Toronto has the fastest-rising prime home prices in the world

By Laura Hanrahan

8/24/2021

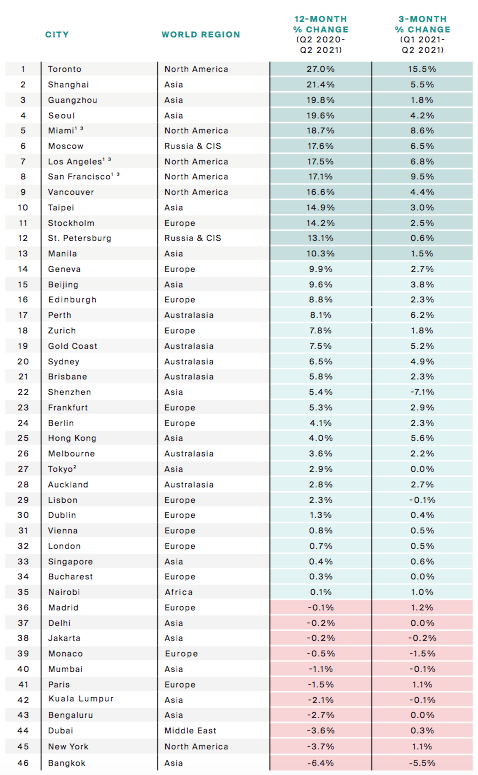

Toronto officially has some of the fastest-rising home prices in any major city in the world, according to a new report.

Although it may be something any Torontonian could have easily guessed, the recently published Prime Global Cities Index from Knight Frank confirmed that Toronto’s prime residential real estate prices are far outpacing other major cities.

Prime real estate is defined as the top 5% of the real estate market.

Toronto beat the next closest city — Shanghai, China — by several percentage points, with Toronto’s prime real estate prices rising 27% year-over-year and 15.5% quarter-over-quarter. Shanghai’s rose 21.4% and 5.5%, respectively.

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

“Toronto leads this quarter’s results, recording annual prime price growth of 27%, driven by strong buyer appetite and low inventory levels,” the report reads.

Guangzhou, China; Seoul, South Korea; Miami, Florida; and Moscow, Russia, round out the top five.

Canada’s third largest city, Vancouver, also made it on the list, coming in at number nine with 16.6% growth year-over-year and 4.4% quarter-over-quarter.

“Housing markets are undergoing the most unusual of recoveries,” the report reads. “An easing of travel rules in some markets, a surge in safe haven purchases by domestic buyers, a flurry of activity ahead of the tapering of stamp duty holidays, and an overall reassessment of lifestyles and commuting patterns, all set against a backdrop of low interest rates.”

Interestingly, a number of major cities like Paris, Dubai, New York, and Mumbai actually saw declining prime residential real estate prices both year-over-year and quarter-over-quarter.

As for what’s next, Knight Frank predicts that the prospect of rising interest rates, government intervention, and the withdrawal of stimulus measures will help to rein in the market later this year.

“Expect more cooling measures as policymakers grapple with the affordability conundrum,” the report reads. “The Chinese mainland’s long-debated national property tax now looks more likely. We expect to see London, New York, Paris and Dubai move up the rankings in Q3 as travel restrictions ease and international buyers start to recognize the relative value in these cities.”

Apr 20, 2021

Is a Housing Market Crash Possible in 2021?

By Mark Mathis

4/22/2021

With the real estate market experiencing surging prices, scant inventories and a backlog of new home construction, many consumers are wondering if what’s gone up must come back down—in other words, are we headed for another housing market crash? Let’s take a closer look.

Think Back to the Great Recession

The unforeseen housing market crash 15 years ago ignited a worldwide recession. Fueled by low interest rates, loose mortgage-lending standards and the nation’s unshakeable faith in homeownership, home values rose at record rates year-after-year. When the housing bubble burst, roughly nine million families lost their homes to foreclosure or short sale between 2006 and 2014. Housing values plunged 30% or more, homeowners lost a collective $7 trillion and it took nearly a decade for most markets to recover. Even today, several real estate markets have not fully recovered.

With the robust market activity we’ve seen lately, could there be a market crash in the near future? The short answer is “not likely.” Today’s market book cannot be sustained completely, but a crash as serious as the one from 15 years ago is unlikely because of a few important factors.

Factor No. 1: More Stringent Lending Standards

Loose mortgage lending practices ultimately brought down some of the nation’s largest banks and mortgage companies. The fallout forced Congress and federal regulators to make significant adjustments that have fundamentally changed how mortgage lending is regulated.

Since then, standards have been raised and the process of obtaining a mortgage is now more transparent. The “anyone can get one” loans of the past are illegal; now borrowers undergo stricter income, credit and asset checks. An entirely new regulatory agency, the Consumer Financial Protection Bureau, was created to enforce this new regulatory framework. Lenders who do not comply with these standards may face heavy penalties.

