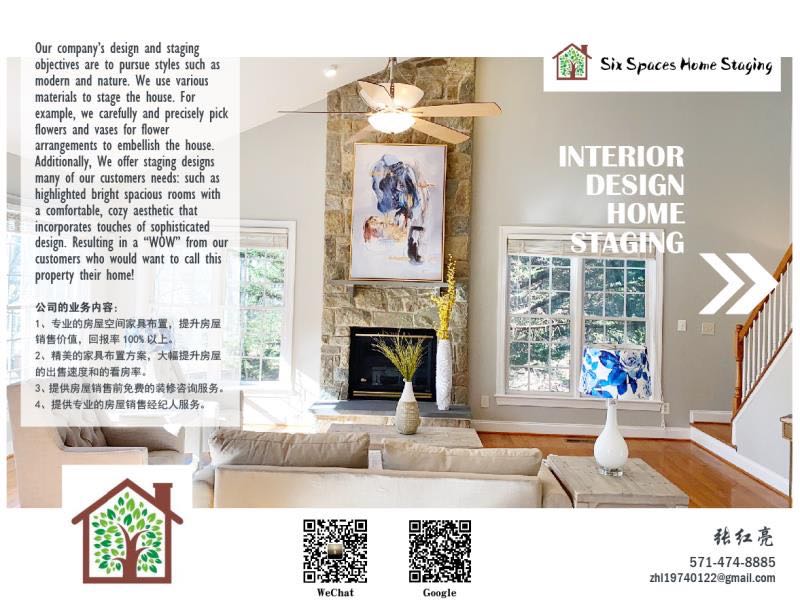

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

QR codes replace service staff as pandemic spurs automation in US

Shift means many jobs lost during Covid crisis will not return, say experts

By Taylor Nicole Rogers

8/31/2021

Alexa Allamano used to pay a woman to work part-time in her jewelry store on Whidbey Island, Washington. But when Foamy Wader reopened in October after a month-long shutdown due to the coronavirus crisis, that job was done through QR codes.

Allamano has restructured their store in such a way that passers-by can scan the QR codes next to each item to be bought with their smartphone while browsing their shop windows.

“It’s like shopping online, but in real life,” said Allamano.

Now customers only come to the store to pick up orders or for advice on custom-made products, and Allamano works alone.

American workers in manufacturing plants and distribution centers have long feared that their employers would find ways to replace them with robots and artificial intelligence, but the Covid-19 crisis has brought this threat to service workers as well. Organizations are increasingly turning to automated tools for customer service tasks that have long been performed by low-paid workers.

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

But not robots, but the ubiquitous QR matrix barcodes are replacing humans.

Many restaurants have started experimenting with QR codes and order management systems like Toast, which allow diners to order food from their phones to their table, rather than human servers. Grocery stores have increased their investment in self-checkout kiosks to replace human cashiers, and more convenience stores, including Circle K, are experimenting with Amazon Go’s computer vision technology that enables customers to make purchases without stopping to stand at a cash register.

The shifts mean some of the 1.7 million recreational, hospitality and 270,000 retail jobs that the U.S. economy has lost since it peaked in February 2020 are unlikely to return.

“There was always some risk of automation in these jobs, but the boost wasn’t there,” said Casey Warman, a professor at Dalhousie University who specializes in labor economics. “Covid started these jobs.”

Many business owners, including Allamano, say they are still desperate for human labor, but a month-long labor shortage has made it difficult to find. Economists say the risk of contracting the delta coronavirus variant combined with expanded unemployment benefits and closed schools has kept some workers at home.

The former Foamy Wader employee decided to stay home full time teaching her son, and Allamano’s ad for the vacancy drew only one application. The new technologies are helping to fill the gap, Allamano said.

Alexa Allamano’s shop window shows QR codes that customers can use to buy their products © Alexa Allamano

Labor economists say that jobs during economic downturns regularly make leaps in automation as tighter margins force them to be more productive with fewer resources. Repetitive jobs are the most vulnerable.

