美人口普查数据:华人财富排亚裔第六 家庭收入逊印裔

文章来源: 界面

9/03/2021

美国2020年人口普查报告出炉,报告首次细分了族裔人口数据。分析人士指出,人口普查史上首次出现白人人口下降的情况,这比过去的预测足足提前了八年。同时,白人占美国总人口比率首次降至60%以下,18岁以下人口大多数是非白人。

这意味着美国人口出现老龄化趋势,全美有31个州的18岁以下人口自2010年以来出现下降。美国劳动力增长更加依赖于少数族裔,2011年出生的非白人婴儿已首次超过白人婴儿,过去20年来的全美儿童人口增长,全靠西裔、亚裔和多元种族者。数据显示,亚裔人口占比有所提升,从1990年的3%到本次普查报告所占比例加倍至6%。非裔人口占比在12.5%左右。

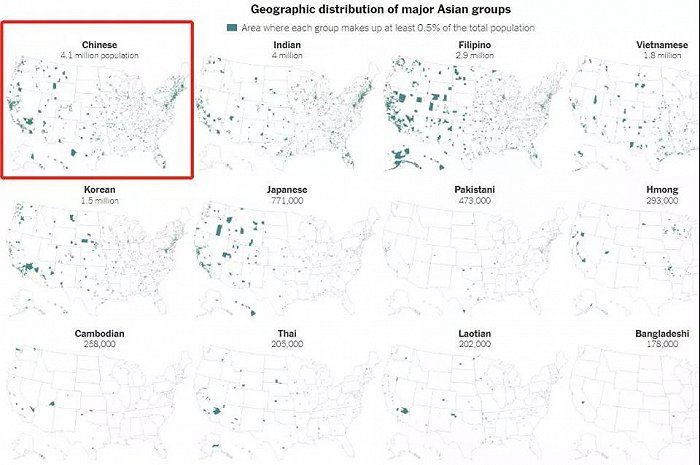

1. 410万华人遍布美国

根据2020年美国人口普查报告,亚裔总人口约2000万,占总人口的6%,增速为35.5%,占比不多,但增速是最快的。他们分别来自来自东亚、南亚40多个国家。1990年,美国的亚裔人口为660万,主要集中在沿海城市的少数地区。30年后,亚裔人口有了显著的增长,亚裔的分布也更加分散。

亚裔很多家庭在美国南部的郊区和中西部的农村地区安家落户,占人口5%以上的县也从1990年的39个增至2020年的176个。

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

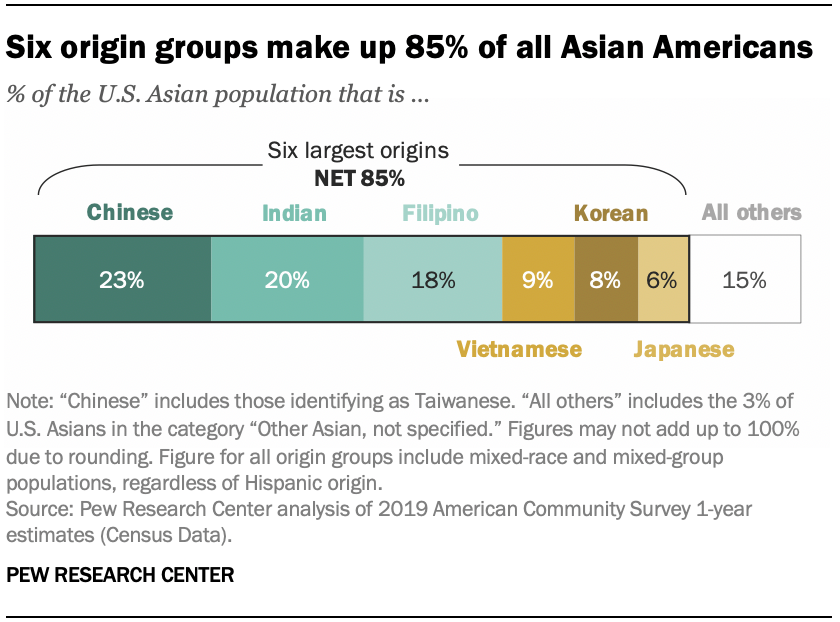

中国大陆背景的美国华裔占亚裔总数的21%,人口数量已经达到410万。而这还不包括非法居留在美国的华人和相当数量持有美国绿卡的华人。中国、印度、菲律宾、越南、韩国、日本这六个国家占了所有美国亚裔人口的85%。

