英研究:冠病疫苗效力将在接种半年内开始减弱

文 / 廖慧婷

8/25/2021

(早报讯)英国研究人员称,两种冠病疫苗所提供的保护效能,在完成接种的半年内开始减弱。

路透社报道,根据英国一项研究显示,在接种第二剂辉瑞冠病疫苗后的五至六个月,预防感染的有效率从88%下降到74%。

阿斯利康疫苗则是在完成接种后的四到五个月,预防感染的有效率从77%下降至67%。

上述研究分析了来自英国冠病研究应用(ZOE COVID)所收集的数据,包括超过120万个检测结果。

该研究的首席研究员斯佩克特表示,在最糟的情况下,老年人和医护人员的保护率到了冬天可能会低于50%。

由于担心已接种的冠病疫苗效力减退,英国政府计划最快从9月初起,向年长者以及最脆弱群体提供第三剂冠病疫苗。

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

Workers, with new perspectives and job options, are quitting in record numbers

By SYDNEY EMBER | THE NEW YORK TIMES

6/21/2021

At some point early this year, Justin Hoffman concluded that he was being underpaid.

The marketing director at an orthopedic practice in Findlay, Ohio, Hoffman was making $42,000 a year — about $13,000 less, by his count, than people were making in similar jobs elsewhere.

But when he asked for a raise in March, he was given only a small bump in pay.

“That was kind of the straw that broke the camel’s back,” he said.

So after some careful thinking, Hoffman, 28, did what he had long ached to do: He quit. His last day was June 4.

Hoffman is among millions of workers who have voluntarily left their jobs recently, one of the most striking elements of the newly blazing-hot job market. According to the Labor Department, nearly 4 million people quit their jobs in April, the most on record, pushing the rate to 2.7% of those employed.

The rate was particularly high in the leisure and hospitality industry, where competition for workers has been especially fierce. But the number of those quitting registered across the board.

Economists believe that one reason more workers are quitting is simply a backlog: By some estimates, more than 5 million fewer people quit last year than would otherwise be expected, as some workers, riding out the labor market’s convulsions, stuck with jobs they may have wanted to leave anyway. (And the millions of involuntary job losses during the pandemic surely accounted for some of the reduction in quitting.) Now that the economy is regaining its footing, workers may suddenly be feeling more emboldened to heed their impulses.

But another factor may be the speed with which the economy has reawakened. As the pandemic has receded and the great reopening has swept across the country, businesses that had gone into hibernation or curtailed their workforce during the pandemic have raced to hire employees to meet the surging demand.

At the same time, many people remain reluctant to return to work because of lingering fears of the virus, child care or elder care challenges, still-generous unemployment benefits, low wages or other reasons.

The result has been an explosion of job openings, despite a relatively high unemployment rate, as businesses struggle to recruit and retain employees — a dynamic that has placed power more firmly in workers’ hands. With employers offering higher wages to attract candidates, many workers — especially in low-wage positions in restaurants and hotels — are leaving their jobs and jumping to ones that pay even slightly more.

“There’s a lot of churn in low-wage jobs where people don’t really have a career progression,” said Julia Pollak, a labor economist at ZipRecruiter. “If you find a job that offers just marginally more, there’s no cost to you in switching.”

More than 740,000 workers quit jobs in leisure and hospitality in April, the Labor Department said, for a rate of 5.3%. A vast majority were in accommodation and food service.

The pandemic has driven workers to quit for other reasons as well. With fewer opportunities for spending, some people were able to save money and pay down their debts, giving them a cushion to leave jobs with which they were dissatisfied. Other workers, disinclined to give up remote work, are abandoning jobs that are no longer affording them as much flexibility.

For Hoffman, the decision to leave his job was the culmination of months of perceived injustices, which he said he was able to evaluate more clearly because of the pandemic.

As coronavirus cases swelled in the fall, he asked to work from home because of the risk he feared he posed to his sister, whose immune system is compromised. His request was denied, he said, crystallizing his sense that he was not respected or valued.

Over the past year, with the pandemic limiting his social interactions, he began to network over Twitter with other people in marketing. That was how he determined that he was being significantly underpaid.

