Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

卡车司机打败政坛老鸟 他当选新州参议员 只花153美元

世界新闻网

11/04/2021

美国2日举行多场州长、市长等地方选举,不断上演惊奇。新泽西州参议会共和党州参议员候选人、商用卡车司机德尔打败寻求连任的民主党籍议长史威尼,而德尔只花了153美元在选举上。

德尔的当选为新州参议院投下震撼弹,议长人选将引发新的政治角力。

根据已开出的逾99%选票,德尔(Edward Durr)领先史威尼约2200多票。德尔投入的选举费用,只有印制传单在选区发放,以及买了一些甜甜圈和饮料。

德尔在推特帐号的自我介绍写着,他是「蓝领、基督徒及保守派」,一直住在新泽西州,有三个孩子,已当祖父。他言简意赅表示:「我并非寻求权力或名气,只希望为民众发声。」他主张低税负及透明政府。

Nov 4, 2021

史威尼(Steve Sweeney)自2010年以来担任新州参议院议长,是该州最有影响力的政客之一。

36岁华裔当选波士顿市长:我父母来美时身无分文

来源:澎湃新闻

11/03/2021

“我父母来到美国的时候还不会说英语,口袋里身无分文。”时任波士顿市议员的吴弭(Michelle Wu)在9月中旬美国波士顿市长初选领先后向其支持者慷慨陈词,“他们从来没有想过,有一天他们的女儿会竞选波士顿市长的职位。”

更出乎吴弭父母预料的是,半个月后的11月2日深夜,她成功当选波士顿200多年历史上首位女性、亚裔市长。“我们将迎来一个包容的波士顿,没有人会被赶出这座城市,我们欢迎所有将波士顿视为家的人前来;这里将有能够负担的房租,政府会推行绿色新政。”吴弭在当日的胜选讲话中说道。

对于现年36岁的吴弭而言,家庭与政治之间有一条极为特殊的纽带。在她人生的前20年,家人避免在任何场合谈论政治。因为在他们的观念里,政治是腐败,是恐惧。“做人应该低调,努力学习,找一份稳定、高薪的工作养家。”因此,当吴弭跨进哈佛大学校门时,她甚至不知道自己是应该支持民主党还是共和党。

不过,也正是由于命途多舛的家庭背景使她在充满隐形障碍的政治、社会体制中四处碰壁,20岁出头的她决意从一个彻彻底底的“局外人”,走近波士顿权力中心,并试图推出进步派政策改变这里的政治生态。

2013年,28岁的吴弭成为首位当选波士顿市议员的亚裔女性;2016年,吴弭全票当选为市议会的主席,也是首位担此要职的少数族裔女性。如今,她再次打破性别与族裔的藩篱,以“外来者”的身份,成为这座具有独特社会文化城市的市长。

年轻的“一家之主”

吴弭出生时,她父母刚从中国台湾移民至美国不久,为的就是子女能够获得更好的发展。

彼时,吴弭的父亲吴函(音译)是化学工程师,准备在伊利诺伊理工大学读研。但他和妻子玉敏(音译)几乎不会说英语,因此,出生在美国的大女儿吴弭从四五岁起就要充当他们的翻译,帮助他们与政府机构打交道,填写各类表格。

在芝加哥郊区读高中时,吴弭已经开始学习大学预修课程,加入数学小组和护旗队,并在学术评估测试(SAT)和大学入学考试(ACT)中获得满分。在毕业典礼上,作为共同致辞代表,她以美国作曲家格什温的《蓝色狂想曲》中的一段钢琴独奏博得了满堂喝彩。

吴弭的妹妹谢瑞尔(Sherell)回忆说,父母鼓励她们培养广泛爱好,但不允许学而不精。当然,这其中不能包括政治,他们一家也从未在饭桌上谈起过政治。

在吴弭父母看来,政治是高风险的职业,他们希望吴弭学医,“通过一连串考试拿到各种学位,从此过上安稳幸福的生活。”后来她按照父母毕生所愿进入哈佛大学,但却没有加入任何党派。

也是在哈佛学习经济学期间,吴弭的父母离异,家庭分崩离析。住在郊区的母亲行为开始出现异常,时常对着电视大喊大叫,甚至还拨打911称受到诡异的威胁。

当刚毕业的吴弭在波士顿咨询公司获得一份颇具前景的工作时,妹妹谢瑞尔的一通电话将她拉回残酷的现实,“我们需要你回家,马上。”

吴弭急忙赶回家,当即被母亲的病情震惊了:母亲拿着行李箱站在雨中,确信会有一名司机来接她参加秘密会议。她仔细端详着吴弭的脸庞,反复确认她是不是机器人。

那一年,22岁的吴弭被迫成为一家之主,扛起了全家的责任:母亲被诊断患有精神分裂症,她带着母亲接受精神治疗。她还开了一间小茶馆,想着让母亲在恢复正常后接手;她也成为家中最小的妹妹(11岁)的主要监护人,最终申请到了法定监护权。

“我记得很多父母会疑惑,‘她(吴弭)什么时候生了这个孩子?’”彼时妹妹所在学校的助理校长托雷斯向波士顿公共广播电台(WBUR)回忆说,“当吴弭还很年轻的时候,她就懂得如何为人父母。”