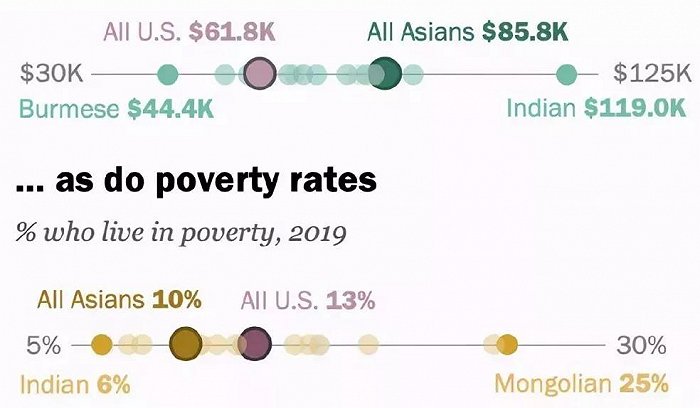

2. 华人财富排亚裔第六

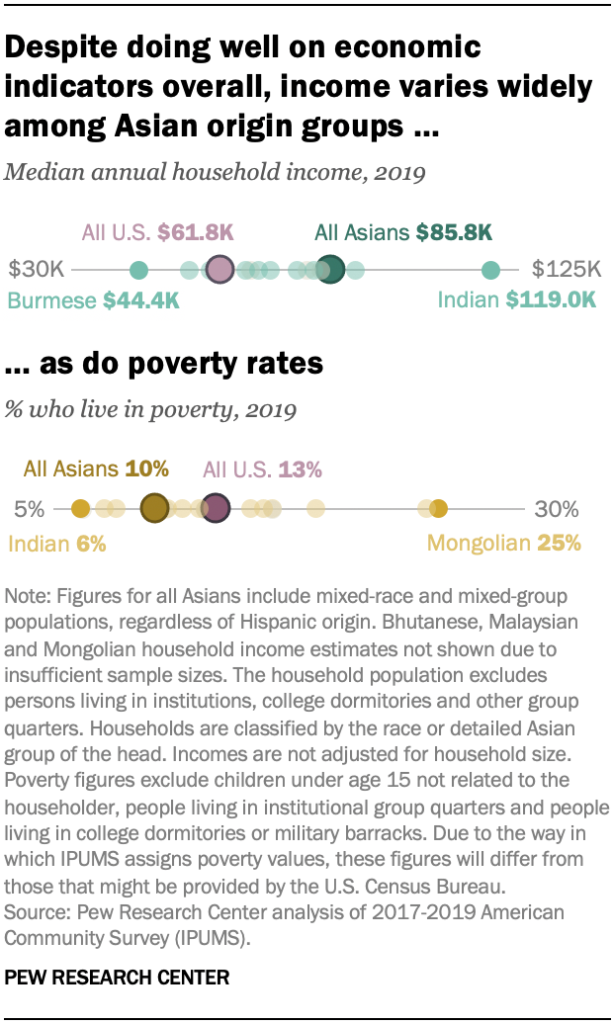

不仅在人口数量上强势,经济上亚裔仍然是大赢家,2020年全美家庭的中位年收入是6.18万美元,相比之下,亚裔家庭的中位年收入是8.58万美元,比全美平均水平高了近4成,另一方面,亚裔的整体贫困率只有10%,同样明显低于全美平均水平的13%。

不过,中国大陆背景华人的家庭人均收入仅仅排在亚裔的第六位,虽然高于美国平均水平,但有30%的家庭年收入低于4万美元。在美国的亚裔中,400万印度裔的平均收入最高,不丹血统的居民收入最低,几乎没有房屋。许多人是不丹难民,他们被困在难民营中多年,受教育机会有限。

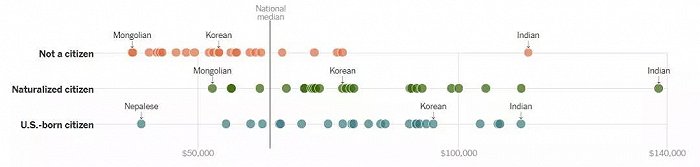

在将近来自二十个国家的亚裔美国人中,新移民收入往往与在美国出生或多年前入籍的人存在差距。以韩国为例,出生在美国的韩裔家庭收入中位数为95000美元,但以非公民韩裔为户主的家庭收入中位数仅为54000 美元,这种差距在其他亚裔群体中也同样存在。

