Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

浅论房屋出售前Home Staging的益处

第五章

10/12/2021

接上篇:

四、 人们对staging误区多

1、Home Staging不需要个性化

工作中最多的误区是,有些卖家甚至是经纪人,主观意识很强。他们通常提出自己要这样做或那样做。很多人忽略了我们不是做redesign(重新设计)。但其实staging是要以大众的方式去做,不能太个性化,因为审美的眼光每个人都会大有不同,有的人喜欢白色有个人喜欢红色,老话说萝卜白菜各有所爱,所以因为有些人可能会接受不了。装修和布展的要求一定是简约,舒服,兼顾美感而不突出的美感,如果空间小,我们要相对展现得大一些。如果空间大就需要突出重点,展现空间效果。所以建议大家销售房子前,要先看它周边的区域怎么样,买房子的人的年龄层,以及都是什么阶层等。之前的房子是甚麽样的装修和设计,也有很大的帮助。建议很多售房者,多花一点时间看看周围出售网上房子的照片,会对自己很有帮助,对自己的房子有一个价格的初步定位,也会在出售过程中起到事半功倍的效果。

2、Home Staging家具的布展要根据房屋实际情况定位

在众多的客户交流当中。很多客户经常会认为家具越多越好,档次越高越好,其实如果不根据房子本身实际情况布展,就会适得其反,比如在一所本身不是装修特别豪华或者内部环境特别高档的情况下,使用特别高档的家具,就会出现“门不当户不对”,不对称的效果,会对买房客户感觉非常不协调,不但不会出现美的效果,反之会感觉到在故意掩饰自身房子的缺点。还有的客户提出是否可以多装饰家具,甚至各个房间全部布展,其实在这个行业大家都心知肚明,做Staging的目的就是突出房子自身的优点,展现空间的美感,让买房者感受到原来这个房子本身,经过布展后还可以如此舒服和美丽,从而激发其购买房屋的欲望,而不是将整个空间拥堵,从而展现不出空间美,多反倒会得不偿失,即损失了金钱又没有起到很好的展示效果。

以上是本人对与 Home Staging工作的浅薄了理解,欢迎大家探讨沟通.公司名称:Six Spaces Home Staging 电话。5714748885. 微信号码:zhl7212.

结束。

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

诚招美国和加拿大法律服务代理

因公司发展需要,诚招美国和加拿大法律服务代理。

要求:

懂英语、或西班牙语、或法语。

能合法工作有社安号或工号。

无需改行, 可以兼职。

大学生和有销售经验优先考虑。

自雇生意公司发美国报税1099,加拿大T4A

有意了解详情, 请扫码加微信, 非诚勿扰!

如何计算一个投资房产的租金回报率?

By Willy Rong

3/07/2021

一直以来都有人问我,如何计算一个投资房产的租金回报率?我答过,但总是似是而非。

今天就这个问题给出我的计算公式Return Of Investment (ROI),仅供大家参考。

这个问题要从两方面讨论,看你是全额现金买房?还是贷款80% 买房?

(全额现金买投资房产)租金回报率 = (12月的租金 – 一年的各种花费)/ 买房价

(贷款80%买投资房产)租金回报率 = (12月的租金 – 一年的各种花费和贷款 )/ (

20%首付+ Closing Cost )

我们还是以一个$38万美元买房实例来计算,比较直观:

