亚洲最贵房市开始「退烧」背后有共通点

世界新闻网

4/08/2022

经历去年的惊人涨势后,亚太地区的一些最贵房市开始降温。上季,雪梨和香港的房价下跌,新加坡则几乎没涨,因买家担心升息以及不利于经济成长的因素,选择场边观望。

局势的转变很突然,先前,疫情期的借贷成本低加上害怕错过的心理,掀起从加拿大多伦多到新西兰奥克兰的全球「购房热」:雪梨的房价去年飙升近27%,新加坡房价出现逾十年来最大涨幅,香港仍旧是全球房价最难负担的城市。

但在澳洲人口最多的城市,房价继2月挫低后、3月再跌0.2%,中止了2020年10月开始的连涨之势。新加坡私人住宅的价格上季仅微幅上涨0.4%,3月的销售则降到21个月来最低。香港房价去年涨势如虹,但去年8月再创新高后,至今下跌7.3%,高盛对后市看法悲观,预测2025年前大跌20%。

尽管各地的情况不同,但房市放缓的背后有一些共通点。对民众能否负担房价的忧虑,促使新加坡实施买房限制并调高税率,而通膨风险导致多国央行考虑升息,使购屋者支付房贷变得较为吃力。

与此同时,疫情加重中国房市面临的阻力。香港防疫引发民怨致人口外流严重,而上海的防疫封控措施则使房市快速复苏的希望落空,当局监格严管债台高筑的房地产开发商造成景气下滑。

Knight Frank亚太区住宅业务主管Victoria Garrett表示:「自全球金融危机以来,亚太地区的政府对资产价格上涨较为警觉,疫情也使贫富差距扩大的问题受到关注。虽然房市从卖方市场转向将带来更多机会,但买方可能挑挑拣拣,并对价格敏感。」

Garrett估计,今年本区的住宅价格涨幅将在较为温和且较有持久性的3%到5%之间。去年涨幅高达9.1%。有一些市场的需求仍能维持,因为余屋不足的问题不太可能在未来12个月获得缓解。而且,升息还在最初阶段,买主还有机会取得不错的贷款利率。

其他地区的房市仍未受阻。在英国,3月的房价上涨速度,创2004年以来最快年增幅,全美20大城市的房价也持续激涨。

房价2年飙涨逾50% 加拿大打炒房、拟禁外国人买房

世界新闻网

4/07/2022

消息人士透露,为使交易火热的房市降温,加拿大计划两年内禁止多数外国人买房,同时拨款数十亿美元鼓励保障性住房这类建设活动。

彭博资讯报导,加国财政部长方惠兰(Chrystia Freeland)将在今(7)日公布预算案,其中预料包含这些措施。

加拿大是全球最贵的房地产市场之一。禁止外国人买房,显示加国总理杜鲁多对房市降温愈发坚定,而且政府日益担心通膨带来政治冲击和推升住房成本上涨。

加国房价两年来飙涨逾50%,2月房价更写下创纪录的月增幅,购屋者急忙在加国央行升息前采取行动,推升一户住宅的基准价格涨至86.93万加币(69.3万美元)。

消息人士说,禁止外国人买房这项政策不适用于学生、外籍劳工或已取得加拿大永久居留权的外国公民。

加国财政部的数十亿美元预算将用于兴建保障性住房,和帮助地方政府更新系统以加快兴建新屋。

华裔夫妻400万抢豪宅后反悔 房没了还惨赔百万

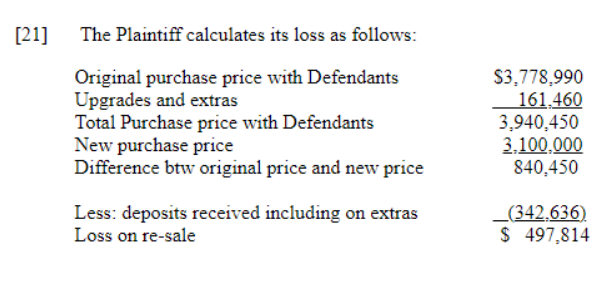

来源:加国无忧

10/13/2021

随着加拿大新冠疫苗接种率不断提高,在经济重启之下,安省甚至整个加拿大的房价开始疯狂。好房难求,加价几十万抢房都是常态。但在安省Thornhill市,一对华裔(专题)夫妇5年前购买了一栋价值近400万的豪宅楼花,却在临近交房的时候,拒绝支付房费准备弃单。结果被开发商一怒之下告上法庭,双方各执一词,最近法庭宣判了该起案件。