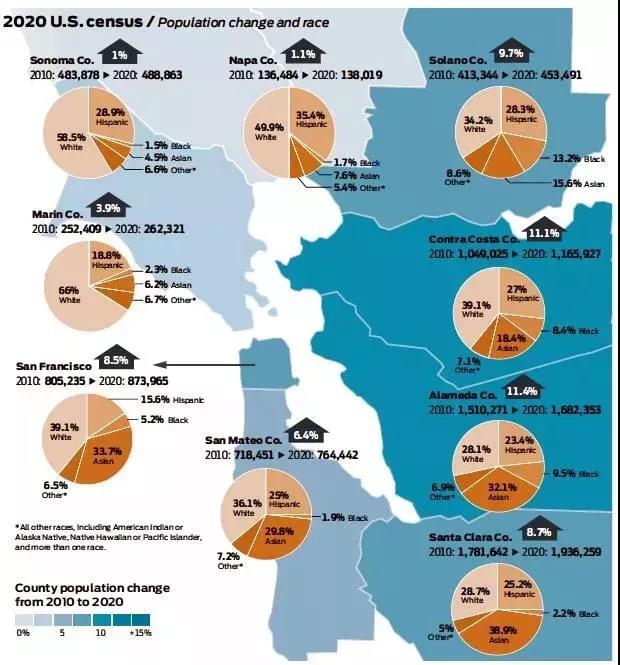

3. 亚裔占领高新区

报告指出,在加州圣克拉拉县,亚裔首次成为了该县最大的种族群体,占了总人口的38.9%,而我们所熟知的硅谷坐落于此,该地区的亚裔人口总数较2010年的人口普查数据增长了3分之1,增加了近19万人。

除了南湾圣克拉拉县,在湾区的另一个人口大县——东湾阿拉米达县(Alameda),亚裔也是第一大种族,占到全县人口的32.1%,亚裔人口50多万人;此外,旧金山县的亚裔人口占1/3,虽然比白人的39%略少,但也是不可小觑的一股力量。

Key facts about Asian Americans, a diverse and growing population

BY ABBY BUDIMAN AND NEIL G. RUIZ

5/25/2021

The U.S. Asian population is diverse. A record 23 million Asian Americans trace their roots to more than 20 countries in East and Southeast Asia and the Indian subcontinent, each with unique histories, cultures, languages and other characteristics.

The 19 largest Asian origin groups in the United States together account for 97% of the nation’s total Asian population. Below are key findings about these Americans. (This analysis includes all those who identify their race as Asian alone or as part of a multiracial background, regardless of Hispanic origin. It is accompanied by updated fact sheets that describe key demographic and economic characteristics of each of Asian origin group, as well as by another analysis that details the diversity of origins within the Asian American population.)

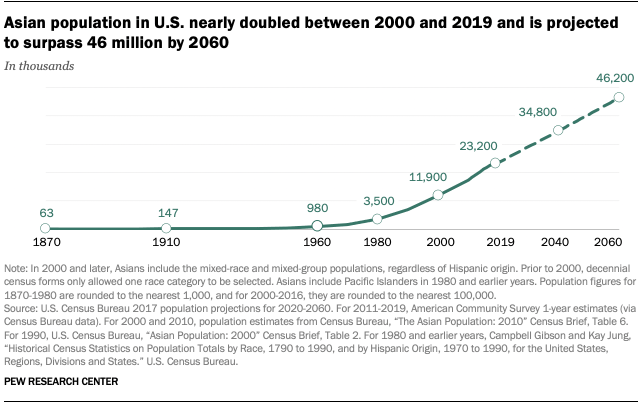

The U.S. Asian population is projected to reach 46 million by 2060. In the 1870 census, roughly 63,000 individuals were classified as Asian by U.S. Census Bureau enumerators. By 1960, the first time census respondents could choose their own race, 980,000 individuals self-identified as Asian. The nation’s Asian population rose to 11.9 million by 2000 and then nearly doubled to 23.2 million by 2019 – a 95% increase within two decades. Asians now make up about 7% of the nation’s overall population, and their numbers are projected to surpass 46 million by 2060, nearly four times their current total. (In decennial censuses conducted in 1980 and earlier, Asian Americans and Pacific Islanders were reported as a single group.)

