妻合报的最高档税率对应年收入上调了将近2万元。实际上,所有税档对应的收入水平较2021年都上调了3%左右。这一上调幅度是近四年来的最大值。

另外,对于个人报税者来说,联邦收入税的最高抵免额调涨了400元至12950元;一家之主的最高抵免额上调了600元至19400元;夫妻合报的最高抵免额则上调了800元至25900元。

每年,IRS都会根据通胀调整税率对应的收入水平。周三劳工部数据显示消费者价格指数同比上涨了6.2%,是自1990年来的最大年度增幅。

IRS provides tax inflation adjustments for tax year 2022

R-2021-219, November 10, 2021

WASHINGTON — The Internal Revenue Service today announced the tax year 2022 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes. Revenue Procedure 2021-45 PDF provides details about these annual adjustments.

Highlights of changes in Revenue Procedure 2021-45:

The tax year 2022 adjustments described below generally apply to tax returns filed in 2023.

The tax items for tax year 2022 of greatest interest to most taxpayers include the following dollar amounts:

- The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600.

- The personal exemption for tax year 2022 remains at 0, as it was for 2021, this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

- Marginal Rates: For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly).The other rates are:

35%, for incomes over $215,950 ($431,900 for married couples filing jointly);

32% for incomes over $170,050 ($340,100 for married couples filing jointly);

24% for incomes over $89,075 ($178,150 for married couples filing jointly);

22% for incomes over $41,775 ($83,550 for married couples filing jointly);

12% for incomes over $10,275 ($20,550 for married couples filing jointly).

The lowest rate is 10% for incomes of single individuals with incomes of $10,275 or less ($20,550 for married couples filing jointly).

- For 2022, as in 2021, 2020, 2019 and 2018, there is no limitation on itemized deductions, as that limitation was eliminated by the Tax Cuts and Jobs Act.

- The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 and begins to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption begins to phase out at $1,079,800). The 2021 exemption amount was $73,600 and began to phase out at $523,600 ($114,600 for married couples filing jointly for whom the exemption began to phase out at $1,047,200).

- The tax year 2022 maximum Earned Income Tax Credit amount is $6,935 for qualifying taxpayers who have three or more qualifying children, up from $6,728 for tax year 2021. The revenue procedure contains a table providing maximum EITC amount for other categories, income thresholds and phase-outs.

- For tax year 2022, the monthly limitation for the qualified transportation fringe benefit and the monthly limitation for qualified parking increases to $280.

- For the taxable years beginning in 2022, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to $2,850. For cafeteria plans that permit the carryover of unused amounts, the maximum carryover amount is $570, an increase of $20 from taxable years beginning in 2021.

- For tax year 2022, participants who have self-only coverage in a Medical Savings Account, the plan must have an annual deductible that is not less than $2,450, up $50 from tax year 2021; but not more than $3,700, an increase of $100 from tax year 2021. For self-only coverage, the maximum out-of-pocket expense amount is $4,950, up $150 from 2021. For tax year 2022, for family coverage, the annual deductible is not less than $4,950, up from $4,800 in 2021; however, the deductible cannot be more than $7,400, up $250 from the limit for tax year 2021. For family coverage, the out-of-pocket expense limit is $9,050 for tax year 2022, an increase of $300 from tax year 2021.

- The modified adjusted gross income amount used by joint filers to determine the reduction in the Lifetime Learning Credit provided in § 25A(d)(2) is not adjusted for inflation for taxable years beginning after December 31, 2020. The Lifetime Learning Credit is phased out for taxpayers with modified adjusted gross income in excess of $80,000 ($160,000 for joint returns).

- For tax year 2022, the foreign earned income exclusion is $112,000 up from $108,700 for tax year 2021.

- Estates of decedents who die during 2022 have a basic exclusion amount of $12,060,000, up from a total of $11,700,000 for estates of decedents who died in 2021.