吴弭将这段经历视作她人生的十字路口——她放弃了父母替她安排好的人生剧本。成为一家之主后,在政府机构碰到过的繁文缛节,让沮丧的她发奋考进哈佛法学院,攻读法律博士(J.D)学位,并把母亲和妹妹从芝加哥接到波士顿一起生活。

“远离政治”的破灭

吴弭在20岁出头所经历的家庭变故,以及与政府打交道的挣扎,都牵引着她从政治“局外人”逐渐走近波士顿权力政治的中心。

谈及自己从政的决定,吴弭在今年7月的一次采访中告诉美国政治新闻网站Politico,20岁左右经历的那场危机,让她深切感受到了与政府接触的沮丧与挣扎:美国的社会保障体系极其复杂;给妹妹们争取学校补助十分繁琐;在当时的体制下,想要经营小生意维持家庭运转,各种问题接踵而至。

“我受够了……任何需要帮助和资源的地方,都有无形的障碍需要跨越。”吴弭在采访中坦言,这些经历“打破了她试图远离政治和政府的幻想”。

与此同时,她也深知,还有许多波士顿家庭正在经历着她曾经的挣扎与痛苦。和年纪轻轻被迫成为一家之主一样,当再次走到人生十字路口,吴弭不由自主地选择了从政这条路。“当我有机会能为更多家庭打破障碍,我不得不将责任扛在肩上,这仿佛是下意识的举动。”

在吴弭步入政界之时,民主党进步派参议员伊丽莎白·沃伦是绝对不能绕过的一位“伯乐”。

彼时在哈佛教授合同法的沃伦,至今犹记得吴弭到办公室找她的情景。沃伦向《纽约(专题)时报》回忆道,吴弭在法学院的第一学期因学业不够精进到办公室向她道歉,但沃伦当时并没注意到吴弭在学业上有任何问题。“她觉得自己没有尽力,希望我明白,她没有任何不尊重我的意思。”

之后,她们促膝长谈,吴弭讲述了自己照顾母亲和妹妹生活的经历。沃伦听完不禁感叹,吴弭在法学院求学,还需照顾家庭,她在25年的教学生涯中从未遇见过这样的学生。

这次办公室交心的谈话,成为吴弭和沃伦之间密切往来的开始。吴弭在法学院的第三年,沃伦第一次竞选国会参议员。吴弭参与了沃伦的竞选工作,她告诉Politico,她是波士顿最早一批通过上门拜访和打电话争取选票的人之一。竞选结束后,吴弭开始为那些在传统意义上被排除在政治之外的社区提供服务。

波士顿前市议员约翰·康诺利称赞吴弭“对实地政治有着非凡的、天才般的理解……对波士顿的边边角角有着过目不忘的记忆……她可以告诉你阿尔巴尼亚人在罗斯林戴尔(编注:波士顿的一个主要居民区)的六个社交场所。”

在今夏波士顿市长的初选中,当被问及为什么会支持吴弭而不是其他进步派候选人时,沃伦的回答直截了当,“吴弭是家人。”

“局外人”面临的改革挑战

当吴弭在波士顿开启自己的政治生涯时,这座城市也正处于一个转折点:选民越来越年轻、教育程度更高、政治立场也逐渐左倾。

她提议让波士顿成为进步派政策的“试验场”——将城市开发合约重新分配给波士顿非裔所有的公司;削减警察工会的权力;免除部分公共交通的费用;并恢复一定的租金管控,这些大刀阔斧的改革想法让房地产利益相关方倍感压力。

“在市政府工作近10年,我发现在政府里最容易做的事就是什么都不做,”吴弭总结说,“而在试图带来改变的过程中,那些想保持现状的人会被影响,或者感到不安,甚至遭受损失。”

“我所有的同学都开始谈论吴弭。”波士顿爱默生学院(Emerson College)大四学生、22岁的本杰明·斯威舍告诉《纽约时报》,吴弭能参与市长竞选“表明年轻人可以做到,我们有想法,去推动这个国家前进、去创造新美国”。

与此同时,在担任波士顿市议员的四届任期中,吴弭也因专注于政府实质事务而赢得声誉,她经常出席一些处理琐事的会议。在接受波士顿环球媒体公司采访时,吴弭自己也坦言,她喜欢在平凡细小的公共工作上深耕,比如解决城市下水道和坑洞的问题。在她看来,每一个微小的项目是实现城市发展愿景的关键。

“她会让人联想到‘有条不紊’这个词……仿佛一旦她把成为市长作为目标,她就会逐一完成每一项待办清单。”活动人士、马萨诸塞州前交通部门官员克里斯·邓普西告诉《纽约时报》,“她出现在公众面前,处理问题,建立选区,展开对话,表现出一种始终如一的态度。”

WGBH电台评论员彼得·卡齐斯也认为,吴弭竞选市长“是经过深思熟虑、精心策划的”。卡齐斯补充说,“她为了得到这个职位下了盘大棋,她布局长远,没有人能做到这种程度。”

不过,可以预见的是,吴弭想要推出的进步派政策势必会面临不小的挑战。批评人士称,吴弭所承诺的是她无法实现的变革,诸如租金管控这样的政策在市长职权之外,需要州级机构采取行动。