As a result, the housing finance marketplace is now more robust and safer than it was 15 years ago. Any dip in the housing market will be cushioned by these stricter regulations.

Factor No. 2: Pandemic Mortgage Forbearance

When the housing market crashed in 2007, the influx of foreclosures pumped housing supply into areas with falling prices and weak labor markets, while also preventing recently foreclosed borrowers from re-entering the market as buyers. According to the Federal Reserve, foreclosures during a time of high unemployment could depress prices, plunging homeowners across the country deeper into negative equity.

However, in the pandemic era, the effects of mass unemployment bear little resemblance to the Great Recession, thanks in large part to forbearance programs that have allowed homeowners to postpone their monthly mortgage payments without suffering penalties.

As of early March 2021, 2.6 million homeowners’ mortgages were in such forbearance plans. As the pandemic economy has slowly recovered, many homeowners have resumed their employment, and thus their home payments. According to CoreLogic, by the end of 2020, overall mortgage delinquencies declined 5.8% due to the forbearance program. The share of mortgages 60 to 89 days past due declined to 0.5%, lower than 0.6% in December 2019.

Housing Market Crash

It’s worth noting that serious delinquencies—defined as 90 days or more past due, including loans in foreclosure—increased when owners who owed large amounts left forbearance. By year end 2020, the serious delinquency rate was 3.9%, up from 1.2% in December 2019.

Factor No. 3: Most Homeowner’s Cushion—Equity

Equity is the difference between the current market value of your home and the amount you owe on it. In other words, it’s the portion of your home’s value that you actually own. Equity can be an incentive to stay in your home longer; if prices rise—something we’ve seen almost universally across the country in recent months—your equity increases, too.

Why does this matter? Simply put, higher levels of equity cushion homeowners from default when home values fall.

Over the past decade, American homeowners have enjoyed housing stability and growth, building up large home equity reserves. In the third quarter of 2020, the average family with a mortgage had $194,000 in home equity, and the average homeowner gained approximately $26,300 in equity over the course of the year. In contrast, 2009 saw nearly a quarter of the nation’s mortgaged homes valued for less than the amount their owners actually owed on those mortgages.

Factor No. 4: Price Growth Will Slow Down, but Continue

The sales boom followed the outbreak of the COVID-19 and surprised many real estate economists. Like most other business sectors, real estate was expected (if not required in many locations) to lock down. But by mid-April, sales were soaring as buyers, many of them millennials, took advantage of record-low mortgage interest rates. Through the remainder of 2020, rates remained below 3%, and existing home sales reached their highest level in 14 years.

A Moving Target

While no one can say for sure what will happen with the real estate sector, most experts are confident that we’ll experience a market dip, but certainly not a crash. In the meantime, there’s plenty of work available for motivated real estate professionals. Find out how Homes.com can help you connect with the current market of active buyers and sellers here!

Source: https://rismedia.com/2021/03/25/housing-market-crash-possible-2021/

Flat-Fee MLS Listing Service in Northern VA

Helping For Sale by Owner (FSBO) & For Rent by Owner (FRBO)

DIY Landlord – Renting out Properties Safer and Quicker!

By David Chen

4/15/2021

Q. We purchased our first home some years ago, and are about to move to another home. We are considering to keep our first home as an income property. We heard of the free ads on CRAIGSLIST and zillow.com, but some landlord friends told us it could be a challenge to find qualified tenants through CRAIGSLIST and zillow.com. Is there any way to rent our property out quicker and safer with minimum cost? We are the kind of persons who would like to try things ourselves, and have some spare time.

A. You may have already done the initial research and have figured out the range of monthly rent of your property.

If the monthly rent is low such as $1600.00 or below, you may want to do it through CRAIGSLIST, https://postlets.com/, zillow.com, or similar web sites. The renters interested in the low-priced rentals may not go to the Realtors community for assistance.

If the monthly rent is $1600.00 or above, you may want to consider listing your rental on brightmls.com for the Realtors community to market it for you.

Bright MLS is made up of nine forward thinking MLSs (43 Associations) in the Mid-Atlantic region who put aside their differences and came together with a shared vision to help solve MLS market overlap and empower everyone to get more out of the MLS. Bright will serve parts of 6 states plus Washington, D.C. encompassing 85,000 real estate professionals who serve over 20 million consumers and facilitate approximately 250,000 transactions a year that are valued at more than $70 billion.

Dozens of public real estate websites (such as: zillow.com, redfin.com, brightmlshomes.com, etc.) pull data from brightmls.com through syndication. In a few hours, your listing will show up on dozens of websites and will get the maximum exposure. It is a lot quicker and safer finding qualified tenants than doing it through CRAIGSLIST and zillow.com. You may talk with a Realtor for assistance. Please be aware some Realtors take rental jobs, some don’t.

