Why Home Depot Sales Predict the Housing Market

Want to know if the housing market is heating up or cooling down? Look at Home Depot, apparently.

By Devan McGuinness

8/22/2021

Experts and buyers have had their eyes on the booming housing market, but a new sign might point to a plateau or a slowdown.

This past year, the housing market has exploded. The pandemic increased the demand for homes and paired with the tight supply and low mortgage rates, it was a seller’s market. As a result, home prices skyrocketed, often going way above the asking price. There’s been lots of crystal ball gazing about whether or not the market is slowing down, but recently, one subtle change took place, and it might be a sign that things are slowing or at least reaching a plateau.

Home Depot – a homeowner’s favorite place to spend all their money on home improvement projects – saw a dip in sales during its second quarter.

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

“Although Home Depot’s second-quarter earnings and revenue topped forecasts on Tuesday morning, a few stats were concerning,” CNN Business explains. “For example, same-store sales growth, which measures how well locations up at least a year are doing, rose just 3.4 percent in the US.”

It’s a “big drop off” from what the company expected. And it sounds like its competitor store, Lowes, saw similar numbers. “Economists are forecasting a drop in housing starts from June and that building permits will be flat,” the publication reports.

Now, of course, several factors could be playing into Home Depot’s drop. For example, maybe homeowners did most of their extensive home renovations last year when they had more time (with all the lockdowns), or they’ve fixed and changed everything already. Or it could be a drop in price since the skyrocketing lumber prices are starting to normalize. Or homeowners’ cash is strapped for a variety of potential reasons.

“If prices plateau, it’s a neutral conundrum,” the Washington Examiner explained after speaking with Patrick Gourley, an assistant professor of economics at the University of New Haven. “Because it means that the housing market isn’t getting worse, but it also isn’t getting any better for those who want to go out and purchase a home.”

Whatever the case, we’re sure Home Depot is going to be just fine. And a housing market plateau or dip down is probably better for the majority of people in the country who are trying to buy a house.

Are we experiencing a K shaped recovery from COVID-19?

By: Kariappa Bheemaiah, Associate research scientist , Cambridge Judge Business School

Mark Esposito, Chief Learning Officer, Nexus FrontierTech

Terence Tse, Executive Director, Nexus FrontierTech

02/14/2021

Image: REUTERS/Carlo Allegri

- Typical economic recoveries can include V, W, Z, U and L.

- However, economists are starting to think the recovery from COVID-19 might be K-shaped.

- This is likely as technology and large capital firms are expected to recover at a far faster rate than small businesses and industries directly affect by COVID-19, such as hospitality.

Since the start of the pandemic, we’ve heard about different recovery curves: Z-shaped recovery (optimistic: downturn, bounces back to pre-crisis growth), V-shaped (optimistic: steep decline, quick recovery), U-shaped (somewhat pessimistic: period between decline and recovery), W-shaped (pessimistic: recovery, second decline), and L-shaped (most pessimistic: extended downturn).

More recently, JP Morgan introduced the K-shaped recovery curve, which paints a more realistic, yet unpleasant, picture. As per their analysis, the covid-19 recovery path bifurcates in two directions: large firms and public-sector institutions with direct access to government and central bank stimulus packages will make some areas of the economy recover fast but leave others out. Those that get left out are the usual whipping boys: small and medium-sized enterprises (SMEs), blue-collar workers, and the dwindling middle class.

Businesses with access to government and central bank stimulus are expected to recover faster. Image: Nicolas Gavrilenko

Businesses with access to government and central bank stimulus are expected to recover faster. Image: Nicolas Gavrilenko

The quandary of economic pollution

Misallocation of stimulus funds or emergency subsidies makes some areas of the economy recover fast but leaves out others. In economics, this is known as The Cantillion Effect, which refers to the change in relative prices resulting from a change in the money supply. When liquidity is injected into the market, there are distributional consequences that operate through the price system. Prices act as viable signals, as relative price changes occur because the change in money supply has a specific injection point, and therefore a specific flow-path through the economy.

