Northern Virginia home sales hit 16-year high

By Jeff Clabaugh

7/31/2021

The number of closed home sales in Northern Virginia in June was the highest since 2005, according to the Northern Virginia Association of Realtors.

Home sales were up 48% over the number of closed sales in June of 2020 and 12% higher than closed sales in May.

Prices continue to rise in Northern Virginia, and there has recently been a healthy increase in the number of homes on the market, even though those listings continue to sell quickly.

NVAR notes buyer interest may have slowed a bit toward the end of June.

NVAR’s members cover sales in Fairfax and Arlington counties, the cities of Alexandria, Fairfax and Falls Church and the towns of Vienna, Herndon and Clifton.

The average sales price in Northern Virginia in June was almost $742,000, up 14.6% from a year ago. New listings were up 37.4% from the number of new listings that hit the market in June 2020, and up 4.6% from the previous month. Homes on the market in Northern Virginia sold in an average of 13 days last month.

NVAR says there was a decline in showing activity by real estate agents toward the end of June. Based on appointments confirmed through ShowingTime as reported by listing service Bright MLS, during the week ending June 6, showing levels were about 161% higher than the same week a year ago. By the last week in June, showing levels were 95.8%, compared to the same week in 2020.

There could be a bump in homes coming on the market soon, but not necessarily because owners want to sell.

“We will be watching to see what happens as forbearance winds down for more people. Our local market is hungry for inventory, and these will probably get absorbed rapidly, muting the market impact here more than other parts of the nation,” said NVAR CEO Ryan McLaughlin.

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

$1 million over asking: D.C. bidding wars escalate as U.S. housing crunch intensifies

By Kathy Orton

7/12/2021

A house in Chevy Chase, Md., sold for $1 million above its asking price last month.

The five-bedroom, five-bathroom, 5,000-square-foot house in sought-after Chevy Chase Village was listed at $3,495,000 on April 16. After receiving seven offers, the sellers accepted a contract for $4,540,000 on April 19. The sale closed on May 3.

Bidding wars have been occurring and homes routinely have been selling above their list price in the lower half of the D.C.-area housing market. A house on Reno Road in Northwest Washington that listed for just under $1 million received 32 offers and sold for $1,336,000 on May 7.

But lately, this activity is creeping into the upper brackets as frenzied buyers are competing against one another to drive up prices.

“We are now seeing the comparable sales in certain neighborhoods are becoming irrelevant,” Thomas Anderson, co-founder and president of Washington Fine Properties, wrote in an email. “Ultimately, a home IS worth what someone is willing to pay for it, and right now, in certain hot neighborhoods with a scarcity of homes, that price is often significantly over asking price. [Year-to-date], just within our firm, 44.2 percent of our sales sold for over the listing price. It’s a great time to be a seller and more challenging to be a buyer, although there are opportunities for buyers in this market as well.”

While low mortgage rates and a desire — compounded by the pandemic — to upgrade one’s living arrangements are contributing to the housing hysteria, the main reason for the escalating prices is a severe shortage of homes for sale. As Daryl Judy, a real estate agent with Washington Fine Properties, wrote in a letter to his clients, “We simply don’t have enough homes for people to live. This is not going to change in The Capital Region. We don’t have land on which we can build, and we have height restrictions as well as city and county restrictions on building. The demand for houses is real, which is pushing prices for good homes in ranges we’ve never seen before.”

