情人节粉红警告 全美受害人遭杀猪盘坑10亿元

世界新闻网

02/11/2022

情人节 (Valentine’s Day)将届,各路骗徒使出浑身解数钓鱼,联邦调查局(FBI)休士顿分局提醒民众防范「罗曼史诈骗」(俗称杀猪盘),并提供实际资源帮市民免受灾殃。

FBI休士顿分局发言人克莉丝汀娜加萨(Christina Garza)指出,2021年全美国罗曼史诈骗(romance scam)的受害人一共损失了10亿元,这只是有报案的金额,被骗却没有报案的还没有计入。情人节将届,感情上没有寄托的人向往有个伴侣,特别容易上当,罗曼史骗徒通常不是一个人,而是一整个帮派,他们有相当高的科技产品使用能力,一步一步让目标食饵上钩。

休士顿郊区拉波特(La Porte)的68岁居民伊丰柯斯塔雷斯(Yvonne Costales)看到朋友在约会网络上认识一名男子,两人交往得十分顺利,让她既羡慕又忌妒,于是她也上约会网站试试,不久一位自称Robert(劳勃)的男子与她联系,他给她的第一个短讯是「哇,妳好漂亮」,她马上对那人起了好感,而且他在送来的照片上是那么英俊。

Feb 10, 2022

两人天天互发短讯,她开始落入情网,每天心里都思念着他。几次约好了要见面,但他临时都说有事来不了,渐渐让她起了疑窦,有一天他说出了大车祸受伤,需要她的帮助,她发现这很可能是骗局。网络感情骗徒被称为鲇鱼(catfish),她用SocialCatfish.com社交鲇鱼网站来追踪劳勃那张照片的最初起源,才发现那是来自另一人的Instagram网页,歹徒偷了那张照片来冒充。

Feb 11, 2021

The FBI’s Washington Field Office issued a warning about romance scams. Romance scams are designed to pull at your heartstrings and the consequences of these scams are often financially and emotionally devastating to victims. These scams occur when a criminal adopts a fake online identity to gain a victim’s affection and trust, and then uses the illusion of a romantic relationship to manipulate or steal from the victim. The criminals who carry out romance scams are experts at what they do and will seem genuine, caring, and believable. Be wary of people you only meet online who are quick to establish a relationship and gain your trust. They may ask for money for an emergency or unexpected expense, and may even ask you to pay for their travel to visit you. But, you likely will never meet this person face to face. If someone you meet online needs your bank account information, they are most likely using your account to carry out a fraud scheme. Report fraud or attempted fraud to the FBI at IC3.gov, this information will help investigate these criminals.

加萨指出,有时候歹徒并不是要从受害人身上诈财,而是要对方帮忙做不法的事,譬如洗钱、代购违禁物品等,如果遵照歹徒意愿而行,会给自己惹上牢狱之灾。FBI休士顿分局的网站上提供相当多的资讯,可以帮助民众判断网络情人是否为骗徒,并敦促市民绝对不要给对方送加密货币(cryptocurrency)、现金或礼物卡,也不要做违法的事。

FBI:浪漫骗局 7个月骗走1.3亿

世界新闻网

01/14/2022

联邦调查局(FBI)旧金山办事处发言人波兰(Cameron Polan)对本报表示,类似的案件,被称为浪漫骗局或信任骗局。犯罪者欺骗受害者,使其相信两者之间有信任关系,无论是家庭、友好还是浪漫关系。骗子最初接触受害者,是通过约会应用程序和其他社媒网站。获得受害者信任后,骗子会声称知道投资或交易机会,可获得巨大利润。然而,这些机会是捏造的,目的是说服受害者汇款。

与其他互联网推动的犯罪相比,浪漫或信任诈骗导致的经济损失最高。从2021年1月1日到7月31日,联调局互联网犯罪投诉中心收到超过1800份投诉,与在线恋爱诈骗有关,导致约1.334亿的损失。 不幸的是,浪漫或信任诈骗是难以证明的犯罪。 当犯罪分子躲在电脑后时,可以是世界上任何地方的任何人,他们会持续寻找方法保持匿名,让执法当局难以找到。

波兰表示,教育公众、防止犯罪发生至关重要,联调局依靠教育和提高公众意识来阻止个人成为浪漫/信任骗局的受害者。如果受害者已汇款,联调局将通过与其他执法机构和金融机构合作,尽一切努力,确保将钱归还给受害者。 受害者应立即向其金融机构报告任何资金转移,然后联系执法部门。在准备报案时,受害者应确保有收据、带有信件的电子邮件和银行档,以提供给执法部门。联调局鼓励受害者与执法部门联系,并向该局互联网犯罪投诉中心(IC3)投诉,www.ic3.gov,也可致电联邦调查局当地办事处。公众可以用任何语言拨打电话。联调局旧金山办事处的电话是415-553-7400。

受害者也可登录网址,得知自己下一步该如何做。

https://www.fbi.gov/scams-and-safety/common-scams-and-crimes/romance-scams。

Romance Scams

01/14/2022

Romance scams occur when a criminal adopts a fake online identity to gain a victim’s affection and trust. The scammer then uses the illusion of a romantic or close relationship to manipulate and/or steal from the victim.