- The annual exclusion for gifts increases to $16,000 for calendar year 2022, up from $15,000 for calendar year 2021.

- The maximum credit allowed for adoptions for tax year 2022 is the amount of qualified adoption expenses up to $14,890, up from $14,440 for 2021.

More Information

- News Release IR-2021-216, IRS announces 401(k) limit increases to $20,500.

IRS announces 401(k) limit increases to $20,500

R-2021-216, November 4, 2021

WASHINGTON — The Internal Revenue Service announced today that the amount individuals can contribute to their 401(k) plans in 2022 has increased to $20,500, up from $19,500 for 2021 and 2020. The IRS today also issued technical guidance regarding all of the cost‑of‑living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2022 in Notice 2021-61 PDF, posted today on IRS.gov.

Highlights of changes for 2022

The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is increased to $20,500, up from $19,500.

The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements (IRAs), to contribute to Roth IRAs, and to claim the Saver’s Credit all increased for 2022.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or the taxpayer’s spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. (If neither the taxpayer nor the spouse is covered by a retirement plan at work, the phase-outs of the deduction do not apply.) Here are the phase-out ranges for 2022:

- For single taxpayers covered by a workplace retirement plan, the phase-out range is increased to $68,000 to $78,000, up from $66,000 to $76,000.

- For married couples filing jointly, if the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is increased to $109,000 to $129,000, up from $105,000 to $125,000.

- For an IRA contributor who is not covered by a workplace retirement plan and is married to someone who is covered, the phase-out range is increased to $204,000 to $214,000, up from $198,000 to $208,000.

- For a married individual filing a separate return who is covered by a workplace retirement plan, the phase-out range is not subject to an annual cost-of-living adjustment and remains $0 to $10,000.

The income phase-out range for taxpayers making contributions to a Roth IRA is increased to $129,000 to $144,000 for singles and heads of household, up from $125,000 to $140,000. For married couples filing jointly, the income phase-out range is increased to $204,000 to $214,000, up from $198,000 to $208,000. The phase-out range for a married individual filing a separate return who makes contributions to a Roth IRA is not subject to an annual cost-of-living adjustment and remains $0 to $10,000.

The income limit for the Saver’s Credit (also known as the Retirement Savings Contributions Credit) for low- and moderate-income workers is $68,000 for married couples filing jointly, up from $66,000; $51,000 for heads of household, up from $49,500; and $34,000 for singles and married individuals filing separately, up from $33,000.

The amount individuals can contribute to their SIMPLE retirement accounts is increased to $14,000, up from $13,500.

Key employee contribution limits that remain unchanged

The limit on annual contributions to an IRA remains unchanged at $6,000. The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000.

The catch-up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan remains unchanged at $6,500. Therefore, participants in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan who are 50 and older can contribute up to $27,000, starting in 2022. The catch-up contribution limit for employees aged 50 and over who participate in SIMPLE plans remains unchanged at $3,000.

Details on these and other retirement-related cost-of-living adjustments for 2022 are in Notice 2021-61 PDF, available on IRS.gov.

最新!拜登银行监管新政,个人账户余额过$1万,IRS有权随时查账!

来源: 华人生活网

10/21/2021

0月20日,拜登政府放弃了一项有争议的提议,该提议要求国税局对每年交易金额超过600美元的所有银行账户收集更多数据。

该计划此前受到了共和党议员和银行业代表的广泛批评,称其税务执法策略代表了联邦政府对隐私的侵犯。

不过虽然该提议夭折,但是拜登政府并未完全放弃银行存款这一块的监管。

根据新规定,帐户余额超过1万美金,或者不包括薪资收入的存款、提款总额超过1万元,就会受到国税局加强检查;银行必须把帐户持有人的现金流导入导出汇整数据交给国税局,好让国税局锁定稽查目标。