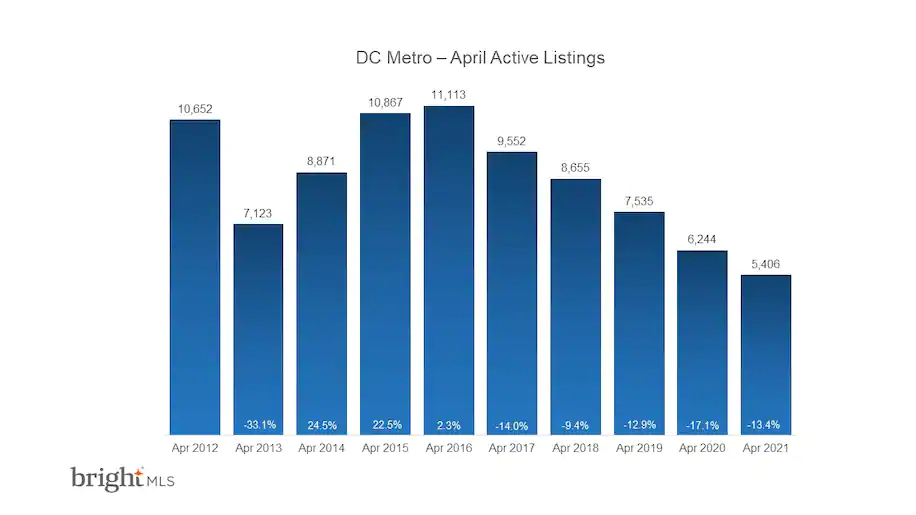

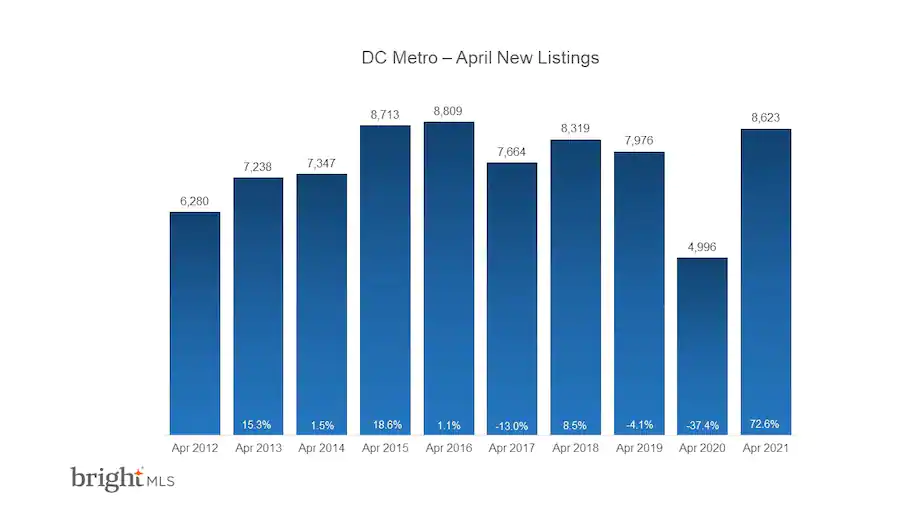

Listings dropped 20 percent year-over-year nationally in April, with just 1.16 million homes for sale, according to the National Association of Realtors. In the D.C. region, only 5,406 homes were on the market in April, down more than 13 percent from a year ago, according to Bright MLS, the area’s multiple listing service. The number of homes for sale in April was less than half the peak of 11,113 in April 2016. Even as vaccines become more widespread, some sellers remain reluctant to put their homes up for sale. Some don’t want strangers going through their homes. Others fear not being able to find another home to buy.

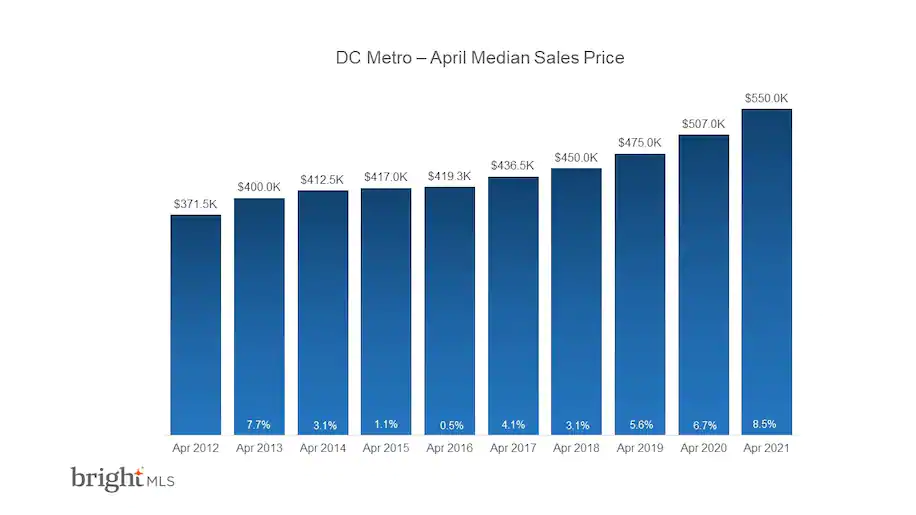

Decreased supply is leading to increased competition, which is pushing up prices. The national Case-Shiller home price index rose 13.2 percent annually in March, the largest year-over-year price increase since December 2005 and one of the largest increases in the index’s 30-year history. It marked the 10th month in a row of accelerating home prices. The median sale price in the D.C. area soared to $550,000 in April, up 8.5 percent from April 2020, according to Bright MLS.