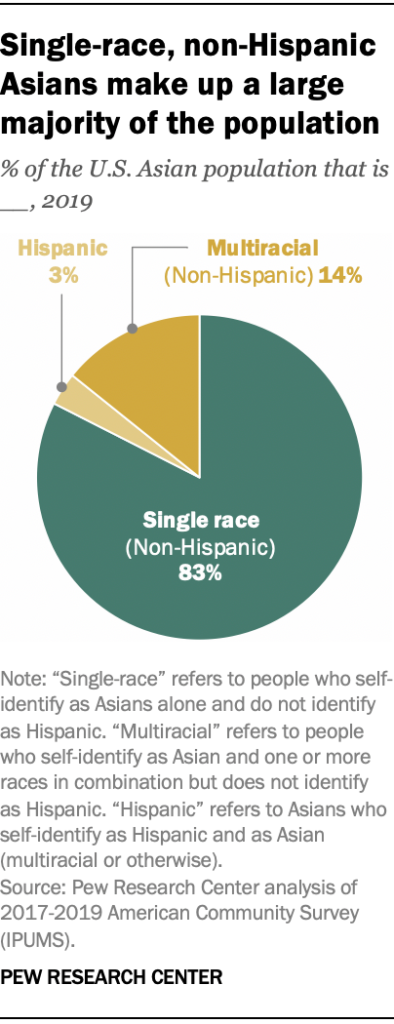

The single-race, non-Hispanic segment of the U.S. Asian population makes up a large majority (83%) of all Asians in the country. This population is also the nation’s fastest-growing racial or ethnic group. Between 2000 and 2019, their numbers grew by 81%, outpacing a 70% increase among Hispanics. The Black population grew by 20% during this span, while there was virtually no change in the White population.

Multiracial and Hispanic Asians comprise 14% and 3% of the Asian population in the U.S., respectively. Those who identify as Asian and White make up a large majority (70%) of non-Hispanic multiracial Asians. Of the 19 origin groups included in this analysis, Japanese Americans are most likely to identify as multiracial non-Hispanic (32% do so). Around one-in-five Filipinos (18%) and 15% of Koreans also identify as multiracial non-Hispanic.

Asian Hispanics, meanwhile, are the smallest segment of the nation’s Asian population. A 34% plurality of this group are Filipino.

Chinese Americans are the largest Asian origin group in the U.S., making up 23% of the Asian population, or 5.4 million people. The next two largest origin groups are Indian Americans, who account for 20% of the total (4.6 million people), and Filipinos, who account for 18% (or 4.2 million people). Those with roots in Vietnam (2.2 million), Korea (1.9 million) and Japan (1.5 million) each have a population of at least 1 million. The other 13 groups in this analysis account for 12% of all U.S. Asians, totaling 2.7 million people, with no one group surpassing 600,000. The remaining 3% of U.S. Asians provided other origins or indicated they are Asian but did not indicate an origin.

Nearly half of U.S. Asians (45%) live in the West, with nearly a third (30%) in California alone. California had an Asian population of roughly 6.7 million in 2019, by far the nation’s largest. It was followed by New York (1.9 million), Texas (1.6 million), New Jersey (958,000) and Washington (852,000). A majority of U.S. Asians (55%) lived in these five states.

Aside from Hawaii, where U.S. Asians accounted for 57% of the population in 2019, Asians made up the largest share of the overall population in California (17%), Washington (11%), New Jersey (11%) and Nevada (11%).

While a plurality of Asian Americans lived in the West in 2019, some 24% lived in the South, 19% in the Northeast and 12% in the Midwest.

Around six-in-ten Asian Americans (57%), including 71% of Asian American adults, were born in another country. By comparison, 14% of all Americans – and 17% of adults – were born elsewhere.

The modern immigration wave from Asia has accounted for a quarter of all immigrants who have arrived in the U.S. since 1965. But when and how Asian immigrants arrived in the U.S. varies, which helps explain why some Asian origin groups are more likely than others to be U.S. born. For example, immigrants account for only 27% of Japanese Americans, who began arriving in the 19th century as plantation workers in what is now the state of Hawaii. By contrast, many Bhutanese arrived recently as refugees, and a large majority (85%) are foreign born.