“吴弭日复一日谈论着不切实际的事情……简直是‘天上掉馅饼’。”此次波士顿市长选举的另一候选人、持务实中间派立场的安妮莎·乔治如是评价。还有批评者警告称,就算吴弭在选举中获胜,但这并不意味着她能胜任市长一职,她所推进的议程会面对来自城市发展部门的多重阻力。

在波士顿传统政客眼里,吴弭身上带着挥着不去的“局外人”标签。的确,就连吴弭自己也承认,“我从小到大未曾见过像我这样的人掌握权力”。童年时期,吴弭在电视上看到的唯一一位美国亚裔女性是花样滑冰运动员关颖珊;在接受美国全国广播公司(NBC)采访时,她回忆称,她的家庭时常遭遇种族主义歧视,父母试图对此视而不见,埋头努力工作。

“现在是我们大胆发声,打破‘隐形亚裔’循环的时候了。”吴弭坚信。

同样,吴弭也深知作为市长将面临何种挑战与难关,但她早在22岁时便学会了独当一面。她时常想起,但鲜有提及一句母亲时常对她的叮嘱——“提醒弭弭:帮助他人,反思政府。”

波士顿华裔市长吴弭 深耕市民日常问题 政治理念受欢迎

世界新闻网

11/03/2021

台湾移民第二代吴弭(Michelle Wu)美国当地时间2日当选波士顿市长,中媒报导,吴弭是波士顿历史上首位当选市长的亚裔女性,打破该市白人男性市长历史,赞誉她「又一位华人之光,登上世界舞台」。

中媒赞:华人之光 登世界舞台

澎湃新闻报导,波士顿200多年来一直是由白人男性当市长,36岁的吴弭胜出,是女性和亚裔的双重历史性胜出。

网易新闻报导,吴弭的父母在1980年从台北移民到美国芝加哥,在美出生的吴弭是移民第二代,家境并不富裕,就像传统的华人父母一样,吴弭的父母避免跟孩子讨论政治。

吴弭很争气18岁入学哈佛,不过,几乎天天打电话回家跟妈妈聊天的吴弭突然发现妈妈开始不接电话,或说一些奇怪的话,后来,吴弭知道妈妈的精神状况亮起红灯,而且逐渐恶化,父母亲也因此离异。

大学毕业后为照顾家人回家的吴弭,因为自营小生意跟妈妈的精神问题,需要不断地跟政府官僚打交道。加上有一次送妈妈急诊,面对院方对精神疾病者非人化的体制,感到愤怒,吴弭决定重回校园,进入哈佛法学院读研,这也是她走入政坛的初心。

吴弭进入哈佛法学院,遇见她的导师,也是政坛贵人——麻州的资深联邦参议员华伦教授,开始在当时波士顿市长的行政及财务办公室工作。

吴弭因为身为女性,也是来华裔第二代移民,她深刻理解一般百姓的苦恼,从深耕小市民生活日常问题为出发,她利用自己经历过的人生困境,推动各种法案,政治理念受到欢迎。2016年她获得市议员一制通过当选波士顿议会议长,成为波士顿首位非白人女性议长。如今更上一层楼,当选美国波士顿市长,改写首位亚裔女性当选市长的记录。

吴弭当选波士顿首位华裔市长 打破200年白男主导局面

世界新闻网

11/03/2021

全美多州2日举行州长、市长等地方性选举,其中波士顿选出首位华裔女市长吴弭(Michelle Wu)。民主党进步派的吴弭2日击败对手埃塞比‧乔治(Annissa Essaibi George),当选成为波士顿首位亚裔女市长,缔造历史,终结波士顿200年来由白人男性主导政坛的局面。

36岁、父母来自台湾的吴弭身穿一袭喜气的大红衣宣布胜选说:「我们准备好迎接这个时刻,我们准备成为所有人的波士顿,准备好成为不赶人的城市,而是欢迎称此地为家的所有人。」

「我的儿子前几个晚上问我,小男孩是否能当选为波士顿市长?」吴弭告诉儿子说:「他们有过,未来也会再有,但不是今晚。今天,波士顿选出你妈妈(当市长)。」

Nov 2, 2021

47岁的突尼斯及波兰裔埃塞比‧乔治当天晚上10点15分左右,承认败选并恭贺吴弭胜选,且不忘强调吴弭当选的历史重要性。当时开出约31%选票,吴弭已取得过半票数。

「我要热烈恭喜吴弭,她是第一位女性、首位有色人种、首位亚裔的波士顿民选市长。」埃塞比‧乔治在败选演讲时说,这不是小事,「我希望她向这个城市展现,身为人母可以做到许多事。」

