Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

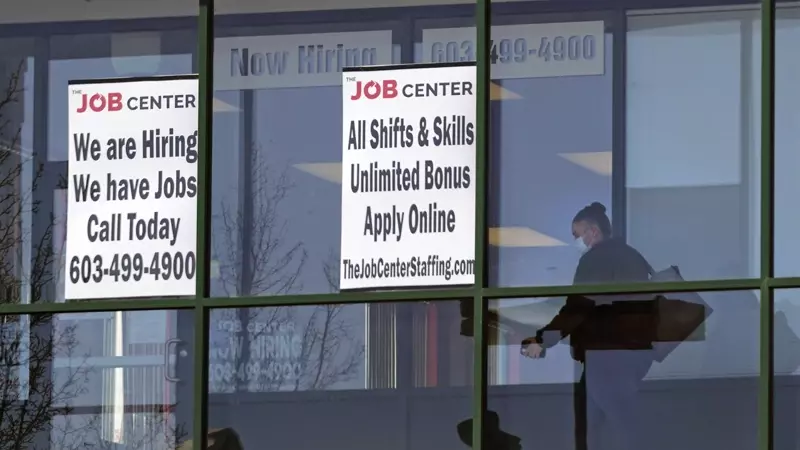

人力短缺乱象:建筑商聘毫无经验劳工 珠宝店无人应征

世界新闻网

11/04/2021

美国劳动市场出现人力短缺,人数破纪录的劳工为争取更好待遇、福利及工作环境而跳槽,身为中小企业的雇主面临重大考验。一家阿肯色州建筑工程包商老板说,现在开出时薪20元的价码,只为了让毫无经验的工人愿意到班;营业已40多年的华盛顿州珠宝店开出新进员工时薪19元的价码,却无人上门应征。

阿肯色州森特顿(Centerton)工程包商「混凝土制造与挖掘公司」(Concrete Creations and Excavations)负责人贺德尔斯顿(JD Huddleston)接受新闻网站「阿肯色旅游者」(Arkansas Traveler)访问时说,自从新冠疫情爆发后,符合资格的人手就越来越难找,如今由于实在缺人,情急之下只能雇用对建筑业完全没有经验的劳工。

他说,人手不足导致公司失去赚钱机会,有时候自己都要加入建筑工人行列。他指出,因为没有人手,「现在经常把案子推掉」。

为了吸引劳工,贺德尔斯顿说,除了调高工资,还提供带薪休假福利,有时候则向其他建筑包商借调人力。

他指出:「我付每小时18元至20元的工资,给对于这个产业毫无概念的人,只为了让他们愿意到班。」不过,许多新进人员因为表现懒散,后来都被解聘。

他说:「平均每8名新聘员工当中,我几乎可以确定,其中有7人会在30天之内解聘,因为实在太懒散了。」

这波劳工短缺潮底下,中小企业面临必须与大型企业抢人的挑战。

Oct 15, 2021

华盛顿州艾德蒙斯(Edmonds)康斯塔克珠宝店(Comstock Jewelers)是从1978年便开立的当地老字号商店,但负责人艾琳‧康斯塔克(Erin Comstock)说,不知为何今年变得很难聘到员工。

她说:「真的令人想不通。我们有很好的工作环境,我不明白为什么没有人想来上班。」

过去半年多来,康斯塔克珠宝店应征两名全职员工,时薪17元,但却找不到人。康斯塔克说,如今主要靠女儿帮忙顾店,原本已退休的丈夫也到店里帮忙。她表示,营业时间缩减为每周二至周六开店,做生意时间为早上10时到下午5时,周日与周一则休息。

Labor shortages expected to continue in 2022, Kelley economic forecast predicts

By Indiana University

11/04/2021

Newswise — INDIANAPOLIS — Economists at the Indiana University Kelley School of Business expect the U.S. and Indiana economies to remain somewhat resilient amid challenges presented by COVID-19 and supply-chain issues, but labor shortages will continue to be a major concern for many businesses in 2022.

The U.S. economy may average only about 300,000 in added jobs each month, according to a forecast released today by the Indiana University Kelley School of Business.

Jun 24, 2021

In the past 12 months, it has been doing so at an average rate of about 450,000 per month.