The criminals who carry out romance scams are experts at what they do and will seem genuine, caring, and believable. Con artists are present on most dating and social media sites.

Feb 13, 2017

The victim of a romance scam describes how she was duped out of $2 million by an online suitor she has never met.

The scammer’s intention is to establish a relationship as quickly as possible, endear himself to the victim, and gain trust. Scammers may propose marriage and make plans to meet in person, but that will never happen. Eventually, they will ask for money.

Scam artists often say they are in the building and construction industry and are engaged in projects outside the U.S. That makes it easier to avoid meeting in person—and more plausible when they ask for money for a medical emergency or unexpected legal fee.

If someone you meet online needs your bank account information to deposit money, they are most likely using your account to carry out other theft and fraud schemes.

Feb 13, 2017

Christine Beining, a special agent in the FBI’s Houston Division, describes how scam artists use Internet sites to prey on lonely men and women to get to their money.

Tips for Avoiding Romance Scams:

- Be careful what you post and make public online. Scammers can use details shared on social media and dating sites to better understand and target you.

- Research the person’s photo and profile using online searches to see if the image, name, or details have been used elsewhere.

- Go slowly and ask lots of questions.

- Beware if the individual seems too perfect or quickly asks you to leave a dating service or social media site to communicate directly.

- Beware if the individual attempts to isolate you from friends and family or requests inappropriate photos or financial information that could later be used to extort you.

- Beware if the individual promises to meet in person but then always comes up with an excuse why he or she can’t. If you haven’t met the person after a few months, for whatever reason, you have good reason to be suspicious.

- Never send money to anyone you have only communicated with online or by phone.

Resources

Public Service Announcements from IC3

08.05.2019 Cyber Actors Use Online Dating Sites to Conduct Confidence/Romance Fraud and Recruit Money Mules

Last year, confidence/romance fraud was the seventh most commonly reported scam to the IC3 based on the number of complaints received, and the second costliest scam in terms of victim loss.

04.29.2011 The Dangerous Side of Online Romance Scams

The IC3 is warning the public to be wary of romance scams in which scammers target individuals who search for companionship or romance online.

Related FBI News and Multimedia

- 12.02.2021 Victim of Romance Scam Who Became Money Mule Tells StoryGlenda, an 81-year-old victim of a romance scam, describes how she became a money mule and is now paying the price. She pleaded guilty on November 2, 2021 for two federal crimes.

- 02.10.2021 FBI Washington Field Office Warns of Romance ScamsThe FBI’s Washington Field Office issued a warning about romance scams.

- 12.07.2017 FBI, This Week: Criminals Put Holiday Spin on Internet-Facilitated SchemesThe FBI says criminals put a holiday twist on the methods they use to scam you online during this time of year.

- 02.13.2017 Special Agent Christine Beining Describes Romance ScamsChristine Beining, a special agent in the FBI’s Houston Division, describes how scam artists use Internet sites to prey on lonely individuals to get to their money.

- 02.13.2017 Victim of Romance Scam Tells Her StoryThe victim of a romance scam describes how she was duped out of $2 million by an online suitor she has never met.

- 02.13.2017 Romance ScamsA woman who lost $2 million to a con artist who she fell in love with online shares her story in the hopes that others might avoid falling victim to this type of crime.

- 02.10.2016 Overseas Romance Scams RisingThe FBI says an increasing number of Americans are becoming victims of romance scams originating from West Africa.

- 01.07.2016 African Romance ScamsAn increasing number of Americans are becoming victims of romance scams originating from West Africa.

- 02.05.2015 Romance ScamsRomance scams, also known as confidence scams, result in the highest amount of financial losses when compared to other Internet-facilitated crimes.