近400万买下豪宅,交房时却弃单不要了

在2016年12月4日,该诉讼官司的被告Z女士以3,778,990元,购买了一处位于Thornhill的在建期房房屋,并签署了Agreement of Purchase and Sale(APS)。10个月后,即2017年9月29日,Z女士将APS转让给其丈夫,也就是该案的另一名被告。但在2018年11月16日,也就是约定交房日期,在开放商已经做好一切交房准备后,被告却反悔不想履约购买该房产。

被告提三点理由解围,申诉自己英文不佳

针对为何会在临近交房日期时,突然毁约拒绝履行购房合同。华裔购房夫妻给出了自己的理由。

迫于房产商销售代表压力购买。Z女士认为,他们并不是成熟的购房者,当时购买房屋时是迫于销售代表的压力。而且他们也没有时间好好阅读APS,去真正理解里面的各项条款,和应该注意的事项。

英文不好存在语言障碍。这一点也是被告方主力陈诉的观点,他们表示存在语言障碍,英文并不是母语,所以不能好好理解APS的内容。

房屋有地下水污染限制发展。被告方称他们因为语言问题,而且不是有经验的买家,所以忽略了购买房地产时应该注意什么。他们称环境部(”MOE”)对该房产发放的财产使用证书(”CPU”)存在问题没有向他们适当披露。他们说后来才明白,这与受污染的地下水有关,可能会限制该物业的某些用途。

法庭表示存在虚假陈述,三点理由全部被驳回

针对被告方所提出的3点诉求,法庭在听取双方庭辩,并采纳双方证据后,全部驳回。

被告方并非初次购买,属于成熟购买者。根据法庭的判决,认定被告夫妻属于成熟购买者。因为这已经是他们在安大略省购买的第四处房产,而且APS中还有一个为期5天的 “冷静考虑期 “条款,允许他们在认为自己仓促签约的情况下取消交易。

被告方不存在语言障碍。法庭认为,被告是高价值房产的成熟购买者,尽管英语未能达到母语水平,但他们懂英语。同时他们聘请了讲英语和普通话的房地产经纪人向他们提出报价的,该经纪人作证说她与夫妻两人逐条讨论了整个APS的条款。

另外在签署APS时,以及之后的几周内,夫妻还聘请了一名房地产律师,因为他们同时还在谈判另一项房产交易。但就该处纠纷地产的购买,夫妻两人放弃了咨询律师,因为他们认为没有必要。因此他们是有机会获得及时的法律咨询,但自己放弃了。

房屋环境污染有前案例可遵守。针对房屋存在地下水污染问题,法庭认为在购买房屋之前,地产经纪已经逐条解释每一项APS内容,包含关于环境部证书的明显警告条款。此外,APS的每一页都包含了用英文大写字母的提醒:口头陈述不构成本协议的一部分,也不能修改本协议。也就是说被告是完全了解,并知道这个情况的。

此外,之前有另一起房地产交易纠纷与该案件相似,法庭认为可以作为参考。而且在环境问题的反驳中,被告夫妻两人存在明显的虚假陈述。这些都削弱了被告人的上诉立场,即并不存在被APS的内容误导的因素。

夫妻两人还主动升级房屋装修。另一点让法庭质疑的是,在签署APS和成交日期之间,被告从未对房屋交易提出任何质疑,也没有要求对环境问题做更多的披露。反而是主动升级装修,向原告订购了超过16万元的高级装修升级。包括定制的厨房区、主卧浴室、升级电梯、内置酒吧等。

不仅房屋已经转售,夫妻败诉损失过百万

由于被告夫妻弃单,开发商不得不另外找买家。而且因为内部装修升级,成本的上升,售价就必须更高,这使得买家本来就不好找。而且到了2020年新冠疫情爆发,大多伦多地区的房地产销售陷入低谷。

直到2020年7月18日,原告才以310万元的价格重新售出该房屋。但即便如此,这一价格与原本的390万差了80多万。减去被告方已经支付的342,636定金,还有497,814的损失。因此原告方要求华裔夫妻赔偿这笔损失。