Setting a price for the Chevy Chase house was a bit tricky for Kathleen Nealon O’Donovan of Washington Fine Properties who co-listed the house with Nancy Taylor Bubes. Typically, a real estate agent looks at comparable houses in the neighborhood that have recently sold and sets the price based on those sales. However, Chevy Chase Village doesn’t have many sales and those that sold recently were not as extensively renovated as this one had been. The house had been completely refurbished by architect Dale Overmyer and builder Peterson & Collins in 2018.

“Having grown up in Chevy Chase Village myself, I know these special homes do not come around often,” O’Donovan said. “So when they do, they go quickly.”

O’Donovan decided to price the house slightly below what she thought it would sell for in a hot market. Her sellers agreed with her pricing strategy. It helped that she had sold a house for them in the past.

“Maybe we’ll get multiples,” she told them. “I’m hoping we can but no promises. You don’t want to get too greedy.”

Once the house went on the market, O’Donovan was pleased by the response.

“There was a ton of interest and my phone was ringing off the hook all weekend from interested agents and their buyers so we decided to set a Monday deadline in order to give everyone the chance to do a pre-inspection if they wanted,” she said.

Judy’s clients were one of the six who lost out on the house. They initially wanted to offer $3.85 million for the house but he convinced them to offer $4.1 million. That still wasn’t enough.

“I think they were shocked, in terms of ‘I can’t believe this is where the market is,’ ” he said. “But I don’t think they were surprised because you could see by the competition.”

Nevertheless, his clients learned a lesson. The next house they found they beat six other offers for it.

O’Donovan has been on the other side as well. She has clients who lost out on the house on Reno Road.

“The market has been on fire the last few months,” she said. “There are multiple offers on homes in all different price ranges. It’s great to be a listing agent these days, but hard to be [a buyers’ agent]. … It is tough for buyers out there. You have to be prepared to come in clean with no contingencies and willing to escalate very high.”

Some buyers are willing to go to extreme lengths to entice sellers to accept their offer. Redfin CEO Glen Kelman tweeted out last week that “a Bethesda, Maryland home buyer working with @Redfin included in her written offer a pledge to name her firstborn child after the seller. She lost.”

Sellers who are thinking about taking advantage of rising home prices should keep in mind that not every house is generating multiple offers. Some houses have been sitting on the market for a while.

“This is one of the things that’s really difficult now in terms of the media and in terms of the public is that we have to look at every market, every micro-market, specifically,” Judy said. “Because the problem is, we have other [houses] that maybe don’t have that activity, that aren’t selling immediately.”

Pricing a house correctly can be the difference between it selling quickly or lingering on the market.

“Here’s the thing that I know is true today: You can’t underprice a house in D.C., Maryland or Virginia,” Judy said. “You can overprice a house. I’ve never seen more clear capitalism — it’s economics. It’s supply and demand — as the housing market. Because it’s completely supply and demand.

“You put something at a price that’s reasonable, that is priced where it should be or maybe a smidge below, the market will take it where the market sees it to be. You price it too high it will just sit.”

More than half of homes sold above asking price in May

Home prices were up 24%, a record high due to the dip in home prices at the start of the pandemic a year earlier

BY Redfin

7/05/2021

The national median home-sale price hit a record high of $377,200 in May, up a record 26% year over year, according to a new report from Redfin (www.redfin.com), the technology-powered real estate brokerage. The housing market also set new records for home-selling speeds and competition, but seasonally adjusted home sales and new listings flattened from April. Leading indicators of housing market activity are also declining into June, according to the latest weekly data, signalling that the pace of the market may be slowing.

The following measures all hit new records in Redfin’s data, which goes back through 2012:

- The number of homes for sale fell to a record low, down 27% from 2020.

- The typical home sold in just 16 days, a record low and down from 38 days in May 2020.

- 54% of homes sold above their list price, a record high, up from 26% a year ago.