亚太裔国会研究所(APAICS)数据显示,全国前100座大城市中,在2日之前只有六位亚裔市长,全都在加州或德州。

维吉尼亚州州长选举结果,则可能变天,由共和党拿下州长及州议会多数席次,而民主党票仓的新泽西州,这次州长选情胶着,难分轩轾。

此外,纽约市长也毫无意外,由民主党的现任布鲁克林区长亚当斯(Eric Adams)胜出,成为纽约市史上第二位非洲裔市长。

吴弭胜选 波士顿选出首位华裔女市长

世界新闻网

11/02/2021

22:50更新

吴弭在开出的52%选票中,以60.3%的得票率领先对手的39.7%。吴弭在胜选演说中表示「这些已成为事实」。她的对手埃塞比‧乔治也已坦承败选。

22:30更新

吴弭在开出的32%选票中,以56.4%的得票率领先对手的43.6%。

22:15更新

波士顿可望选出第一位华裔女市长,吴弭(Michelle Wu)在截稿前开出的近22%选票中,以57.9%的得票率领先对手的42.1%。

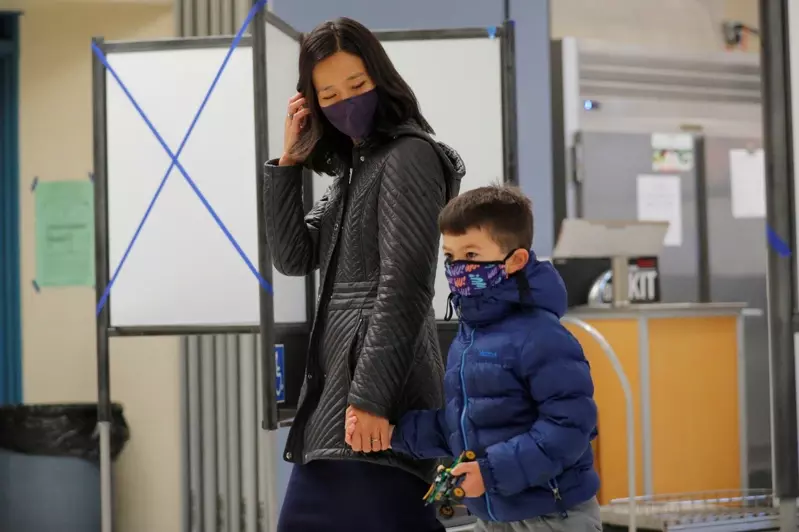

36岁台裔波士顿市议员吴弭在选前民调中稳步领先,她2日一早8时左右,便与丈夫和两个儿子前往罗斯林代尔(Roslindale)的菲尼亚斯贝茨(Phineas Bates)小学投票。

吴弭说:「这是对波士顿而言相当重要的时刻,我们有很大的机会直接因应危机,并让所有人参与对话。」

吴弭与同党市议员、47岁突尼斯及波兰裔的埃塞比‧乔治(Annissa Essaibi George)9月在党内初选中脱颖而出,无论谁当选,都会缔造历史,成为波士顿首位有色人种女市长,终结波士顿200年来由白人男性主导政坛的局面。

Michelle Wu wins Boston mayoral race over Annissa Essaibi-George

By SEAN PHILIP COTTER

11/02/2021

Michelle Wu has declared victory in the Boston mayoral race, ushering in a historic first for the city as the first female chief executive elected.

“Thank you for placing your trust in me to serve as the next mayor of Boston,” a jubilant Wu told cheering supporters inside the Cyclorama in the South End. “Let’s dig in.”

The 36-year-old Wu, a city councilor from Roslindale who’s the daughter of Taiwanese immigrants, will be the first woman and first person of color elected mayor in Boston after defeating fellow at-large Councilor Annissa Essaibi-George.

Wu stressed her progressive vision for Boston, declaring the Hub “ready to be a Green New Deal city.”

“We don’t have to choose between generational change and keeping the street lights on, between offering bold solutions and filling our potholes,” she said, articulating her general governing philosophy. “We deserve both. All of this is possible.”

Essaibi-George, of Dorchester conceded the race in a phone call to Wu just before 10 p.m. from the Fairmont Copley Hotel.

“I want to offer a big congratulations to Michelle Wu. She’s the first woman and first Asian American elected to be mayor of Boston,” Essaibi-George told supporters. “It’s no small feat.”

After taking the stage to Kenny Chesney’s “Boston,” Essaibi-George vowed, “I’m never going to stop fighting for the city that I love.”

The vote count remains unofficial as city workers scramble to tally Election Day votes and mail-in ballots.

Wu, who’s been on the council since 2014, ran as a progressive in the style of her mentor and former Harvard Law professor U.S. Sen. Elizabeth Warren, who stumped around the city with her in the waning days of the race.

Asked whether Boston will be a proving ground for progressive politics, Wu said, “Absolutely.”

Essaibi-George framed herself as the relative moderate in a race that was congenial most of the way but turned nasty in the final week, largely involving Essaibi-George-affiliated PACs and activists going on the offensive against Wu with polls predicting her heavy lead.

The pair were the top two finishers in a more crowded field in the September preliminary, ousting Acting Mayor Kim Janey, City Councilor Andrea Campbell and former city economic development director John Barros.

Wu’s fond of quickly reeling off the number of days since she began her run for mayor, but in reality that’s an undersell. She’s been gearing up for years, and did so successfully — as was first shown in the preliminary race, when she stayed above the fray and ran a strong first place.

Because there is no sitting mayor, Wu will take office in just two weeks, on Nov. 16. That means what’s normally a couple of months’ time for a transition will now be compressed into the time before Thanksgiving.

Wu’s been reticent about who’s on her transition team, besides naming the leader, local education activist Mariel Novas. She’s also declined to talk about who would be in her cabinet. She told reporters that those conversations would begin Wednesday and announcements would be on their way soon.

