Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

浅论房屋出售前Home Staging的益处

第一章

10/12/2021

随着2020年初疫情的发展,美国房地产行业却在整个几乎冰冻的市场经济中,最早异军突起,特别是美联储的低利率以及原材料持续高涨的多种因素下,更加推高了房屋价格。在这种一房难求的状况下,出售前对房屋重新包装和布置,更是尤为重要!但对于一个抱有期望,想要高价出售房屋的卖家来说,卖房前要做的事远远不是挂牌上市出售这么简单,尤其是在高涨的房地产市场,房主更应该采取适当的步骤来进行销售。为自己的房屋能给买房人美好的第一印象,适当的装修和Home Staging成为了抬升房屋价格,提高看房率,缩减交易周期的最有力的普遍方法。

一、Home Staging在美国的房屋销售市场的历史

首先谈一下Home Staging在美国的房屋销售市场的历史。据公开资料查询,该行业的兴起最早的1972年,在美国华盛顿州的Bellevue市,一位名叫Barb Schwarz的室内设计师决定离开自己从事了几十年的专业工作, 进入房地产买卖领域. 很快的, 以一个设计师的敏锐眼光, 她发现几乎每个房地产销售经纪在卖房时都面临一系列的挑战: 有些卖家家里乱得让买家无从下脚, 有些卖家家里满是宠物味道让买家掩鼻而去, 有些家里有各种奇怪的宗教摆设令买家不知所措望而却步,这样的房子建筑本身其实没有什么问题, 但是买家都因为卖家居住环境的恶劣而不愿意下单. 房地产经纪意识到这个问题, 但是不知道如何跟卖家交流, 更不知道该如何改变这种状况. 兼具剧院工作经验的她开始建议房地产经纪”stage”他们的房源. 自此, Home Staging就诞生了.

房地产行业的销售状况因为这个行业的诞生, 得到了很大改善:挂牌一年的房子经过Home Staging之后,一个星期就卖掉了;本来挂牌市场价40万的房子,经过Home Staging之后, 以46万迅速卖掉了. 经过Home Staging之后, 在房屋市场好的时候帮助卖主卖高价,在市场不好的时候帮助卖主顺利快速卖出 。根据美国主要媒体调查所得,没有做Home Staging 的房子平均售出率是175天,而作了Home Staging的平均岀售时间是35天。可以说是快三分之一的时间。地产agent一般为快点帮客户卖出自己手里的房子,也会建议客户考虑用Home Staging,可能有很棒的效果。这时候您需要一位专业的Stager,通过将房产包装转化为一个受欢迎,有吸引力,买房人都需要的产品。

自1990年之后, Home Staging的概念和操作日趋成熟完善并取得了一系列商业专利, 不仅席卷了北美和欧洲, 很快又发展到澳洲. 在北美和欧洲的家居电视频道里, 房屋售前设计成为了最热门的主题,。在, 越来越多的房地产经纪认识到Home Staging的重要性并享受到了她带来的好处, 同时额外增加这个服务也大大增加了在同行中的竞争力. 同时, 随着市场认知度的增加, 卖房的业主也会主动寻求home staging设计师的帮助, 或者请他的售房经纪帮忙寻找优质的公司布展公司. 据美国房屋市场价值观察网的统计, 有76%的房地产经纪在使用或者向客户推荐使用home staging, 同时, 通常在不到一个月的短短时间里, home staging能为售房者带来的投资回报比是196%.

未完待续。。 。

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

诚招美国和加拿大法律服务代理

因公司发展需要,诚招美国和加拿大法律服务代理。

要求:

懂英语、或西班牙语、或法语。

能合法工作有社安号或工号。

无需改行, 可以兼职。

大学生和有销售经验优先考虑。

自雇生意公司发美国报税1099,加拿大T4A

有意了解详情, 请扫码加微信, 非诚勿扰!

如何计算一个投资房产的租金回报率?

By Willy Rong

3/07/2021

一直以来都有人问我,如何计算一个投资房产的租金回报率?我答过,但总是似是而非。

今天就这个问题给出我的计算公式Return Of Investment (ROI),仅供大家参考。

这个问题要从两方面讨论,看你是全额现金买房?还是贷款80% 买房?