遭杀猪盘惨骗 受害人泣诉:绝望濒死 老公要跟我离婚

世界新闻网

01/14/2022

「12月17日的时候,在我的MT5帐户原本有26万多美金的资本瞬间化为乌有。于是每日寝食难安、夜晚辗转无眠,压抑到要爆炸却总是难以启齿,濒临死亡绝望无所求的状态。」

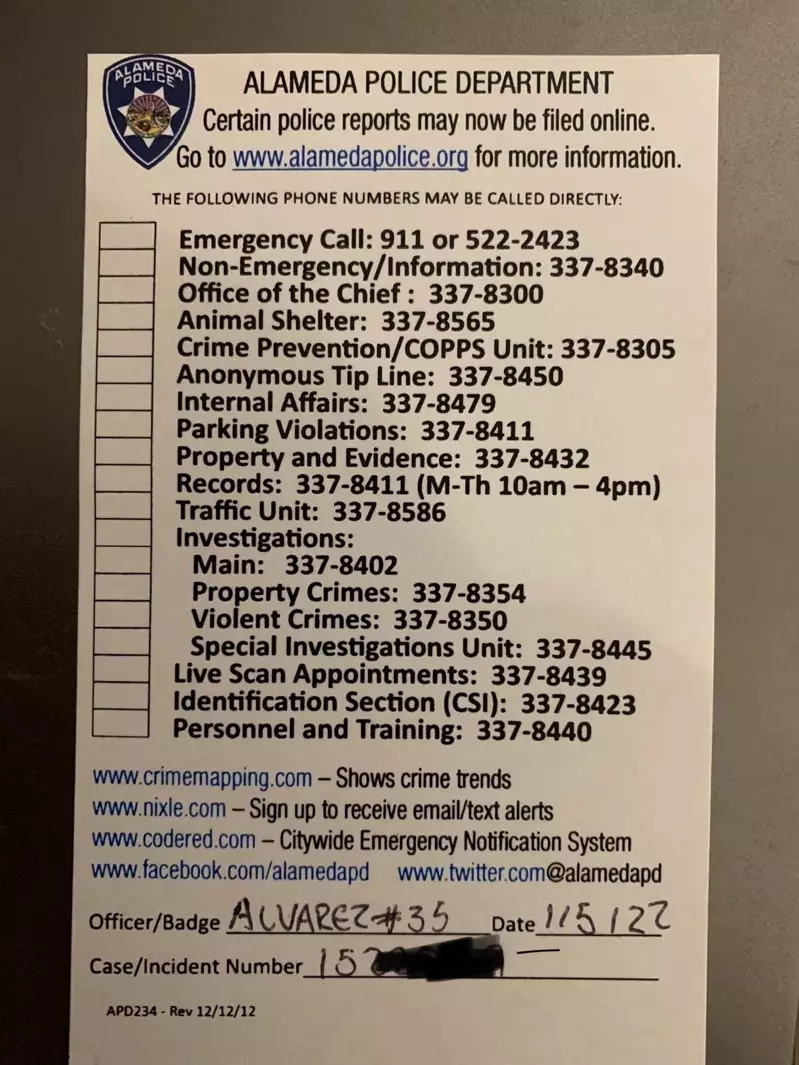

来美国三年半的华人新移民、前媒体人「S女士」向本报展示过去数周来与「杀猪盘」骗徒的对话纪录与「投资」截屏。她对于遭骗一事非常懊悔,更愤怒骗子的无良,「在那一天、12月17日时,我可以说是被谋杀了。报警了,但是员警却和我说没有足够的证据,很遗憾我只是心灵脆弱、我就是自杀的。我说我怎么就是自杀的呢?不可能,请你调查清楚还我真相。」