She’ll also get to install a new police chief — she’s vowed a “national search” — and multiple school committee appointments.

A Wu victory leads to some open questions that only time in office will answer. To what extent will she focus on her more ambitious ideas — which generally are outside of her direct control — such as making the MBTA free, implementing rent control and abolishing the Boston Planning & Development Agency?

How will her relationship with the police department and the cops unions evolve, as she seeks to renegotiate some elements of contracts in the name of reform?

And how will Wu, who’s savored being the opposition for so many years as a vocal critic of Marty Walsh, handle becoming the establishment?

北美法律公益讲座安排

时间:周二到周五 晚间

5:30-7:00(西部)

8:30-9:30(东部)

重播:第二天

上午9:00(西部时间)

中午12:00(东部时间)

周二: 遗嘱和授权书(Lisa讲)

周三: 数据泄露和个人身份保护&事业机会说明会

周四:北美常见法律问题(讲员Irene )

周五:小企业法律和员工福利(晶旌)

Zoom 6045004698,

密码:请扫码进群

另外:周三6:30(西部时间)美国专场

定期邀请美国律师联合讲座

Zoom 951 9092 9213

密码:请扫码进群

Massachusetts housing market so hot, burned house going for almost $400K

Median sale price of single family homes in the state currently between $535,000 and $552,000

Associated Press

9/28/2021

A home in Massachusetts seriously damaged by fire has been listed on the market with an asking price of $399,000.

In August, industry groups listed the median sale price of single family homes in the state to be between $535,000 and $552,000.

The online listing for the burned three-bedroom, 1,857-square foot home starts with a call out to contractors, and continues: “House is in need of a complete renovation or potential tear down and rebuild. Buyer to do due diligence. House being sold as is.”

The house suffered an intense fire in August that blew out the front windows, which are now boarded up. The Boston Globe reported that firefighters had to tear out parts of the walls and ceiling of the home to extinguish the blaze.

Home-flipping profits are shrinking, but here’s where you can net the most

By Diana Olick

9/27/2021

KEY POINTS

- During the second quarter of this year, close to 80,000 single-family homes and condominiums were flipped.

- The gross profit on a typical flip rose to $67,000. But the return on investment shrunk to a decade low.

- Of course all real estate is local, and flippers in some markets are seeing higher profits than in others.

Home flipping has never been easy, no matter how much fun TV shows like “Flip or Flop” make it out to be.

It’s been even harder lately, due to low supply, high prices and a run on housing triggered by the coronavirus pandemic.

Flipping a home is defined as buying and reselling the same home within a 12-month period, and profits rely heavily on both the health of the housing market as well as the cost to flip. Most flippers will upgrade or improve the house in some way to increase their returns.

Despite the long list of obstacles, close to 80,000 single-family homes and condominiums were flipped during the second quarter of this year, according to property database Attom. That represents nearly 5% of all home sales. While the volume is lower than the average seen over the past decade, it is the first increase in flipping in more than a year.

The profits, however, are shrinking. The gross profit on a typical flip rose to $67,000 in the second quarter as home values increased. But the return on investment, which is calculated after all the costs of the flip are factored in, dropped.

The return was just 33.5% in the second quarter, down from 37% in the quarter before and down from 40% in the second quarter of 2020. Investors are now seeing the lowest returns since 2011, when the housing market had yet to begin its recovery from the subprime mortgage crash.

“It’s not like home flipping has become a losing proposition. A 33% profit on a short-term investment remained pretty decent, even after renovation and holding expenses,” said Todd Teta, chief product officer at Attom. “But with a few more periods like the second quarter of this year, investors may need to reframe how they look at these deals.”

Of course all real estate is local, and flippers in some markets are seeing higher profits than in others.

Metropolitan areas showing the largest flipping returns on investment:

- Oklahoma City (196%)

- Fargo, North Dakota (185%)

- Pittsburgh (154%)

- Omaha, Nebraska (135%)

- Philadelphia (100%)

- Buffalo, New York (93%)

- Baltimore (91%)

Areas seeing the smallest profits on home flips:

- Gulfport, Mississippi (- 8%);

- Corpus Christi, Texas (+ 0.7%)

- College Station, Texas (+ 1%)

- Longview, Texas (+ 7%)

- Daphne-Fairhope, Alabama (+ 8.5%)

Returns are shrinking for several reasons. Home prices are still rising at a fast clip, but the gains have been moderating lately. In addition, the cost of rehabbing a house are much higher, due to inflation and supply chain disruptions from the pandemic.

What’s more, many home flippers are individuals or small operators who don’t have access to discounted materials like lumber that major homebuilders have, Teta said.

“As a result, they end up basically paying retail like the average consumer,” he added.

The labor shortage is also hitting flippers, causing additional delays and increased costs, which will likely trim profits in the coming quarters as well.

Frustrated House Hunters Are Giving up on Buying Only to Face an Expensive Rental Market

By Aly J. Yale

9/22/2021

Cramped in a one-bedroom, new parents Kristina and David Mahon were desperate to buy a larger home. But after scouring the Pompano Beach, Florida market for nearly a year (and losing out on 20 houses in the process), the pair eventually gave up.

Now, the couple — with a 10-month old baby in tow, no less — are renting, a decision Kristina says they felt “forced” into.