- The average sale-to-list ratio, a measure of how close homes are selling to their asking prices, hit a record high of 102.2%. In other words, the average home sold for 2.2% above its asking price.

Pandemic-driven lockdowns significantly slowed homebuying and selling in May 2020, which means the year-over-year trends for home prices, pending sales, closed sales and new listings are exaggerated. For better context, Redfin’s full report includes extra charts that zoom in on the last three years of home sales and new listings, without seasonal adjustments.

“May marked the likely peak of the blazing hot pandemic housing market, as many buyers and sellers are vaccinated and returning to pre-pandemic spending patterns,” said Redfin Lead Economist Taylor Marr. “Sellers are still squarely in the drivers’ seat, but buyers have hit a limit on their willingness to pay. The affordability boost from low mortgage rates has been offset by high home price growth.”

| National Market Summary | May 2021 | Month-Over-Month | Year-Over-Year |

| Median sale price | $377,200 | 2.4% | 26.3% |

| Homes sold, seasonally adjusted | 615,800 | -0.7% | 52.2% |

| Pending sales, seasonally adjusted | 569,400 | 3.4% | 39.6% |

| New listings, seasonally adjusted | 598,700 | -0.4% | 12.6% |

| All Homes for sale, seasonally adjusted | 1,329,500 | -6.0% | -26.9% |

| Median days on market | 16 | -3 | -22 |

| Months of supply | 1.1 | 0 | -1.9 |

| Sold above list | 53.6% | 4.7 pts† | 28.0 pts† |

| Median Off-Market Redfin Estimate | $345,300 | 1.4% | 15.3% |

| Average Sale-to-list | 102.2% | 0.7 pts† | 3.7 pts† |

| Average 30-year fixed mortgage rate | 2.96% | -0.10 pts† | -0.27 pts† |

| † – “pts” = percentage-point change |

Median sale prices increased from a year earlier in all of the 85 largest metro areas Redfin tracks. This is partly due to a shift in the mix of homes that are selling toward larger, higher-end properties. The smallest increase was in San Francisco, where prices were up 2.8% from a year ago. The largest price increases were in Austin, TX (+42%), Phoenix, AZ (+33%) and Detroit (+32%). To put Austin’s price increases in context, consider that the sale price of a typical 3 bedroom, 2 bathroom suburban Austin home has increased from around $330,000 in May 2020 to $470,000 in May of 2021.

The number of homes sold in May was up 46% from a year earlier, but was down 0.7% from April. Compared to May 2020, home sales rose in all of the 85 largest metro areas Redfin tracks. The largest gains in sales were in places that had the most abrupt slowdown of home sales in May 2020, including San Francisco (+171%), San Jose (+167%) and Warren, MI (+154%).

Seasonally adjusted active listings—the count of all homes that were for sale at any time during the month—fell 27% year over year to their lowest level on record. Only seven of the 85 largest metros tracked by Redfin posted a year-over-year increase in the number of seasonally adjusted active listings of homes for sale. Philadelphia (+14%), New York (+13%) and San Francisco (+12%) experienced the biggest gains, all areas that saw a more abrupt decline in listings a year ago. The biggest year-over-year declines in active housing supply in May were in Baton Rouge, LA (-60%) and North Port, FL (-51%).

Seasonally adjusted new listings of homes for sale were up 12% in May from a year earlier, but down 14% from the same time in 2019, providing little hope for homebuyers anxious to see more homes to choose from. New listings fell from a year ago in 18 of the 85 largest metro areas. The biggest declines were in Baton Rouge (-47%) and St. Louis, MO (43%). New listings rose the most from a year ago in New York (+77%), Nassau County (+63%) and Philadelphia (+52%).

Although sales slowed slightly, the housing market was once again more competitive in May than any time since Redfin began tracking national housing data in 2012. The typical home that sold in May went under contract in 16 days—less than half as much time as a year earlier, when homes sold in a median 38 days.

The average sale-to-list price ratio continued to surge in May, hitting a record high of 102.2%. This measure typically peaks in June, so the market is likely to post an additional record high this month.

