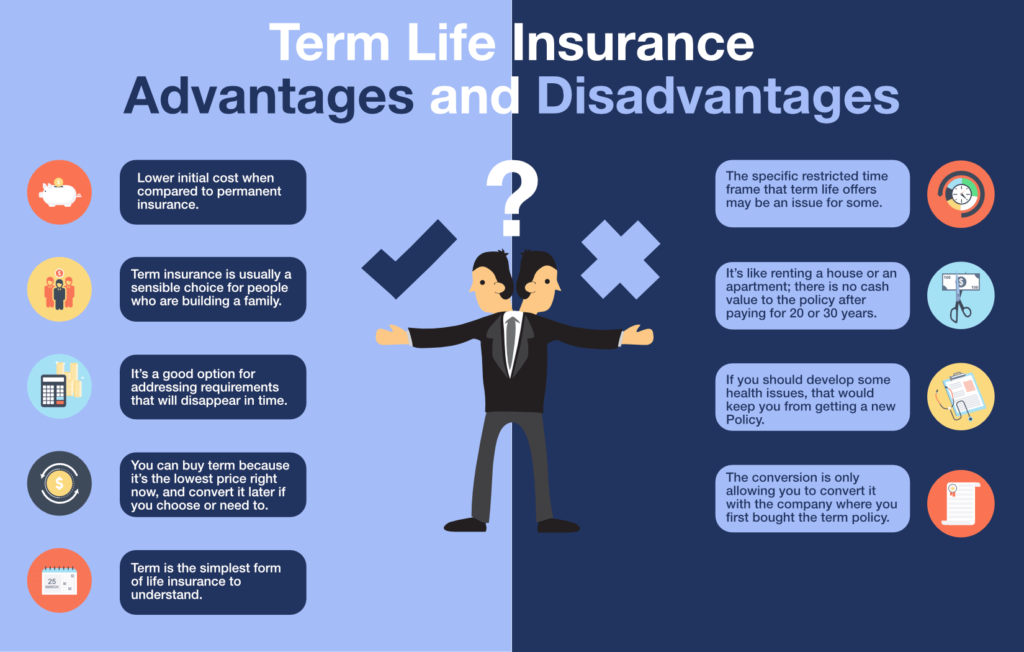

Recessions don’t affect life insurance policy rates as much as you might think, especially if you elect to protect your family with a term life insurance policy. Whether or not there is economic uncertainty, buying life insurance now, when you need it, is still a smart financial move.

Here’s what you need to know about how life insurance companies price their policies, why term life insurance policies are less affected by economic fluctuations than permanent life insurance policies, and what you can do to get the most affordable life insurance policy possible.

How life insurance companies price their policies

Your life insurance premium rate is determined by your age, health history and tobacco use. However, life insurance policy rates, as a whole, are determined by the profitability of a life insurance company, which is generally affected by three main factors: mortality rates, company expenses and the interest rate environment. “If you have a change in any of these three components, it will impact a life insurance company’s profitability,” explains Aneesha Deshpande, head of product innovation at Haven Life. When a company’s profitability goes down, its policy rates might go up.

That said, short-term economic volatility doesn’t typically affect life insurance policy rates. “Life insurance companies have investment managers that are prepared for these short-term fluctuations, and are generally able to handle them without a rate impact,” Deshpande says. If an economic recession looks like it might last for a longer period of time, life insurance companies might begin to increase rates to maintain profitability — but if this happens, term life insurance policies will experience smaller rate increases than permanent life insurance policies.

For example, a healthy 35-year-old woman can buy a 20-year, $500,000 term life insurance policy through Haven Life for about $20 per month. If term life insurance rates were to increase by 5%, that woman’s premium would be about $21.