According to Warman’s research, women without a college degree are the most likely to lose their jobs. According to a Philadelphia Federal Reserve paper, computers replaced thousands of administrative assistants, telemarketers and payroll clerks during the 2007 financial crisis.

“It has happened before and it happens again,” said Mark Muro, a senior fellow studying technology at the Brookings Institution.

Employers in the post-recession years have focused on automating how things work in distribution centers and supply chains to speed up. But the Covid crisis has spurred the customization of automated customer service tools as both consumers and business owners tried to reduce face-to-face interactions as much as possible, Muro said.

“The whole thing was a great product placement [advertisement] for technical solutions, ”said Muro.

Alex Shahrestani, a partner in a technology law firm in Austin, Texas, was looking for an intern or paralegal to help plan and onboard new clients when the pandemic moved their business remotely.

“While everyone was trying to figure out zoom calls, I thought people would be a lot more forgiving if we tried new things,” Shahrestani said. “We have already moved in that direction, but the pandemic gave us the opportunity to try a lot more.”

The firm uses an in-house developed program to help clients schedule attorney meetings and to automatically reply to emails with frequently asked questions such as pricing.

Now Shahrestani is more interested in hiring a computer programmer to expand and maintain his system.

Automations like the one Shahrestani’s company uses often create highly skilled programming jobs, but in the long term it reduces the demand for workers without a college degree, Warman said.

Rob Carpenter, founder of start-up Valyant AI, which makes a voice recognition system that takes orders at fast food passageways, said many automated tools only have the ability to ease the burden of human workers. He said that most fast food restaurants didn’t have an employee taking drive-through orders and that many of the 30 restaurants that used Valyant’s system were trying to hire more human employees.

“For those able to stay on the job, it could make their jobs better,” Warman said. “But others could be fired. There will be winners and losers here. With automation there have always been winners and losers. “

Federal Communications Commission

Emergency Broadband Benefit

The Emergency Broadband Benefit is an FCC program to help families and households struggling to afford internet service during the COVID-19 pandemic. This new benefit will connect eligible households to jobs, critical healthcare services, virtual classrooms, and so much more.

About the Emergency Broadband Benefit

The Emergency Broadband Benefit will provide a discount of up to $50 per month towards broadband service for eligible households and up to $75 per month for households on qualifying Tribal lands. Eligible households can also receive a one-time discount of up to $100 to purchase a laptop, desktop computer, or tablet from participating providers if they contribute more than $10 and less than $50 toward the purchase price.

The Emergency Broadband Benefit is limited to one monthly service discount and one device discount per household.

Who Is Eligible for the Emergency Broadband Benefit Program?

A household is eligible if a member of the household meets one of the criteria below:

- Has an income that is at or below 135% of the Federal Poverty Guidelines or participates in certain assistance programs, such as SNAP, Medicaid, or Lifeline;

- Approved to receive benefits under the free and reduced-price school lunch program or the school breakfast program, including through the USDA Community Eligibility Provision in the 2019-2020 or 2020-2021 school year;

- Received a Federal Pell Grant during the current award year;

- Experienced a substantial loss of income due to job loss or furlough since February 29, 2020 and the household had a total income in 2020 at or below $99,000 for single filers and $198,000 for joint filers; or

- Meets the eligibility criteria for a participating provider’s existing low-income or COVID-19 program.

How to Apply

The online application for the Emergency Broadband Benefit Program is experiencing high demand. We appreciate your patience as we actively work to resolve any connectivity issues users may encounter.

Apply Now

There are three ways for eligible households to apply:

- Contact your preferred participating broadband provider directly to learn about their application process.

- Go to GetEmergencyBroadband.org to apply online and to find participating providers near you.