To read the full report, including charts and additional metro-level data breakouts, please visit: https://www.redfin.com/news/over-half-of-homes-sold-above-list-price-in-may-for-the-first-time-on-record/

美国房市攀升 仍可归纳5趋势 地产并未泡沫化

文章来源: 星岛日报

7/05/2021

《霍士商业网》(FOX Business )报道,美国的房屋,即使是在最负担得起的社区地段,价格也在不断攀升,阻止更多买家想买便宜房价。在疫情期间,美国房地产市场供不应求,导致价格飙升。据房地产经纪公司 Redfin 称,问题尚未解决。

屋主不仅拼命寻找独立屋的额外空间,而且还希望利用历史低位的房贷利率,目前30年期固定房贷平均利率约为3%。

新泽西州的房地产经纪人俄葛(Kristin Ehrgott)指出,“买家发现他们可以用非常低的利率购屋并长期锁定这些利率,这意味着他们可以买到更高价的房屋,同时锁定长达 30 年的低利贷款。这是导致房价迅速上涨并引发竞购战的原因。”事实上,根据 Redfin 收集分析全美 400 多个都市区数据,在2021年5月份全国各地很多居民想要购屋, 51% 的房屋以创纪录的高价售出。

据经纪公司称,虽然因为价格飙涨,竞购终于开始减缓,但在尝试购屋时仍应注意许多变数。以下是房主应该注意的5件事:

1. 房地产并未泡沫化

美国并未处于房地产泡沫之中,即由于需求增长超过供应,房屋市场价格急剧上涨。自疫情开始以来房价飙升并不表明存在泡沫,因为需求来自资金充足的买家,他们争夺缺稀的房屋。

2. 竞争趋缓

随着越来越多的房主推迟找房,激烈的竞竞正在减缓。经纪商指出,许多房主要么一直找不到适合的房屋,要么被定价吓跑。在某些情况下,由于避疫限制正在解除,房主更倾向于将资金用于旅行和外出就餐。

3. 房价仍在攀升

尽管市场上的竞争较少,但“购房者仍然必须在竞价胜出”。为此,房主可能不得不支付更多现金,从而进一步推高房价。然而,为了更了解市场脉动,俄葛指出,消费者不应过度依赖买家的要价,而是了解附近房产最近的售价。

4.相对能负担的地段变贵

全国某些城市,如凤凰城、拉斯维加斯和沙加缅度,一直是购房者的热门目的地。然而,随着价格上涨,这些曾经负担得起的地方,不仅对新来者而且对当地人来说都变得遥不可及。

5. 待售房源不足

供应仍然是大问题。事实上,部分房主因为担心以后买不起,不会将他们的房子放在市场上。此外,建筑商受到木材价格高昂和劳动力短缺的阻碍,造成市场的不平衡,房价和竞购也不会平息。

然而,即使房价在不久的将来下跌,长期受益于低房贷的房主“可能会等房市消退,直到赚回本再出售。”

Jun 19, 2021

Jun 10, 2021

Jun 10, 2021

Home values throughout the Tampa Bay area are increasing by the day. Real estate agents say around 90% of homes are selling over the asking price.

The market is being driven up by out-of-state buyers who make cash offers. The high demand continues to push up home values throughout the Tampa area.

All-cash home sales are on the up

25% of deals were all-cash in April, up from a year ago

TRD Staff

6/20/2021

In a housing market with an inventory squeeze, overwhelming demand and skyrocketing prices, there are ways to get ahead. One of those ways? Paying in all cash.

These offers often close faster than those awaiting mortgage approvals. It’s also less of a risk for sellers who worry a financing deal could fall apart.

More homebuyers are catching on: Twenty-five percent of all sales were all-cash deals in April, up from 15 percent from a year ago, CNN reported.

Some buyers with the means will put up a cash offer to close the deal quicker, then decide later if they want to opt for a mortgage and take advantage of low interest rates.

One agent told the publication that financed offers have to be at least 1 percent higher than the all-cash offer to seal the deal.

Tomer Fridman, a Compass agent based in Beverly Hills, said the ultra-high end has always seen cash deals, but recent windfall from IPOs, company sales and the cryptocurrency frenzy has led to more.

“It is wild how many people have that much money,” Fridman told the publication.

For those who don’t have the option to pay in full, not all hope is lost: Buyers who need mortgages can still make all-cash offers with help of an online lender like HomeLight Cash Offer, a real estate technology firm and lender.

If a buyer qualifies for a loan, the firm evaluates the home and then makes an all-cash offer on the buyer’s behalf, CNN reported. If accepted, the company then buys the home and holds onto it while the actual buyer secures traditional financing, the publication added.