Term life insurance rates generally remain stable

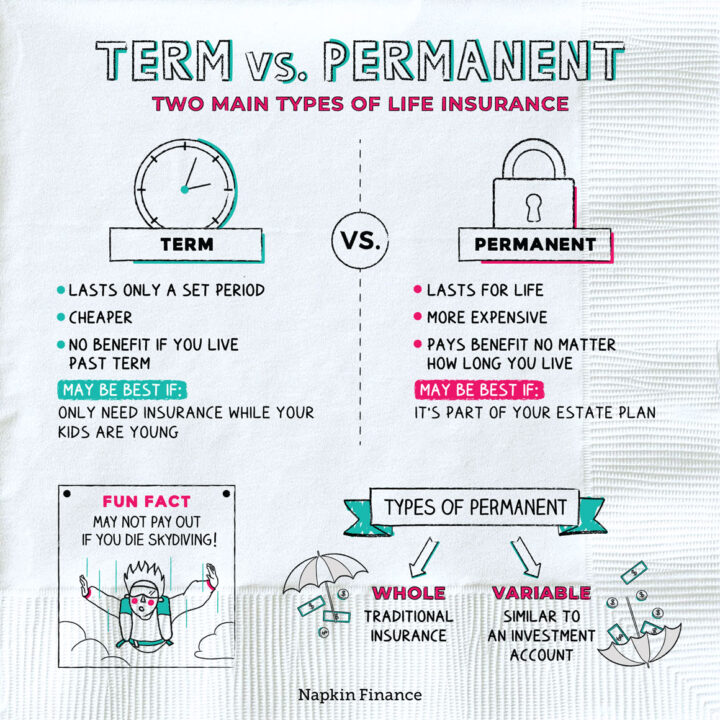

Term life insurance policy rates tend to remain stable even during periods of financial crisis. Why? Because these policies cover individuals for a short period of time relative to permanent insurance — usually 10, 15, 20 or 30 years, depending on the coverage you choose. Permanent policies, on the other hand, cover you for a lifetime, so as long as your coverage remains in good standing, there is a 100% chance the insurance company will pay out a death benefit at some point.

These shorter term lengths protect both the consumer and the life insurance company from economic fluctuations, Deshpande says, because “term products are less severely impacted by low-interest-rate environments” than permanent life insurance policies. (See more on that below.)

This is why life insurance companies are comfortable offering affordable term life insurance policies even during recessions and when people are unemployed. Since each policy provides coverage for a defined period of time, the insurer isn’t taking on as much risk that they’ll lose money if the economy declines long-term.

Consumers also get to benefit from the low risk factor that affordable level premium term policies provide — once you complete your term life insurance application, you’ll secure a monthly premium that will remain constant for the length of your insurance policy.

终身寿险有什么好处?适合哪些人群?

今日(10-14)公益讲座:

Why Whole Life Insurance is the rock of our financial fundation

为何终身寿险是个人与家庭的财务基石

请进群获取活动注册信息

👇一周免费活动,尽在群中👇

Your term life insurance premium won’t change

When you buy level premium term life insurance, you lock in your premium rate for the length of the term — called “guaranteed level premiums.” In other words: If you buy a 10-year term life insurance policy, you pay the same monthly premium for the full 10 years, no matter what happens to the economy during that period. If you decide to protect your family with a 30-year term life insurance policy, your premium rate will stay the same, every month, for thirty years.

How many other products can offer the same guarantee? Term life insurance is designed to fit into nearly every budget, and the security of knowing that your premiums won’t increase due to inflation, recession or any other economic issue can provide just as much peace of mind as the policy itself.

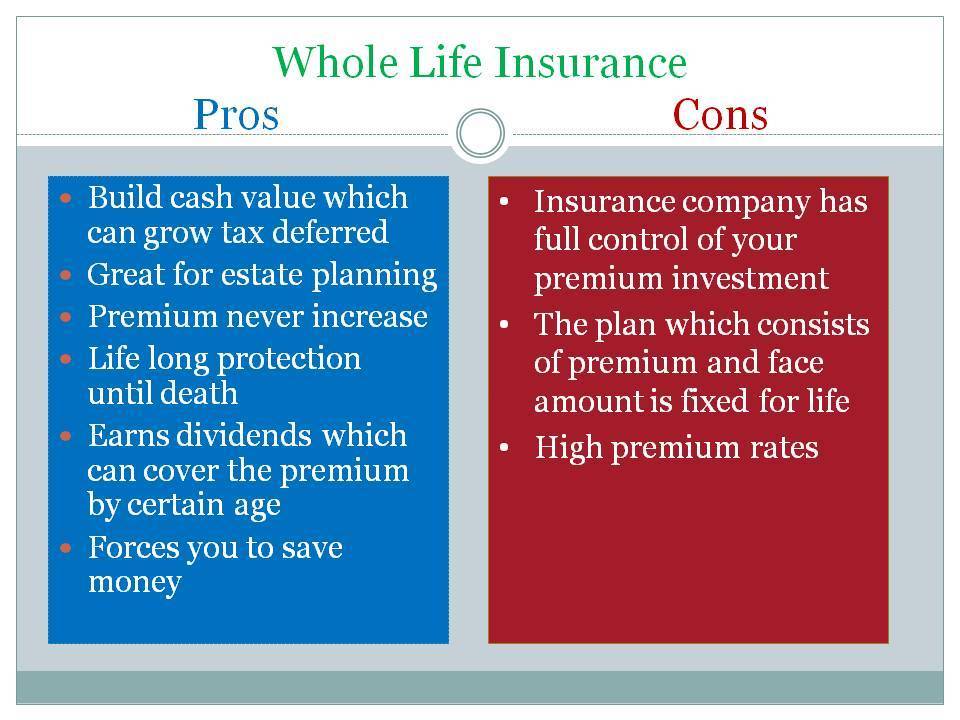

Permanent life insurance can become more expensive during economic uncertainty

Unlike less interest rate sensitive products like term life insurance, permanent life insurance policies — common types being universal or whole life insurance — are more likely to see rate fluctuations during a period of economic uncertainty. “Permanent life insurance policies protect the policyholder for a lifetime and some products offer long-term cash value guarantees,” Deshpande says. “These guarantees can be costly for life insurance companies in the current market environment.” In a lower interest rate environment paired with economic uncertainty, life insurance companies can be impacted by reduced profitability or even losses on these products, and as a result, rates will likely increase.