最后计算上各种利息,杂费之后,法院判被告方华裔夫妇需要赔偿584,306给原告方,加上已经支付的定金,再算上律师费,总共损失超过百万。

Toronto has the fastest-rising prime home prices in the world

By Laura Hanrahan

8/24/2021

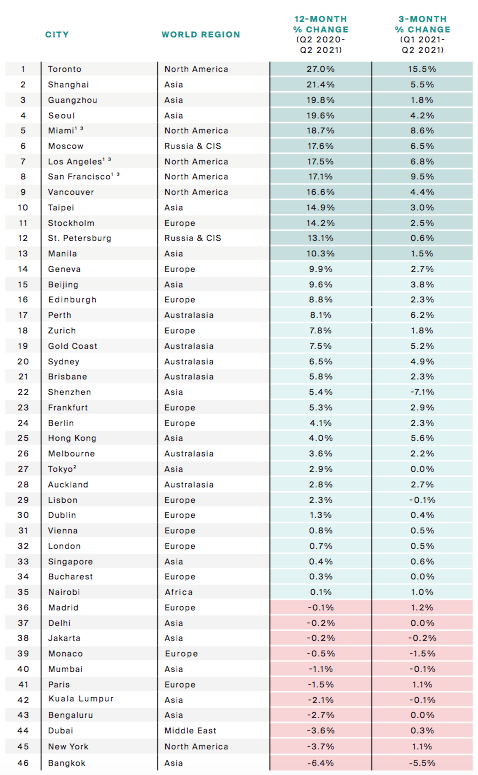

Toronto officially has some of the fastest-rising home prices in any major city in the world, according to a new report.

Although it may be something any Torontonian could have easily guessed, the recently published Prime Global Cities Index from Knight Frank confirmed that Toronto’s prime residential real estate prices are far outpacing other major cities.

Prime real estate is defined as the top 5% of the real estate market.

Toronto beat the next closest city — Shanghai, China — by several percentage points, with Toronto’s prime real estate prices rising 27% year-over-year and 15.5% quarter-over-quarter. Shanghai’s rose 21.4% and 5.5%, respectively.

“Toronto leads this quarter’s results, recording annual prime price growth of 27%, driven by strong buyer appetite and low inventory levels,” the report reads.

Guangzhou, China; Seoul, South Korea; Miami, Florida; and Moscow, Russia, round out the top five.

Canada’s third largest city, Vancouver, also made it on the list, coming in at number nine with 16.6% growth year-over-year and 4.4% quarter-over-quarter.

“Housing markets are undergoing the most unusual of recoveries,” the report reads. “An easing of travel rules in some markets, a surge in safe haven purchases by domestic buyers, a flurry of activity ahead of the tapering of stamp duty holidays, and an overall reassessment of lifestyles and commuting patterns, all set against a backdrop of low interest rates.”

Interestingly, a number of major cities like Paris, Dubai, New York, and Mumbai actually saw declining prime residential real estate prices both year-over-year and quarter-over-quarter.

As for what’s next, Knight Frank predicts that the prospect of rising interest rates, government intervention, and the withdrawal of stimulus measures will help to rein in the market later this year.

“Expect more cooling measures as policymakers grapple with the affordability conundrum,” the report reads. “The Chinese mainland’s long-debated national property tax now looks more likely. We expect to see London, New York, Paris and Dubai move up the rankings in Q3 as travel restrictions ease and international buyers start to recognize the relative value in these cities.”

Apr 20, 2021

Is a Housing Market Crash Possible in 2021?

By Mark Mathis

4/22/2021

With the real estate market experiencing surging prices, scant inventories and a backlog of new home construction, many consumers are wondering if what’s gone up must come back down—in other words, are we headed for another housing market crash? Let’s take a closer look.

Think Back to the Great Recession

The unforeseen housing market crash 15 years ago ignited a worldwide recession. Fueled by low interest rates, loose mortgage-lending standards and the nation’s unshakeable faith in homeownership, home values rose at record rates year-after-year. When the housing bubble burst, roughly nine million families lost their homes to foreclosure or short sale between 2006 and 2014. Housing values plunged 30% or more, homeowners lost a collective $7 trillion and it took nearly a decade for most markets to recover. Even today, several real estate markets have not fully recovered.

With the robust market activity we’ve seen lately, could there be a market crash in the near future? The short answer is “not likely.” Today’s market book cannot be sustained completely, but a crash as serious as the one from 15 years ago is unlikely because of a few important factors.

Factor No. 1: More Stringent Lending Standards

Loose mortgage lending practices ultimately brought down some of the nation’s largest banks and mortgage companies. The fallout forced Congress and federal regulators to make significant adjustments that have fundamentally changed how mortgage lending is regulated.

Since then, standards have been raised and the process of obtaining a mortgage is now more transparent. The “anyone can get one” loans of the past are illegal; now borrowers undergo stricter income, credit and asset checks. An entirely new regulatory agency, the Consumer Financial Protection Bureau, was created to enforce this new regulatory framework. Lenders who do not comply with these standards may face heavy penalties.

As a result, the housing finance marketplace is now more robust and safer than it was 15 years ago. Any dip in the housing market will be cushioned by these stricter regulations.