Hoffman, who is now looking for work, said he probably would have quit eventually. But the pandemic, he said, hastened his decision.

“I think that if the pandemic hadn’t happened, then things wouldn’t have turned out this way,” he said. “It didn’t just change my perspective on my compensation, but I think it’s changed a lot about my understanding of the relationship between employers and employees.”

On a more philosophical level, the constant threat of illness, more time with family members, leisure time that gave way to new passions — all may have prompted some workers to reassess how they want to spend their time. Burned out, some people have left their jobs for once-in-a-lifetime experiences, like traveling the world. Others have seen an opportunity to shift careers or branch out on their own.

Startups surged during the pandemic, particularly in Black communities, as stimulus checks and unemployment benefits helped seed entrepreneurs’ dreams and bolster their confidence.

“The pandemic, for a lot of people, was really stressful and caused a lot of uncertainty, so I think what a lot of people did was reflect on their lives,” said Anthony Klotz, an associate professor of management at Texas A&M University who studies employee resignations.

Klotz said people were accustomed to work being at the center of their lives and identities — a reality that may have shifted during the pandemic.

“In general, we want a life of contentment and a life that has purpose,” he said. “And I think for many people, they’ve discovered that contentment and purpose for them may lie outside of work.”

That was the case for Matt Gisin, 24, who gave notice at his job as a graphic designer at a health and wellness company this month. During the pandemic, he was able to work remotely, and without a commute, he had more time for hobbies like CrossFit and video game streaming.

“I got very adjusted to all of this time and all of this freedom,” he said.

But slowly, his company began requiring employees to come back into the office — first for two days a week, then three, then four. With so many people commuting to work in their cars, his trip from his home in Mamaroneck, New York, to the middle of Long Island could stretch to two hours each way, leaving him little time for his pastimes.

“I wasn’t happy anymore,” he said. “I was finding happiness in a lot of outside activities, so I took this kind of leap to leave.”

He now hopes to find a job in the video game industry.

Economists expect the elevated level of quitting to continue for some time as the pandemic eases and the economy rebalances.

“I would be surprised if this ended before the summer ended,” said Andrew Chamberlain, chief economist for the hiring site Glassdoor. But he also said there was an “expiration date”: A high number of workers quitting will contribute to a labor shortage, eventually forcing employers to raise wages and provide other incentives, which will help lure workers back and reestablish economic equilibrium.

In the meantime, he said, workers — especially those with low wages — will continue to gain leverage over employers.

“The longer these shortages persist, the more bargaining power you put into the hands of very low-skilled workers,” he said. “There is some evidence that employers are moving in response, and that’s unusual.”

c.2021 The New York Times Company

Californians are headed to Texas. Why more people are moving to Lone Star State

Home prices are a big driver for tens of thousands of Californians to pack up and head to Texas, researchers say.

By Jeff Ehling

4/17/2021

The data proves Californians are leaving the Golden State and buying homes in the Lone Star State. See why and how many have moved here.

Californians are headed to Texas.

Researchers at Rice University’s Kinder Institute for Urban Research in Houston, Texas say home prices are a big driver.

It’s causing tens of thousands of Californians to seek out new places to live in the Lone Star State.

When Bill Fulton was recently asked by business leaders if Golden State residents were really coming to Texas in large numbers, he went to work to find the answer.

As the director of the Kinder Institute for Urban Research at Rice University, Fulton analyzed the numbers.

He found, on average, about 35,000 to 40,000 Texans move to California every year, but recently a noticeable number of people are doing just the opposite.

In 2018 and 2019, about 80,000 people a year made the move from California to Texas.

The Kinder Institute found as housing prices go up in California, there is a steady migration to Texas.

It has a real-world impact on housing prices in the Lone Star State and those who were born and raised there when they try to find an affordable place to live.

“The consequences it does have is the people who already live in Texas who maybe do not have a lot of home equity and are not used to those California home prices, they may have a more difficult time buying a house, at least the house they want to buy in the place they want to buy,” said Fulton

That means lower income families may have to move further away from the city center to find affordable housing, making their commutes longer and more expensive.

As for whether or not those moving Californians could turn Texas blue, researchers say there doesn’t seem to be enough migration to make that happen on its own.