民众注意的是通过工资收入获得的、自动扣除联邦税的收入的账户不计入其中。领取失业救济金和社会保障等联邦福利的人也可以豁免。

拜登表示:“很多富人为了逃税,每年从美国人民身上骗取数十亿美元。当适用于逃税行为的报告规则松散而模糊时,逃税行为就会猖獗起来。民主党人想要修复这个支离破碎的方法,打击高层的欺骗行为,”

财政部长珍妮特·耶伦(Janet Yellen)在会议上表示:“今天的新提案反映了政府的强烈信念,我们应该瞄准那些顶端的收入规模不付他们欠的税,同时保护美国工人通过设置银行账户阈值为10000美元,为工薪阶层提供豁免和教师和消防员一样。”

她表示,长期以来问题的核心是向IRS报告各种收入的方式存在差异:不透明的收入来源经常逃避审查,而工资和联邦福利通常几乎要完全遵守。这种双重税收制度是不公平的,剥夺了国家用于资助核心优先事项的资源。”

“新规定为了回应对范围的考虑,(国会)制定了一个新办法,包括对工薪阶层和工薪阶层以及联邦项目受益者的豁免。

这些变化将免除数百万美国人的申报要求,并帮助国税局将目标锁定在较富裕的美国人,特别是那些从投资、房地产和其他交易中赚钱的人,这些交易对国税局来说更难追踪。

最初的提议引起了共和党议员的愤怒,他们称这侵犯了隐私,是政府越权的一个例子。

即使修改了提案,参议院的共和党人仍然持批评态度。

爱达荷州共和党参议员迈克·克拉波(Mike Crapo)表示,拜登总统曾经承诺称,不会对年收入低于40万美元的美国人增税,他认为这一门槛应该适用于国税局的申报。

“他们为什么不直接颁布禁令,禁止美国国税局窥探年收入低于40万美元的人的账户呢?”我认为,这是这个方法的发起者应该问的问题。”

另外,银行业代表仍对任何额外的报告要求持怀疑态度,称这将造成负担,尤其是对小型社区银行。

据了解,该提案距离实施还有很长的路要走。该计划目前包括在数万亿美元的社会支出计划中,立法者和白宫已经协商了几个月。如果该方案获得通过并签署成为法律,这项要求要到2022年12月才会生效。

政府估计,税收执法的改善将在未来10年增加6000亿美元的税收收入。

美联邦国税局查帐门槛升至1万 仍遭质疑侵犯隐私

来源:世界新闻网

10/20/2021

美国联邦国税局(IRS)拟查看所有存款馀额逾600元,或一年之内汇入汇出转帐额度超过600元的银行帐户,消息曝光后引发舆论强烈反弹;美国民主党籍国会议员19日达成协议,把查看帐户的适用对象改为存款馀额1万元以上帐户,但共和党方面则说,修正后的门槛仍侵犯民众隐私,“除非大家都不花钱。”

民主党籍麻州联邦参议员华伦(Elizabeth Warren)与参院财政委员会主席、民主党籍俄勒冈州联邦参议员魏登(Ron Wyden)19日下午公布修改后的新版政策。

根据新版规定,帐户馀额超过1万元,或者不包括薪资收入的存款、提款总额超过1万元,就会受到国税局加强检查;银行必须把帐户持有人的现金流汇入汇出彙整资料交给国税局,好让国税局锁定稽查目标。

彙整报告中的现金流不包括薪酬或工资所得,因为这部份原本就在国税局W-2报税表格权限范围;社安金支票也不会纳入现金流彙整报告统计。

国税局打算加强检视馀额600元以上帐户的计画,遭到共和党及金融机构极力反对,理由则是侵犯民众隐私;对于修正之后的新版规定,共和党国会议员也不接受。

共和党籍宾州联邦参议员图米(Pat Toomey)19日在记者会上说:“如果他们把门槛调高到1万元,适用对象仍然几乎包括所有人,还有所有商家。”