- Call 833-511-0311 for a mail-in application, and return it along with copies of documents showing proof of eligibility to:

Emergency Broadband Support Center

P.O. Box 7081

London, KY 40742

After receiving an eligibility determination, households can contact their preferred service provider to select an Emergency Broadband Benefit eligible service plan.

Get More Consumer Information

Check out the Broadband Benefit Consumer FAQ for more information about the benefit.

Which Broadband Providers Are Participating in the Emergency Broadband Benefit?

Various broadband providers, including those offering landline and wireless broadband, are participating in the Emergency Broadband Benefit. Find broadband service providers offering the Emergency Broadband Benefit in your state or territory.

Broadband providers can find more information about how to participate here.

Source: https://www.fcc.gov/broadbandbenefit

Evictions During COVID-19: Landlords’ Rights and Options When Tenants Can’t Pay Rent

Tips, resources, and advice for landlords whose tenants aren’t able to pay the rent due to the coronavirus outbreak.

By Ann O’Connell, Attorney

11/01/2020

Many renters are facing financial challenges resulting from coronavirus-related business shut-downs, furloughs, layoffs, and stay-at-home orders. The longer this crisis goes on, the more likely it is that many will not be able to pay their rent. When renters default on rent, landlords suffer, and might not be able to meet their own financial obligations, such as making the mortgage payments on the rental property.

Here are some suggestions about how landlords can mitigate the financial impact of tenant defaults during the COVID-19 outbreak.

Terminations and Evictions

Under normal circumstances, when tenants don’t pay rent, landlords have the option of terminating the tenancy (by serving the tenant with either a pay rent or quit notice or an unconditional quit notice, depending on the applicable laws). When tenants don’t pay the rent or move out by the deadline given in the notice, landlords can then file an eviction lawsuit to have the tenants physically removed from the rental.

However, health and safety concerns due to COVID-19 have led many states, cities, counties, and courts to place moratoriums on evictions. The scope of these temporary bans on evictions varies greatly: some have banned any and all action relating to evictions, while others simply postpone hearings on evictions until the court can arrange a hearing via telephone or video.

If you are a landlord in an area with an eviction moratorium, you might still be able to file eviction papers with the court, but your case might not be heard for a while. However, even if there are no bans in place, evicting tenants who can’t pay the rent due to the coronavirus crisis probably shouldn’t be your first recourse. Aside from optics (you don’t want to get a reputation as the ruthless landlord who booted tenants out of their home in the middle of a stay-at-home order), if you remove tenants right now, you’re going to be faced with having to disinfect the rental, advertise the rental, screen new prospective tenants (of which there might be very few), sign a new lease or rental agreement, and get the new tenants moved in—all while taking measures to abide by emergency guidelines and health and safety measures.

Consider the following options instead.

Evaluate Your Personal Financial Situation

Take a moment to evaluate your own finances. As dire as it sounds, it might be time to take stock of what could happen in a worst-case scenario. Most landlords have likely considered the situation where tenants don’t pay rent, as this can happen at any time. But there’s no denying that this is a different situation—what will happen if your tenants can’t pay for a long time, and your options for finding new (paying) tenants are slim?

Your assessment of how this worst-case scenario will affect your ability to pay your mortgage (if any) and your personal bills will inform how you respond when your tenants can’t pay their rent.

- If your financial situation looks grim: If your ability to pay the mortgage on your rental property hinges on month-to-month rental income, you should take actions to prevent your own default This includes options discussed below, such as contacting your lender and proactively seeking arrangements with tenants that allow them to make at least partial payments.

- If you have a few months’ reserves: If your personal reserves or financial position won’t feel too much of a pinch if tenants aren’t able to pay rent for a while, you still might have to make some compromises to retain good tenants. If you have tenants who have previously been reliable and are simply finding it hard to make ends meet currently, do what you can to take some pressure off them—see the discussion below about working out a temporary solution with tenants.

Try to Work Out a Temporary Solution With Tenants

Depending on how desperately you need to receive income from your rental, you have a few options for working with tenants who aren’t able to pay rent because of COVID-19. Consider the following possible arrangements.

