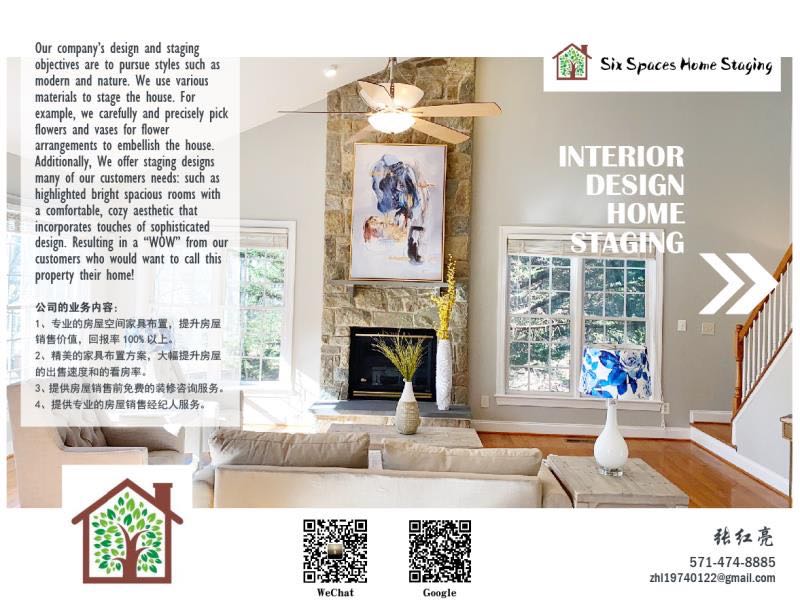

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

30-year mortgage rate holds near record low

By Jeff Ostrowski

9/12/2020

Mortgage rates edged up from a record low this week. The benchmark 30-year fixed-rate mortgage rose 1 basis point to 3.11 percent from a week earlier, according to Bankrate’s weekly survey of large lenders.

A year ago, the 30-year was 3.87 percent. Four weeks ago, the rate was 3.24 percent. The 30-year fixed-rate average for this week is 0.86 percentage points below the 52-week high of 3.97 percent, and is 0.01 percentage points greater than the 52-week low of 3.10 percent.

The 30-year fixed mortgages in this week’s survey had an average total of 0.30 discount and origination points.

Over the past 52 weeks, the 30-year fixed has averaged 3.63 percent. This week’s rate is 0.52 percentage points lower than the 52-week average.

- The 15-year fixed-rate mortgage fell to 2.55 percent from 2.56 percent.

- The 5/1 adjustable-rate mortgage rose to 3.25 percent from 3.24 percent.

- The 30-year fixed-rate jumbo mortgage rose to 3.57 percent from 3.55 percent.

At the current 30-year fixed rate, you’ll pay $427.56 each month for every $100,000 you borrow, up from $427.02 last week.

At the current 15-year fixed rate, you’ll pay $669.15 each month for every $100,000 you borrow, down from $669.62 last week.

At the current 5/1 ARM rate, you’ll pay $435.21 each month for every $100,000 you borrow, up from $434.66 last week.

Results of Bankrate.com’s weekly national survey of large lenders conducted September 9, 2020 and the effect on monthly payments for a $165,000 loan:

| Breakdown | 30-year fixed | 15-year fixed | 5-year ARM |

|---|---|---|---|

| This week’s rate: | 3.11% | 2.55% | 3.25% |

| Change from last week: | +0.01 | -0.01 | +0.01 |

| Monthly payment: | $705.47 | $1,104.09 | $718.09 |

| Change from last week: | +$0.89 | -$0.78 | +$0.90 |

Where mortgage rates are headed

In the week ahead (Sept. 10-16), 36 percent of the experts on Bankrate’s panel predict rates will rise, while 27 percent expect rates to hold steady and 36 percent think rates will fall.

“There is risk of an increase if the inflation numbers come in higher than expected. Not a high likelihood, but let’s face it, 2020 has been a lesson in low probability/high impact events,” said Greg McBride, chief financial analyst, Bankrate.com.

“As expected, there wasn’t too much movement as far as rates were concerned going into the three-day weekend. I suspect that the same trend will continue this week. However, what lies in our future is another story. We know the loan-level pricing adjustment is coming, so when will lenders and the market react? With extended turn times and preparing loans sales for delivery to the GSEs by the December deadline, we could see a change in our near future,” said Jennifer Kouchis, senior vice president, real estate lending, VyStar Credit Union in Jacksonville, Florida.

Homebuyers and refinancers enjoy low mortgage rates

Rates are near a record low and are expected to stay this way for many months to come. You can see the forecast from various experts for the year ahead here.

That means more and more homeowners can refinance to cut their monthly mortgage payments. However, refinancing comes with costs that you must make up if you are to profit from a refi. Bankrate has a calculator to help you decide whether refinancing is a good idea.

Related story: As mortgage rates fall to record lows, beware high closing costs.

Jumbo borrowers, meanwhile, will find they must cast a wide net to find a mortgage, and they will pay a higher interest rate. Some lenders, fearful of risk during the coronavirus recession, have left this market. Refinancing with cash out is shrinking too as lenders are worried people will lose their jobs and be unable to pay, while home values could possibly fall if the recession is prolonged.

Market watchers are waiting for the spread between Treasury yields and mortgage rates to narrow, a development that would create additional downward pressure on rates. But with the Federal Reserve’s commitment to nearly unlimited buying in the mortgage-backed securities market, anyone with good to excellent credit who wants a mortgage this spring should be able to snag a historically low rate, and even borrowers with poor to bad credit will benefit as well with a lower rate than before the Fed intervention.

Source: https://www.bankrate.com/mortgages/analysis/