“This will be about two-thirds the rate during the past year, but it will be enough to put year-end employment above its pre-pandemic level,” said Bill Witte, author of the Kelley School’s U.S. forecast and an associate professor emeritus of economics. “Total employment remains 4.5 million below its pre-pandemic level. This deficit is not a result of deficient demand for labor — currently there are nearly 11 million job openings in the U.S. — it reflects a severe decline in labor force participation.

“During the shutdown, the participation rate dropped 3.2 points — a very large change. During the first four months of the restart, it recovered close to half that, but in the 14 months since it has made no further progress. The labor market situation confounds the other supply-side problems. Building new capacity requires labor, both for construction and then eventually staffing.”

Indiana — which has seen about 60,000 workers drop out of the labor force — will mirror the nation, with labor growth close to 2 percent in 2022. Most job gains in the state will be in services.

“Last winter, we thought slack in the labor market would provide opportunities for growth in 2021, but Indiana, along with the rest of the country, has reported labor shortages — a reversal of expectations,” said Timothy Slaper, co-director of the Kelley School’s Indiana Business Research Center. “We hope to see the workforce recover in Indiana by the end of 2022. Many factors will affect the recovery, including stimulus, supply-chain restoration, labor participation rates, and continued demand for goods and services.”

One sector of the labor market particularly expected to hamper economic output in Indiana is trucking. The Commercial Carrier Journal reported a shortage of 80,000 truck drivers nationally.

“This leaves manufacturing-oriented states like Indiana in the middle of the supply-chain bottleneck,” Slaper said. “With aging truck drivers and early retirements fostered by COVID-19, as well as logistics interruptions for shipping, the problem is only amplified.”

Kyle Anderson, clinical assistant professor of business economics and faculty chair of Kelley’s Evening MBA Program, said the Indianapolis Metropolitan Statistical Area — which accounts for 31 percent of the state’s population and about a third of state employment and income — will continue to be the economic driver for the state.

But Anderson added that downtown Indianapolis may need to reinvent itself in some ways as fewer people return there for work.

“Tourism and convention business should pick up in 2022, bringing in welcome dollars from across the country,” Anderson said. “Residential development in the area marks a shift toward a more balanced and healthy economy. However, these gains are offset by work-from-home trends that will continue for the foreseeable future. Office real estate will remain underutilized, limiting economic growth for the city.”

Employment growth over the next three years in Indianapolis is projected at nearly 3 percent.

Witte, who has helped prepare the annual Business Outlook forecasts for more than three decades, is also concerned that higher wages sparked by the current labor shortages could produce “serious inflationary pressures.”

“The Federal Reserve says this will be temporary,” he said. “That sounds a lot like what they said in the late 1960s and the 1970s, as inflation rose from 1 percent to double digits.”

Other key points from the forecast:

- Growth in output will come back in 2022 but will decelerate during the year. Growth will total about 4 percent for the year.

- The world economy is expected to expand by 4.9 percent in 2022, although growth will be uneven due to the inequality in countries’ vaccine access and the differences in their ability to provide fiscal and monetary stimulus to support the recovery.

The starting point for the forecast is an econometric model of the United States, developed by IU’s Center for Econometric Model Research, which analyzes numerous statistics to develop a national forecast for the coming year. A similar econometric model of Indiana provides a corresponding forecast for the state economy based on the national forecast plus data specific to Indiana.

A detailed report on the outlook for 2022 will be published in the winter issue of the Indiana Business Review, available online in December. In addition to predictions about the nation, state and Indianapolis, it also will include forecasts for other Indiana cities and key economic sectors.

The Kelley School presented its forecast today at the Crowne Plaza Downtown/Union Station hotel in Indianapolis. Kelley faculty around the state, where they will be joined by local panelists from other IU campuses and other universities, offering perspectives on the global, national, state, and local economies and financial markets. The tour is sponsored by the Kelley School of Business, the Kelley School of Business Alumni Association, the IU Alumni Association, IU campuses and numerous community organizations.