- Forgive rent. If your situation allows for it, you could waive rent for a month, with an agreement to revisit the payment arrangement on a certain date. A landlord in Bakersfield recently did this for his tenants.

- Postpone rent. You could offer to postpone rent payments for a month, with an agreement that it will be repaid. Your repayment arrangement could state that the rent owed could be spread out over time, paid all at once, or paid when (if) a stimulus check

- Reduce rent. If you can, consider dropping the rent temporarily to a level that enables you to meet your obligations but forgoes profit for the time being. For example, if you normally collect $1200 a month, but your mortgage is $900 a month, you could temporarily drop rent to $900 to make sure you at least don’t get in trouble with your lender.

Before deciding to make any of these adjustments, try talking to your tenants. Ask them straight out what they think they can make work. If you’re able to accommodate their suggestions, chances are higher that they will do everything they can to hold up their end of the bargain. Be sure to put any agreements in writing, preferably as an addendum to your current lease or rental agreement that includes all details of the arrangement.

Look for Outside Assistance

Even if you think you can float a month or two without rental income, you still might want to consider taking some measures now to protect your position in the event that the coronavirus crisis lasts longer than your cushion can handle. If you’re already feeling the pinch, take these actions immediately.

Attend to Your Mortgage

At this point in the COVID-19 crisis, most private lenders are willing to work with borrowers to ensure that they don’t lose their homes. Call your lender directly and ask what steps it is taking to assist borrowers who can’t meet their mortgage obligations due to the coronavirus pandemic.

- If your loan is owned by Fannie Mae or Freddie Mac, you might be able to delay making payments for a certain period of time without incurring late fees or getting hit with a credit score penalty.

- Look into your options under the Coronavirus Aid, Relief, and Economic Security Act.

- The Federal Housing Administration (FHA) has put in place a foreclosure moratorium for single family homeowners with FHA-insured mortgages.

- Visit your state’s website to find out if the state is offering assistance to homeowners. For example, New York has announced a delay of mortgage payments for 90 days. Many other states are postponing any foreclosure actions indefinitely. Find your state’s website at State and Government on the Net.

Look Into Property Tax Breaks

Some states and counties are extending the deadline for paying property taxes, or cancelling late fees and interest. Check your county’s tax assessor’s website to see if this is an option where your property is located.

Seek a Loan

Consider seeking a loan from family, friends, or private lenders. The U.S. Small Business Administration might be another source of assistance—its disaster loan assistance web page has a wealth of information. You can also contact your regular bank or credit union and inquire about what assistance it can offer.

Research Options for Your Renters

Some areas are beginning to offer rent vouchers or emergency funds to renters in need. For example, the Pennsylvania Apartment Association is collecting donations for funds to give to renters who can’t pay rent. Currently, renters’ needs are getting a lot more attention in the press than landlords’ needs, and there are already a lot more resources being made available for renters. It’s in your best interest to research these options and bring them to your renters’ attention—do what you can to help your tenants pay you.

Landlords are getting squeezed between tenants and lenders

By ANNE D’INNOCENZIO

NEW YORK (AP) — When it comes to sympathetic figures, landlords aren’t exactly at the top of the list. But they, too, have fallen on hard times, demonstrating how the coronavirus outbreak spares almost no one.

Take Shad Elia, who owns 24 single-family apartment units in the Boston area. He says government stimulus benefits allowed his hard-hit tenants to continue to pay the rent. But now that the aid has expired, with Congress unlikely to pass a new package before Election Day, they are falling behind.

Heading into a New England winter, Elia is worried about such expenses as heat and snowplowing in addition to the regular year-round costs, like fixing appliances and leaky faucets.

Elia wonders how much longer his lenders will cut him slack.

“We still have a mortgage. We still have expenses on these properties,” he said. “But there comes a point where we will exhaust whatever reserves we have. At some point, we will fall behind on our payments. They can’t expect landlords to provide subsidized housing.”

