A shock is headed for the housing market

By Lance Lambert

9/06/2021

At the height of the pandemic, more than 7.2 million homeowners were in the mortgage forbearance program, which allows some borrowers to pause their payments. The economy has since posted one of the fastest recoveries in history. Now, just 1.7 million borrowers are enrolled in the forbearance program.

But soon it’ll be zero.

The Biden-Harris administration has made it clear it has no plans for another extension of the mortgage forbearance program, which is set to lapse on Sept. 30. Borrowers won’t all get removed at once, instead they’ll be phased out over a period of several months. (For details on the mortgage forbearance wind down, go here).

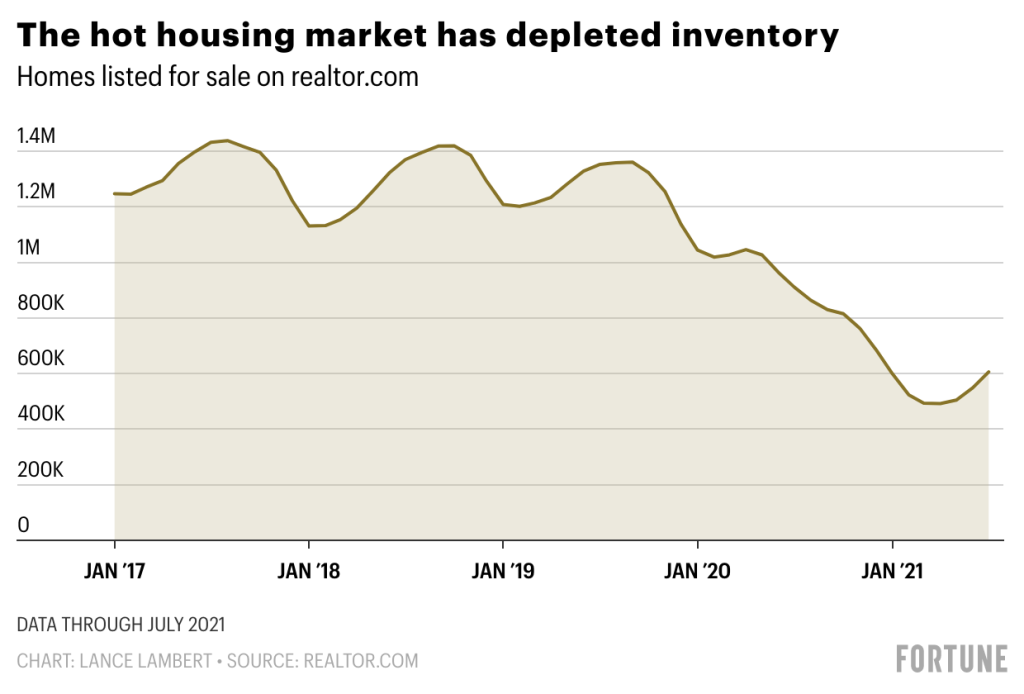

Nonetheless, as Fortune has previously reported, this is a major shake-up headed for the housing market. In a nation of more than 80 million homeowners, 1.7 million might not sound like a lot—until you consider there are just over 600,000 homes for sale right now on realtor.com. In fact, this year housing inventory hit a 40-year low. So, if even a small percentage of these 1.7 million struggling borrowers opt to sell—rather than returning to their monthly payments—it could cause a shock in the housing market.

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

Back in July, Fortune reached out to researchers at Home.LLC, a startup that provides down payment assistance to homebuyers in return for a share of profits, to forecast how the end of forbearance would impact the market. They found the end of the program is likely to see U.S. inventory—homes for sale—rise by 11% later this year. While that’ll hardly shift the housing market from a seller’s market to a buyer’s market, it would soften the market a bit.

Even before mortgage forbearance ends, the market is already starting to cool. After seeing housing inventory plummet over 50% between April 2020 to April 2021, it’s moving up again. Inventory levels ticked up 8.8% in June, and another 10.4% in July. Over the past year, median home prices are up 17.2%, according to real estate research firm CoreLogic. In the coming 12 months, CoreLogic foresees that slowing down a bit, to just a 3.2% appreciation.

But don’t expect the end of forbearance to sink the market. A housing market crash is very unlikely: In the short term, a wave of demographics and years of under-building will ensure, industry insiders tell Fortune, that demand outmatches supply.

A foreclosure meltdown is also unlikely. The strong housing market means most of these struggling homeowners have positive home equity. So if these homeowners decide to walk away, they can simply sell. That is very different from what happened during the Great Recession: Millions of underwater borrowers, with mortgage balances greater than their home’s value—were forced to sell. But we could still see a lot more inventory in the coming months.

This story was originally featured on Fortune.com

It Took Homes 11 Days To Sell In Denver In August. That Might Be A Sign That The Market Is Slowing

By Sarah Mulholland

9/04/2021

Home sales in the Denver metro are slowing, giving some buyers a chance to jump into what has been a highly competitive market for more than a year.

In August, houses sat on the market for an average of 11 days, according to a new report from the Denver Metro Association of Realtors. That may not sound like a lot, but it’s an increase from nine days in July.

And, earlier this year, homes were routinely going into contract within three to four days of being put on the market in the metro area, which includes Boulder and Broomfield counties.

Buyers typically move slower in late summer as families settle in for a new school year, Andrew Abrams, chair of the real estate association’s trend committee and a realtor in the area, noted in the report.

“They are a bit more patient, wanting to find the right house for the ‘right’ price,” Abrams wrote.

How long it takes to sell a home depends on its price, with less expensive homes selling faster than more expensive ones. A home with a price tag that is less than $500,000, for example, might be on the market for nine days, while a home priced in the $750,000 to $1 million range might sell in 16 days.

In August, the median price for a home in Denver was $540,000, which was about the same as July. But that’s 17 percent higher than it was a year ago.

It’s too early to tell whether the recent slowdown is due to seasonal patterns or the housing market beginning to correct itself after a boom that drove double-digit price gains across much of the state and the country.

“Sellers have basked in the control seat for so long that it can be hard to set reasonable expectations,” realtor Amanda Snitker wrote in the report, advising homeowners to prepare for a slower sales process.

While sellers might not be getting multiple bids in one weekend, low interest rates and a lack of homes for sale are still fueling a tight housing market.

A record-low 3,582 homes were listed last month in metro Denver, marking a 35 percent decline from the same time in 2020, according to the report. Typically, there are about 16,000 homes for sale in August, though that number topped 31,000 homes in 2006 — a record high.

So far this year, Denver home sales have totaled more than $25.5 billion, a 25 percent jump compared to this time last year, and about five percent above sales volume in August 2019. The pandemic shifted the normal ebbs and flows of the housing market, halting sales in the spring and early summer of 2020, and pushing them into the colder months.