Source: https://therealdeal.com/2021/06/03/all-cash-home-sales-are-on-the-up/

Californians are headed to Texas. Why more people are moving to Lone Star State

Home prices are a big driver for tens of thousands of Californians to pack up and head to Texas, researchers say.

By Jeff Ehling

4/17/2021

The data proves Californians are leaving the Golden State and buying homes in the Lone Star State. See why and how many have moved here.

Californians are headed to Texas.

Researchers at Rice University’s Kinder Institute for Urban Research in Houston, Texas say home prices are a big driver.

It’s causing tens of thousands of Californians to seek out new places to live in the Lone Star State.

When Bill Fulton was recently asked by business leaders if Golden State residents were really coming to Texas in large numbers, he went to work to find the answer.

As the director of the Kinder Institute for Urban Research at Rice University, Fulton analyzed the numbers.

He found, on average, about 35,000 to 40,000 Texans move to California every year, but recently a noticeable number of people are doing just the opposite.

In 2018 and 2019, about 80,000 people a year made the move from California to Texas.

The Kinder Institute found as housing prices go up in California, there is a steady migration to Texas.

It has a real-world impact on housing prices in the Lone Star State and those who were born and raised there when they try to find an affordable place to live.

“The consequences it does have is the people who already live in Texas who maybe do not have a lot of home equity and are not used to those California home prices, they may have a more difficult time buying a house, at least the house they want to buy in the place they want to buy,” said Fulton

That means lower income families may have to move further away from the city center to find affordable housing, making their commutes longer and more expensive.

As for whether or not those moving Californians could turn Texas blue, researchers say there doesn’t seem to be enough migration to make that happen on its own.

Jun 9, 2020

Dec 3, 2020

Oct 17, 2020

Is a Housing Market Crash Possible in 2021?

By Mark Mathis

4/15/2021

With the real estate market experiencing surging prices, scant inventories and a backlog of new home construction, many consumers are wondering if what’s gone up must come back down—in other words, are we headed for another housing market crash? Let’s take a closer look.

Think Back to the Great Recession

The unforeseen housing market crash 15 years ago ignited a worldwide recession. Fueled by low interest rates, loose mortgage-lending standards and the nation’s unshakeable faith in homeownership, home values rose at record rates year-after-year. When the housing bubble burst, roughly nine million families lost their homes to foreclosure or short sale between 2006 and 2014. Housing values plunged 30% or more, homeowners lost a collective $7 trillion and it took nearly a decade for most markets to recover. Even today, several real estate markets have not fully recovered.

With the robust market activity we’ve seen lately, could there be a market crash in the near future? The short answer is “not likely.” Today’s market book cannot be sustained completely, but a crash as serious as the one from 15 years ago is unlikely because of a few important factors.

Factor No. 1: More Stringent Lending Standards

Loose mortgage lending practices ultimately brought down some of the nation’s largest banks and mortgage companies. The fallout forced Congress and federal regulators to make significant adjustments that have fundamentally changed how mortgage lending is regulated.

Since then, standards have been raised and the process of obtaining a mortgage is now more transparent. The “anyone can get one” loans of the past are illegal; now borrowers undergo stricter income, credit and asset checks. An entirely new regulatory agency, the Consumer Financial Protection Bureau, was created to enforce this new regulatory framework. Lenders who do not comply with these standards may face heavy penalties.

As a result, the housing finance marketplace is now more robust and safer than it was 15 years ago. Any dip in the housing market will be cushioned by these stricter regulations.

Factor No. 2: Pandemic Mortgage Forbearance

When the housing market crashed in 2007, the influx of foreclosures pumped housing supply into areas with falling prices and weak labor markets, while also preventing recently foreclosed borrowers from re-entering the market as buyers. According to the Federal Reserve, foreclosures during a time of high unemployment could depress prices, plunging homeowners across the country deeper into negative equity.

However, in the pandemic era, the effects of mass unemployment bear little resemblance to the Great Recession, thanks in large part to forbearance programs that have allowed homeowners to postpone their monthly mortgage payments without suffering penalties.

As of early March 2021, 2.6 million homeowners’ mortgages were in such forbearance plans. As the pandemic economy has slowly recovered, many homeowners have resumed their employment, and thus their home payments. According to CoreLogic, by the end of 2020, overall mortgage delinquencies declined 5.8% due to the forbearance program. The share of mortgages 60 to 89 days past due declined to 0.5%, lower than 0.6% in December 2019.