“I feel like I’m wasting money for something that’s not mine,” Kristina says. The rental“options were very limited, and the prices were on the high side of what we were comfortable spending on a rental.”

The Mahons’ is a common storyline these days, according to those in the industry. Burned-out house hunters are tired of bidding wars, rising prices and dwindling options and are bowing out of the purchase market, opting to rent instead.

“It’s common given the current market and environment that we are in,” says Kaley Tuning, the Native Realty agent who worked with the Mahons. “It just becomes frustrating for the everyday buyer. I’ve had buyers bid upwards of $40,000 over asking price and still get outbid.”

Unfortunately, the pivot to renting isn’t always easy. While the move may afford frustrated buyers time to wait out the competitive housing market, it often means entering an equally hot rental scene — one where rising rents and dwindling supply are growing concerns.

According to Realtor.com, median national rents grew a whopping 11.5% between August 2020 and August 2021. And rent applications? Those are up as much as 95% in some cities, according to apartment listing platform RentCafe.

For hopeful homeowners, it’s made for a unique catch-22 that’s as frustrating as it is costly.

Rents are on the rise

It’s no secret the housing market’s been hot this year. The purchase market has boomed in nearly every corner of the nation since last spring. Home prices are up 17% over the year, and inventory, while improving, is still near record lows.

The rental picture has been more mixed, though. At the start of the pandemic, vacancies in big cities rose and prices dropped, while demand for suburban rentals skyrocketed. Now, rents are bouncing back across the country, reaching well above pre-pandemic levels in many areas.

According to Realtor.com, the typical rent now clocks in at $1,633 per month — $169 more than this time last year and almost $200 more than 2019’s numbers. And in nearly half of the country’s biggest cities? Monthly starter home payments are more affordable than average rents.

The hot housing market has a lot to do with this spike in rent costs. With rising home prices and limited for-sale listings, more and more buyers are stepping back. This puts pressure on rental inventory and drives up rents.

As Lisa Harris, an agent at RE/MAX Center in Braselton, Georgia, explains, “Fewer homes listed for sale and much higher prices for them have kept many want-to-be buyers in their rental units, taxing the rental supply.”

The pandemic plays a role, too. Eviction bans have kept many non-paying renters in place, tying up units for much of the last year. While the CDC’s eviction moratorium was shot down late last month, the experience has made many landlords warier than ever.

“Not only have the prices increased, but the demand on tenant screening seems to be getting much more stringent,” Harris says. “Landlords are seeking tenants with higher credit scores, higher deposits, no pets, a clean criminal history and more.”

The trickle-down of higher rents

Alex Lashner, like the Mahons, has experienced the difficult rental market firsthand. She even had to expand her rental search to account for price increases and is now looking as far as 90 minutes from her office just to stay on budget.

“I’m hoping it will be a short-term sacrifice so I can buy closer to my workplace a few years down the line,” she says.

Lashner was originally looking to buy her first home somewhere in Bucks County, Pennsylvania, but due to the competitiveness of the market — and her refusal to waive contingencies or overpay (as many buyers are forced to do lately), she lost out on every property she bid on. She finally opted to rent, only to find rising prices there, too.

“I’m frustrated that buying a three-bedroom home in my budget is cheaper than renting when you compare the monthly costs of a mortgage, property taxes and HOA fees versus the rental costs for a two-bedroom or even a one-bedroom apartment,” Lashner says. “That’s where my real sticker shock is.”

Rising rents are more than just a budgetary strain for hopeful buyers, though. They also make it harder to save, which could push back those homebuying goals even further. The Mahons are one household in that camp, something Kristina calls “frustrating.”

“Instead of us paying down our own mortgage and building equity, we are paying someone else’s mortgage,” she says. “For the next year or as long as we are renting, we will not be able to save as much as we had hoped.”

Buyers who are forced to sign long-term leases have another dilemma, too: What if mortgage rates go up?

Interest rates have been hovering near historic lows for months now and have played a major role in boosting buyer demand. Kristi Nowrouzi, a mortgage loan officer with Geneva Financial, says many buyers who have backed out of the market recently are concerned those conditions could change.

“There’s a fear of missing out on the low-interest-rate environment,” Nowrouzi says. “Inflation is blowing up and who knows what rates will look like next year at the end of an annual lease agreement.”

What’s the solution?

One option for buyers facing sky-high rents is to opt for a month-to-month lease. The flexibility usually comes with a slightly higher monthly rent, but it ensures you can act quickly should the right house hit the market.

“By doing a month-to-month lease, even though rent might be slightly higher than signing a long-term lease, they can be ready to take action,” says Shmuel Shayowitz, president and chief lending officer at Approved Funding, a mortgage lender in New Jersey. “They can also continue to actively look for homes and, even if pricing doesn’t soften, be in a better position to act.”

Fortunately, strategies like this might not be necessary for long. Buyers still face plenty of challenges, but recent data points to growing housing supply — particularly in the starter home segment. Existing home sales have also slowed, falling 2% in August, and price growth has decelerated as well. According to Realtor.com, 17% of all listings had price reductions in August.

“The market is absolutely shifting now, and prices are decreasing a bit and sellers aren’t getting as high price per square feet as they were a few months ago,” Nowrouzi says.