“民众平均帐户出入总额,约为6万1000元。”共和党籍爱达荷州联邦参议员克雷波(Mike Crapo)表示:“一般美国百姓都将成为这项计画的调查目标。”

帐户都被监视“除非大家不花钱”

克雷波说,排除薪水收入不计,其实影响不大,绝大多数民众的帐户还是将成为受到加强检视的对象,“除非大家都不花钱”。

面对共和党阵营批评,魏登回应指出:“共和党紧咬这个议题不放,用来做为扯谎藉口,原因是他们明白他们推出的税改政策其实非常失败。”

金融机构组织“美国独立银行家协会”(Independent Community Bankers of America,ICBA)发表声明指出,不管查看帐户的门槛是600元,1万元或10万元,适用对象都将包括数以百万计的消费者以及小型商家。

IRS:海外银行资产和金融账户申报10月15日截止

来源: 华人生活网

10/06/2021

很多华人即便入了美国国籍,但是在中国依旧有银行存款账户,也有人还有一些海外的生意。

大家要注意了,以下情况是要提交《国外银行和金融帐户报告》的。

在一个或多个帐户中有经济利益、有签字权或有其他权力,这些帐户包括在美国境外的银行帐户、经纪帐户、共同基金或其他金融帐户;日历年内任何时候所有外国金融帐户的总价值超过 1万 美元。

国税局(IRS)10月1日提醒美国公民、税法定义居民和任何境内法人实体,提交《国外银行和金融帐户报告》(FBAR) 的延期截止日为今年10 月15日。正常来说申报人若错过今年早些时候的 4 月 15 日年度截止日期,会被自动延期至 10 月 15 日提交FBAR,不需要申请延期。

国税局表示,申报人若受自然灾害影响,FBAR到期日可以要求进一步延长。重要的是,申报者须查看相关的FBAR 救援通知以获取完整信息。

目前由于1万美元这个界限的存在,国税局鼓励美国税务居民或拥有外国帐户的实体(即使是拥有相对较小的帐户),核查他们是否应就此报告申报。

美国税务居民指的是美国公民、居民或任何境内法人实体,例如合伙企业、公司、有限责任公司、遗产或信託。

国税局表示,申报人不应将FBAR与他们的联邦所得税申报表一起提交。

2020年FBAR必须以电子方式提交给金融罪行加强执法网络 (FinCEN),并且只能通过BSA电子申报系统网站递交。无法通过电子方式提交FBAR的纳税人必须致电金融罪行加强执法网络(FinCEN),美国境内拨打800-949-2732,美国境外拨打 703-905-3975。

凡未及时提交FBAR者,可能受到严重的民事和刑事处罚,可能导致罚款或监禁。

但若国税局确定延迟提交的原因合理,则不会惩罚那些延迟提交的FBAR 、报告外国帐户的人。

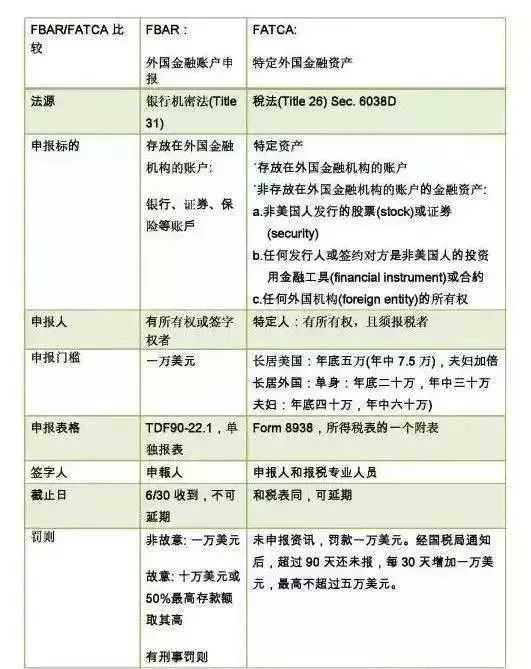

也有民众此前询问为什么经常看到5万美元的门槛,为什么此文中又说1万美元。这其实就是肥爸与肥咖的区别!