疫情下的美国大离职潮 更多民众提早退休但不领社安金

世界新闻网

11/02/2021

原文标题: 华邮:疫情期间另类大离职潮 提早退休但不领社安金

随着新冠疫情爆发而出现的「大离职潮」(Great Resignation)当中,包括一股与众不同的趋势。华盛顿邮报报导,某些手头较为宽裕的民众,靠着联邦政府的疫情纾困支票以及一波波股市上涨,便得以提前从职场退休,但不必领取社安金,等数年后年纪较长,可领取金额更高时才申请。住在华盛顿州奥乍得港(Port Orchard)的妇人米契尔(Fawn Michel),今年5月以62岁年纪退休,但打算等到70岁才要申请领取社安金。

米契尔接受华盛顿邮报专访时说,今年稍早与丈夫查看积蓄之后,发现因为资产快速增值,如果能够控制生活开销,其实已经可以不必再工作了,也不必申请社安金。她说,雇主要求恢复进办公室上班,但一想到要开车到西雅图郊区的办公室通勤上下班,「我就觉得已经受够了」。

她说,看到朋友、亲属因为疫情而丧生,使得她对于退休的观念因此改变,「我不禁想着,如果不现在退休,恐怕永远没机会了」。

报导指出,对于经济状况相对较好的民众来说,疫情经济(pandemic economy)的到来,提供了现代史上最具吸引力的提休诱因。联邦政府大方发放纾困现金支票,股市蒸蒸日上,房价一路走高,外加担心感染病毒等健康风险考量,让不少美国民众纷纷决定提早退休。

华盛顿邮报分析,疫情爆发后提早退休的民众当中,颇为让人意外的现象为,许多民众并没有因为退休而领取社安金福利(Social Security benefits),而是决定延后几年才要申请,届时每月可领取的社安金,支票金额将比现在领取更高。

社会安全局(Social Security Administration,SSA)统计显示,今年9月截止的12个月期间,申请社安金福利的人数与一年前同期相比,下降约5%,创下近20年来最大幅度。华盛顿邮报报导,对照同一时间的劳工统计局(Bureau of Labor Statistics)数据,65岁至69岁之间劳工申请退休的比例,则增加了5%。

较为年长的美国劳工离开职场,却没有申请社安金福利,成为疫情爆发后的另类趋势。经济学者、研究人员及政府官员认为,原因在于联邦政府慷慨发放纾困支票,还有额外失业津贴补助,让民众退休之后短时间内至少三餐不成问题。股价与房价双双上涨,则让美国劳工退休帐户充实不少。

科罗拉多大学丹佛分校(University of Colorado at Denver)经济学家尼可拉斯(Lauren Hersch Nicholas)指出,通常在经济衰退期间,依赖社安金计划过日子的民众人数将会增加,「我们原以为疫情发生之后,也会出现相同状况」。她说,但从申请社安金的人数来看,实际情形并非如此。

根据社安金计划规定,最早可以申请领取的年龄为62岁,随着年龄增长,每月可领取社安金支票金额也跟着提高,增加金额的年龄计算上限为70岁。社会安全局推算公式显示,今年当中届满65岁民众,退休前年收入至少6万元以上,只要延后领取社安金一年,每月领取金额大约就可增加9%,从原本每月领取1418元,变成可领1550元。

北美法律公益讲座安排

时间:周二到周五 晚间

5:30-7:00(西部)

8:30-9:30(东部)

重播:第二天

上午9:00(西部时间)

中午12:00(东部时间)

周二: 遗嘱和授权书(Lisa讲)

周三: 数据泄露和个人身份保护&事业机会说明会

周四:北美常见法律问题(讲员Irene )

周五:小企业法律和员工福利(晶旌)

Zoom 6045004698,

密码:请扫码进群

另外:周三6:30(西部时间)美国专场

定期邀请美国律师联合讲座

Zoom 951 9092 9213

密码:请扫码进群

Social Security cost-of-living increase will boost benefits 5.9% in 2022 as inflation spikes

By Paul Davidson | USA TODAY

10/13/2021

Now that’s more like it.

Older Americans scraping by on meager increases in their Social Security checks the past decade will reap a relative windfall next year.

The roughly 70 million people – retirees, disabled people and others – who rely on Social Security will receive a 5.9% cost-of-living adjustment next year, the Social Security Administration said Wednesday. That’s the biggest bump since 1982.

The sharp increase is tied to a COVID-19-fueled spike in inflation after years of paltry consumer price increases.