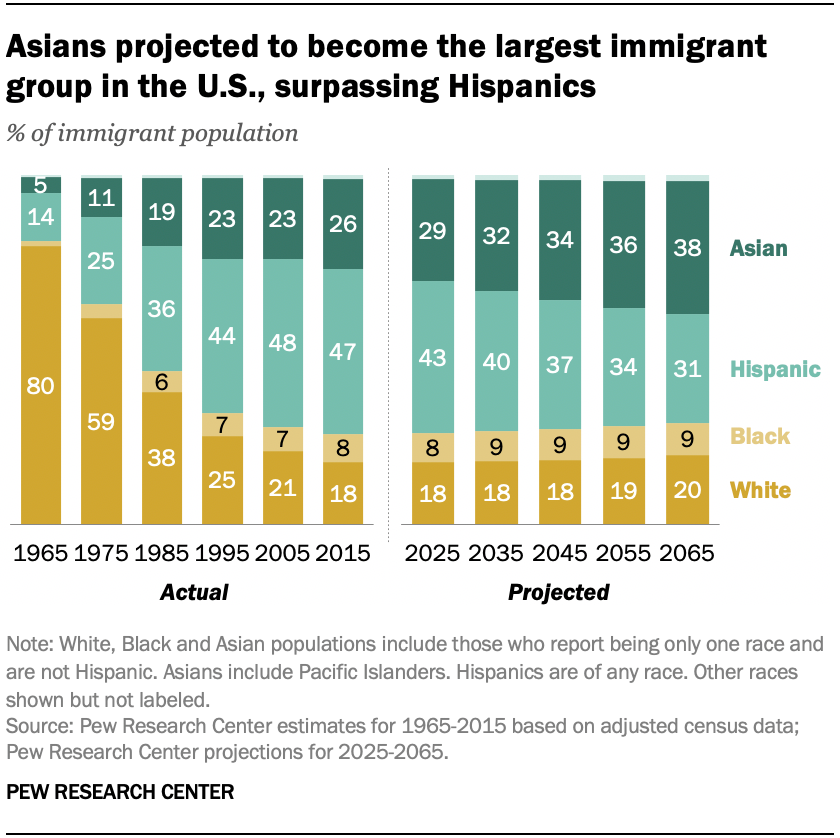

Asian Americans are projected to be the nation’s largest immigrant group by the middle of the century. Single-race, non-Hispanic Asians are projected to become the largest immigrant group in the country, surpassing Hispanics in 2055. By then, Asians are expected to make up 36% of all U.S. immigrants, while Hispanics will make up 34%, according to population projections from the Pew Research Center.

People from Asia made up about 14% of the 10.5 million unauthorized immigrants in the U.S. in 2017. Four nations in Asia were among the top 15 countries of birth for U.S. unauthorized immigrants: India (525,000), China (375,000), the Philippines (160,000) and Korea (150,000).