本月截止的是FBAR,也就是华人常说的肥爸。

“肥爸”﹙FBAR, Report of Foreign Bank and Financial Accounts ﹚是奥巴马政府于2009年5月发布税制改革“绿皮书”(The Green Book)中规定的,目的为严查美国境外所得税申报,以确定纳税人的境外所得完整申报,包含所有境外金融机构之账户,原先要求于2009年9月23日前需补申报海外账户。

后来,为了打击海外逃税,IRS又制定了“肥咖”(FATCA, Foreign Account Tax Compliance Act﹚。要求全世界各国银行交出美国税务居民金额美金5万以上的账户资料,企图在未来十年内追回估计超过85亿美元的海外逃税。两者在申报上也有许多区别:

1 美元=6.47人民币

IRS: Oct. 15 FBAR extension deadline nears for foreign bank and financial account holders

IR-2021-196, October 1, 2021

WASHINGTON — The Internal Revenue Service reminds U.S. citizens, resident aliens and any domestic legal entity that the extension deadline to file their annual Report of Foreign Bank and Financial Accounts (FBAR) is Oct. 15, 2021.

Filers missing the April 15 annual due date earlier this year received an automatic extension until Oct. 15, 2021, to file the FBAR. They did not need to request the extension.

Filers affected by a natural disaster may have their FBAR due date further extended. It’s important filers review relevant FBAR Relief Notices for complete information.

Who needs to file?

The Bank Secrecy Act requires U.S. persons to file an FBAR if they have:

- Financial interest in, signature authority or other authority over one or more accounts, such as a bank account, brokerage account, mutual fund or other financial account located outside the United States, and

- The aggregate value of all foreign financial accounts exceeds $10,000 at any time during the calendar year.

Because of this threshold, the IRS encourages U.S. persons or entities with foreign accounts, even relatively small ones, to check if this filing requirement applies to them. A U.S. person is a citizen or resident of the United States or any domestic legal entity such as a partnership, corporation, limited liability company, estate or trust.

How to file

Filers do not file the FBAR with their federal income tax return. The 2020 FBAR must be filed electronically with the Financial Crimes Enforcement Network (FinCEN) and is only available through the BSA E-Filing System website. Those who are unable to e-file their FBAR must call FinCEN at 800-949-2732, or from outside the U.S. at 703-905-3975.

Avoid penalties

Those who don’t file an FBAR when required may be subject to significant civil and criminal penalties that can result in a fine and/or prison. The IRS will not penalize those who properly reported a foreign account on a late-filed FBAR if the IRS determines there was reasonable cause for late filing.

FBAR resources on IRS.gov:

- How to report foreign bank and financial accounts

- International Taxpayers

- IRS FBAR Reference Guide PDF

- FAQs About International Individual Tax Matters

- FinCEN’s website Reporting Maximum Account Value

To help avoid delays with tax refunds, taxpayers living abroad should visit Helpful Tips for Effectively Receiving a Tax Refund for Taxpayers Living Abroad on IRS.gov.

IRS: Report of Foreign Bank and Financial Accounts (FBAR)

Every year, under the law known as the Bank Secrecy Act, you must report certain foreign financial accounts, such as bank accounts, brokerage accounts and mutual funds, to the Treasury Department and keep certain records of those accounts. You report the accounts by filing a Report of Foreign Bank and Financial Accounts (FBAR) on FinCEN Form 114.

Who Must File

A United States person, including a citizen, resident, corporation, partnership, limited liability company, trust and estate, must file an FBAR to report:

- a financial interest in or signature or other authority over at least one financial account located outside the United States if

- the aggregate value of those foreign financial accounts exceeded $10,000 at any time during the calendar year reported.