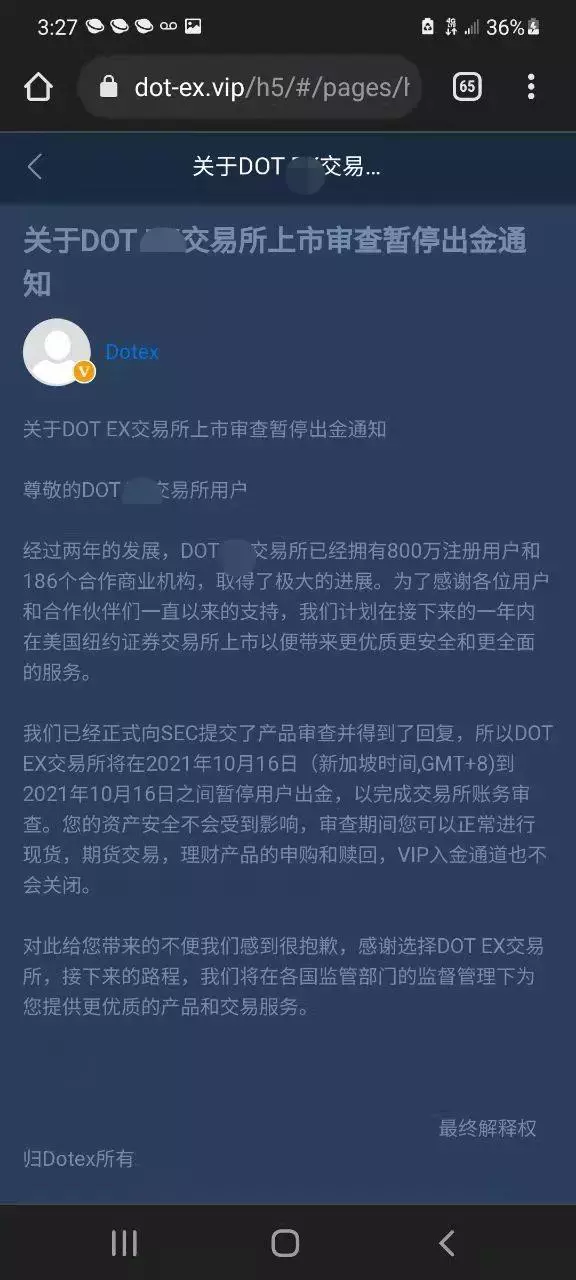

S女士说,骗徒是在11月初通过社交软件Whatsapp加她为朋友,最初先是积极嘘寒问暖、聊天创建信任感,后来逐渐展现出在黄金投资非常容易获利、找到了投资致胜节奏的假象,诱骗她入金。前后放进9万5000美元进去后,「本金加获利」一度升至26万多美元,「骗徒每次都告诉我什么时候买,什么时候卖,带进带出的,一开始都赚钱。」

然而,就像所有类似的骗术一样,「猪」养肥了自然就到了宰杀的时间。帐上大笔金额真要提现,或者骗徒发现受害人已经没钱入金、也已经借不到钱没法入金时,帐号就爆仓清零,或者直接无法提现。

先取得信赖,等到骗够了就「收网」

她说,骗徒是诱导她到MT5平台上投资,MT5全名是MetaTrader5,从Apple App Store就能够下载,除了MT5还有MT4,同一家公司在Apple App Store与Google Play上都有大量的下载量。投资人可以利用MT5进行外汇、股票、期货以及其他金融商品的投资。虽然平台正规,但是骗徒再通过交易XAUUSD品种来投资黄金,并加上其他复杂的操作方式,将被害人的钱完全骗光。

「这不是犯罪吗? 我有足够的证据,而且目前这个诈骗集团仍然依旧还在营业,受害者不断的涌现。 我第一次报警,12月21日员警说我信错了人,做了坏的投资,钱无法追回。 我第二次报警,1月5日员警直接把我拒之门外,不同的是第一次12月21日帐面没钱。而1月5日我的帐面时有18万,可我却无法提现,我依然诉讼无门。在12月21日后我再用「杀猪盘」关键字查看Google网页,我看到了和我一样被骗的人继续出现,悲剧就没有停止再发生。」

S女士气愤地说,这些诈骗这么猖獗,就是因为无法抓到骗徒,背后老板更在后面逍遥法外。更可恶的是,这样的诈骗手法等于是将诈骗平台与App Store等正规平台架在一起,降低大众疑心。她认为大的平台也应该肩负起责任,主动监管。

S女士以前在国内在电视台工作,为了子女的教育来美国,至今才三年半,「前年因为疫情,都不好过,看到投资机会不是就想多赚些钱吗?」她说,直到帐户完全清零,才发现自己确实被骗,「这些养猪男、养猪女,就是杀人,只是用的刀不一样而已。我自己也是挺绝望的。发生事情的过程中,老公有怀疑我被诈骗,劝我我没听。老公很生气,现在都准备跟我离婚了。我是真的给他们搞到家都散了!」

「杀猪盘」骗局 诱炒数字货币、期货 湾区华人丢数十万

世界新闻网

01/14/2022

连日来,本报记者调查发现,湾区多名华人遭遇「杀猪盘」骗局。陌生人加了华人微信或脸书等社媒后,声称有投资高回报的机会,鼓动华人炒作数字货币或期货等,一开始让华人赚钱、尝到甜头,诱骗华人加大投资,最终卷走华人巨款。仅记者采访的两个受骗华人,就被骗走超31万。

加私人微信搭讪

屋仑华人Marina 表示,在美国生活数十年,没想到遭遇杀猪盘骗局。有陌生人通过股票群加她私人微信,声称要移民来旧金山。两人熟悉之后,陌生人鼓动她卖掉数字货币,在网络平台投资炒期货,最终她被骗走18万,陌生人杳无音信。

