Study: Orlando’s affordable housing supply keeps dwindling as investors scoop up properties

BY MOLLY DUERIG | ORLANDO

9/06/2021

ORLANDO, Fla. — Large real estate investors are purchasing residential properties at rapid speed — in Orlando, 170% more than at this point last year, according to one study.

That study, conducted by the real estate company Redfin, reveals nationwide, investors bought one of every six homes purchased during 2021’s second quarter. That translates to $49 billion worth of homes purchased by large investors, who are honing in on mid-size, traditionally more affordable housing markets during the coronavirus pandemic.

It’s a trend some experts fear will further strain the country’s already-thin affordable housing supply, if investors choose to lease out those properties at market rates.

“Right now we’re dealing with supply and demand issues,” said Ability Housing CEO and President Shannon Nazworth. Ability Housing is a nonprofit affordable housing developer based in Jacksonville.

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

“If you don’t have enough physical stock, enough apartments or rental homes available, the price goes up and up and up,” she said.

While no state has an adequate supply of rental housing that’s affordable to its lowest-income residents, Florida is in an especially dire position. The state only has enough units to house 28% of its poorest residents, making it the fifth least-affordable state to find housing, according to the National Low Income Housing Coalition.

One Parramore landlord, Vincent Seay, said during the pandemic he’s turned down more buyer offers than ever before — between three and five a month, at least.

Seay said he doesn’t plan to ever sell his property, which he wants to pass onto his children. He said he also won’t raise monthly rents, or file evictions against his tenants who fall behind during the coronavirus pandemic.

That’s good news for at least one of Seay’s tenants, Brennen Hill, who said he’d “probably be homeless” if his $800 monthly rent were to increase. Hill’s rented a two-bedroom duplex unit from Seay for about two years now, and said he does his best to always abide by the terms of his lease — but it’s been tough during the pandemic.

“He’s really helped me a lot,” Hill said of Seay, adding that he’s never been charged any fees for making a late rental payment. “He’s a small owner. He still has bills to pay.”

Hill said he knows his situation is unique, and that many other landlords wouldn’t be as lenient with tenants who can’t always pay right on time.

“That’s very rare. They’re forcing every penny they can drain out of the folks around here,” Hill said. “They want late charges per day, per day, per day, which adds up to hundreds of more dollars, on top of what you’re already paying — ridiculous prices.”

The Biden Administration has stated its commitment to affordable housing, recently announcing a list of “immediate steps” to expand the nation’s affordable housing supply. One of those steps involves setting limits on where and when large investors can purchase real estate.

How Commercial Property Owners May Avoid (Or Defeat) Foreclosure

By John Higgins

John Frank Higgins is a New Mexico-based attorney helping clients turn water into wine since 2009.

5/23/2021

If you own property that’s central to your business, or if owning and leasing commercial property is your business, then making those monthly mortgage payments may get pretty tough at times. When customers aren’t coming in or when renters suffering the same problem can’t pony up, the cash flow simply isn’t there, and reserves can rapidly run dry.

Momentary panic and even despair are understandable, even allowable, but once you’ve had a minute to wrap your head around the situation, it’s time for an action plan. There are things you can do to avoid bankruptcy, avoid foreclosure, keep your property and keep your business — and maybe even keep your mortgage lender happy.

1. Be Preemptive And Proactive

It’s easier to predict some ongoing cash flow difficulties than others — for example, in a pandemic. (This really isn’t an article about Covid-19, and the advice here is true at all times, but we know we’ll be on this particular economic roller-coaster for a little while yet.) When the writing’s on the wall, don’t wait for the worst to happen. Pick up the phone and talk to your lender to see what you can do.

Most commercial mortgage lenders have no desire to be in the real estate business. When they foreclose, they not only have to go through the legal process of taking title to (and physical possession of) your property, but they also have to find a buyer, negotiate a sale and go through closing. That can take months or years, during which time they’re not receiving a penny. And then, they can generally only recoup the face value of the loan, possibly with some additional penalties and fees — they’ll lose out on most of the interest you would have paid, which is where they profit.