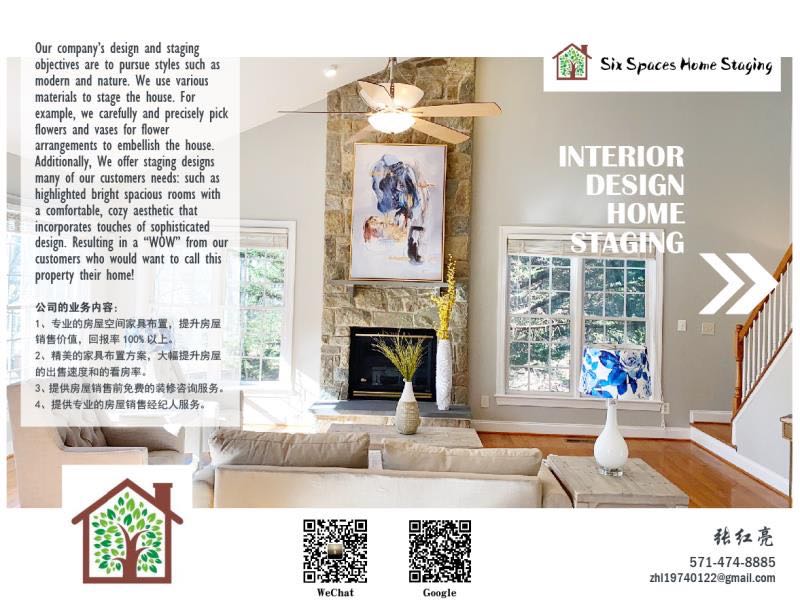

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

If the injected liquidity or subsidies go toward specific industries or market players, it leads to greater inequality, dips in demand curves, and increasing levels of unemployment and private debt. As unemployment and private debt levels increase, so do defaults. And if the institutions that issue the debt are “too big to fail,” then the defaults they incur result in government bailouts, effectively converting private debt into public debt. This phenomenon was given the term “economic pollution” by Adair Turner, ex-chairman of the Financial Services Authority, and was one of the primary forces behind the 2008 crisis.

If we look at changes in employment levels and prices since the beginning of the pandemic, we start seeing the manifestation of the K shape. Considering that SMEs account for 66.4% of employment in the EU-28 and are significant contributors to economic activity (small businesses generate 44% of US economic activity), we need to acknowledge that a K-shaped recovery is a rising tide that sinks all boats.

But acknowledgment without action is a waste of time. And the time to act is now, as the K-shape seems to be gaining acceleration. A recent Yelp Economic Average report shows that while some businesses are reopening, many remain closed. As the recessionary environment continues to simmer, it also makes the recovery curve lethargic. The higher the level of unemployment in a recession, the longer the recovery curve—and this crisis is going to have an exceptionally long recovery curve.

Technology: A proxy antidote to economic pollution

Given the urgency of the situation, the focus needs to be on tempo. Waiting for government policies to ensure proper capital allocation, or better supply-side economic policy changes—like less red-tape for opening a business or less tax burden—is a luxury most businesses and workers simply do not have. The working capital of businesses needs to be propped up via sales as security comes from revenue streams. It is here that technology plays a crucial role, as it acts as a key enabler of productivity growth and new revenue streams when leveraged intelligently.

For example, as an increasing number of office workers began working online, the virtual conferencing platform Zoom experienced an unprecedented increase in traffic—a challenge their data centers were not suited for. Thankfully, as their entire business had migrated to the cloud, their partnership with Amazon Web Services (AWS) allowed them to address this challenge. CEO Eric Yuan told Forbes: “We had a 20X increase in [annual meeting minutes] run rate, from 100 billion at the end of January 2020, to over 2 trillion meeting minutes in April 2020 … Scaling capacity to meet this increase in traffic and use cases, while providing reliable, uninterrupted, and high-quality services for our customers … could not have done it without relying on our [cloud] partners. When the crisis started, our own data centers could not scale fast enough … fortunately, our partner AWS … was able to respond quickly by provisioning the majority of the new servers we needed, sometimes adding several thousand a day for several days in a row.”