Generally, an account at a financial institution located outside the United States is a foreign financial account. Whether the account produced taxable income has no effect on whether the account is a “foreign financial account” for FBAR purposes.

But, you don’t need to report foreign financial accounts that are:

- Correspondent/Nostro accounts,

- Owned by a governmental entity,

- Owned by an international financial institution,

- Maintained on a United States military banking facility,

- Held in an individual retirement account (IRA) you own or are beneficiary of,

- Held in a retirement plan of which you’re a participant or beneficiary, or

- Part of a trust of which you’re a beneficiary, if a U.S. person (trust, trustee of the trust or agent of the trust) files an FBAR reporting these accounts.

You don’t need to file an FBAR for the calendar year if:

- All your foreign financial accounts are reported on a consolidated FBAR.

- All your foreign financial accounts are jointly-owned with your spouse and:

- You completed and signed FinCEN Form 114a authorizing your spouse to file on your behalf, and your spouse reports the jointly-owned accounts on a timely-filed, signed FBAR.

Note: Income tax filing status, such as married-filing-jointly and married-filing-separately has no effect on your qualification for this exception.

The FBAR Reference Guide PDF) and FBAR instructions PDF provide more detailed information. The FBAR webinar explains how to calculate the aggregate value of your accounts to figure if you need to file an FBAR.

When to File

The FBAR is an annual report, due April 15 following the calendar year reported.

You’re allowed an automatic extension to October 15 if you fail to meet the FBAR annual due date of April 15. You don’t need to request an extension to file the FBAR.

If you are affected by a natural disaster, the government may further extend your FBAR due date. It’s important that you review relevant FBAR Relief Notices for complete information.

For certain employees or officers with signature or other authority over, but no financial interest in certain foreign financial accounts, the 2018 FBAR due date is deferred to April 15, 2020. See Notice 2018-1 PDF.

How to File

You must file the FBAR electronically through the Financial Crimes Enforcement Network’s BSA E-Filing System. You don’t file the FBAR with your federal tax return.

If you want to paper-file your FBAR, you must call FinCEN’s Regulatory Helpline to request an exemption from e-filing. See Contact Us below to reach this Helpline. If FinCEN approves your request, FinCEN will send you the paper FBAR form to complete and mail to the IRS at the address in the form’s instructions. IRS will not accept paper-filings on TD F 90-22.1 (obsolete) or a printed FinCEN Form 114 (for e-filing only).

If you want someone to file your FBAR on your behalf, use FinCEN Report 114a PDF, Record of Authorization to Electronically File FBARs, to authorize that person to do so. You don’t submit FinCEN Report 114a when filing the FBAR; just keep it for your records and make it available to FinCEN or IRS upon request.

Keeping Records

You must keep records for each account you must report on an FBAR that establish:

- Name on the account,

- Account number,

- Name and address of the foreign bank,

- Type of account, and

- Maximum value during the year.

The law doesn’t specify the type of document to keep with this information; it can be bank statements or a copy of a filed FBAR, for example, if they have all the information.

You must keep these records for five years from the due date of the FBAR.

Exception: An officer or employee who files an FBAR to report signature authority over an employer’s foreign financial account doesn’t need to personally keep records on these accounts. The employer must keep the records for these accounts.

Penalties

You may be subject to civil monetary penalties and/or criminal penalties for FBAR reporting and/or recordkeeping violations. Assertion of penalties depends on facts and circumstances. Civil penalty maximums must be adjusted annually for inflation. Current maximums are as follows:

| U.S. Code citation | Civil Monetary Penalty Description | Current Maximum |

|---|---|---|

| 31 U.S.C. 5321(a)(5)(B)(i) | Foreign Financial Agency Transaction – Non-Willful Violation of Transaction | $12,921 |

| 31 U.S.C. 5321(a)(5)(C) | Foreign Financial Agency Transaction – Willful Violation of Transaction | Greater of $129,210, or 50% of the amount per 31 U.S.C.5321(a)(5)(D) |

| 31 U.S.C. 5321(a)(6)(A) | Negligent Violation by Financial Institution or Non-Financial Trade or Business | $1,118 |

| 31 U.S.C. 5321(a)(6)(B) | Pattern of Negligent Activity by Financial Institution or Non-Financial Trade or Business | $86,976 |

Criminal penalty maximums are provided in the FBAR Resources below.