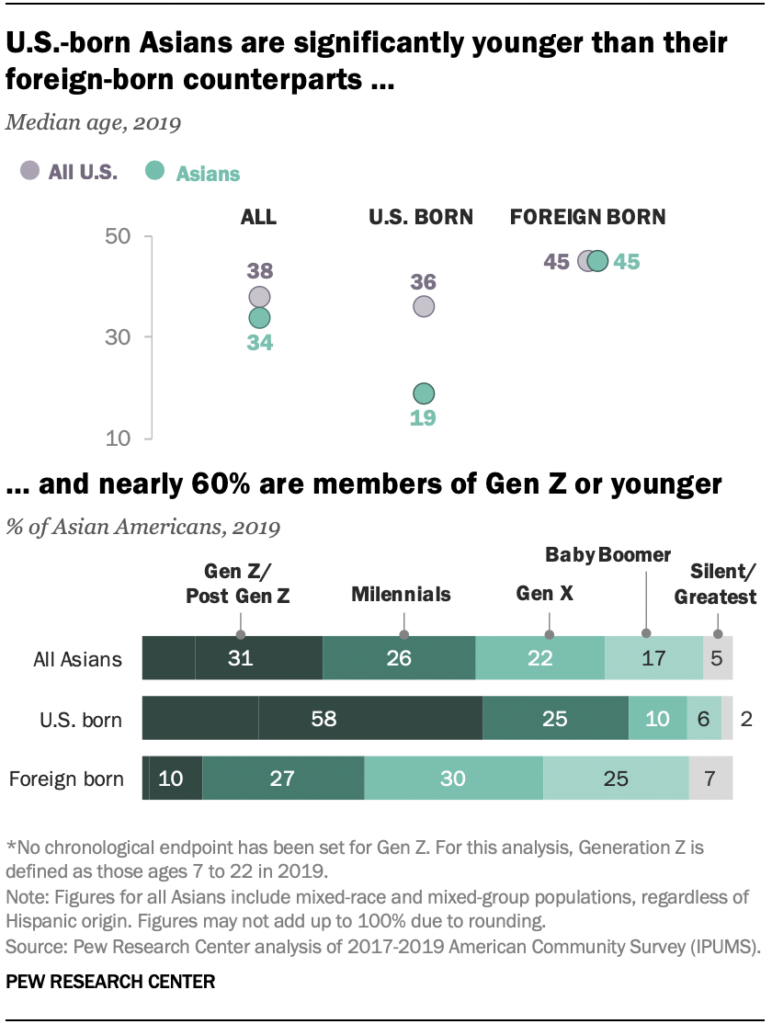

U.S.-born Asians are substantially younger than the rest of the Asian American population. As of 2019, the Asian population in the U.S. had a median age of 34, slightly lower than the nation’s overall median of 38. But the median age of U.S.-born Asians was just 19 – compared with 36 among all U.S.-born people. Foreign-born Asians, meanwhile, had the same median age as the nation’s overall immigrant population (45).

The relative youth of the U.S.-born Asian population is reflected in their generational breakdown. Nearly six-in-ten U.S.-born Asians (58%) were members of Generation Z in 2019, which means they were 22 or younger at the time. Another quarter of the U.S.-born Asian population that year belonged to the Millennial generation, while one-in-ten or fewer were part of Generation X or older generations.

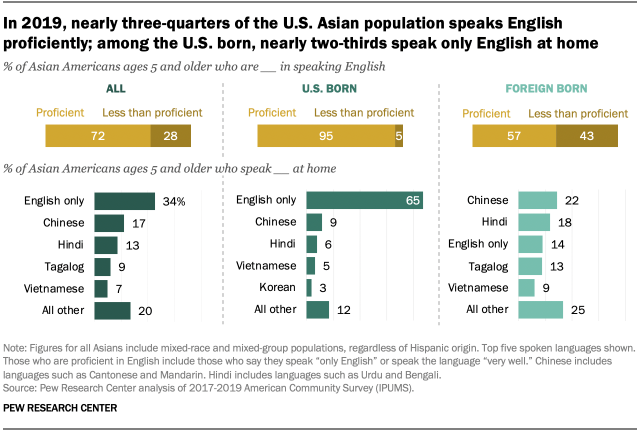

Overall, 72% of all U.S. Asians were “proficient” in English as of 2019, meaning they either spoke only English or spoke the language very well. Nearly all U.S.-born Asians (95%) were proficient in English, compared with 57% of foreign-born Asians.

About a third of U.S. Asians (34%) speak only English in their homes. The remaining 66% speak a language other than English at home. The most common of these is Chinese, including Mandarin and Cantonese, spoken by 34% of Asians at home. Hindi (13%) is the second most commonly spoken non-English language among Asians, followed by Tagalog and other Filipino languages (9%) and Vietnamese (7%).

Nearly two-thirds of U.S.-born Asians (65%) speak only English at home. Most Asian immigrants, by contrast, speak a language other than English at home. Chinese is the most commonly spoken language among the foreign-born Asian population (22%), followed by Hindi (18%).

About a quarter of Asian Americans (27%) live in multigenerational households. That’s comparable to the share among all immigrants in the U.S. (28%), but higher than the share among Americas overall (19%). Asians who are immigrants are slightly more likely than U.S.-born Asians to reside in households with multiple generations under one roof (29% vs 23%).

Asians have a lower homeownership rate than the U.S. public overall (59% vs. 64%). Nevertheless, the homeownership rate is on the rise among Asian Americans, increasing from 53% in 2000 to 59% in 2019. Immigrant Asians were slightly more likely than U.S.-born Asians to be homeowners in 2019 (60% vs. 56%). Among the entire U.S. population, however, immigrants were less likely than the U.S. born to own a home in 2019 (53% vs. 66%).

On the whole, Asian Americans do well on measures of economic well-being compared with the overall U.S. population, but this varies widely among Asian origin groups. In 2019, the median annual household income of households headed by Asian people was $85,800, compared with $61,800 among all U.S. households. Foreign-born Asian households earned slightly more than those headed by U.S.-born Asians ($88,000 vs. $85,000).

These overall figures hide differences among Asian origin groups, however. Households headed by Burmese Americans, for example, had significantly lower incomes than Asian Americans overall ($44,400 vs. $85,800). By contrast, only two Asian origin groups had higher household incomes than among Asian Americans overall: those headed by Indian Americans ($119,000) and those headed by Filipino Americans ($90,400).