For the average retiree who got a monthly check of $1,565 this year, the bump means an additional $92 a month in 2022, boosting the typical payment to $1,657.

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

“The guaranteed benefits provided by Social Security and the COLA increase are more crucial than ever as millions of Americans continue to face the health and economic impacts of the pandemic,” AARP CEO Jo Ann Jenkins said in a statement. “Social Security is the largest source of retirement income for most Americans and provides nearly all income (90% or more) for one in four seniors.”

SSA bases its cost-of-living adjustment on average annual increases in the consumer price index for urban wage earners and clerical workers, or CPI-W, from July through September. The CPI-W largely reflects the broad CPI that the Labor Department releases each month.

On Wednesday, Labor said the CPI-W rose 5.9% annually in September following a 5.8% jump in August.

The COLA has averaged 1.4% the past 10 years – half the average over the prior decade – because of unusually low inflation, according to the Senior Citizen League, an advocacy group.

During this period, tens of millions of Social Security beneficiaries saw much or all of their cost-of-living increases effectively erased because of sharply climbing premiums for Medicare Part B, which are automatically deducted from many Social Security checks.

That shouldn’t be the case for most recipients this year because of the healthy COLA advance. The Part B premium is set to rise by $10 and prescription drug plan premiums are likely to increase an average of about 5%, says Mary Johnson, a policy analyst for the Senior Citizen League.

Johnson has long complained that the basket of goods that determines the CPI-W index doesn’t reflect the spending patterns of seniors who buy less gasoline, electronics and other products that make up a big portion of younger workers’ spending. Seniors instead spend more on food, health care costs and other items that have seen sharp price increases during the pandemic.

Johnson has called for the SSA to base its COLA on a proposed index for the elderly called CPI-E that would put more weight on health, food and other expenditures.

Since 2000, Social Security recipients have lost 32% of their buying power as COLAS grew by about half as much as the cost of goods and services typically purchased by retirees, according to the league.

With energy prices soaring this year, part of that dynamic is being reversed, with seniors, who don’t buy as much gasoline, poised to gain from the large COLA increase.

“They’re getting the benefit of that,” Johnson says.

At the same time, older Americans will still face sharply higher costs for some goods and services, including food, rent and prescription drugs. Seniors also could be socked by a 21% to 25% surge in home heating oil and natural gas costs this winter, according to the league and the U.S. Energy Information Administration.

“Retirees have been pummeled by the rising cost of health care, and the CPI-W does not accurately reflect how much retirees are spending on health care,” says Rhian Horgan, CEO of Silvur, maker of a retirement planning app.

Although the COLA bump could somewhat narrow Social Security recipients’ longstanding shortfall in buying power, “it’s not going to restore it,” to 2000 levels, Johnson says.

“While the high COLA is welcome, we have received hundreds of emails from retired and disabled Social Security recipients who say that the low COLAs in recent years have not kept pace with their rising costs,” Johnson says. “That has made it more difficult for many to cope with the rampant inflation of 2021.”

And, she says, the more generous payment will subject some recipients to new taxes or bump them into a higher tax bracket, offsetting some or all of the increase.

Also, many economists are forecasting high inflation again next year as supply chain bottlenecks continue to drive up product costs while labor shortages push employee wages, and related prices, higher.

“The COLA is paying for inflation from last year,” Johnson says. “Not,” she adds, “for future years.”

Federal Communications Commission

Emergency Broadband Benefit

The Emergency Broadband Benefit is an FCC program to help families and households struggling to afford internet service during the COVID-19 pandemic. This new benefit will connect eligible households to jobs, critical healthcare services, virtual classrooms, and so much more.

About the Emergency Broadband Benefit

The Emergency Broadband Benefit will provide a discount of up to $50 per month towards broadband service for eligible households and up to $75 per month for households on qualifying Tribal lands. Eligible households can also receive a one-time discount of up to $100 to purchase a laptop, desktop computer, or tablet from participating providers if they contribute more than $10 and less than $50 toward the purchase price.

The Emergency Broadband Benefit is limited to one monthly service discount and one device discount per household.

Who Is Eligible for the Emergency Broadband Benefit Program?