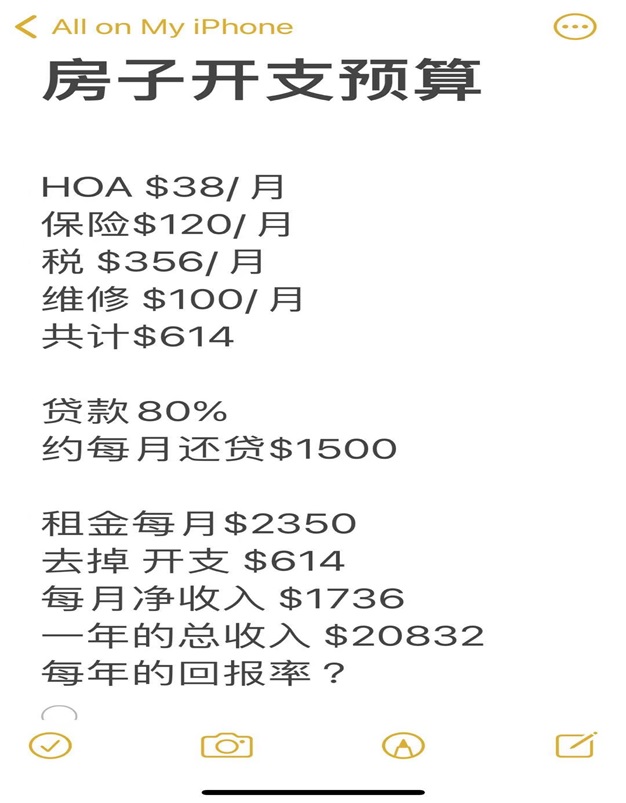

房子开支预算:

HOA $38/月; 保险 $120/月; 税 $356/月; 维修 $100/月。

共计 $614。

贷款 80%, 约每月还贷$1500;

租金每月$2350;去掉开支 $614; 每月净收入 $1736;

一年的总收入 $20832。

问:一个$38万美元的房产,每年的回报率?

(全额现金买投资房产)租金回报率 = (12月的租金 – 一年的各种花费)/ 买房价

$38万美元房子的租金回报率 = 一年的总收入 $20832 / 买房价$380,000 = $0.0548

全额现金$38万美元房子的租金回报率一年约为:5.5%;

(贷款80%买投资房产)租金回报率 = (12月的租金 – 一年的各种花费和贷款 ) / (

20%买房首付 + Closing Cost)

$38万美元贷款80%房子的租金回报率 = (一年的总收入$20832 – $18000) / (首付 $

76000 + $5000 Closing Cost ) = $0.0349

$38万美元贷款80%买投资房产的租金回报率一年约为:3.5%.

这个$38万美元的房子在最好学区,房子升值潜力大!

考虑到加上房子产权equity 上涨的因素,一年在6%-8%。所以要加上一个Equity 增值

率,换句话说,是用$81000 买了一个$38万美元的房产,是用杠杆买的房子。

这里有2个概念:一个是租金回报率;一个是Equity 回报率;

利用杠杆买房,就要让银行在这个房子上也赚一些钱,所以贷款租金回报率3.5%.要低

于全额现金租金回报率5.5%,这个逻辑是对的,那个2% 回报率的差让银行赚去了。

什么是智慧?智慧就是解决问题的能力!

能够把一个复杂问题简单化,用直白的方式讲清楚,这也是智慧。

现在亚特兰大地区(佐治亚),一个房子的租金回报率大概在3% ~ 6%左右,真心话,

投资房净租金回报率6%是一个不错的回报。

你若嫌上面二手房一年的租金回报率还低,你可以全现金买126包租5年的项目,一年的

租金回报率为净6%。

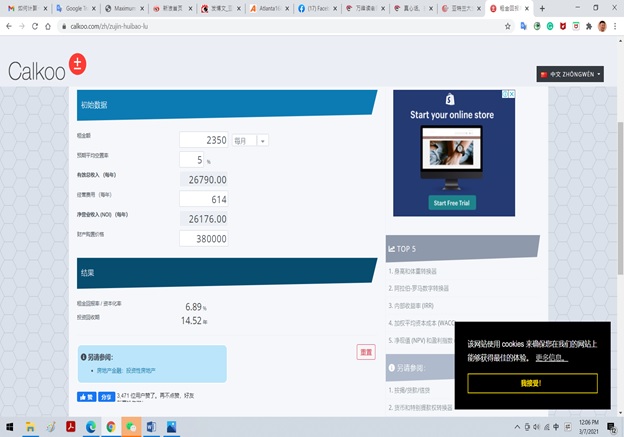

下面是在网上找到的租金回报率计算器,大家可以去练习:

租金回报率

https://www.calkoo.com/zh/zujin-huibao-lu

提示:算大账不算小账,可能公式不够严谨,但逻辑是对的。

Source: http://www.mitbbs.com/article_t/Georgia/31320547.html

How to Calculate ROI on a Rental Property

Why it’s important to know a property’s ROI before buying real estate

By JEAN FOLGER

3/07/2021

One of the main reasons people invest is to increase their wealth. Although the motivations may differ between investors—some may want money for retirement, others may choose to sock away money for other life events like having a baby or for a wedding—making money is usually the basis of all investments. And it doesn’t matter where you put your money, whether it goes into the stock market, the bond market, or real estate. https://66fb8f8f96c41eb6be84c3a0428532d2.safeframe.googlesyndication.com/safeframe/1-0-37/html/container.html

Real estate is tangible property that’s made up of land, and generally includes any structures or resources found on that land. Investment properties are one example of a real estate investment. People usually purchase investment properties with the intent of making money through rental income. Some people buy investment properties with the intent of selling them after a short time.

Regardless of the intention, for investors who diversify their investment portfolio with real estate, it’s important to measure return on investment (ROI) to determine a property’s profitability. Here’s a quick look at ROI, how to calculate it for your rental property, and why it’s important that you know a property’s ROI before you make a real estate purchase.

KEY TAKEAWAYS

- Return on investment (ROI) measures how much money, or profit, is made on an investment as a percentage of the cost of that investment.

- To calculate the percentage ROI for a cash purchase, take the net profit or net gain on the investment and divide it by the original cost.

- If you have a mortgage, you’ll need to factor in your downpayment and mortgage payment.

- Other variables can affect your ROI including repair and maintenance costs, as well as your regular expenses.

What Is Return on Investment (ROI)?

Return on investment measures how much money, or profit, is made on an investment as a percentage of the cost of that investment. It shows how effectively and efficiently investment dollars are being used to generate profits. Knowing ROI allows investors to assess whether putting money into a particular investment is a wise choice or not.

ROI can be used for any investment—stocks, bonds, a savings account, and a piece of real estate. Calculating a meaningful ROI for a residential property can be challenging because calculations can be easily manipulated—certain variables can be included or excluded in the calculation. It can become especially difficult when investors have the option of paying cash or taking out a mortgage on the property.

Here, we’ll review two examples for calculating ROI on residential rental property: a cash purchase and one that’s financed with a mortgage.

The Formula for ROI

To calculate the profit or gain on any investment, first take the total return on the investment and subtract the original cost of the investment.

Because ROI is a profitability ratio, the profit is represented in percentage terms.

To calculate the percentage ROI, we take the net profit, or net gain, on the investment and divide it by the original cost.

For instance, if you buy ABC stock for $1,000 and sell it two years later for $1,600, the net profit is $600 ($1,600 – $1,000). ROI on the stock is 60% [$600 (net profit) ÷ $1,000 (cost) = 0.60].

Calculating ROI on Rental Properties

The above equation seems simple enough, but keep in mind that there are a number of variables that come into play with real estate that can affect ROI numbers. These include repair and maintenance expenses, and methods of figuring leverage—the amount of money borrowed with interest to make the initial investment. Of course, financing terms can greatly affect the overall cost of the investment.

ROI for Cash Transactions

Calculating a property’s ROI is fairly straightforward if you buy a property with cash. Here’s an example of a rental property purchased with cash:

- You paid $100,000 in cash for the rental property.

- The closing costs were $1,000 and remodeling costs totaled $9,000, bringing your total investment to $110,000 for the property.

- You collected $1,000 in rent every month.

A year later:

- You earned $12,000 in rental income for those 12 months.