Over the years I have helped some landlords in the community renting their properties out with very low cost. A popular arrangement is to help the landlords ‘DIY’, which has been working well for those experienced landlords.

The good side of ‘DIY’ is that the landlords can ‘screen’ the potential tenants from the very beginning, have 100% control of the whole process, and enjoy the feeling of “on top of things”.

If you prefer minimum service, I can help you ‘DIY’:

1. I provide CMA, list your rental on brightmls.com, put a realtor’s lockbox at the front door if needed, provide the access log (if needed), support you through the whole process.

I charge a flat fee for the minimum service.

2. If you would like me to prepare the lease or review the lease, there is another reasonable flat fee. This service is optional.

3. You answer phone calls, work with the tenant (if the tenant doesn’t have an agent) or the tenant’s agent, run credit check, verify employment, check references, etc.. You pay the tenant’s agent (if there is one) directly on the move-in date – usually 25% of first-month rent.

If you need full-service, the commission is first-month rent – which includes the commission to be paid to the tenant’s agent.

If you need any customized service (between minimum service and full-service), we can work out an agreement.

Some information:

CMA stands for Comparable (some called Competitive) Market Analysis, that will help you determine the market value of your property for sale or for rent.

I use Sentry-key lockbox. Any Realtor with membership of NVAR (Northern Virginia Association of Realtors) or any other VA Realtors association can access and show the property.

The access log tells when the agents enter the property and their contact info. which can help you follow up with the agents.

If you like the DIY experience, I would recommend you to use the minimum service.

Please feel free to reach me if you need any assistance.

—

David Chen

Realtor (Licensed in VA) | Neighborhood Specialist (McLean, Falls Church, Vienna)

Libra Realty, LLC

dchenj@gmail.com

703-395-5406

WeChat ID: dchenj2015

Last update: 4/15/2021

Websites that will show your flat fee mls listings

4/15/2021

Almost all real estate websites that offer the ability to search brokerage listings use a data feed from the MLS called Internet Data Exchange (IDX) to pull in listing data. Depending on the number of sites tapping into your MLS, your listing could appear on hundreds of websites. We do not control the content of any of the websites listed below. updated periodically & subject to change at any time Here are some examples of national websites by area that pull listings from the MLS:

This block contains unexpected or invalid content.Attempt Block Recovery

- Zillow

- Trulia

- Move.com

- MSN.com

- REALTOR.com

- REMAX.com (in markets where they have an office)

- ZipRealty.com (in markets where they have an office)

- Yahoo.com / Prudential (in markets where they have an office)

- Google Base

- Redfin

- Yahoo Classifieds

- AOL Real Estate

- HomeGain

- Lycos

- Oodle

- Hotpads

- HomeSeekers

- ColdwellBanker.com

- Cenutry21.com

- HouseFront

- CondoQuickFind

Here are just a few examples of local media websites that pull listings from the MLS in their area:

- AZCentral.com (Phoenix, Arizona)

- Chron.com (Houston, Texas)

- DallasNews.com (Dallas/Fort Worth, Texas)

- DenverPost.com (Denver, Colorado)

- LATimes.com (Los Angeles, California)

- MySA.com (San Antonio, Texas)

- RGJ.com (Reno, Nevada)

- SignOnSanDiego.com (San Diego, California)

- StarBulletin.com (Honolulu, Hawaii)

- Tucson.com(Tucson, Arizona)

Here are just a few examples of local brokerage websites that pull listings from the MLS in their area:

- BishopRealty.com (Payson, Arizona)

- Boulderco.com (Boulder, Colorado)

- C21MoneyWorld.com (Las Vegas, Nevada)

- ColdwellBanker-Idaho.com (Coeur d’Alene, Idaho)

- Ebby.com (Dallas, Texas)

- Floberg.com (Billings, Montana)

- LongRealty.com (Tucson, Arizona)

- SantaFeSIR.com (Santa Fe, New Mexico)

- TB.com (Spokane, Washington)

Additionally, here are just a few examples of local REALTOR® Boards or MLS’s that have a public view portal. (Not all boards have this feature):

- ABQREALTORS.com (Albuquerque, New Mexico)

- AlaskaRealEstate.com (Anchorage, Alaska)

- AustinHomeSearch.com (Austin, Texas)

- HAR.com (Houston, Texas)

- HavasuRealtors.com (Lake Havasu City, Arizona)

- HICentral.com (Honolulu, Hawaii)

- mlslistings.com (San Jose, California)

- SFAR.com (Santa Fe, New Mexico)

- TARMLS.com (Tucson, Arizona)

These are just examples. Your listing could literally show up at hundreds of other websites.

Source: https://www.congressrealty.com/Flat-Fee-MLS-Listings/Sites-with-Listings/default.aspp