A household is eligible if a member of the household meets one of the criteria below:

- Has an income that is at or below 135% of the Federal Poverty Guidelines or participates in certain assistance programs, such as SNAP, Medicaid, or Lifeline;

- Approved to receive benefits under the free and reduced-price school lunch program or the school breakfast program, including through the USDA Community Eligibility Provision in the 2019-2020 or 2020-2021 school year;

- Received a Federal Pell Grant during the current award year;

- Experienced a substantial loss of income due to job loss or furlough since February 29, 2020 and the household had a total income in 2020 at or below $99,000 for single filers and $198,000 for joint filers; or

- Meets the eligibility criteria for a participating provider’s existing low-income or COVID-19 program.

How to Apply

The online application for the Emergency Broadband Benefit Program is experiencing high demand. We appreciate your patience as we actively work to resolve any connectivity issues users may encounter.

Apply Now

There are three ways for eligible households to apply:

- Contact your preferred participating broadband provider directly to learn about their application process.

- Go to GetEmergencyBroadband.org to apply online and to find participating providers near you.

- Call 833-511-0311 for a mail-in application, and return it along with copies of documents showing proof of eligibility to:

Emergency Broadband Support Center

P.O. Box 7081

London, KY 40742

After receiving an eligibility determination, households can contact their preferred service provider to select an Emergency Broadband Benefit eligible service plan.

Get More Consumer Information

Check out the Broadband Benefit Consumer FAQ for more information about the benefit.

Which Broadband Providers Are Participating in the Emergency Broadband Benefit?

Various broadband providers, including those offering landline and wireless broadband, are participating in the Emergency Broadband Benefit. Find broadband service providers offering the Emergency Broadband Benefit in your state or territory.

Broadband providers can find more information about how to participate here.

Source: https://www.fcc.gov/broadbandbenefit

Evictions During COVID-19: Landlords’ Rights and Options When Tenants Can’t Pay Rent

Tips, resources, and advice for landlords whose tenants aren’t able to pay the rent due to the coronavirus outbreak.

By Ann O’Connell, Attorney

11/01/2020

Many renters are facing financial challenges resulting from coronavirus-related business shut-downs, furloughs, layoffs, and stay-at-home orders. The longer this crisis goes on, the more likely it is that many will not be able to pay their rent. When renters default on rent, landlords suffer, and might not be able to meet their own financial obligations, such as making the mortgage payments on the rental property.

Here are some suggestions about how landlords can mitigate the financial impact of tenant defaults during the COVID-19 outbreak.

Terminations and Evictions

Under normal circumstances, when tenants don’t pay rent, landlords have the option of terminating the tenancy (by serving the tenant with either a pay rent or quit notice or an unconditional quit notice, depending on the applicable laws). When tenants don’t pay the rent or move out by the deadline given in the notice, landlords can then file an eviction lawsuit to have the tenants physically removed from the rental.

However, health and safety concerns due to COVID-19 have led many states, cities, counties, and courts to place moratoriums on evictions. The scope of these temporary bans on evictions varies greatly: some have banned any and all action relating to evictions, while others simply postpone hearings on evictions until the court can arrange a hearing via telephone or video.

If you are a landlord in an area with an eviction moratorium, you might still be able to file eviction papers with the court, but your case might not be heard for a while. However, even if there are no bans in place, evicting tenants who can’t pay the rent due to the coronavirus crisis probably shouldn’t be your first recourse. Aside from optics (you don’t want to get a reputation as the ruthless landlord who booted tenants out of their home in the middle of a stay-at-home order), if you remove tenants right now, you’re going to be faced with having to disinfect the rental, advertise the rental, screen new prospective tenants (of which there might be very few), sign a new lease or rental agreement, and get the new tenants moved in—all while taking measures to abide by emergency guidelines and health and safety measures.

Consider the following options instead.

Evaluate Your Personal Financial Situation

Take a moment to evaluate your own finances. As dire as it sounds, it might be time to take stock of what could happen in a worst-case scenario. Most landlords have likely considered the situation where tenants don’t pay rent, as this can happen at any time. But there’s no denying that this is a different situation—what will happen if your tenants can’t pay for a long time, and your options for finding new (paying) tenants are slim?

Your assessment of how this worst-case scenario will affect your ability to pay your mortgage (if any) and your personal bills will inform how you respond when your tenants can’t pay their rent.