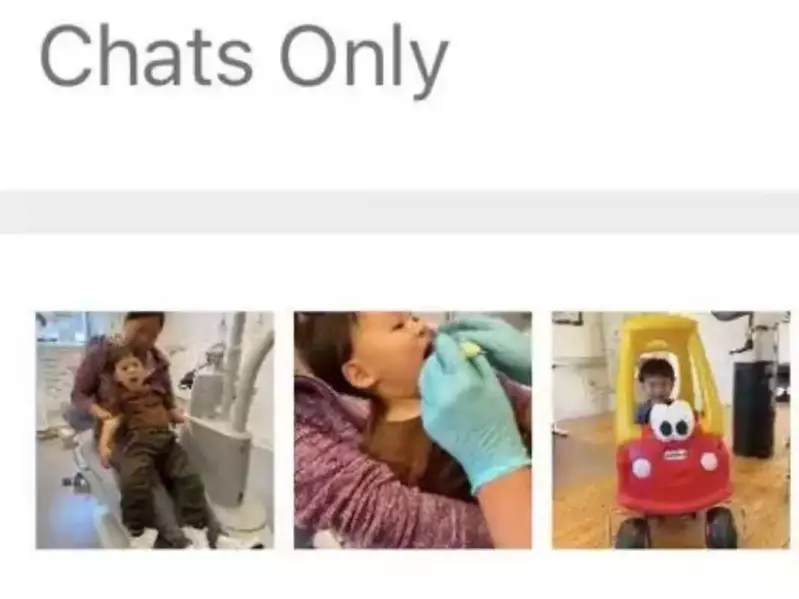

去年9月中,有人通过股票微信群加Marina为朋友。声称在比利时做餐厅,想移民到旧金山,希望Marina介绍移民律师,帮忙在旧金山带路看房。此人的微信数据详细,朋友圈有抱着孩子的照片,有看牙医的图片,一幅热爱家庭生活的样子,不像一个骗子。

经过几天的聊天,此人开始鼓动Marina说,他知道一个网站平台,可以设立帐户投资赚钱,本大利大。经过一番说服,Marina将手中的2个比特币、斤1400个文档币(Filecoin)卖掉,转成18万美元,在网站平台投资炒期权。登录帐户后,可以看到自己的本金和赚钱利润情况,帐户貌似也可以转账出来。Marina看着自己的帐户,赚钱越来越多,本金18万,营利10万,总额达到28万。

骗刷信用卡套现

骗子后来还要求,Marina再转10万到帐户。Marina觉得不对头,因为她的所有金融资产都放在帐户中。她开始有些担心是杀猪盘。于是和对方说,要申请新贷款接着炒期权,但需要拿部分钱出来。对方就一拖再拖,甚至要Marina去刷信用卡套现金出来、继续投资。两人多番交涉,骗子用各种理由拒绝转账。最终,Marina发现,根本联系不上骗子,相关理财平台也难以登录。才确认,自己真的上了当。

Marina说,5、6月有旧金山朋友被骗。没想到此事发生在自己身上。一直以为,杀猪盘是帅哥美女,欺骗感情,再来骗钱。没想到利用华人投资的心理,也能骗这么多。「我后来发现,骗子的微信朋友圈照片,和另一个微信号一模一样。估计是同一个人,用好几个手机号注册微信号,利用同样的朋友圈,编造人设,获取陌生人的信任。也希望提醒华人朋友,遇到有人声称投资高回报的,要特别小心,不要上当受骗。」

警方爱莫能助

Marina说,被骗18万后,试图询问联邦调查局(FBI),但没有回复。骗子的微信号地址,位于中国贵州,也不知道如何报警。

湾区华人J女士的经历类似,被骗走13万多。她说,去年11月底,有陌生人通过Facebook联系她,自称金融界人士,年薪800万。有一段时间天天嘘寒问暖,熟悉之后。此人鼓动J女士开户操作比特币赚钱。她转账到该户口1000元,但不能操作,这笔钱原封不动退回。骗子又让她开另外一个户口,电汇5000元,经过一番操作,赚了800,利润超10%。连本带利5800元都转回给J。

J又电汇1万元,但还是不能操作,钱又退回来。因为骗子多次将钱转回,J深信不疑,最终电汇超13万存款,交给对方操作。骗子说,连续两天赚取共3万。她希望退钱,对方却说钱卡在系统中,要加钱10万才能继续操作,甚至不惜让J去借钱。J才意识到自己上当,但数次报警给湾区当地警局,对方也爱莫能助。

多位在美国被骗的华人,组建了微信群,分享资讯,希望督促政府部门破案。

两中国公民南加州经营非法汇款业务遭FBI通缉

世界新闻网

01/14/2022

据加州中区联邦检察官办公室13日(周四)提交的一份起诉书,指控 31岁的王殿伟(Dianwei Wang,译音)和36岁的宋志立(Zhili “Ethan” Song,译音)共谋经营无牌汇款业务并妨碍司法公正,分别被指控篡改证据。他们都是中国公民,住在西柯汶纳(West Covina),但目前下落不明已被视为逃犯,遭到联调局(FBI)通缉。

检察官说,他们据称经营着一个「非正式钱币转移系统」,这是一种地下银行网络,用来将资金从中国转移到美国。

根据起诉书,王和宋要求客户将钱存入他俩控制的或可以登录的中国银行账户,并同意将等量的美元存入客户开设的美国银行账户,但需要扣除手续费用。起诉书显示,从2017年4月到2017年12月,他俩从中国转移或试图转移约200万美元到美国。

起诉书称,为了履行他们的协议,王和宋使用他们从第三方获得的钱,包括浪漫骗局,作为他们存入客户美国账户的美元来源。这些骗局涉及在约会网站或社交媒体平台上创建虚假账户,以诱骗通常是老年人的受害者,说服他们汇款。

Fugitives accused of running illegal L.A.-area operation to move money from China to U.S.