Housing Market Crash

It’s worth noting that serious delinquencies—defined as 90 days or more past due, including loans in foreclosure—increased when owners who owed large amounts left forbearance. By year end 2020, the serious delinquency rate was 3.9%, up from 1.2% in December 2019.

Factor No. 3: Most Homeowner’s Cushion—Equity

Equity is the difference between the current market value of your home and the amount you owe on it. In other words, it’s the portion of your home’s value that you actually own. Equity can be an incentive to stay in your home longer; if prices rise—something we’ve seen almost universally across the country in recent months—your equity increases, too.

Why does this matter? Simply put, higher levels of equity cushion homeowners from default when home values fall.

Over the past decade, American homeowners have enjoyed housing stability and growth, building up large home equity reserves. In the third quarter of 2020, the average family with a mortgage had $194,000 in home equity, and the average homeowner gained approximately $26,300 in equity over the course of the year. In contrast, 2009 saw nearly a quarter of the nation’s mortgaged homes valued for less than the amount their owners actually owed on those mortgages.

Factor No. 4: Price Growth Will Slow Down, but Continue

The sales boom followed the outbreak of the COVID-19 and surprised many real estate economists. Like most other business sectors, real estate was expected (if not required in many locations) to lock down. But by mid-April, sales were soaring as buyers, many of them millennials, took advantage of record-low mortgage interest rates. Through the remainder of 2020, rates remained below 3%, and existing home sales reached their highest level in 14 years.

A Moving Target

While no one can say for sure what will happen with the real estate sector, most experts are confident that we’ll experience a market dip, but certainly not a crash. In the meantime, there’s plenty of work available for motivated real estate professionals. Find out how Homes.com can help you connect with the current market of active buyers and sellers here!

Source: https://rismedia.com/2021/03/25/housing-market-crash-possible-2021/

Flat-Fee MLS Listing Service in Northern VA

Helping For Sale by Owner (FSBO) & For Rent by Owner (FRBO)

DIY Landlord – Renting out Properties Safer and Quicker!

By David Chen

4/15/2021

Q. We purchased our first home some years ago, and are about to move to another home. We are considering to keep our first home as an income property. We heard of the free ads on CRAIGSLIST and zillow.com, but some landlord friends told us it could be a challenge to find qualified tenants through CRAIGSLIST and zillow.com. Is there any way to rent our property out quicker and safer with minimum cost? We are the kind of persons who would like to try things ourselves, and have some spare time.

A. You may have already done the initial research and have figured out the range of monthly rent of your property.

If the monthly rent is low such as $1600.00 or below, you may want to do it through CRAIGSLIST, https://postlets.com/, zillow.com, or similar web sites. The renters interested in the low-priced rentals may not go to the Realtors community for assistance.

If the monthly rent is $1600.00 or above, you may want to consider listing your rental on brightmls.com for the Realtors community to market it for you.

Bright MLS is made up of nine forward thinking MLSs (43 Associations) in the Mid-Atlantic region who put aside their differences and came together with a shared vision to help solve MLS market overlap and empower everyone to get more out of the MLS. Bright will serve parts of 6 states plus Washington, D.C. encompassing 85,000 real estate professionals who serve over 20 million consumers and facilitate approximately 250,000 transactions a year that are valued at more than $70 billion.

Dozens of public real estate websites (such as: zillow.com, redfin.com, brightmlshomes.com, etc.) pull data from brightmls.com through syndication. In a few hours, your listing will show up on dozens of websites and will get the maximum exposure. It is a lot quicker and safer finding qualified tenants than doing it through CRAIGSLIST and zillow.com. You may talk with a Realtor for assistance. Please be aware some Realtors take rental jobs, some don’t.

Over the years I have helped some landlords in the community renting their properties out with very low cost. A popular arrangement is to help the landlords ‘DIY’, which has been working well for those experienced landlords.

The good side of ‘DIY’ is that the landlords can ‘screen’ the potential tenants from the very beginning, have 100% control of the whole process, and enjoy the feeling of “on top of things”.

If you prefer minimum service, I can help you ‘DIY’:

1. I provide CMA, list your rental on brightmls.com, put a realtor’s lockbox at the front door if needed, provide the access log (if needed), support you through the whole process.