Not only could Zoom respond to a growing need, but its flexible cloud-based operating model also led to a steep acquisition of paying customers. It’s not just purely tech firms that can benefit from the smart use of technology and partners who understand their needs. As the pandemic unrolled, Texas retail giant H-E-B used data from Chinese and European retailers who were further along the covid curve, to determine what the emerging needs of consumers would be, revamped their supply chains to respond to upcoming demand shifts, and partnered with local restaurant suppliers and other disrupted businesses to fill gaps in stock and distribution. Not only were they able to respond to new needs, but by partnering with local firms, they were able to create new supply chains that benefit the local economy. A win-win scenario that stemmed from data analysis.

Fighting the K-shaped curve via a tech-led strategy

Whether it involves robotic process automation, AI that is fed on multivariate data, or augmented reality to increase sales on Facebook and Instagram shop, almost every business today is now a tech business. Being able to use technology to address concerns that are not being addressed by government stimulus packages is the first and crucial step in ensuring that businesses can remain operational and shorten the unemployment recovery curve seen above.

On a more strategic and practical level we offer the following insights that can act as guidelines of continuous adaptation to the multiple new normals we will see as the future unrolls:

- Move from well-defined strategy execution and refinement to —>Continuously experimenting with strategy. Data and simulation-based strategy are quintessential here.

- Rather than having a laser-focus on well-defined sequential goals —>Pursue superordinate goals that are pertinent under a wide range of conditions.

- Move away from optimizing your workflows —> Buffering your workflows (i.e.: making the processes resilient enough to withstand shocks via fire drills and chaos engineering).

- Rather than hunting for talent with best-fit and clear and stable job descriptions —> Hire people who can adapt to open-ended roles.

The importance of using technology as a lever of adaptation and survival is going to become increasingly important as covid-19 instigates changes in consumer preferences and increases their use of digital platforms. If before technology was seen quasi-exclusively as the panacea of all troubles, it may be time just now to collectively design it toward solutions of which we are in dire need.

Source: https://www.weforum.org/agenda/2020/12/k-shaped-covid19-coronavirus-recovery/

Understanding the K-shaped economic recovery

Osler Hoskin & Harcourt LLP

02/14/2021

COVID-19 is a natural disaster of the first order. It is altering the very fabric of our society, that much is clear. Predicting how this will all turn out is, of course, very difficult. But what we can do is to help people understand the forces acting on the economy so they can make more informed personal and business decisions.

The natural response to the pandemic last spring was to shut everything down, asking people and their children to stay home. Those who could work from home did so, while essential front-line workers went about their business, proving how essential they really are. Things stabilized during the summer, but as autumn unfolded so did a second wave. Having learned a few things, governments imposed much more targeted second-round shutdowns.

Where do we go from here? Obviously, much depends on how the infection curve plays out. For the economy, the best descriptor of the situation I have seen so far is the letter “K.” Usually, when the economy experiences a setback, economists look for a “V-shaped” recovery, where all the lost activity is made up fairly quickly. If the recovery is slower than hoped, it is called a “U”; if there is a double-dip, it is a “W”; and if it is a depression, then the dreaded “L-shape” is what emerges. The second wave could produce a “W” but looking forward the “K” is still apt. It captures a basic idea – that the pandemic is having significant adverse economic effects on some parts of the economy (the bottom part of the K) and having very little effect on others (the top part of the K).

When we look at the economy as a whole, we need to understand that there are really two different economies operating. One economy is under considerable stress, with companies struggling for survival. The other economy is going about its business, and there are even signs of excess demand.

Understandably, most of the news and commentary has been about the bottom part of the K. There have been significant impacts on restaurants and bars, hotels, airlines, in-person retail and the oil business. As well, small businesses of all stripes are being affected by the plunge in daily commuting – with so few people going downtown, everything from the corner café to your clothing store to your drycleaner has seen a severe drop in demand.

The rest of the economy is in the top part of the K, where we see a classic V-shaped recovery from the spring shutdown. Even though the shutdown was very widespread, economic activity fell during March and April to a level 19% below where it was before all this started. The economy began to recover as restrictions were eased in May, and by autumn was operating at over 95% of its February level.