BY GREGORY YEE | Los Angeles Times

01/14/2022

(U.S. attorney’s office)

The FBI is searching for two Chinese citizens accused of running an illegal money transfer business in Southern California.

A federal indictment filed Thursday charges Dianwei Wang, 31, and Zhili “Ethan” Song, 36, both formerly of West Covina, with conspiracy to operate an unlicensed money transmitting business and obstruction of justice. Both men are also separately charged with witness tampering.

Wang’s and Song’s whereabouts are not known and they are considered fugitives, according to the U.S. attorney’s office for the Central District of California.

The men allegedly ran an “informal value transfer system,” a kind of underground banking network that they used to move money from China to the U.S., prosecutors said.

According to the indictment, Wang and Song told their customers to make deposits into Chinese bank accounts the men controlled or had access to, and agreed to deposit the equivalent amount of U.S. dollars, minus a fee, in American bank accounts set up by the customers.

From April to December 2017, the men transferred or attempted to transfer about $2 million from China to the U.S., according to the indictment.

In order to fulfill their agreements, Wang and Song used money they got from third parties, including romance scams, as a source for the dollars they deposited into U.S. accounts, according to the indictment.

The scams involved creating fake accounts on dating sites or social media platforms to trick victims, often older adults, into believing they had a relationship with the scammer, who persuaded victims to send them money, according to the indictment.

“Wang allegedly directed people associated with the online scammers to send him checks or wire him funds derived from romance scam victims, most of whom were older adults,” prosecutors said. “In some cases, Wang allegedly directed the people associated with scammers to have victims send checks directly to him.”

The scams netted nearly $1.1 million over six months in 2017, prosecutors said.

Wang and Song are also accused of lying to the FBI in late 2017 when agents asked them about wire transfers to a Chinese citizen who was living in Southern California, prosecutors said.

“Both defendants are charged with conspiracy to obstruct justice for telling the third Chinese national to falsely tell the FBI that she was buying a house with Wang as a way of explaining the wire transfers and supporting their own false statements to FBI agents,” prosecutors said.

Authorities seized more than $450,000 from the third person’s accounts, prosecutors said.

The FBI previously seized about $1.9 million from accounts controlled by Wang, Song and other Chinese nationals, prosecutors said. Of that total, $376,000 has been forfeited. Authorities intend to seek forfeiture of the remaining money.

According to prosecutors, conspiracy to operate an unlicensed money transmitting business carries a maximum sentence of five years in federal prison.

The obstruction of justice and witness tampering charges each carry a maximum sentences of 20 years, they said.

Anyone with information on Wang’s or Song’s whereabouts should call their local FBI office, or nearest U.S. embassy or consulate.

The FBI’s Los Angeles office can be reached at (310) 477-6565.

经中间人兑换本票 华人被跳票逾50万元

世界新闻网

12/14/2021

布碌仑(布鲁克林)近日有数名华人因买房或其他之需而通过中间人兑换银行本票(Cashier’s Check),不料却遭遇跳票,其中仅通过同一个中间人兑换的银行本票就有51万元被跳票。

数名受害者日前到美国亚裔社团联合总会求助,据陈氏夫妇讲述,因要购置房产,所有通过朋友介绍认识了以现金兑换银行本票的中间人张某,在将5万元现金交给对方后,于11月24日拿到本票,但因第二天是感恩节,他们在26日才前往银行,但不料再查帐户时发现跳票。

受害者石先生表示,他也是通过中间人张先生兑换了近2万元本票,然后在感恩节前后通过银行的ATM机存入,随后也遭跳票。

中间人张先生也场,他表示,自己至多从中赚取一个百分点,此次他是通过一名居住在新泽西州李堡(Fort Lee)的一华裔男子去当地银行兑换的本票。

张先生说,为保险起见,他还专门安排了一名司机带着45万元现金亲至李堡的银行,当面看着那名华裔男子将钱兑成本票并清点清楚后,才带着本票回到布碌仑。

据张先生称,在跳票后的第二天他即请律师前往银行查问,被告知那名男子随后又持身分证件回到银行要求撤销本票,导致这些本票跳票。

律师斯科拉里(Lisa Scolari)对此表示,受害者被骗后应第一时间向警方报案,另外因这些本票是跨州兑换,该案已涉及违反联邦法律,受害者还应尽快向联邦调查局(FBI)等部门举报。