All of this gives lenders an incentive to keep you paying something on your mortgage if it’s at all feasible for you to recover and catch back up eventually. Though some lenders are less flexible than others, many might be willing to temporarily adjust terms, suspend payments or find other ways to work with you so you can keep your commercial property and they can keep collecting. It’s always worth an inquiry, and your lawyer or accountant may be able to help.

2. Missed Payments May Mean Opportunity

Maybe you talked to your lender already and they wouldn’t budge, meaning a missed payment is looming right around the corner. Maybe you’ve already missed a payment. In that case, you may face more of an uphill battle, but you still have options.

If you haven’t already spoken to your lender, now would be the time to do that, and again, a lawyer or accountant may be able to help. Otherwise, most lenders’ next step will be to “call in” the loan, meaning they’ll demand full repayment of the loan, pronto. A provision allowing lenders to do this at the first sign of default is standard in most commercial mortgage contracts, and it is an extreme but effective way for lenders to protect their interests.

Assuming you don’t have cash on hand to pay your entire mortgage balance, you can do a few things. If you’re ready to walk away from your business, you can try to sell the property, pay off the loan and possibly pocket a bit of the proceeds if there’s anything left over. This requires finding a buyer willing to pay at least the balance of the mortgage, which may not be possible if you’re underwater on your loan or if commercial property investment is slow. You could also simply walk away from the property and allow a foreclosure to proceed, though this isn’t always as simple as it sounds and can damage your future ability to borrow, personally and as a business entity.

If you want to hang onto your property, you could also try filing for Chapter 11 protection, which allows you to reorganize your debt so you can keep running your business. This is a lengthy and expensive process, however, and you’ll have to demonstrate that you can realistically run the business profitably in the near future and ultimately pay off your debts.

Your last option is to fight the call-in provision in court. If there’s a good reason you can’t live up to your contractual obligations, your lender may not be able to enforce it. You’ll need to speak with a lawyer about your specific circumstances and the laws and court mechanisms in your state to determine how best to proceed.

3. Fighting Foreclosure

If all else fails and you’re unable to fend off foreclosure proceedings, all is not lost. Though some states allow foreclosures to begin before anything is filed in court — “nonjudicial foreclosure” states — all states allow a challenge to a foreclosure proceeding to be brought in court. In a judicial foreclosure state, you’ll get that chance upfront, when the lender files for foreclosure; in a nonjudicial foreclosure state, you (with your lawyer) will initiate the proceeding.

Either way, courts generally treat commercial mortgage contracts like any other contract. That means, just as in a challenge to a call-in provision, you’ll need to argue that there’s a good and legally recognized reason that you shouldn’t be held to the terms of your contract, at least temporarily. (Again, this advice isn’t limited to times of a global pandemic and widespread economic impacts, but Covid-19 might form part of a valid argument.)

With some ingenuity and perseverance, you may be able to stave off foreclosure until your business is back up on its feet. There’s nothing quite like a court order to get a lender off your back and get the breathing room you need.

Once things are running smoothly, you can always refinance.

The information provided here is not legal advice and does not purport to be a substitute for advice of counsel on any specific matter. For legal advice, you should consult with an attorney concerning your specific situation.

如何计算一个投资房产的租金回报率?

By Willy Rong

3/07/2021

一直以来都有人问我,如何计算一个投资房产的租金回报率?我答过,但总是似是而非。

今天就这个问题给出我的计算公式Return Of Investment (ROI),仅供大家参考。

这个问题要从两方面讨论,看你是全额现金买房?还是贷款80% 买房?