A completely cooled-off market, though? That could be a long way in the future. Until then, Tuning says, “Patience is a virtue.”

为解住严重宅荒 美联邦政府要盖10万户平价宅

来源:经济日报

9/02/2021

在美国房价持续高涨之际,白宫官员表示,美国政府为纾解严重住宅荒,将采取一系列立即可实施的步骤,以现有经费和权力,在未来三年兴建、销售10万户平价住宅。

路透引述官员说法报导,这套计划最快1日宣布,将聚焦于扩大对个人和非营利机构销售房屋,同时对大型投资人买房设限。第2季全美各地每售出六户住宅,就有一户被投资大户买走。

美国房屋需求在新冠肺炎疫情爆发初期激增,反映民众为居家办公和学习购置更宽敞的房子。但待售屋不足和供应链瓶颈把房价推得更高,租金行情跟着水涨船高,加重家庭财务负担。白宫官员说,全美平价住宅估计短缺多达400万户。

白宫官员表示,美国总统拜登(专题)已提议,斥资逾3,000亿美元增建200万户平价住宅,这项措施是3.5兆美元基础建设投资案的一部分,正在国会审议中。但拜登希望推动立即可行步骤。

这套新计划将涵盖乡村与都会地区的住宅建案,重点摆在平价房市,希望能协助房屋自有率偏低的有色人种族群。

此计划将由美国住宅与都市发展部(HUB)部长法吉(Marcia Fudge)宣布,具体行动由该部、财政部及房贷机构房利美(Fannie Mae)与房地美(Freddie Mae)等联邦监管机构共同规划。“两房”合计占全美11兆美元房贷市场的一半。其中,一大关键步骤是重启曾由财政部与HUB合办但在2019年结束的“风险分摊计划”,该计划让各州住宅金融机构能扩大提供低利贷款,促进兴建平价住宅。

此计划也将提高组合屋及二至四户多户型不动产的供应量,希望透过房地美扩大融资达成目标。同时也将采取行动,限制对大型投资人销售一些由联邦住宅管理局(FHA)提供担保的不动产。

拜登政府另打算与各州和地方政府合作运用现有联邦资金,并协助减少排他性分区(exclusionary zoning)等阻挠提高住宅供应量的做法。

White House tackles housing shortage with plan for 100,000 affordable homes

By Andrea Shalal

9/02/2021

WASHINGTON, Aug 31 (Reuters) – The Biden administration is taking steps to address a severe housing shortage in the United States by creating and selling 100,000 affordable homes over the next three years using existing funds, the White House said on Wednesday.

The moves will focus on boosting home sales to individuals and non-profit organizations, while limiting sales to large investors, who scooped up one in six homes sold in the second quarter, according to a White House statement.

Demand for housing soared early in the pandemic as Americans sought more spacious accommodations for home offices and home schooling, but a shortage of homes for sale and supply chain bottlenecks have driven housing prices sharply higher.

Rental prices, which typically follow the lead of house prices, are also a big concern, given that even before the pandemic 11 million families – or nearly a quarter of all renters – were already spending more than half their income on rent, according to the White House.

The United States has an estimated shortage of as many as 4 million affordable housing units, White House officials say.

U.S. President Joe Biden has proposed spending over $300 billion to add 2 million more affordable housing units as part of a $3.5 trillion investment package being considered by Congress, but wanted to push forward with immediate steps that could be taken now, the White House said.

The plans will cover rural and urban housing projects, with a focus on aiding communities of color, where home ownership rates have lagged historically.

U.S. Housing and Urban Development (HUD) Secretary Marcia Fudge will announce the measures after touring a new five-story affordable housing complex in Philadelphia on Wednesday.

Fudge called the initiatives “significant downpayment” on Biden’s commitment to boost the supply of affordable rental housing, expanding access to capital for state Housing Finance Agencies, empowering local communities to build more affordable housing and promoting equitable housing policies.

Specific actions are planned by Fudge’s department, the U.S. Treasury and agencies such as Fannie Mae and Freddie Mac, which will increase financing opportunities to enable more Americans to purchase homes, the White House said.

One key step is the revival of a joint Treasury-HUD “Risk Sharing Program” that ended in 2019 and that will enable state housing financing agencies to provide more low-cost capital for affordable housing development.

The plans will also boost the supply of manufactured housing and 2-4 unit properties by expanding financing through Freddie Mac, while taking steps to limit the sale of some U.S. Federal Housing Administration-insured properties to large investors.

Investor purchases, which have been as high as one in every four homes in some communities, have driven up prices for lower-cost houses and triggered fierce competition for starter homes, the White House said.

The administration also plans to work with state and local governments to leverage existing federal funds, and help reduce exclusionary zoning and other practices that have discouraged efforts to boost the supply of housing, the official said.

The Federal Housing Finance Agency “will begin to study the interaction between exclusionary zoning and our regulated entities,” said acting Director Sandra L. Thompson.

如何计算一个投资房产的租金回报率?

By Willy Rong

3/07/2021

一直以来都有人问我,如何计算一个投资房产的租金回报率?我答过,但总是似是而非。

今天就这个问题给出我的计算公式Return Of Investment (ROI),仅供大家参考。

这个问题要从两方面讨论,看你是全额现金买房?还是贷款80% 买房?