Factor No. 2: Pandemic Mortgage Forbearance

When the housing market crashed in 2007, the influx of foreclosures pumped housing supply into areas with falling prices and weak labor markets, while also preventing recently foreclosed borrowers from re-entering the market as buyers. According to the Federal Reserve, foreclosures during a time of high unemployment could depress prices, plunging homeowners across the country deeper into negative equity.

However, in the pandemic era, the effects of mass unemployment bear little resemblance to the Great Recession, thanks in large part to forbearance programs that have allowed homeowners to postpone their monthly mortgage payments without suffering penalties.

As of early March 2021, 2.6 million homeowners’ mortgages were in such forbearance plans. As the pandemic economy has slowly recovered, many homeowners have resumed their employment, and thus their home payments. According to CoreLogic, by the end of 2020, overall mortgage delinquencies declined 5.8% due to the forbearance program. The share of mortgages 60 to 89 days past due declined to 0.5%, lower than 0.6% in December 2019.

Housing Market Crash

It’s worth noting that serious delinquencies—defined as 90 days or more past due, including loans in foreclosure—increased when owners who owed large amounts left forbearance. By year end 2020, the serious delinquency rate was 3.9%, up from 1.2% in December 2019.

Factor No. 3: Most Homeowner’s Cushion—Equity

Equity is the difference between the current market value of your home and the amount you owe on it. In other words, it’s the portion of your home’s value that you actually own. Equity can be an incentive to stay in your home longer; if prices rise—something we’ve seen almost universally across the country in recent months—your equity increases, too.

Why does this matter? Simply put, higher levels of equity cushion homeowners from default when home values fall.

Over the past decade, American homeowners have enjoyed housing stability and growth, building up large home equity reserves. In the third quarter of 2020, the average family with a mortgage had $194,000 in home equity, and the average homeowner gained approximately $26,300 in equity over the course of the year. In contrast, 2009 saw nearly a quarter of the nation’s mortgaged homes valued for less than the amount their owners actually owed on those mortgages.

Factor No. 4: Price Growth Will Slow Down, but Continue

The sales boom followed the outbreak of the COVID-19 and surprised many real estate economists. Like most other business sectors, real estate was expected (if not required in many locations) to lock down. But by mid-April, sales were soaring as buyers, many of them millennials, took advantage of record-low mortgage interest rates. Through the remainder of 2020, rates remained below 3%, and existing home sales reached their highest level in 14 years.

A Moving Target

While no one can say for sure what will happen with the real estate sector, most experts are confident that we’ll experience a market dip, but certainly not a crash. In the meantime, there’s plenty of work available for motivated real estate professionals. Find out how Homes.com can help you connect with the current market of active buyers and sellers here!

Source: https://rismedia.com/2021/03/25/housing-market-crash-possible-2021/

Flat-Fee MLS Listing Service in Northern VA

Helping For Sale by Owner (FSBO) & For Rent by Owner (FRBO)

DIY Landlord – Renting out Properties Safer and Quicker!

By David Chen

4/15/2021

Q. We purchased our first home some years ago, and are about to move to another home. We are considering to keep our first home as an income property. We heard of the free ads on CRAIGSLIST and zillow.com, but some landlord friends told us it could be a challenge to find qualified tenants through CRAIGSLIST and zillow.com. Is there any way to rent our property out quicker and safer with minimum cost? We are the kind of persons who would like to try things ourselves, and have some spare time.

A. You may have already done the initial research and have figured out the range of monthly rent of your property.

If the monthly rent is low such as $1600.00 or below, you may want to do it through CRAIGSLIST, https://postlets.com/, zillow.com, or similar web sites. The renters interested in the low-priced rentals may not go to the Realtors community for assistance.

If the monthly rent is $1600.00 or above, you may want to consider listing your rental on brightmls.com for the Realtors community to market it for you.

Bright MLS is made up of nine forward thinking MLSs (43 Associations) in the Mid-Atlantic region who put aside their differences and came together with a shared vision to help solve MLS market overlap and empower everyone to get more out of the MLS. Bright will serve parts of 6 states plus Washington, D.C. encompassing 85,000 real estate professionals who serve over 20 million consumers and facilitate approximately 250,000 transactions a year that are valued at more than $70 billion.

Dozens of public real estate websites (such as: zillow.com, redfin.com, brightmlshomes.com, etc.) pull data from brightmls.com through syndication. In a few hours, your listing will show up on dozens of websites and will get the maximum exposure. It is a lot quicker and safer finding qualified tenants than doing it through CRAIGSLIST and zillow.com. You may talk with a Realtor for assistance. Please be aware some Realtors take rental jobs, some don’t.