All told, 12 Asian origin groups had higher median household incomes than the median among all Americans.

Asians are less likely than Americans overall to live in poverty (10% vs. 13% as of 2019). Poverty rates among U.S.-born and foreign-born Asians were 9% and 11%, respectively, that year. The poverty rate among immigrant Asian minors – those under the age of 18 – was slightly higher, at 16%.

Again, there are large differences in poverty rates among Asian subgroups. Most of the Asian origin groups analyzed (12 of 19) had poverty rates that were as high as or higher than the U.S. average in 2019. Mongolians (25%) had the highest poverty rates among Asian groups, while the lowest rate was among Indians (6%).

More than half of Asians ages 25 and older (54%) have a bachelor’s degree or more education, compared with 33% of the U.S. population in the same age range. Similar shares of U.S.-born (55%) and foreign-born Asians (54%) have earned a college degree. Both figures are substantially higher than the share of all U.S.-born people and all U.S. immigrants with a college degree (32% each).

As a result, the housing finance marketplace is now more robust and safer than it was 15 years ago. Any dip in the housing market will be cushioned by these stricter regulations.

Factor No. 2: Pandemic Mortgage Forbearance

When the housing market crashed in 2007, the influx of foreclosures pumped housing supply into areas with falling prices and weak labor markets, while also preventing recently foreclosed borrowers from re-entering the market as buyers. According to the Federal Reserve, foreclosures during a time of high unemployment could depress prices, plunging homeowners across the country deeper into negative equity.

However, in the pandemic era, the effects of mass unemployment bear little resemblance to the Great Recession, thanks in large part to forbearance programs that have allowed homeowners to postpone their monthly mortgage payments without suffering penalties.

Much like economic trends within the U.S. Asian population, there are wide disparities among origin groups. Indians ages 25 and older have the highest level of educational attainment among U.S. Asians, with 75% holding a bachelor’s degree or more in 2019. Bhutanese adults are the least likely Asian origin group to have a college degree (15%).

Note: This is an update of a post originally published Sept. 8, 2017. See full methodology here.

Source: https://www.pewresearch.org/fact-tank/2021/04/29/key-facts-about-asian-americans/

Flat-Fee MLS Listing Service in Northern VA

Helping For Sale by Owner (FSBO) & For Rent by Owner (FRBO)

DIY Landlord – Renting out Properties Safer and Quicker!

By David Chen

4/15/2021

Q. We purchased our first home some years ago, and are about to move to another home. We are considering to keep our first home as an income property. We heard of the free ads on CRAIGSLIST and zillow.com, but some landlord friends told us it could be a challenge to find qualified tenants through CRAIGSLIST and zillow.com. Is there any way to rent our property out quicker and safer with minimum cost? We are the kind of persons who would like to try things ourselves, and have some spare time.

A. You may have already done the initial research and have figured out the range of monthly rent of your property.

If the monthly rent is low such as $1600.00 or below, you may want to do it through CRAIGSLIST, https://postlets.com/, zillow.com, or similar web sites. The renters interested in the low-priced rentals may not go to the Realtors community for assistance.

If the monthly rent is $1600.00 or above, you may want to consider listing your rental on brightmls.com for the Realtors community to market it for you.

Bright MLS is made up of nine forward thinking MLSs (43 Associations) in the Mid-Atlantic region who put aside their differences and came together with a shared vision to help solve MLS market overlap and empower everyone to get more out of the MLS. Bright will serve parts of 6 states plus Washington, D.C. encompassing 85,000 real estate professionals who serve over 20 million consumers and facilitate approximately 250,000 transactions a year that are valued at more than $70 billion.

Dozens of public real estate websites (such as: zillow.com, redfin.com, brightmlshomes.com, etc.) pull data from brightmls.com through syndication. In a few hours, your listing will show up on dozens of websites and will get the maximum exposure. It is a lot quicker and safer finding qualified tenants than doing it through CRAIGSLIST and zillow.com. You may talk with a Realtor for assistance. Please be aware some Realtors take rental jobs, some don’t.

Over the years I have helped some landlords in the community renting their properties out with very low cost. A popular arrangement is to help the landlords ‘DIY’, which has been working well for those experienced landlords.

The good side of ‘DIY’ is that the landlords can ‘screen’ the potential tenants from the very beginning, have 100% control of the whole process, and enjoy the feeling of “on top of things”.