I charge a flat fee for the minimum service.

2. If you would like me to prepare the lease or review the lease, there is another reasonable flat fee. This service is optional.

3. You answer phone calls, work with the tenant (if the tenant doesn’t have an agent) or the tenant’s agent, run credit check, verify employment, check references, etc.. You pay the tenant’s agent (if there is one) directly on the move-in date – usually 25% of first-month rent.

If you need full-service, the commission is first-month rent – which includes the commission to be paid to the tenant’s agent.

If you need any customized service (between minimum service and full-service), we can work out an agreement.

Some information:

CMA stands for Comparable (some called Competitive) Market Analysis, that will help you determine the market value of your property for sale or for rent.

I use Sentry-key lockbox. Any Realtor with membership of NVAR (Northern Virginia Association of Realtors) or any other VA Realtors association can access and show the property.

The access log tells when the agents enter the property and their contact info. which can help you follow up with the agents.

If you like the DIY experience, I would recommend you to use the minimum service.

Please feel free to reach me if you need any assistance.

—

David Chen

Realtor (Licensed in VA) | Neighborhood Specialist (McLean, Falls Church, Vienna)

Libra Realty, LLC

dchenj@gmail.com

703-395-5406

WeChat ID: dchenj2015

Last update: 4/15/2021

Websites that will show your flat fee mls listings

4/15/2021

Almost all real estate websites that offer the ability to search brokerage listings use a data feed from the MLS called Internet Data Exchange (IDX) to pull in listing data. Depending on the number of sites tapping into your MLS, your listing could appear on hundreds of websites. We do not control the content of any of the websites listed below. updated periodically & subject to change at any time Here are some examples of national websites by area that pull listings from the MLS:

This block contains unexpected or invalid content.Attempt Block Recovery

- Zillow

- Trulia

- Move.com

- MSN.com

- REALTOR.com

- REMAX.com (in markets where they have an office)

- ZipRealty.com (in markets where they have an office)

- Yahoo.com / Prudential (in markets where they have an office)

- Google Base

- Redfin

- Yahoo Classifieds

- AOL Real Estate

- HomeGain

- Lycos

- Oodle

- Hotpads

- HomeSeekers

- ColdwellBanker.com

- Cenutry21.com

- HouseFront

- CondoQuickFind

Here are just a few examples of local media websites that pull listings from the MLS in their area:

- AZCentral.com (Phoenix, Arizona)

- Chron.com (Houston, Texas)

- DallasNews.com (Dallas/Fort Worth, Texas)

- DenverPost.com (Denver, Colorado)

- LATimes.com (Los Angeles, California)

- MySA.com (San Antonio, Texas)

- RGJ.com (Reno, Nevada)

- SignOnSanDiego.com (San Diego, California)

- StarBulletin.com (Honolulu, Hawaii)

- Tucson.com(Tucson, Arizona)

Here are just a few examples of local brokerage websites that pull listings from the MLS in their area:

- BishopRealty.com (Payson, Arizona)

- Boulderco.com (Boulder, Colorado)

- C21MoneyWorld.com (Las Vegas, Nevada)

- ColdwellBanker-Idaho.com (Coeur d’Alene, Idaho)

- Ebby.com (Dallas, Texas)

- Floberg.com (Billings, Montana)

- LongRealty.com (Tucson, Arizona)

- SantaFeSIR.com (Santa Fe, New Mexico)

- TB.com (Spokane, Washington)

Additionally, here are just a few examples of local REALTOR® Boards or MLS’s that have a public view portal. (Not all boards have this feature):

- ABQREALTORS.com (Albuquerque, New Mexico)

- AlaskaRealEstate.com (Anchorage, Alaska)

- AustinHomeSearch.com (Austin, Texas)

- HAR.com (Houston, Texas)

- HavasuRealtors.com (Lake Havasu City, Arizona)

- HICentral.com (Honolulu, Hawaii)

- mlslistings.com (San Jose, California)

- SFAR.com (Santa Fe, New Mexico)

- TARMLS.com (Tucson, Arizona)

These are just examples. Your listing could literally show up at hundreds of other websites.

Source: https://www.congressrealty.com/Flat-Fee-MLS-Listings/Sites-with-Listings/default.aspp