斯科拉里还表示,若这些本票为真,银行不可能停止支付,因每张本票是由银行担保、以银行自有资金开具并由出纳员签署;因此不存在购买者第二天持证件又返回要求银行撤销的现象,除非这些本票为假才会跳票。

亚总会会长陈善庄表示,该案受害者至少有十几名,有的个人损失高达11万元,共计金额已经超过了50万元;但至今部分受害者选择不报警,怕税务局查税;但骗徒正是利用了这一点,他呼吁更多受害者站出来,配合调查。

藉耶稣基督之名圈钱 德州诈骗客被判关到死

世界新闻网

11/04/2021

北德州一名基督教广播电台节目主持人,经营庞氏骗局(Ponzi scheme)大约十年后露馅,他于1日(周一)被法官判处第三个终身监禁。

现年80岁的威廉嘉勒格(William Gallagher),其实从2019年3月被捕后一直都待在监牢中,他因为同样的诈欺行为已被达拉斯法院判处25年徒刑,德州法院也已判了他30年。2019年8月,泰伦特县(Tarrant County) 法院对他提诉,这次的审判庭是为福和市一带的受害者讨回公道。

嘉勒格在一家基督教广播电台担任主持人,他每次节目收尾时,总说「星期天教堂见」(See you in church on Sunday),这成了听众百听不厌的口头禅,他还出版理财的书籍,譬如有一本名叫「耶稣基督,金钱大师」(Jesus Christ, Money Master)。他所成立的嘉勒格财务集团(Gallagher Financial Group)在电视台做广告,有许多年长者相信他是虔诚的基督徒,绝对不会骗他们的钱。

泰伦特县检察官办公室年长者财务诈欺小组(Elder Financial Fraud team)的组长萝莉瓦内尔(Lori Varnell)指出,这是她执法多年来所看到的最恶劣案例,嘉勒格在各教会的周日集会中与教友接触,这些已退休人士把钱交给他投资,少的有几万元,多的有60万元,最后却血本无归,有些人必须卖房,有的人跟子女讨钱过生活,有些人重回职场上班赚钱,他们损失的金钱总数达3200万元。

1920年代,查尔斯庞济(Charles Ponzi)在波士顿为他的投资公司做广告,宣称有丰厚的报酬率又没有风险,他把新投资人的钱拿来付老投资人的年度利息,经过几年名声越来越大,收到的资金越来越多,但庞氏骗局终究有爆发的一日,投资人失去资本,诈骗者入狱服刑,这种骗术如今就是以他为名。

Zelle scammers bilk bank customers out of thousands — how to avoid them

By Paul Wagenseil

9/03/2021

Scams involving Zelle payment service still happening

Two Chicago-area women say scammers bilked them out of $3,500 each by conning them over the phone and then using the Zelle mobile-payment system to withdraw money from their Bank of America accounts.

“It’s really distressing,” one of the women, Nausheen Brooks, told TV station WLS. “You save your hard-earned money to just be taken away from you.”

The scammers texted Brooks and the other woman, Darlene Chelsey, pretending to be Bank of America and asking them to verify purchases. Both women denied making the purchases in question, and then were called by persons claiming to be bank representatives. The scammers used what appeared to be legitimate Bank of America phone numbers.

The women were each told that there had been Zelle withdrawals from their accounts, but that the problems could quickly be fixed if they used their own mobile banking apps to transfer the money back to themselves.

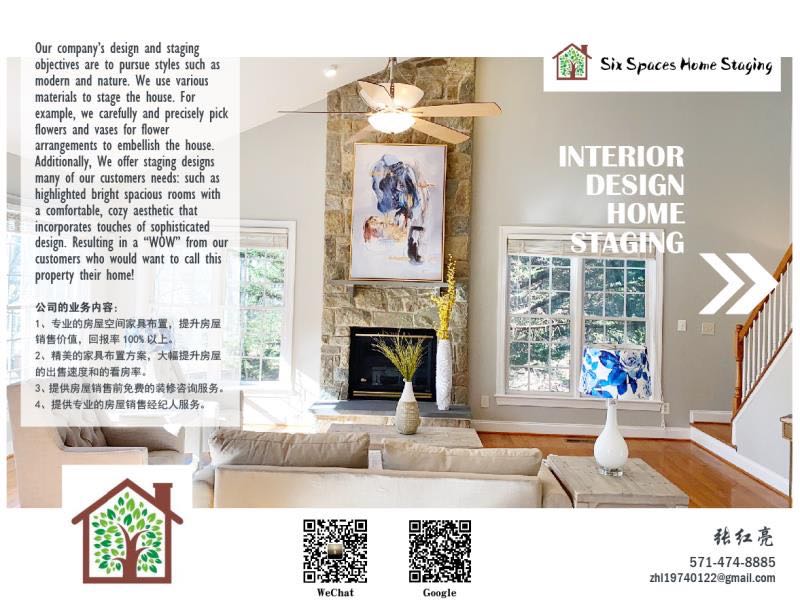

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

Brooks and Chelsey both did so, and the money disappeared. It seems that both their Zelle accounts had already been taken over by the scammers.