Over the years I have helped some landlords in the community renting their properties out with very low cost. A popular arrangement is to help the landlords ‘DIY’, which has been working well for those experienced landlords.

The good side of ‘DIY’ is that the landlords can ‘screen’ the potential tenants from the very beginning, have 100% control of the whole process, and enjoy the feeling of “on top of things”.

If you prefer minimum service, I can help you ‘DIY’:

1. I provide CMA, list your rental on brightmls.com, put a realtor’s lockbox at the front door if needed, provide the access log (if needed), support you through the whole process.

I charge a flat fee for the minimum service.

2. If you would like me to prepare the lease or review the lease, there is another reasonable flat fee. This service is optional.

3. You answer phone calls, work with the tenant (if the tenant doesn’t have an agent) or the tenant’s agent, run credit check, verify employment, check references, etc.. You pay the tenant’s agent (if there is one) directly on the move-in date – usually 25% of first-month rent.

If you need full-service, the commission is first-month rent – which includes the commission to be paid to the tenant’s agent.

If you need any customized service (between minimum service and full-service), we can work out an agreement.

Some information:

CMA stands for Comparable (some called Competitive) Market Analysis, that will help you determine the market value of your property for sale or for rent.

I use Sentry-key lockbox. Any Realtor with membership of NVAR (Northern Virginia Association of Realtors) or any other VA Realtors association can access and show the property.

The access log tells when the agents enter the property and their contact info. which can help you follow up with the agents.

If you like the DIY experience, I would recommend you to use the minimum service.

Please feel free to reach me if you need any assistance.

—

David Chen

Realtor (Licensed in VA) | Neighborhood Specialist (McLean, Falls Church, Vienna)

Libra Realty, LLC

dchenj@gmail.com

703-395-5406

Last update: 4/15/2021

Websites that will show your flat fee mls listings

4/15/2021

Almost all real estate websites that offer the ability to search brokerage listings use a data feed from the MLS called Internet Data Exchange (IDX) to pull in listing data. Depending on the number of sites tapping into your MLS, your listing could appear on hundreds of websites. We do not control the content of any of the websites listed below. updated periodically & subject to change at any time Here are some examples of national websites by area that pull listings from the MLS:

This block contains unexpected or invalid content.Attempt Block Recovery

- Zillow

- Trulia

- Move.com

- MSN.com

- REALTOR.com

- REMAX.com (in markets where they have an office)

- ZipRealty.com (in markets where they have an office)

- Yahoo.com / Prudential (in markets where they have an office)

- Google Base

- Redfin

- Yahoo Classifieds

- AOL Real Estate

- HomeGain

- Lycos

- Oodle

- Hotpads

- HomeSeekers

- ColdwellBanker.com

- Cenutry21.com

- HouseFront

- CondoQuickFind

Here are just a few examples of local media websites that pull listings from the MLS in their area:

- AZCentral.com (Phoenix, Arizona)

- Chron.com (Houston, Texas)

- DallasNews.com (Dallas/Fort Worth, Texas)

- DenverPost.com (Denver, Colorado)

- LATimes.com (Los Angeles, California)

- MySA.com (San Antonio, Texas)

- RGJ.com (Reno, Nevada)

- SignOnSanDiego.com (San Diego, California)

- StarBulletin.com (Honolulu, Hawaii)

- Tucson.com(Tucson, Arizona)

Here are just a few examples of local brokerage websites that pull listings from the MLS in their area:

- BishopRealty.com (Payson, Arizona)

- Boulderco.com (Boulder, Colorado)

- C21MoneyWorld.com (Las Vegas, Nevada)

- ColdwellBanker-Idaho.com (Coeur d’Alene, Idaho)

- Ebby.com (Dallas, Texas)

- Floberg.com (Billings, Montana)

- LongRealty.com (Tucson, Arizona)

- SantaFeSIR.com (Santa Fe, New Mexico)

- TB.com (Spokane, Washington)

Additionally, here are just a few examples of local REALTOR® Boards or MLS’s that have a public view portal. (Not all boards have this feature):

- ABQREALTORS.com (Albuquerque, New Mexico)

- AlaskaRealEstate.com (Anchorage, Alaska)

- AustinHomeSearch.com (Austin, Texas)

- HAR.com (Houston, Texas)

- HavasuRealtors.com (Lake Havasu City, Arizona)

- HICentral.com (Honolulu, Hawaii)

- mlslistings.com (San Jose, California)

- SFAR.com (Santa Fe, New Mexico)

- TARMLS.com (Tucson, Arizona)

These are just examples. Your listing could literally show up at hundreds of other websites.

Source: https://www.congressrealty.com/Flat-Fee-MLS-Listings/Sites-with-Listings/default.aspp