(全额现金买投资房产)租金回报率 = (12月的租金 – 一年的各种花费)/ 买房价

(贷款80%买投资房产)租金回报率 = (12月的租金 – 一年的各种花费和贷款 )/ (

20%首付+ Closing Cost )

我们还是以一个$38万美元买房实例来计算,比较直观:

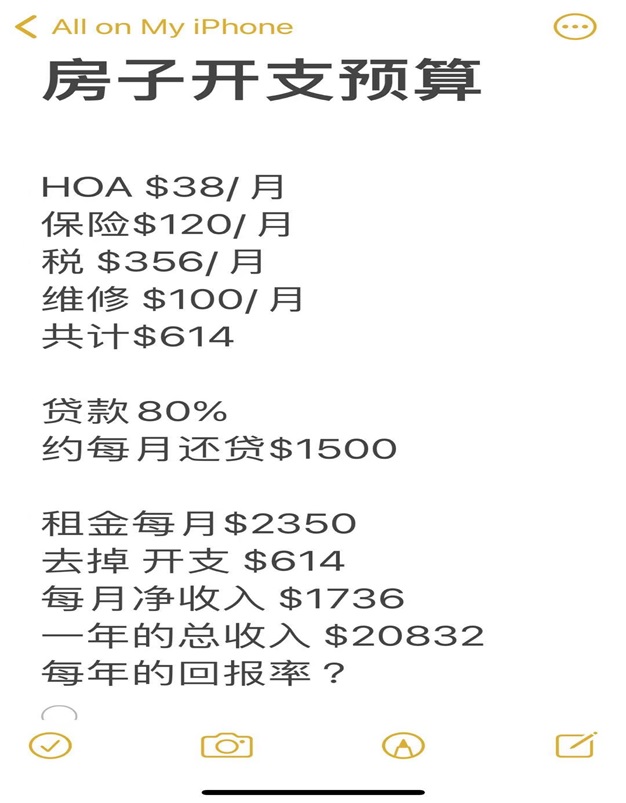

房子开支预算:

HOA $38/月; 保险 $120/月; 税 $356/月; 维修 $100/月。

共计 $614。

贷款 80%, 约每月还贷$1500;

租金每月$2350;去掉开支 $614; 每月净收入 $1736;

一年的总收入 $20832。

问:一个$38万美元的房产,每年的回报率?

(全额现金买投资房产)租金回报率 = (12月的租金 – 一年的各种花费)/ 买房价

$38万美元房子的租金回报率 = 一年的总收入 $20832 / 买房价$380,000 = $0.0548

全额现金$38万美元房子的租金回报率一年约为:5.5%;

(贷款80%买投资房产)租金回报率 = (12月的租金 – 一年的各种花费和贷款 ) / (

20%买房首付 + Closing Cost)

$38万美元贷款80%房子的租金回报率 = (一年的总收入$20832 – $18000) / (首付 $

76000 + $5000 Closing Cost ) = $0.0349

$38万美元贷款80%买投资房产的租金回报率一年约为:3.5%.

这个$38万美元的房子在最好学区,房子升值潜力大!

考虑到加上房子产权equity 上涨的因素,一年在6%-8%。所以要加上一个Equity 增值

率,换句话说,是用$81000 买了一个$38万美元的房产,是用杠杆买的房子。

这里有2个概念:一个是租金回报率;一个是Equity 回报率;

利用杠杆买房,就要让银行在这个房子上也赚一些钱,所以贷款租金回报率3.5%.要低

于全额现金租金回报率5.5%,这个逻辑是对的,那个2% 回报率的差让银行赚去了。

什么是智慧?智慧就是解决问题的能力!

能够把一个复杂问题简单化,用直白的方式讲清楚,这也是智慧。

现在亚特兰大地区(佐治亚),一个房子的租金回报率大概在3% ~ 6%左右,真心话,

投资房净租金回报率6%是一个不错的回报。

你若嫌上面二手房一年的租金回报率还低,你可以全现金买126包租5年的项目,一年的

租金回报率为净6%。

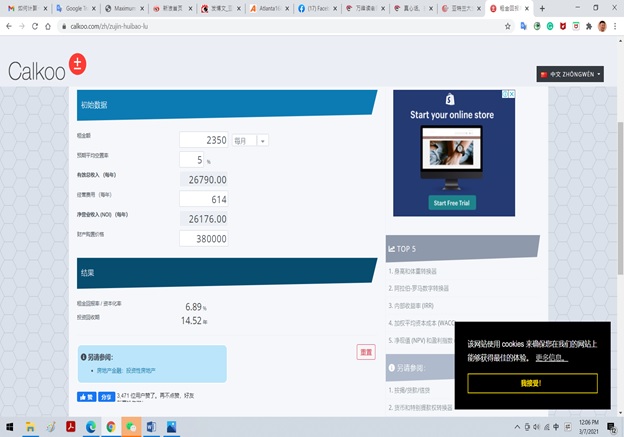

下面是在网上找到的租金回报率计算器,大家可以去练习:

租金回报率

https://www.calkoo.com/zh/zujin-huibao-lu

提示:算大账不算小账,可能公式不够严谨,但逻辑是对的。

Source: http://www.mitbbs.com/article_t/Georgia/31320547.html

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

How to Calculate ROI on a Rental Property

Why it’s important to know a property’s ROI before buying real estate

By JEAN FOLGER

3/07/2021

One of the main reasons people invest is to increase their wealth. Although the motivations may differ between investors—some may want money for retirement, others may choose to sock away money for other life events like having a baby or for a wedding—making money is usually the basis of all investments. And it doesn’t matter where you put your money, whether it goes into the stock market, the bond market, or real estate. https://66fb8f8f96c41eb6be84c3a0428532d2.safeframe.googlesyndication.com/safeframe/1-0-37/html/container.html

Real estate is tangible property that’s made up of land, and generally includes any structures or resources found on that land. Investment properties are one example of a real estate investment. People usually purchase investment properties with the intent of making money through rental income. Some people buy investment properties with the intent of selling them after a short time.

Regardless of the intention, for investors who diversify their investment portfolio with real estate, it’s important to measure return on investment (ROI) to determine a property’s profitability. Here’s a quick look at ROI, how to calculate it for your rental property, and why it’s important that you know a property’s ROI before you make a real estate purchase.

KEY TAKEAWAYS

- Return on investment (ROI) measures how much money, or profit, is made on an investment as a percentage of the cost of that investment.

- To calculate the percentage ROI for a cash purchase, take the net profit or net gain on the investment and divide it by the original cost.

- If you have a mortgage, you’ll need to factor in your downpayment and mortgage payment.

- Other variables can affect your ROI including repair and maintenance costs, as well as your regular expenses.

What Is Return on Investment (ROI)?

Return on investment measures how much money, or profit, is made on an investment as a percentage of the cost of that investment. It shows how effectively and efficiently investment dollars are being used to generate profits. Knowing ROI allows investors to assess whether putting money into a particular investment is a wise choice or not.

ROI can be used for any investment—stocks, bonds, a savings account, and a piece of real estate. Calculating a meaningful ROI for a residential property can be challenging because calculations can be easily manipulated—certain variables can be included or excluded in the calculation. It can become especially difficult when investors have the option of paying cash or taking out a mortgage on the property.

Here, we’ll review two examples for calculating ROI on residential rental property: a cash purchase and one that’s financed with a mortgage.

The Formula for ROI

To calculate the profit or gain on any investment, first take the total return on the investment and subtract the original cost of the investment.

Because ROI is a profitability ratio, the profit is represented in percentage terms.

To calculate the percentage ROI, we take the net profit, or net gain, on the investment and divide it by the original cost.

For instance, if you buy ABC stock for $1,000 and sell it two years later for $1,600, the net profit is $600 ($1,600 – $1,000). ROI on the stock is 60% [$600 (net profit) ÷ $1,000 (cost) = 0.60].

Calculating ROI on Rental Properties

The above equation seems simple enough, but keep in mind that there are a number of variables that come into play with real estate that can affect ROI numbers. These include repair and maintenance expenses, and methods of figuring leverage—the amount of money borrowed with interest to make the initial investment. Of course, financing terms can greatly affect the overall cost of the investment.

ROI for Cash Transactions

Calculating a property’s ROI is fairly straightforward if you buy a property with cash. Here’s an example of a rental property purchased with cash:

- You paid $100,000 in cash for the rental property.

- The closing costs were $1,000 and remodeling costs totaled $9,000, bringing your total investment to $110,000 for the property.