“They definitely had access to the account if the money was wired to herself,” Bogdan Bodezatu, a threat researcher with Bitdefender, told WLS. He added that the scammers may have gotten access to the accounts due to data breaches at other websites, which can compromise reused passwords.

How to avoid Zelle scams

Avoiding Zelle scams is like avoiding many other online scams. Create strong, unique passwords for any account that involves money, especially banking accounts, and use one of the best password managers to keep all of them straight.

Don’t trust anyone who calls or texts you and wants you to perform a financial transaction, even if that person appears to be from your bank. Instead, call the bank yourself using a number that you look up.

Don’t give out one-time-use verification codes to anyone, even if they claim to be from your bank. And again, never reuse passwords for sensitive accounts.

Years of Zelle scams

Sadly, this is not a new occurrence. Zelle-based scams have been happening for years — we first wrote about them in April 2018.

The earliest scams involved crooks getting people to pay for non-existent items through Zelle, then discovering they couldn’t get their money back because unlike with a credit-card, the money is withdrawn immediately from your bank account.

Later, people who’d never even signed up for Zelle were scammed out of thousands of dollars by crooks who set up accounts in their names and drained their bank accounts.

That’s because Zelle is owned by seven of the largest U.S. banks, including Bank of America, and used by hundreds more banks. Anyone who has an account with those banks is eligible for a Zelle account, and many banks build Zelle right into their own mobile apps.

These most recent scams seem to involve persons whose accounts have already been hijacked, perhaps through password reuse. (If you use a password on more than one account, then a compromise of any one of those accounts compromises them all.)

Why Zelle is vulnerable

The real problem is that Zelle uses email addresses and phone numbers to identify account holders, and neither was ever designed to be foolproof. Both email addresses and phone numbers can be easily “spoofed” by cheap software.

Many banks do text a one-time code to customers to verify certain transactions, yet not only can text messages be intercepted, but scammers can con customers into revealing texted codes.

Another issue is that Zelle has direct access to bank accounts. Venmo, which is not affiliated with the banks, makes users create a separate account that is linked to a credit card or into which the users deposit money. This creates a buffer between Venmo transactions and their bank accounts.

We’ve reached out to Zelle to ask if the company has made any security improvements in the past three years, and whether Zelle would consider setting up a “staging” account to act as a buffer, similar to the way Venmo operates. We’ll update this story when we receive a response.

In the meantime, one thing does appear to have changed: Both Brooks and Chelsey had their $3,500 losses covered by Bank of America. That’s a better outcome than some of the earliest Zelle scam stories, in which the victims were essentially told by the banks that they should have read the fine print.

That fine print, by the way, still says that the bank isn’t legally liable if you transfer money via Zelle to the wrong people.

Update: Zelle responds

In response to our inquiries, Zelle provided this statement.

“Phishing Scam: This is an example of a phishing scam where the scammer spoofed the Bank of America phone number and attempted to convince the individual to provide their personal information, not a breach of Bank of America or Zelle security.

We’d like to remind consumers that your bank will never call you to ask for sensitive information and they would not ask a customer to transfer funds between accounts in order to prevent fraud. Hang up and call your bank at the phone number listed on the back of your bank-issued debit card or on the bank’s official website if you must provide information over the phone.

In-App Notifications: When consumers send money using Zelle within their mobile or online banking experience, they are sending money directly from their bank account to another person’s bank account, typically within minutes when both users are already enrolled.

When sending money there is a final prompt requiring the sender to confirm the mobile number or email address being used and that it belongs to the intended recipient. This prompt provides the first name of the person who the mobile number or email is enrolled to and an alert that the payment cannot be cancelled once sent.

Consumer education: Zelle is working to address an acute need for financial education. Through our Pay It Safe initiatives, we have partnered with organizations to offer free financial education to consumers through modern banking courses and consumer protection resources.

Through a strategic partnership with EVERFI — the leading social impact education technology company — we have reached more than 60k students in 47 states. Results show that high school students achieved a 39% average knowledge gain after taking the Zelle Money Moves: Modern Banking & Identity Protection course.

In addition, we are working with Cybercrime Support Network to spread awareness and educate consumers and small businesses on avoiding financial fraud and scams.”