Deshpande also notes that premiums will not change for existing permanent life insurance policyholders with level premiums — which is the case for most whole life insurance policies. However, some universal life insurance products may have premiums projected based on a higher assumed rate of return than is the current reality. Permanent policyholders should review their coverage with a financial professional to ensure policies don’t lapse prematurely and to understand how a low-interest-rate environment may impact their coverage.

人寿保险不是诅咒!年轻人应该买人寿保险吗?

一提到人寿保险,很多唯恐人避之不急。一方面我们觉得自己还年轻、健康,要我买保险是要诅咒我吗;另一方面大家常常看到“买保险骗人”的新闻,所以大家对保险有抵触心理。

其实这存在一个很大误区,实际上在美国人寿保险非常的普遍,今天小编就在这里给大家做一个人寿保险大揭秘!

人寿保险的两大类型

1定期人寿保险

定期寿险是指在保险合同约定的期间内,如果被保险人死亡或全残,则保险公司按照约定的保险金额给付保险金,若保险期限届满被保险人健在,则保险合同自然终止,保险公司不再承担保险责任,并且不退回保险费。定期寿险的保险期限有10年、15年、20年等多项选择。

它的优势就在于保费低,而不好的地方就是没有现金价值、没有储蓄的功能。

2永久人寿保险

永久人寿保险又分为终身人寿保险和指数型人寿保险。

终生人寿保险的特质是:注重死亡赔偿金,以小数的钱换取较大数量的赔偿金。它的好处是有储蓄积累的功能,而缺点则是保费较高、功能有限、等待的时间较长。终生人寿保险比较适合非常注重死亡理赔的人。

指数型人寿保险特质是:收益根据股市市场而定,有保底锁利的功能,只赚不赔!指数型人寿保险有很多好处,比如储蓄积累的功能、生前福利、省税、灵活运用等;它的缺点则是收益有限顶,相比股市来讲没有那么高的报酬率。指数型人寿保险适合希望有较高投资收益且没有风险的人。

很多读者对“保险”有错误的观点,觉得自己用不上。但是我们谁都不知道明天和意外谁会先来,提早做准备是没有错的。如果担心被骗钱的话,可以扫描下方二维码找美国泛宇集团的专业保险经纪人做一个好的投资组合!

9月人寿保险意识月:什么时候买寿险最好?

20年前 的9.11,因很多人无辜意外遇难的原因,九月被定为人寿保险意识月。

我们说life insurance = love insurance

爱,是行动,是保障,是尽自己最大努力提供,不成为家人的负担。

2020年,COVID-19病毒大流行给每个家庭敲响了警钟,意外死亡造成的情感痛苦是无法估量的。对于没有人寿保险的家庭,亲人的死亡会带来严重的经济困难。人寿保险在家庭最需要的时候为其提供了必不可少的财务支持。

2021年人寿保险意识月,也是爱之保险月。COVID-19病毒让我们意识到生命是如此的脆弱。希望这种意识宣传月将鼓励更多人为意外做好准备,获得他们需要的人寿保险保护家人和爱人。

全球病毒大流行和动荡不安的世界,给我们大多数人带来了焦虑和无助感。我们担心我们的工作,财务,健康,亲人和我们自己的意外身亡。有些事情我们无法控制,但是我们可以做些事情,来帮助我们自己和家人克服困难并度过难关。人寿保险是最佳选择。

人寿保险,是通过人寿保险公司购买的一种人寿保险产品。在受保人去世后,保险公司将向受益人一次性支付一笔款,受益人不用交税。任何人都可以购买它,不同的保单,可以满足不同家庭收入预算和情况。

但是,仍然有许多人没有购买人寿保险。他们担心这可能太昂贵,太复杂,或者不想面对死亡。其实有不同类型的人寿保险来满足个人与家庭需求,包括无需体检和终生保单保证5年,10年或者15年或随便你想多少年付清等。

我们在挑选理财产品的时候,首先要找到信用评级较高的银行。信用评级越高,银行的金融实力越强,我们购买的理财产品也就越靠谱。挑选保险产品也一样,首先要看保险公司的信用评级。

什么时候买人寿保险好?

Life insurance越早买越好,买的早,价格也会更加便宜。其实跟“重疾险”的概念是差不多的,被保人越年轻,那么保险公司赔付的概率也会更低,所以保费也会越便宜。

除了年龄之外,性别、健康状况、工作类型的不同也会影响保费高低,同等条件下男性买寿险的保费会比女性更高;健康状况越不好的话,保费也会越高;工作越危险,保费也会越高。