Filing Delinquent FBARs

Filing an FBAR late or not at all is a violation and may subject you to penalties (see Penalties above). If you have not been contacted by IRS about a late FBAR and are not under civil or criminal investigation by IRS, you may file late FBARs and, to keep potential penalties to a minimum, should do so as soon as possible. To keep potential penalties to a minimum, you should file late FBARs as soon as possible.

Follow these instructions to explain your reason for filing late. If you’re participating in an optional program to resolve FBAR noncompliance, such as Delinquent FBAR Submission Procedures or Streamlined Filing Compliance Procedures , follow the instructions for those programs.

Representation for FBAR Issues

You can file Form 2848, Power of Attorney and Declaration of Representative, if the IRS begins an FBAR examination as a result of an income tax examination (Title 26). Complete Line 3, acts authorized, as follows:

- Under Description of Matter – Matters relating to Report of Foreign Bank and Financial Accounts or “FBAR Examination”

- Under Tax Form Number – FinCEN Form 114

- Under Year(s) or Period(s) – applicable tax year(s)

(Note: Disregard previous guidance to complete Line 5a, additional acts authorized.)

Don’t use Form 2848 if a related income tax examination doesn’t apply. You may use a general power of attorney form executed under applicable state law.

FBAR Resources

- FBAR Reference Guide PDF

- Webinar: Reporting of Foreign Bank and Financial Accounts on the Electronic FBAR

- FBAR fact sheet

Note: Civil penalty maximums in these materials are no longer current, as these amounts are adjusted annually for inflation. See Penalties above for more information.

Contact Us

Can’t find the answer to your question in online information? Contact us.

| Contact | Business Hours | Help Offered | |

|---|---|---|---|

| IRS FBAR Hotline | 866-270-0733; or if calling from outside the United States, 313-234-6146 | Monday – Friday, 8 a.m. to 4:30 p.m. EST | General questions: FBAR filing requirements Filing methods |

| FinCEN’s BSA E-Filing Help Desk | See FinCEN’s website for contact information | Monday – Friday, 8 a.m. to 6 p.m. EST | Technical questions about BSA’s E-Filing System |

| FinCEN’s Regulatory Helpline | See FinCEN’s website for contact information | Leave a message for a return call | E-filing exemptions to allow FBAR paper-filingQuestions about BSA regulations |

IRS: Expanded tax benefits help individuals and businesses give to charity during 2021; deductions up to $600 available for cash donations by non-itemizers

IR-2021-190, September 17, 2021

WASHINGTON — The Internal Revenue Service today explained how expanded tax benefits can help both individuals and businesses give to charity before the end of this year.

The Taxpayer Certainty and Disaster Tax Relief Act of 2020, enacted last December, provides several provisions to help individuals and businesses who give to charity. The new law generally extends through the end of 2021 four temporary tax changes originally enacted by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Here is a rundown of these changes.

Deduction for individuals who don’t itemize; cash donations up to $600 qualify

Ordinarily, individuals who elect to take the standard deduction cannot claim a deduction for their charitable contributions. The law now permits these individuals to claim a limited deduction on their 2021 federal income tax returns for cash contributions made to certain qualifying charitable organizations. Nearly nine in 10 taxpayers now take the standard deduction and could potentially qualify to claim a limited deduction for cash contributions.

These individuals, including married individuals filing separate returns, can claim a deduction of up to $300 for cash contributions made to qualifying charities during 2021. The maximum deduction is increased to $600 for married individuals filing joint returns.