- If your financial situation looks grim: If your ability to pay the mortgage on your rental property hinges on month-to-month rental income, you should take actions to prevent your own default This includes options discussed below, such as contacting your lender and proactively seeking arrangements with tenants that allow them to make at least partial payments.

- If you have a few months’ reserves: If your personal reserves or financial position won’t feel too much of a pinch if tenants aren’t able to pay rent for a while, you still might have to make some compromises to retain good tenants. If you have tenants who have previously been reliable and are simply finding it hard to make ends meet currently, do what you can to take some pressure off them—see the discussion below about working out a temporary solution with tenants.

Try to Work Out a Temporary Solution With Tenants

Depending on how desperately you need to receive income from your rental, you have a few options for working with tenants who aren’t able to pay rent because of COVID-19. Consider the following possible arrangements.

- Forgive rent. If your situation allows for it, you could waive rent for a month, with an agreement to revisit the payment arrangement on a certain date. A landlord in Bakersfield recently did this for his tenants.

- Postpone rent. You could offer to postpone rent payments for a month, with an agreement that it will be repaid. Your repayment arrangement could state that the rent owed could be spread out over time, paid all at once, or paid when (if) a stimulus check

- Reduce rent. If you can, consider dropping the rent temporarily to a level that enables you to meet your obligations but forgoes profit for the time being. For example, if you normally collect $1200 a month, but your mortgage is $900 a month, you could temporarily drop rent to $900 to make sure you at least don’t get in trouble with your lender.

Before deciding to make any of these adjustments, try talking to your tenants. Ask them straight out what they think they can make work. If you’re able to accommodate their suggestions, chances are higher that they will do everything they can to hold up their end of the bargain. Be sure to put any agreements in writing, preferably as an addendum to your current lease or rental agreement that includes all details of the arrangement.

Look for Outside Assistance

Even if you think you can float a month or two without rental income, you still might want to consider taking some measures now to protect your position in the event that the coronavirus crisis lasts longer than your cushion can handle. If you’re already feeling the pinch, take these actions immediately.

Attend to Your Mortgage

At this point in the COVID-19 crisis, most private lenders are willing to work with borrowers to ensure that they don’t lose their homes. Call your lender directly and ask what steps it is taking to assist borrowers who can’t meet their mortgage obligations due to the coronavirus pandemic.

- If your loan is owned by Fannie Mae or Freddie Mac, you might be able to delay making payments for a certain period of time without incurring late fees or getting hit with a credit score penalty.

- Look into your options under the Coronavirus Aid, Relief, and Economic Security Act.

- The Federal Housing Administration (FHA) has put in place a foreclosure moratorium for single family homeowners with FHA-insured mortgages.

- Visit your state’s website to find out if the state is offering assistance to homeowners. For example, New York has announced a delay of mortgage payments for 90 days. Many other states are postponing any foreclosure actions indefinitely. Find your state’s website at State and Government on the Net.

Look Into Property Tax Breaks

Some states and counties are extending the deadline for paying property taxes, or cancelling late fees and interest. Check your county’s tax assessor’s website to see if this is an option where your property is located.

Seek a Loan

Consider seeking a loan from family, friends, or private lenders. The U.S. Small Business Administration might be another source of assistance—its disaster loan assistance web page has a wealth of information. You can also contact your regular bank or credit union and inquire about what assistance it can offer.

Research Options for Your Renters

Some areas are beginning to offer rent vouchers or emergency funds to renters in need. For example, the Pennsylvania Apartment Association is collecting donations for funds to give to renters who can’t pay rent. Currently, renters’ needs are getting a lot more attention in the press than landlords’ needs, and there are already a lot more resources being made available for renters. It’s in your best interest to research these options and bring them to your renters’ attention—do what you can to help your tenants pay you.

Landlords are getting squeezed between tenants and lenders

By ANNE D’INNOCENZIO

NEW YORK (AP) — When it comes to sympathetic figures, landlords aren’t exactly at the top of the list. But they, too, have fallen on hard times, demonstrating how the coronavirus outbreak spares almost no one.

Take Shad Elia, who owns 24 single-family apartment units in the Boston area. He says government stimulus benefits allowed his hard-hit tenants to continue to pay the rent. But now that the aid has expired, with Congress unlikely to pass a new package before Election Day, they are falling behind.