- Expenses including the water bill, property taxes, and insurance, totaled $2,400 for the year. or $200 per month.

- Your annual return was $9,600 ($12,000 – $2,400).

To calculate the property’s ROI:

- Divide the annual return ($9,600) by the amount of the total investment, or $110,000.

- ROI = $9,600 ÷ $110,000 = 0.087 or 8.7%.

- Your ROI was 8.7%.

ROI for Financed Transactions

Calculating the ROI on financed transactions is more involved.

For example, assume you bought the same $100,000 rental property as above, but instead of paying cash, you took out a mortgage.

- The downpayment needed for the mortgage was 20% of the purchase price, or $20,000 ($100,000 sales price x 20%).

- Closing costs were higher, which is typical for a mortgage, totaling $2,500 up front.

- You paid $9,000 for remodeling.

- Your total out-of-pocket expenses were $31,500 ($20,000 + $2,500 + $9,000).

There are also ongoing costs with a mortgage:

- Let’s assume you took out a 30-year loan with a fixed 4% interest rate. On the borrowed $80,000, the monthly principal and interest payment would be $381.93.

- We’ll add the same $200 per month to cover water, taxes, and insurance, making your total monthly payment $581.93.

- Rental income of $1,000 per month totals $12,000 for the year.

- Monthly cash flow is $418.07 ($1,000 rent – $581.93 mortgage payment).

One year later:

- You earned $12,000 in total rental income for the year at $1,000 per month.

- Your annual return was $5,016.84 ($418.07 x 12 months).

To calculate the property’s ROI:

- Divide the annual return by your original out-of-pocket expenses (the downpayment of $20,000, closing costs of $2,500, and remodeling for $9,000) to determine ROI.

- ROI = $5,016.84 ÷ $31,500 = 0.159.

- Your ROI is 15.9%.

Home Equity

Some investors add the home’s equity into the equation. Equity is the market value of the property minus the total loan amount outstanding. Keep in mind that home equity is not cash-in-hand. You would need to sell the property to access it.

To calculate the amount of equity in your home, review your mortgage amortization schedule to find out how much of your mortgage payments went toward paying down the principal of the loan. This builds up the equity in your home.

The equity amount can be added to the annual return. In our example, the amortization schedule for the loan showed that a total of $1,408.84 of principal was paid down during the first 12 months.

- The new annual return, including the equity portion, equals $6,425.68 ($5,016.84 annual income + $1,408.84 equity).

- ROI = $6,425.68 ÷ $31,500 = 0.20.

- Your ROI is 20%.

The Importance of ROI for Real Estate

Knowing the ROI for any investment allows you to be a more informed investor. Before you buy, estimate your costs and expenses, as well as your rental income. This gives you a chance to compare it to other, similar properties.

Once you’ve narrowed it down, you can then determine how much you’ll make. If, at any point, you realize that your costs and expenses will exceed your ROI, you may need to decide whether you want to ride it out and hope you’ll make a profit again—or sell so you don’t lose out.

Other Considerations

Of course, there may be additional expenses involved in owning a rental property, such as repairs or maintenance costs, which would need to be included in the calculations, ultimately affecting the ROI.

Also, we assumed that the property was rented out for all 12 months. In many cases, vacancies occur, particularly in between tenants, and you must account for the lack of income for those months in your calculations.

The ROI for a rental property is different because it depends on whether the property is financed via a mortgage or paid for in cash. As a general rule of thumb, the less cash paid up front as a downpayment on the property, the larger the mortgage loan balance will be, but the greater your ROI.

Conversely, the more cash paid upfront and the less you borrow, the lower your ROI, since your initial cost would be higher. In other words, financing allows you to boost your ROI in the short term, as your initial costs are lower.

It’s important to use a consistent approach when measuring the ROI for multiple properties. For example, if you include the home’s equity in evaluating one property, you should include the equity of the other properties when calculating the ROI for your real estate portfolio. This can provide the most accurate view of your investment portfolio.