Cash contributions to most charitable organizations qualify. However, cash contributions made either to supporting organizations or to establish or maintain a donor advised fund do not qualify. Cash contributions carried forward from prior years do not qualify, nor do cash contributions to most private foundations and most cash contributions to charitable remainder trusts. In general, a donor-advised fund is a fund or account maintained by a charity in which a donor can, because of being a donor, advise the fund on how to distribute or invest amounts contributed by the donor and held in the fund. A supporting organization is a charity that carries out its exempt purposes by supporting other exempt organizations, usually other public charities. See Publication 526, Charitable Contributions for more information on the types of organizations that qualify.

Cash contributions include those made by check, credit card or debit card as well as amounts incurred by an individual for unreimbursed out-of-pocket expenses in connection with the individual’s volunteer services to a qualifying charitable organization. Cash contributions don’t include the value of volunteer services, securities, household items or other property.

100% limit on eligible cash contributions made by itemizers in 2021

Subject to certain limits, individuals who itemize may generally claim a deduction for charitable contributions made to qualifying charitable organizations. These limits typically range from 20% to 60% of adjusted gross income (AGI) and vary by the type of contribution and type of charitable organization. For example, a cash contribution made by an individual to a qualifying public charity is generally limited to 60% of the individual’s AGI. Excess contributions may be carried forward for up to five tax years.

The law now permits electing individuals to apply an increased limit (“Increased Individual Limit”), up to 100% of their AGI, for qualified contributions made during calendar-year 2021. Qualified contributions are contributions made in cash to qualifying charitable organizations.

As with the new limited deduction for nonitemizers, cash contributions to most charitable organizations qualify, but, cash contributions made either to supporting organizations or to establish or maintain a donor advised fund, do not. Nor do cash contributions to private foundations and most cash contributions to charitable remainder trusts.

Unless an individual makes the election for any given qualified cash contribution, the usual percentage limit applies. Keep in mind that an individual’s other allowed charitable contribution deductions reduce the maximum amount allowed under this election. Eligible individuals must make their elections with their 2021 Form 1040 or Form 1040-SR.

Corporate limit increased to 25% of taxable income

The law now permits C corporations to apply an increased limit (Increased Corporate Limit) of 25% of taxable income for charitable contributions of cash they make to eligible charities during calendar-year 2021. Normally, the maximum allowable deduction is limited to 10% of a corporation’s taxable income.

Again, the Increased Corporate Limit does not automatically apply. C corporations must elect the Increased Corporate Limit on a contribution-by-contribution basis.

Increased limits on amounts deductible by businesses for certain donated food inventory

Businesses donating food inventory that are eligible for the existing enhanced deduction (for contributions for the care of the ill, needy and infants) may qualify for increased deduction limits. For contributions made in 2021, the limit for these contribution deductions is increased from 15% to 25%. For C corporations, the 25% limit is based on their taxable income. For other businesses, including sole proprietorships, partnerships, and S corporations, the limit is based on their aggregate net income for the year from all trades or businesses from which the contributions are made. A special method for computing the enhanced deduction continues to apply, as do food quality standards and other requirements.

Keep good records

The IRS reminds individuals and businesses that special recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction. Usually, this includes obtaining an acknowledgment letter from the charity before filing a return and retaining a cancelled check or credit card receipt for contributions of cash. For donations of property, additional recordkeeping rules apply, and may include filing a Form 8283 and obtaining a qualified appraisal in some instances.

For details on how to apply the percentage limits and a description of the recordkeeping rules for substantiating gifts to charity, see Publication 526, available on IRS.gov.

The IRS also encourages employers to help get the word out about the advance payments of the Child Tax Credit because they have direct access to many employees and individuals who receive this credit.

For more information about other Coronavirus-related tax relief, visit IRS.gov/coronavirus.