(全额现金买投资房产)租金回报率 = (12月的租金 – 一年的各种花费)/ 买房价

(贷款80%买投资房产)租金回报率 = (12月的租金 – 一年的各种花费和贷款 )/ (

20%首付+ Closing Cost )

我们还是以一个$38万美元买房实例来计算,比较直观:

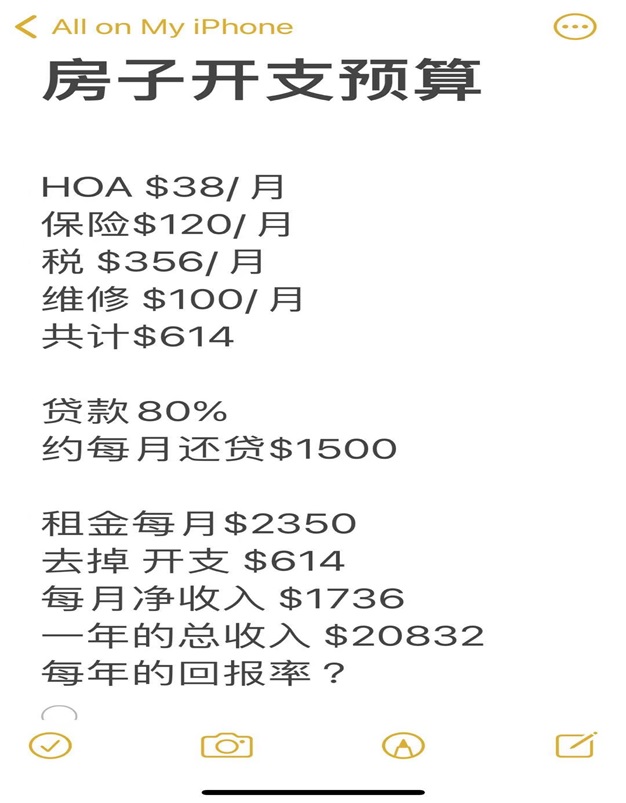

房子开支预算:

HOA $38/月; 保险 $120/月; 税 $356/月; 维修 $100/月。

共计 $614。

贷款 80%, 约每月还贷$1500;

租金每月$2350;去掉开支 $614; 每月净收入 $1736;

一年的总收入 $20832。

问:一个$38万美元的房产,每年的回报率?

(全额现金买投资房产)租金回报率 = (12月的租金 – 一年的各种花费)/ 买房价

$38万美元房子的租金回报率 = 一年的总收入 $20832 / 买房价$380,000 = $0.0548

全额现金$38万美元房子的租金回报率一年约为:5.5%;

(贷款80%买投资房产)租金回报率 = (12月的租金 – 一年的各种花费和贷款 ) / (

20%买房首付 + Closing Cost)

$38万美元贷款80%房子的租金回报率 = (一年的总收入$20832 – $18000) / (首付 $

76000 + $5000 Closing Cost ) = $0.0349

$38万美元贷款80%买投资房产的租金回报率一年约为:3.5%.

这个$38万美元的房子在最好学区,房子升值潜力大!

考虑到加上房子产权equity 上涨的因素,一年在6%-8%。所以要加上一个Equity 增值

率,换句话说,是用$81000 买了一个$38万美元的房产,是用杠杆买的房子。

这里有2个概念:一个是租金回报率;一个是Equity 回报率;

利用杠杆买房,就要让银行在这个房子上也赚一些钱,所以贷款租金回报率3.5%.要低

于全额现金租金回报率5.5%,这个逻辑是对的,那个2% 回报率的差让银行赚去了。

什么是智慧?智慧就是解决问题的能力!