If you prefer minimum service, I can help you ‘DIY’:

1. I provide CMA, list your rental on brightmls.com, put a realtor’s lockbox at the front door if needed, provide the access log (if needed), support you through the whole process.

I charge a flat fee for the minimum service.

2. If you would like me to prepare the lease or review the lease, there is another reasonable flat fee. This service is optional.

3. You answer phone calls, work with the tenant (if the tenant doesn’t have an agent) or the tenant’s agent, run credit check, verify employment, check references, etc.. You pay the tenant’s agent (if there is one) directly on the move-in date – usually 25% of first-month rent.

If you need full-service, the commission is first-month rent – which includes the commission to be paid to the tenant’s agent.

If you need any customized service (between minimum service and full-service), we can work out an agreement.

Some information:

CMA stands for Comparable (some called Competitive) Market Analysis, that will help you determine the market value of your property for sale or for rent.

I use Sentry-key lockbox. Any Realtor with membership of NVAR (Northern Virginia Association of Realtors) or any other VA Realtors association can access and show the property.

The access log tells when the agents enter the property and their contact info. which can help you follow up with the agents.

If you like the DIY experience, I would recommend you to use the minimum service.

Please feel free to reach me if you need any assistance.

—

David Chen

Realtor (Licensed in VA) | Neighborhood Specialist (McLean, Falls Church, Vienna)

Libra Realty, LLC

dchenj@gmail.com

703-395-5406

WeChat ID: dchenj2015

Last update: 4/15/2021

Websites that will show your flat fee mls listings

4/15/2021

Almost all real estate websites that offer the ability to search brokerage listings use a data feed from the MLS called Internet Data Exchange (IDX) to pull in listing data. Depending on the number of sites tapping into your MLS, your listing could appear on hundreds of websites. We do not control the content of any of the websites listed below. updated periodically & subject to change at any time Here are some examples of national websites by area that pull listings from the MLS:

This block contains unexpected or invalid content.Attempt Block Recovery

- Zillow

- Trulia

- Move.com

- MSN.com

- REALTOR.com

- REMAX.com (in markets where they have an office)

- ZipRealty.com (in markets where they have an office)

- Yahoo.com / Prudential (in markets where they have an office)

- Google Base

- Redfin

- Yahoo Classifieds

- AOL Real Estate

- HomeGain

- Lycos

- Oodle

- Hotpads

- HomeSeekers

- ColdwellBanker.com

- Cenutry21.com

- HouseFront

- CondoQuickFind

Here are just a few examples of local media websites that pull listings from the MLS in their area:

- AZCentral.com (Phoenix, Arizona)

- Chron.com (Houston, Texas)

- DallasNews.com (Dallas/Fort Worth, Texas)

- DenverPost.com (Denver, Colorado)

- LATimes.com (Los Angeles, California)

- MySA.com (San Antonio, Texas)

- RGJ.com (Reno, Nevada)

- SignOnSanDiego.com (San Diego, California)

- StarBulletin.com (Honolulu, Hawaii)

- Tucson.com(Tucson, Arizona)

Here are just a few examples of local brokerage websites that pull listings from the MLS in their area:

- BishopRealty.com (Payson, Arizona)

- Boulderco.com (Boulder, Colorado)

- C21MoneyWorld.com (Las Vegas, Nevada)

- ColdwellBanker-Idaho.com (Coeur d’Alene, Idaho)

- Ebby.com (Dallas, Texas)

- Floberg.com (Billings, Montana)

- LongRealty.com (Tucson, Arizona)

- SantaFeSIR.com (Santa Fe, New Mexico)

- TB.com (Spokane, Washington)

Additionally, here are just a few examples of local REALTOR® Boards or MLS’s that have a public view portal. (Not all boards have this feature):

- ABQREALTORS.com (Albuquerque, New Mexico)

- AlaskaRealEstate.com (Anchorage, Alaska)

- AustinHomeSearch.com (Austin, Texas)

- HAR.com (Houston, Texas)

- HavasuRealtors.com (Lake Havasu City, Arizona)

- HICentral.com (Honolulu, Hawaii)

- mlslistings.com (San Jose, California)

- SFAR.com (Santa Fe, New Mexico)

- TARMLS.com (Tucson, Arizona)

These are just examples. Your listing could literally show up at hundreds of other websites.

Source: https://www.congressrealty.com/Flat-Fee-MLS-Listings/Sites-with-Listings/default.aspp