The data on employment also suggest that the bottom part of the K represents less than 5% of the economy. Some three million people lost their jobs during the shutdown and many more were working shorter hours than usual. By November, the level of employment had recovered to a point where there were less than 600,000 fewer jobs than in February. That is still close to 3% of the workforce, which of course explains why the unemployment rate in November was 8.5%, while it was 5.5% at the start of the year.

The government’s income support programs deserve much of the credit for preventing a much deeper downturn in the economy. Banks’ willingness to defer mortgage and loan payments also merit recognition. As a consequence, retail sales have recovered completely, and in September were 3% above the level of last February – a classic V-shaped recovery. Even so, Canadians have boosted their savings considerably.

What this means is that when we look at the economy as a whole, we need to understand that there are really two different economies operating. One economy is under considerable stress, with companies struggling for survival. The other economy is going about its business, and there are even signs of excess demand, particularly in housing construction, renovation and home resales. This is a very human reaction – when people cannot travel, dine out or socialize, they spend their money feathering their nest instead. This is exactly what people did immediately after 9-11. At that time, economists predicted a major global economic slowdown that never materialized because people chose to spend their money around the house instead of travelling.

The economy’s “K” and the diverse responses of Canadian companies is clearly reflected in the activities at Osler during the past year. Many important transactions were derailed by the arrival of the pandemic, of course. But as the situation evolved, firms in the top part of the K shifted into expansion and acquisition mode and the capital markets continued to provide investment opportunities. The Fourth Industrial Revolution – the digitalization of business and the deployment of artificial intelligence – appears to have been accelerated by the pandemic, both in customer service channels and in employment channels. Global supply chains, already under review in light of U.S. protectionist policies, were quickly reorganized to ensure domestic supplies of strategic health care items. Indeed, Canada’s health care system, under strain for obvious reasons, was forced to innovate – adopting automated appointment management, video consultations and around-the-clock diagnostics and surgical delivery. Meanwhile, the bottom part of the K saw numerous mergers, restructurings or, sometimes, insolvencies. The associated labour market stresses meant a busy year for employment law. At the same time, entrepreneurs created and investors invested in thousands of new and growing businesses in Canada.

Since part of the economy is struggling, it will take a long time for the total economy to return to normal, even if most of it already has. People who have been displaced permanently from their jobs will need help to shift to sectors of the economy where there is more economic growth, like the construction and renovation sector, for example. They will need government support during that transition, along with enhanced programs for training and cross-country mobility. Canada has managed through major shocks before, including the 2014 collapse in oil prices. Our system has also managed through periods of much higher unemployment than we are experiencing today.

Nevertheless, many are wondering how governments are going to pay for all this. Indeed, the International Monetary Fund has projected that public debt will exceed 100% of global GDP in 2021. However, it is worth noting that this is not unlike the situation the world faced in the mid-1940s. Most baby boomers today have no memory of labouring under the debt burden left behind by World War II. In fact, our economy grew its way out of that debt burden.

There is no reason why this cannot happen again. Technically, the critical debt sustainability condition requires that headline economic growth (including inflation) be greater than the rate of interest that governments must pay on their debt. In that situation, regular debt service payments stay low, while total debt shrinks as a share of the economy. To help ensure this outcome, governments can do three things in particular. First, they can lock-in long-term financing at today’s very low interest rates. Second, they can ensure that their spending programs are aimed at growth-enhancing investments – including physical infrastructure , digital infrastructure, and social infrastructure like daycare and education – and more immigration. Third, they can eliminate inter-provincial barriers to trade and worker mobility, thereby adding meaningfully to long-term economic growth.

The Canadian economy will never be the same as it was before the pandemic. A return to normalcy will mean a new normal, with many scars from this experience. But we can be confident that Canada’s fundamental strengths – its unique and extensive resource base, its world-class financial system, and its diverse and talented people – will continue to serve us well.

Source: https://www.lexology.com/library/detail.aspx?g=d3318b07-c332-4460-81e2-42db062a947d