Jun 9, 2020

Dec 3, 2020

Is a Housing Market Crash Possible in 2021?

By Mark Mathis

4/15/2021

With the real estate market experiencing surging prices, scant inventories and a backlog of new home construction, many consumers are wondering if what’s gone up must come back down—in other words, are we headed for another housing market crash? Let’s take a closer look.

Think Back to the Great Recession

The unforeseen housing market crash 15 years ago ignited a worldwide recession. Fueled by low interest rates, loose mortgage-lending standards and the nation’s unshakeable faith in homeownership, home values rose at record rates year-after-year. When the housing bubble burst, roughly nine million families lost their homes to foreclosure or short sale between 2006 and 2014. Housing values plunged 30% or more, homeowners lost a collective $7 trillion and it took nearly a decade for most markets to recover. Even today, several real estate markets have not fully recovered.

With the robust market activity we’ve seen lately, could there be a market crash in the near future? The short answer is “not likely.” Today’s market book cannot be sustained completely, but a crash as serious as the one from 15 years ago is unlikely because of a few important factors.

Factor No. 1: More Stringent Lending Standards

Loose mortgage lending practices ultimately brought down some of the nation’s largest banks and mortgage companies. The fallout forced Congress and federal regulators to make significant adjustments that have fundamentally changed how mortgage lending is regulated.

Since then, standards have been raised and the process of obtaining a mortgage is now more transparent. The “anyone can get one” loans of the past are illegal; now borrowers undergo stricter income, credit and asset checks. An entirely new regulatory agency, the Consumer Financial Protection Bureau, was created to enforce this new regulatory framework. Lenders who do not comply with these standards may face heavy penalties.

As a result, the housing finance marketplace is now more robust and safer than it was 15 years ago. Any dip in the housing market will be cushioned by these stricter regulations.

Factor No. 2: Pandemic Mortgage Forbearance

When the housing market crashed in 2007, the influx of foreclosures pumped housing supply into areas with falling prices and weak labor markets, while also preventing recently foreclosed borrowers from re-entering the market as buyers. According to the Federal Reserve, foreclosures during a time of high unemployment could depress prices, plunging homeowners across the country deeper into negative equity.

However, in the pandemic era, the effects of mass unemployment bear little resemblance to the Great Recession, thanks in large part to forbearance programs that have allowed homeowners to postpone their monthly mortgage payments without suffering penalties.

As of early March 2021, 2.6 million homeowners’ mortgages were in such forbearance plans. As the pandemic economy has slowly recovered, many homeowners have resumed their employment, and thus their home payments. According to CoreLogic, by the end of 2020, overall mortgage delinquencies declined 5.8% due to the forbearance program. The share of mortgages 60 to 89 days past due declined to 0.5%, lower than 0.6% in December 2019.

Housing Market Crash

It’s worth noting that serious delinquencies—defined as 90 days or more past due, including loans in foreclosure—increased when owners who owed large amounts left forbearance. By year end 2020, the serious delinquency rate was 3.9%, up from 1.2% in December 2019.

Factor No. 3: Most Homeowner’s Cushion—Equity

Equity is the difference between the current market value of your home and the amount you owe on it. In other words, it’s the portion of your home’s value that you actually own. Equity can be an incentive to stay in your home longer; if prices rise—something we’ve seen almost universally across the country in recent months—your equity increases, too.

Why does this matter? Simply put, higher levels of equity cushion homeowners from default when home values fall.

Over the past decade, American homeowners have enjoyed housing stability and growth, building up large home equity reserves. In the third quarter of 2020, the average family with a mortgage had $194,000 in home equity, and the average homeowner gained approximately $26,300 in equity over the course of the year. In contrast, 2009 saw nearly a quarter of the nation’s mortgaged homes valued for less than the amount their owners actually owed on those mortgages.

Factor No. 4: Price Growth Will Slow Down, but Continue

The sales boom followed the outbreak of the COVID-19 and surprised many real estate economists. Like most other business sectors, real estate was expected (if not required in many locations) to lock down. But by mid-April, sales were soaring as buyers, many of them millennials, took advantage of record-low mortgage interest rates. Through the remainder of 2020, rates remained below 3%, and existing home sales reached their highest level in 14 years.