(全额现金买投资房产)租金回报率 = (12月的租金 – 一年的各种花费)/ 买房价

(贷款80%买投资房产)租金回报率 = (12月的租金 – 一年的各种花费和贷款 )/ (

20%首付+ Closing Cost )

我们还是以一个$38万美元买房实例来计算,比较直观:

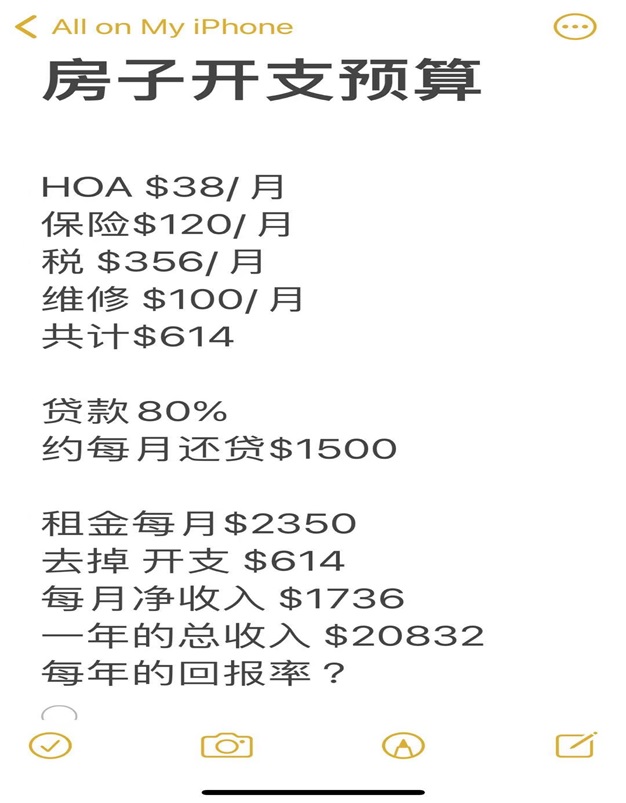

房子开支预算:

HOA $38/月; 保险 $120/月; 税 $356/月; 维修 $100/月。

共计 $614。

贷款 80%, 约每月还贷$1500;

租金每月$2350;去掉开支 $614; 每月净收入 $1736;

一年的总收入 $20832。

问:一个$38万美元的房产,每年的回报率?

(全额现金买投资房产)租金回报率 = (12月的租金 – 一年的各种花费)/ 买房价

$38万美元房子的租金回报率 = 一年的总收入 $20832 / 买房价$380,000 = $0.0548

全额现金$38万美元房子的租金回报率一年约为:5.5%;

(贷款80%买投资房产)租金回报率 = (12月的租金 – 一年的各种花费和贷款 ) / (

20%买房首付 + Closing Cost)

$38万美元贷款80%房子的租金回报率 = (一年的总收入$20832 – $18000) / (首付 $

76000 + $5000 Closing Cost ) = $0.0349

$38万美元贷款80%买投资房产的租金回报率一年约为:3.5%.

这个$38万美元的房子在最好学区,房子升值潜力大!

考虑到加上房子产权equity 上涨的因素,一年在6%-8%。所以要加上一个Equity 增值

率,换句话说,是用$81000 买了一个$38万美元的房产,是用杠杆买的房子。

这里有2个概念:一个是租金回报率;一个是Equity 回报率;

利用杠杆买房,就要让银行在这个房子上也赚一些钱,所以贷款租金回报率3.5%.要低

于全额现金租金回报率5.5%,这个逻辑是对的,那个2% 回报率的差让银行赚去了。

什么是智慧?智慧就是解决问题的能力!

能够把一个复杂问题简单化,用直白的方式讲清楚,这也是智慧。

现在亚特兰大地区(佐治亚),一个房子的租金回报率大概在3% ~ 6%左右,真心话,

投资房净租金回报率6%是一个不错的回报。

你若嫌上面二手房一年的租金回报率还低,你可以全现金买126包租5年的项目,一年的

租金回报率为净6%。

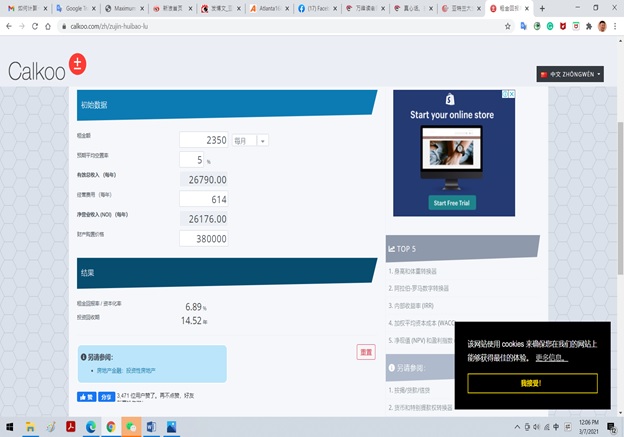

下面是在网上找到的租金回报率计算器,大家可以去练习:

租金回报率

https://www.calkoo.com/zh/zujin-huibao-lu

提示:算大账不算小账,可能公式不够严谨,但逻辑是对的。

Source: http://www.mitbbs.com/article_t/Georgia/31320547.html

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com