Fairfax County Homeowners to Get a $600 (8%) Tax Hike

By Arthur Purves

7/19/2022

Taxation by Misrepresentation

Around June 28 Fairfax County homeowners will get their real estate tax bill, which is due July 28. The typical homeowner’s real estate tax bill will increase by $484 or 6.8%, from $7,159 to $7,643.

Around Sept. 5, Fairfax County car owners will get their personal property tax bill, which is due Oct. 5. The typical household’s personal property tax will increase by $151 or 36%, from $420 to $571.

Combining real estate and property tax increases, the typical household will have a $634 or 8.4% tax increase. This is the largest increase since Gerry Connolly’s 9.7% increase in 2006, at the end of the housing bubble. (When he was county chairman, Congressman Connolly increased taxes 15% in 2003, which makes him the record holder for the largest tax increase since 1982.)

However, if you read county chairman Jeff McKay’s April 26, 2022, newsletter about next year’s budget, you’d think your taxes are going down.

First, he says that the supervisors lowered the tax rate 3 cents, from $1.14 to $1.11. In fact, the supervisors increased the tax rate, since $1.11 is 7 cents higher than the $1.04 rate which would have prevented a tax increase due to higher assessments.

Virginia Code Section 58.1-3321 requires supervisors to compare the new rate of $1.11 not to the current $1.14 rate but to a lower rate that would offset the increase in assessments. For homeowners that “lowered” rate is $1.04. Chairman McKay ignores the Virginia Code.

Also, Chairman McKay left out the storm water tax, which is also based on assessments. The storm water rate is 3 ¼ cents, so the total real estate tax rate is $1.14 ¼ cents, and not $1.11.

Second, Chairman McKay says, “The Board also agreed to a 15% reduction in the assessment of personal property (car tax), …” However, used car values have increased so much that even with this 15% “reduction”, the typical household’s car tax bill will increase 36%.

Third, Chairman McKay cites “expanded tax relief for seniors,” which will increase the number of seniors eligible for tax relief by 2,000. There are about 160,000 seniors in the county, so the expanded tax relief benefits only about 1% of seniors.

Under compensation, Chairman McKay says all county employees are getting 4% raises. However, the supervisors’ budget package states that there will be “… average pay increases of 7.86 percent for uniformed public safety employees and 6.16 percent for non-uniformed employees …”

All told, county revenue increases next year total $246 million. The total cost of raises and rate hikes for benefits for the county and schools (school employees are also getting 6% raises) is $252 million. So, the quarter-of-a-billion-dollar tax hike is all for raises and benefits.

Chairman McKay’s newsletter does not mention this. Instead, he says, “In total, this budget provides $199.4 million in tax relief.

This is taxation by misrepresentation.

What he means is that the supervisors were thinking of raising taxes and other revenues by $445 million, but instead they only raised taxes and revenues by $246 million.

Suppose Chairman McKay had said that the supervisors effectively raised the real estate tax rate 7 cents rather than decreasing it 3 cents; that the rate is actually $1.14, not $1.11; that the car tax is going up 36%, not down 15%, that county employees are getting raises of 6% and 7%, not 4%, and that county revenues are increasing $246 million to pay for the raises and not going down by $199 million.

Would that jeopardize Chairman McKay’s reelection next year?

Fairfax County, Vienna Real Estate Taxes Over Last 40 Years

By David Swink

7/02/2022

This FCTA board member has lived in the same southwest Vienna rambler since Dec 1975 — with no improvements made which would alter its accessed value for tax purposes. So my home can serve as a baseline for judging the actual growth of real estate taxes in both Fairfax County and Town of Vienna for the period from 1976 onward.