The stakes are particularly high for small landlords, whether they own commercial properties, such as storefronts, or residential properties such as apartments. Many are borrowing money from relatives or dipping into their personal savings to meet their mortgage payments.

The big residential and commercial landlords have more options. For instance, the nation’s biggest mall owner, Simon Property Group, is in talks to buy J.C. Penney, a move that would prevent the department store chain from going under and causing Simon to lose one of its biggest tenants. At the same time, Simon is suing the Gap for $107 million in back rent.

Michael Hamilton, a Los Angeles-based real estate partner at the law firm O’Melveny & Myers, said he expects to see more retail and other commercial landlords going to court to collect back rent as they get squeezed between lenders and tenants.

Residential landlords are also fighting back against a Trump administration eviction moratorium that protects certain tenants through the end of 2020. At least 26 lawsuits have been filed by property owners around the country in places such as Tennessee, Georgia and Ohio, many of them claiming the moratorium unfairly strains landlords’ finances and violates their rights.

Apartment dwellers and other residential tenants in the U.S. owe roughly $25 billion in back rent, and that will reach nearly $70 billion by year’s end, according to an estimate in August by Moody’s Analytics.

An estimated 30 million to 40 million people in the U.S. could be at risk of eviction in the next several months, according to an August report by the Aspen Institute, a nonprofit organization.

Jessica Elizabeth Michelle, 37, a single mother with a 7-month-old baby, represents a growing number of renters who are afraid of being homeless once the moratorium on evictions ends.

The San Francisco resident saw her income of $6,000 a month as an event planner evaporate when COVID-19 hit. Supplemental aid from the federal government and the city helped her pay her monthly rent of $2,400 through September. But all that has dried up, except for the unemployment checks that total less than $2,000 a month.

For her October rent, she handed $1,000 to her landlord. She said her landlord has been supportive but has made it clear he has bills to pay, too.

“I never had an issue of paying rent up until now. I cry all night long. It’s terrifying,” Michelle said. “I don’t know what to do. My career was ripped out from under me. It’s gotten to the point of where it’s like, ‘Am I going to be homeless?’ I have no idea.’”

Some landlords are trying to work with their commercial or residential tenants, giving them a break on the rent or more flexible lease terms. But the crisis is costing them.

Analytics firm Trepp, which tracks a type of real estate loan taken out by owners of commercial properties such as offices, apartments, hotels and shopping centers, found that hotels have a nearly 23% rate of delinquency, or 30 days overdue, on their loans, while the retail industry has a 14.9% delinquency rate as of August.

The apartment rental market has so far navigated the crisis well, with a delinquency rate of 3%, according to Trepp. That’s in part because of the eviction moratorium, along with extra unemployment benefits from Washington that have since expired.

“There are bad actors, but the majority of landlords are struggling and are trying to work with a bad situation,” said Andreanecia M. Morris, executive director of HousingNOLA, a public-private partnership that pushes for more affordable housing in the New Orleans area.

Morris, who works with both landlords and tenants, said that government money wasn’t adequate to help tenants pay their rent, particularly in expensive cities. She is calling for comprehensive rental assistance.

She fears that residential landlords will see their properties foreclosed on next year, and the holdings will be bought by big corporations, which are not as invested in the neighborhoods.

Gary Zaremba, who owns and and manages 350 apartment units spread out over 100 buildings in Dayton, Ohio, said he has been working with struggling tenants — many of them hourly workers in restaurants and stores — and directs them to social service agencies for additional help.

But he is nervous about what’s next, especially with winter approaching and the prospect of restaurants shutting down and putting his tenants out of work. He has a small mortgage on the buildings he owns but still has to pay property taxes and fix things like broken windows or leaky plumbing.

“As a landlord, I have to navigate a global pandemic on my own,” Zaremba said, “and it’s confusing.”