A Moving Target

While no one can say for sure what will happen with the real estate sector, most experts are confident that we’ll experience a market dip, but certainly not a crash. In the meantime, there’s plenty of work available for motivated real estate professionals. Find out how Homes.com can help you connect with the current market of active buyers and sellers here!

Source: https://rismedia.com/2021/03/25/housing-market-crash-possible-2021/

Flat-Fee MLS Listing Service in Northern VA

Helping For Sale by Owner (FSBO) & For Rent by Owner (FRBO)

DIY Landlord – Renting out Properties Safer and Quicker!

By David Chen

4/15/2021

Q. We purchased our first home some years ago, and are about to move to another home. We are considering to keep our first home as an income property. We heard of the free ads on CRAIGSLIST and zillow.com, but some landlord friends told us it could be a challenge to find qualified tenants through CRAIGSLIST and zillow.com. Is there any way to rent our property out quicker and safer with minimum cost? We are the kind of persons who would like to try things ourselves, and have some spare time.

A. You may have already done the initial research and have figured out the range of monthly rent of your property.

If the monthly rent is low such as $1600.00 or below, you may want to do it through CRAIGSLIST, https://postlets.com/, zillow.com, or similar web sites. The renters interested in the low-priced rentals may not go to the Realtors community for assistance.

If the monthly rent is $1600.00 or above, you may want to consider listing your rental on brightmls.com for the Realtors community to market it for you.

Bright MLS is made up of nine forward thinking MLSs (43 Associations) in the Mid-Atlantic region who put aside their differences and came together with a shared vision to help solve MLS market overlap and empower everyone to get more out of the MLS. Bright will serve parts of 6 states plus Washington, D.C. encompassing 85,000 real estate professionals who serve over 20 million consumers and facilitate approximately 250,000 transactions a year that are valued at more than $70 billion.

Dozens of public real estate websites (such as: zillow.com, redfin.com, brightmlshomes.com, etc.) pull data from brightmls.com through syndication. In a few hours, your listing will show up on dozens of websites and will get the maximum exposure. It is a lot quicker and safer finding qualified tenants than doing it through CRAIGSLIST and zillow.com. You may talk with a Realtor for assistance. Please be aware some Realtors take rental jobs, some don’t.

Over the years I have helped some landlords in the community renting their properties out with very low cost. A popular arrangement is to help the landlords ‘DIY’, which has been working well for those experienced landlords.

The good side of ‘DIY’ is that the landlords can ‘screen’ the potential tenants from the very beginning, have 100% control of the whole process, and enjoy the feeling of “on top of things”.

If you prefer minimum service, I can help you ‘DIY’:

1. I provide CMA, list your rental on brightmls.com, put a realtor’s lockbox at the front door if needed, provide the access log (if needed), support you through the whole process.

I charge a flat fee for the minimum service.

2. If you would like me to prepare the lease or review the lease, there is another reasonable flat fee. This service is optional.

3. You answer phone calls, work with the tenant (if the tenant doesn’t have an agent) or the tenant’s agent, run credit check, verify employment, check references, etc.. You pay the tenant’s agent (if there is one) directly on the move-in date – usually 25% of first-month rent.

If you need full-service, the commission is first-month rent – which includes the commission to be paid to the tenant’s agent.

If you need any customized service (between minimum service and full-service), we can work out an agreement.

Some information:

CMA stands for Comparable (some called Competitive) Market Analysis, that will help you determine the market value of your property for sale or for rent.

I use Sentry-key lockbox. Any Realtor with membership of NVAR (Northern Virginia Association of Realtors) or any other VA Realtors association can access and show the property.

The access log tells when the agents enter the property and their contact info. which can help you follow up with the agents.

If you like the DIY experience, I would recommend you to use the minimum service.

Please feel free to reach me if you need any assistance.