Heading into a New England winter, Elia is worried about such expenses as heat and snowplowing in addition to the regular year-round costs, like fixing appliances and leaky faucets.

Elia wonders how much longer his lenders will cut him slack.

“We still have a mortgage. We still have expenses on these properties,” he said. “But there comes a point where we will exhaust whatever reserves we have. At some point, we will fall behind on our payments. They can’t expect landlords to provide subsidized housing.”

The stakes are particularly high for small landlords, whether they own commercial properties, such as storefronts, or residential properties such as apartments. Many are borrowing money from relatives or dipping into their personal savings to meet their mortgage payments.

The big residential and commercial landlords have more options. For instance, the nation’s biggest mall owner, Simon Property Group, is in talks to buy J.C. Penney, a move that would prevent the department store chain from going under and causing Simon to lose one of its biggest tenants. At the same time, Simon is suing the Gap for $107 million in back rent.

Michael Hamilton, a Los Angeles-based real estate partner at the law firm O’Melveny & Myers, said he expects to see more retail and other commercial landlords going to court to collect back rent as they get squeezed between lenders and tenants.

Residential landlords are also fighting back against a Trump administration eviction moratorium that protects certain tenants through the end of 2020. At least 26 lawsuits have been filed by property owners around the country in places such as Tennessee, Georgia and Ohio, many of them claiming the moratorium unfairly strains landlords’ finances and violates their rights.

Apartment dwellers and other residential tenants in the U.S. owe roughly $25 billion in back rent, and that will reach nearly $70 billion by year’s end, according to an estimate in August by Moody’s Analytics.

An estimated 30 million to 40 million people in the U.S. could be at risk of eviction in the next several months, according to an August report by the Aspen Institute, a nonprofit organization.

Jessica Elizabeth Michelle, 37, a single mother with a 7-month-old baby, represents a growing number of renters who are afraid of being homeless once the moratorium on evictions ends.

The San Francisco resident saw her income of $6,000 a month as an event planner evaporate when COVID-19 hit. Supplemental aid from the federal government and the city helped her pay her monthly rent of $2,400 through September. But all that has dried up, except for the unemployment checks that total less than $2,000 a month.

For her October rent, she handed $1,000 to her landlord. She said her landlord has been supportive but has made it clear he has bills to pay, too.

“I never had an issue of paying rent up until now. I cry all night long. It’s terrifying,” Michelle said. “I don’t know what to do. My career was ripped out from under me. It’s gotten to the point of where it’s like, ‘Am I going to be homeless?’ I have no idea.’”

Some landlords are trying to work with their commercial or residential tenants, giving them a break on the rent or more flexible lease terms. But the crisis is costing them.

Analytics firm Trepp, which tracks a type of real estate loan taken out by owners of commercial properties such as offices, apartments, hotels and shopping centers, found that hotels have a nearly 23% rate of delinquency, or 30 days overdue, on their loans, while the retail industry has a 14.9% delinquency rate as of August.

The apartment rental market has so far navigated the crisis well, with a delinquency rate of 3%, according to Trepp. That’s in part because of the eviction moratorium, along with extra unemployment benefits from Washington that have since expired.

“There are bad actors, but the majority of landlords are struggling and are trying to work with a bad situation,” said Andreanecia M. Morris, executive director of HousingNOLA, a public-private partnership that pushes for more affordable housing in the New Orleans area.

Morris, who works with both landlords and tenants, said that government money wasn’t adequate to help tenants pay their rent, particularly in expensive cities. She is calling for comprehensive rental assistance.

She fears that residential landlords will see their properties foreclosed on next year, and the holdings will be bought by big corporations, which are not as invested in the neighborhoods.

Gary Zaremba, who owns and and manages 350 apartment units spread out over 100 buildings in Dayton, Ohio, said he has been working with struggling tenants — many of them hourly workers in restaurants and stores — and directs them to social service agencies for additional help.

But he is nervous about what’s next, especially with winter approaching and the prospect of restaurants shutting down and putting his tenants out of work. He has a small mortgage on the buildings he owns but still has to pay property taxes and fix things like broken windows or leaky plumbing.

“As a landlord, I have to navigate a global pandemic on my own,” Zaremba said, “and it’s confusing.”