- You collected $1,000 in rent every month.

A year later:

- You earned $12,000 in rental income for those 12 months.

- Expenses including the water bill, property taxes, and insurance, totaled $2,400 for the year. or $200 per month.

- Your annual return was $9,600 ($12,000 – $2,400).

To calculate the property’s ROI:

- Divide the annual return ($9,600) by the amount of the total investment, or $110,000.

- ROI = $9,600 ÷ $110,000 = 0.087 or 8.7%.

- Your ROI was 8.7%.

ROI for Financed Transactions

Calculating the ROI on financed transactions is more involved.

For example, assume you bought the same $100,000 rental property as above, but instead of paying cash, you took out a mortgage.

- The downpayment needed for the mortgage was 20% of the purchase price, or $20,000 ($100,000 sales price x 20%).

- Closing costs were higher, which is typical for a mortgage, totaling $2,500 up front.

- You paid $9,000 for remodeling.

- Your total out-of-pocket expenses were $31,500 ($20,000 + $2,500 + $9,000).

There are also ongoing costs with a mortgage:

- Let’s assume you took out a 30-year loan with a fixed 4% interest rate. On the borrowed $80,000, the monthly principal and interest payment would be $381.93.

- We’ll add the same $200 per month to cover water, taxes, and insurance, making your total monthly payment $581.93.

- Rental income of $1,000 per month totals $12,000 for the year.

- Monthly cash flow is $418.07 ($1,000 rent – $581.93 mortgage payment).

One year later:

- You earned $12,000 in total rental income for the year at $1,000 per month.

- Your annual return was $5,016.84 ($418.07 x 12 months).

To calculate the property’s ROI:

- Divide the annual return by your original out-of-pocket expenses (the downpayment of $20,000, closing costs of $2,500, and remodeling for $9,000) to determine ROI.

- ROI = $5,016.84 ÷ $31,500 = 0.159.

- Your ROI is 15.9%.

Home Equity

Some investors add the home’s equity into the equation. Equity is the market value of the property minus the total loan amount outstanding. Keep in mind that home equity is not cash-in-hand. You would need to sell the property to access it.

To calculate the amount of equity in your home, review your mortgage amortization schedule to find out how much of your mortgage payments went toward paying down the principal of the loan. This builds up the equity in your home.

The equity amount can be added to the annual return. In our example, the amortization schedule for the loan showed that a total of $1,408.84 of principal was paid down during the first 12 months.

- The new annual return, including the equity portion, equals $6,425.68 ($5,016.84 annual income + $1,408.84 equity).

- ROI = $6,425.68 ÷ $31,500 = 0.20.

- Your ROI is 20%.

The Importance of ROI for Real Estate

Knowing the ROI for any investment allows you to be a more informed investor. Before you buy, estimate your costs and expenses, as well as your rental income. This gives you a chance to compare it to other, similar properties.

Once you’ve narrowed it down, you can then determine how much you’ll make. If, at any point, you realize that your costs and expenses will exceed your ROI, you may need to decide whether you want to ride it out and hope you’ll make a profit again—or sell so you don’t lose out.

Other Considerations

Of course, there may be additional expenses involved in owning a rental property, such as repairs or maintenance costs, which would need to be included in the calculations, ultimately affecting the ROI.

Also, we assumed that the property was rented out for all 12 months. In many cases, vacancies occur, particularly in between tenants, and you must account for the lack of income for those months in your calculations.

The ROI for a rental property is different because it depends on whether the property is financed via a mortgage or paid for in cash. As a general rule of thumb, the less cash paid up front as a downpayment on the property, the larger the mortgage loan balance will be, but the greater your ROI.

Conversely, the more cash paid upfront and the less you borrow, the lower your ROI, since your initial cost would be higher. In other words, financing allows you to boost your ROI in the short term, as your initial costs are lower.

It’s important to use a consistent approach when measuring the ROI for multiple properties. For example, if you include the home’s equity in evaluating one property, you should include the equity of the other properties when calculating the ROI for your real estate portfolio. This can provide the most accurate view of your investment portfolio.