—

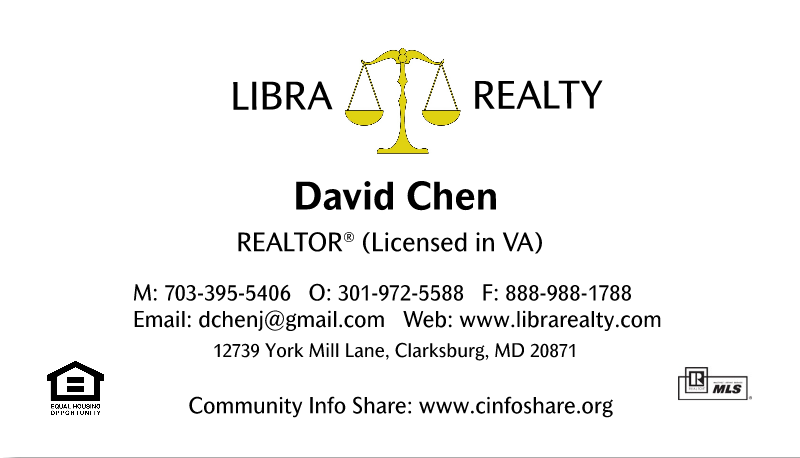

David Chen

Realtor (Licensed in VA) | Neighborhood Specialist (McLean, Falls Church, Vienna)

Libra Realty, LLC

dchenj@gmail.com

703-395-5406

WeChat ID: dchenj2015

Last update: 4/15/2021

Websites that will show your flat fee mls listings

4/15/2021

Almost all real estate websites that offer the ability to search brokerage listings use a data feed from the MLS called Internet Data Exchange (IDX) to pull in listing data. Depending on the number of sites tapping into your MLS, your listing could appear on hundreds of websites. We do not control the content of any of the websites listed below. updated periodically & subject to change at any time Here are some examples of national websites by area that pull listings from the MLS:

This block contains unexpected or invalid content.Attempt Block Recovery

- Zillow

- Trulia

- Move.com

- MSN.com

- REALTOR.com

- REMAX.com (in markets where they have an office)

- ZipRealty.com (in markets where they have an office)

- Yahoo.com / Prudential (in markets where they have an office)

- Google Base

- Redfin

- Yahoo Classifieds

- AOL Real Estate

- HomeGain

- Lycos

- Oodle

- Hotpads

- HomeSeekers

- ColdwellBanker.com

- Cenutry21.com

- HouseFront

- CondoQuickFind

Here are just a few examples of local media websites that pull listings from the MLS in their area:

- AZCentral.com (Phoenix, Arizona)

- Chron.com (Houston, Texas)

- DallasNews.com (Dallas/Fort Worth, Texas)

- DenverPost.com (Denver, Colorado)

- LATimes.com (Los Angeles, California)

- MySA.com (San Antonio, Texas)

- RGJ.com (Reno, Nevada)

- SignOnSanDiego.com (San Diego, California)

- StarBulletin.com (Honolulu, Hawaii)

- Tucson.com(Tucson, Arizona)

Here are just a few examples of local brokerage websites that pull listings from the MLS in their area:

- BishopRealty.com (Payson, Arizona)

- Boulderco.com (Boulder, Colorado)

- C21MoneyWorld.com (Las Vegas, Nevada)

- ColdwellBanker-Idaho.com (Coeur d’Alene, Idaho)

- Ebby.com (Dallas, Texas)

- Floberg.com (Billings, Montana)

- LongRealty.com (Tucson, Arizona)

- SantaFeSIR.com (Santa Fe, New Mexico)

- TB.com (Spokane, Washington)

Additionally, here are just a few examples of local REALTOR® Boards or MLS’s that have a public view portal. (Not all boards have this feature):

- ABQREALTORS.com (Albuquerque, New Mexico)

- AlaskaRealEstate.com (Anchorage, Alaska)

- AustinHomeSearch.com (Austin, Texas)

- HAR.com (Houston, Texas)

- HavasuRealtors.com (Lake Havasu City, Arizona)

- HICentral.com (Honolulu, Hawaii)

- mlslistings.com (San Jose, California)

- SFAR.com (Santa Fe, New Mexico)

- TARMLS.com (Tucson, Arizona)

These are just examples. Your listing could literally show up at hundreds of other websites.

Source: https://www.congressrealty.com/Flat-Fee-MLS-Listings/Sites-with-Listings/default.aspp