能够把一个复杂问题简单化,用直白的方式讲清楚,这也是智慧。

现在亚特兰大地区(佐治亚),一个房子的租金回报率大概在3% ~ 6%左右,真心话,

投资房净租金回报率6%是一个不错的回报。

你若嫌上面二手房一年的租金回报率还低,你可以全现金买126包租5年的项目,一年的

租金回报率为净6%。

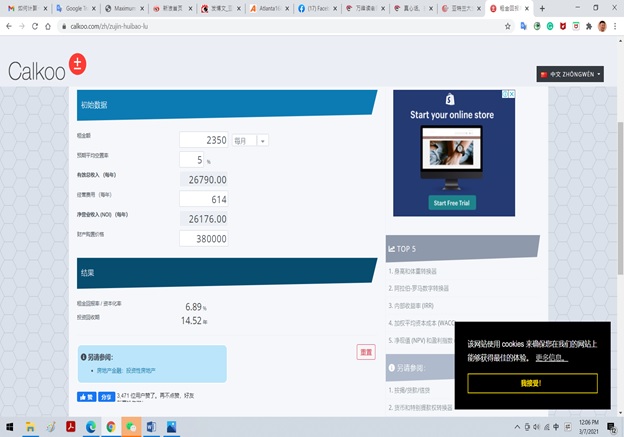

下面是在网上找到的租金回报率计算器,大家可以去练习:

租金回报率

https://www.calkoo.com/zh/zujin-huibao-lu

提示:算大账不算小账,可能公式不够严谨,但逻辑是对的。

Source: http://www.mitbbs.com/article_t/Georgia/31320547.html

How to Calculate ROI on a Rental Property

Why it’s important to know a property’s ROI before buying real estate

By JEAN FOLGER

3/07/2021

One of the main reasons people invest is to increase their wealth. Although the motivations may differ between investors—some may want money for retirement, others may choose to sock away money for other life events like having a baby or for a wedding—making money is usually the basis of all investments. And it doesn’t matter where you put your money, whether it goes into the stock market, the bond market, or real estate. https://66fb8f8f96c41eb6be84c3a0428532d2.safeframe.googlesyndication.com/safeframe/1-0-37/html/container.html

Real estate is tangible property that’s made up of land, and generally includes any structures or resources found on that land. Investment properties are one example of a real estate investment. People usually purchase investment properties with the intent of making money through rental income. Some people buy investment properties with the intent of selling them after a short time.

Regardless of the intention, for investors who diversify their investment portfolio with real estate, it’s important to measure return on investment (ROI) to determine a property’s profitability. Here’s a quick look at ROI, how to calculate it for your rental property, and why it’s important that you know a property’s ROI before you make a real estate purchase.

KEY TAKEAWAYS

- Return on investment (ROI) measures how much money, or profit, is made on an investment as a percentage of the cost of that investment.

- To calculate the percentage ROI for a cash purchase, take the net profit or net gain on the investment and divide it by the original cost.

- If you have a mortgage, you’ll need to factor in your downpayment and mortgage payment.

- Other variables can affect your ROI including repair and maintenance costs, as well as your regular expenses.

What Is Return on Investment (ROI)?

Return on investment measures how much money, or profit, is made on an investment as a percentage of the cost of that investment. It shows how effectively and efficiently investment dollars are being used to generate profits. Knowing ROI allows investors to assess whether putting money into a particular investment is a wise choice or not.

ROI can be used for any investment—stocks, bonds, a savings account, and a piece of real estate. Calculating a meaningful ROI for a residential property can be challenging because calculations can be easily manipulated—certain variables can be included or excluded in the calculation. It can become especially difficult when investors have the option of paying cash or taking out a mortgage on the property.

Here, we’ll review two examples for calculating ROI on residential rental property: a cash purchase and one that’s financed with a mortgage.

The Formula for ROI

To calculate the profit or gain on any investment, first take the total return on the investment and subtract the original cost of the investment.

Because ROI is a profitability ratio, the profit is represented in percentage terms.

To calculate the percentage ROI, we take the net profit, or net gain, on the investment and divide it by the original cost.

For instance, if you buy ABC stock for $1,000 and sell it two years later for $1,600, the net profit is $600 ($1,600 – $1,000). ROI on the stock is 60% [$600 (net profit) ÷ $1,000 (cost) = 0.60].

Calculating ROI on Rental Properties

The above equation seems simple enough, but keep in mind that there are a number of variables that come into play with real estate that can affect ROI numbers. These include repair and maintenance expenses, and methods of figuring leverage—the amount of money borrowed with interest to make the initial investment. Of course, financing terms can greatly affect the overall cost of the investment.

ROI for Cash Transactions

Calculating a property’s ROI is fairly straightforward if you buy a property with cash. Here’s an example of a rental property purchased with cash:

- You paid $100,000 in cash for the rental property.