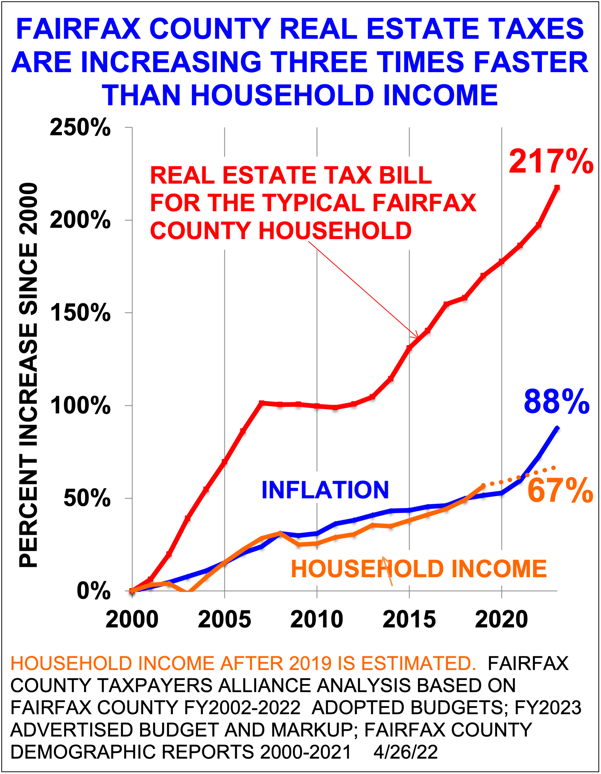

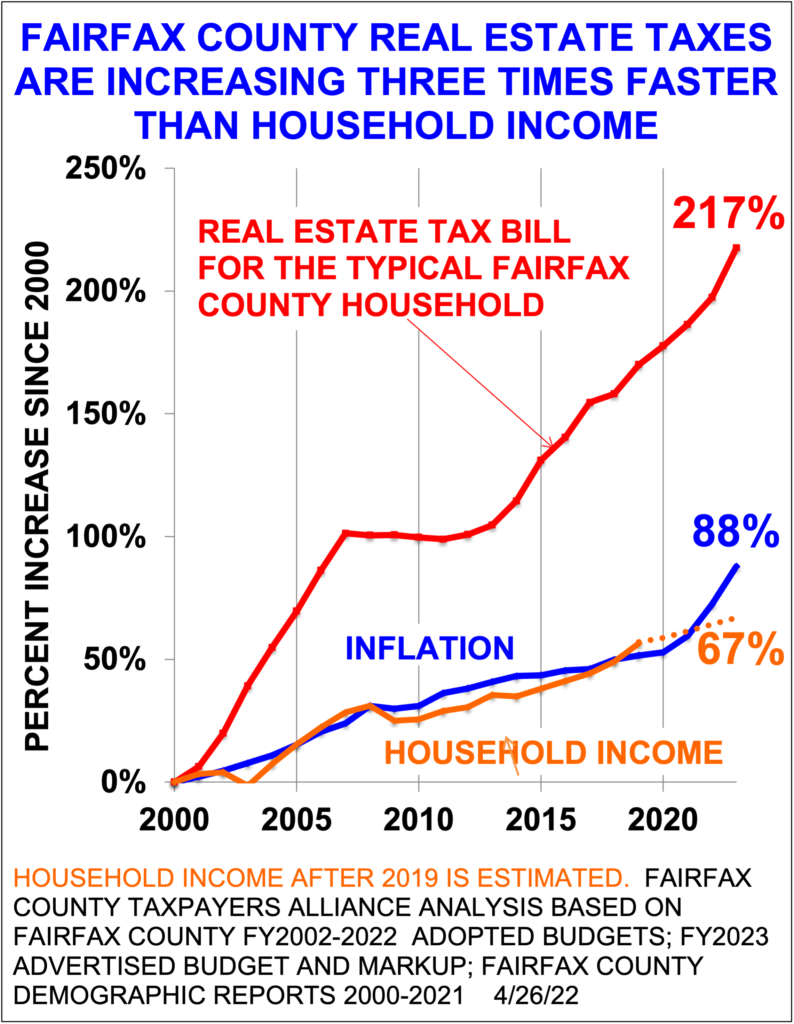

We’re all familiar with FCTA’s graph of Fairfax County real estate tax increases since FY2000. But here is raw data going back another 25 years — in actual dollars (not noting inflation).

A column is provided showing the County real estate tax percent increase from the previous year. Another column shows Vienna’s real estate tax as a percentage of the county’s, to see if Vienna’s numbers track with those of the county. So what does one notice? Even without a graph, one can deduce the following:

- Both Fairfax County and Vienna taxes “took off” after year 2000, leveled during the Great Recession, and are now back on full throttle.

- The Vienna percentage is fairly consistently in the low-to-mid 20’s, and thus seems more tied to county increases than to actual need.

- Oddly, the raw tax increase (not adjusted for inflation) from 1976 to 2013 is precisely a factor of 6.18 for both the county and Vienna.

Numbers for future years will be added to the table as they become available. Also, information such as the political make-up of the Fairfax County Board of Supervisors for each period may be added. Enjoy.

客服电话:1 (888) 666-7723

客服邮箱:customerservice@huarenstore.com

独立日大促,22款风靡华人圈的厨房小家电特惠推荐,速来选购!

BOS Chairman Year Fx Co Tax Yr-Yr Vienna Tax Vn/Fx

Jack Herrity-R 1976 $821.72 - $170.01 20.69%

" 1977 $857.91 +4.44% $177.50 20.69%

" 1978 $872.97 +1.76% $175.66 20.12%

" 1979 $884.27 +1.29% $178.00 20.13%

" 1980 $980.98 +10.94% $197.47 20.13%

" 1981 $1077.23 +9.81% $235.42 21.85%

" 1982 $1164.02 +8.06% $261.31 22.45%

" 1983 $1164.02 0 $261.31 22.45%

" 1984 $1217.13 +4.56% $275.10 22.60%

" 1985 $1216.67 -0.04% $288.85 23.74%

" 1986 $1232.69 +1.32% $292.19 23.70%

" 1987 $1354.12 +9.85% $318.01 23.48%

Audrey Moore-D 1988 $1554.41 +14.79% $358.71 23.08%

" 1989 $1752.93 +14.79% $412.45 23.53%

" 1990 $1913.03 +9.13% $482.57 25.23%

" 1991 $1779.11 -7.00% $464.81 26.13%

Tom Davis-R 1992 $1826.46 +2.66% $471.23 25.80%

" 1993 $1824.27 -0.12% $471.23 25.83%

" 1994 $1824.27 0 $471.23 25.83%

Kate Hanley-D 1995 $1886.98 +3.44% $487.43 25.80%

" 1996 $2000.07 +5.99% $487.43 24.37%

" 1997 $1998.44 -0.08% $503.67 25.20%

" 1998 $1998.44 0 $503.67 25.20%

" 1999 $1998.44 0 $503.67 25.20%

" 2000 $2123.17 +6.24% $534.67 25.18%

" 2001 $2441.63 +15.00% $595.04 24.37%

" 2002 $2955.38 +21.04% $695.52 23.53%

" 2003 $3185.20 +7.78% $754.46 23.69%

Gerry Connolly-D 2004 $3413.19 +7.16% $799.73 23.43%

" 2005 $3753.75 +9.98% $825.00 21.98%

" 2006 $4281.44 +14.07% $894.73 20.90%

" 2007 $4281.44 0 $959.12 22.40%

" 2008 $4425.59 +3.37% $1004.77 22.70%

Sharon Bulova-D 2009 $4396.65 -0.65% $958.76 21.81%

" 2010 $4294.60 -2.32% $950.56 22.13%

" 2011 $4690.11 +9.21% $1045.56 22.29%

" 2012 $4658.44 -0.68% $1029.02 22.09%

" 2013 $5080.52 +9.06% $1051.02 20.69%

" 2014 $5547.46 +9.19% $1139.88 20.55%

" 2015 $5783.11 +4.25% $1165.95 20.16%

" 2016 $6243.39 +7.96% $1212.57 19.42%

" 2017 $6422.76 +2.87% $1244.72 19.38%

" 2018 $6837.56 +6.46% $1299.92 19.01%

" 2019 $6984.07 +2.14% $1327.77 19.01%

Jeff McKay-D 2020 $7159.35 +2.51% $1361.09 19.01%

" 2021 $7452.66 +4.10% $1413.05 18.96%

" 2022 $7812.16 +4.82% $1400.52 17.93%

— David Swink, FCTA board member / Updated 2022-07-02