- The closing costs were $1,000 and remodeling costs totaled $9,000, bringing your total investment to $110,000 for the property.

- You collected $1,000 in rent every month.

A year later:

- You earned $12,000 in rental income for those 12 months.

- Expenses including the water bill, property taxes, and insurance, totaled $2,400 for the year. or $200 per month.

- Your annual return was $9,600 ($12,000 – $2,400).

To calculate the property’s ROI:

- Divide the annual return ($9,600) by the amount of the total investment, or $110,000.

- ROI = $9,600 ÷ $110,000 = 0.087 or 8.7%.

- Your ROI was 8.7%.

ROI for Financed Transactions

Calculating the ROI on financed transactions is more involved.

For example, assume you bought the same $100,000 rental property as above, but instead of paying cash, you took out a mortgage.

- The downpayment needed for the mortgage was 20% of the purchase price, or $20,000 ($100,000 sales price x 20%).

- Closing costs were higher, which is typical for a mortgage, totaling $2,500 up front.

- You paid $9,000 for remodeling.

- Your total out-of-pocket expenses were $31,500 ($20,000 + $2,500 + $9,000).

There are also ongoing costs with a mortgage:

- Let’s assume you took out a 30-year loan with a fixed 4% interest rate. On the borrowed $80,000, the monthly principal and interest payment would be $381.93.

- We’ll add the same $200 per month to cover water, taxes, and insurance, making your total monthly payment $581.93.

- Rental income of $1,000 per month totals $12,000 for the year.

- Monthly cash flow is $418.07 ($1,000 rent – $581.93 mortgage payment).

One year later:

- You earned $12,000 in total rental income for the year at $1,000 per month.

- Your annual return was $5,016.84 ($418.07 x 12 months).

To calculate the property’s ROI:

- Divide the annual return by your original out-of-pocket expenses (the downpayment of $20,000, closing costs of $2,500, and remodeling for $9,000) to determine ROI.

- ROI = $5,016.84 ÷ $31,500 = 0.159.

- Your ROI is 15.9%.

Home Equity

Some investors add the home’s equity into the equation. Equity is the market value of the property minus the total loan amount outstanding. Keep in mind that home equity is not cash-in-hand. You would need to sell the property to access it.

To calculate the amount of equity in your home, review your mortgage amortization schedule to find out how much of your mortgage payments went toward paying down the principal of the loan. This builds up the equity in your home.

The equity amount can be added to the annual return. In our example, the amortization schedule for the loan showed that a total of $1,408.84 of principal was paid down during the first 12 months.

- The new annual return, including the equity portion, equals $6,425.68 ($5,016.84 annual income + $1,408.84 equity).

- ROI = $6,425.68 ÷ $31,500 = 0.20.

- Your ROI is 20%.

The Importance of ROI for Real Estate

Knowing the ROI for any investment allows you to be a more informed investor. Before you buy, estimate your costs and expenses, as well as your rental income. This gives you a chance to compare it to other, similar properties.

Once you’ve narrowed it down, you can then determine how much you’ll make. If, at any point, you realize that your costs and expenses will exceed your ROI, you may need to decide whether you want to ride it out and hope you’ll make a profit again—or sell so you don’t lose out.

Other Considerations

Of course, there may be additional expenses involved in owning a rental property, such as repairs or maintenance costs, which would need to be included in the calculations, ultimately affecting the ROI.

Also, we assumed that the property was rented out for all 12 months. In many cases, vacancies occur, particularly in between tenants, and you must account for the lack of income for those months in your calculations.

The ROI for a rental property is different because it depends on whether the property is financed via a mortgage or paid for in cash. As a general rule of thumb, the less cash paid up front as a downpayment on the property, the larger the mortgage loan balance will be, but the greater your ROI.

Conversely, the more cash paid upfront and the less you borrow, the lower your ROI, since your initial cost would be higher. In other words, financing allows you to boost your ROI in the short term, as your initial costs are lower.

It’s important to use a consistent approach when measuring the ROI for multiple properties. For example, if you include the home’s equity in evaluating one property, you should include the equity of the other properties when calculating the ROI for your real estate portfolio. This can provide the most accurate view of your investment portfolio.