DHS Announces Rescission of Civil Penalties for Failure-to-Depart

Release Date: April 23, 2021

WASHINGTON – Today, at the direction of Secretary of Homeland Security Alejandro N. Mayorkas, U.S. Immigration and Customs Enforcement (ICE) rescinded two delegation orders related to the collection of civil financial penalties for noncitizens who fail to depart the U.S., stating they run counter to the agency’s best interest.

“There is no indication that these penalties promoted compliance with noncitizens’ departure obligations,” said Secretary Mayorkas. “We can enforce our immigration laws without resorting to ineffective and unnecessary punitive measures.”

After reviewing detailed data regarding the issuance of such fines since 2018, it was clear to Secretary Mayorkas and Acting ICE Director Tae Johnson that the fines were not effective and had not meaningfully advanced the interests of the agency. ICE intends to work with the Department of Treasury to cancel the existing debts of those who had been fined.

The two delegation orders—ICE Delegation No. 01-2018, Delegation of Authority to Administer and Enforce Provisions Relating to Civil Penalties for Failure to Depart, and ICE Delegation No. 006-2020, Delegation of Authority to Administer Certain Provisions Relating to Civil Penalties for Failure to Depart—delegated to certain ICE officials the authority to administer and enforce certain civil penalties for noncitizens who fail to depart.

Although ICE has had the authority to assess financial penalties to individuals for failing to depart for more than 20 years, the agency did not initiate enforcement of these penalties until 2018. As of January 20, 2021, ICE ceased issuing these fines. This formalizes the Biden Administration’s change in direction.

The rescission marks ICE’s latest move toward focusing its limited resources on those posing the greatest risk to national security and public safety in accordance with the current guidance on civil immigration enforcement and removal priorities, which Acting Director Johnson issued on Feb. 18, 2021.

Source: https://www.dhs.gov/news/2021/04/23/dhs-announces-rescission-civil-penalties-failure-depart

DHS Seeks Public Input to Identify Barriers that Limit or Prevent Access to Immigration Benefits and Services

Release Date 04/19/2021

WASHINGTON—The Department of Homeland Security (DHS) is seeking comment from the public on how U.S. Citizenship and Immigration Services (USCIS) can reduce barriers that prevent both U.S. and foreign citizens from obtaining access to the full assortment of legally available immigration services and benefits.

DHS published a Request for Public Input in the Federal Register seeking the public’s input on barriers to USCIS benefits and services, including but not limited to adjustment of status, naturalization, H-1B nonimmigrant status, refugee status, asylum, and parole. A central goal of the Request for Public Input is to promote equity, above all by reducing administrative burdens, undue complexity, unnecessary confusion, and processing and waiting times. The department requests feedback about any regulations or processes that disproportionally burden disadvantaged, vulnerable, or marginalized communities.

This effort will help identify process improvements for USCIS to operate more efficiently and effectively, and to improve its administration of the nation’s immigration benefits, a core pillar in the agency’s mission. These improvements have the potential to provide major benefits to individuals; state, local, tribal, and territorial governments; small business and startups; educational institutions of all kinds; and nonprofits.

This announcement is a part of the Department’s commitment to fulfill the promise of President Biden’s Feb. 2, 2021, Executive Order 14012, “Restoring Faith in Our Legal Immigration Systems and Strengthening Integration and Inclusion Efforts for New Americans,” which directs responsible Federal agencies to identify strategies that promote inclusion and identify barriers that impede access to immigration benefits.

The public may submit comments, identified by docket number USCIS-2021-0004, through the Federal eRulemaking Portal. Please follow the instructions for submitting comments. All written comments are requested on or before May 19. Comments submitted in a manner other than the one listed in the Federal Register, including e-mails or letters sent to DHS or USCIS officials, may not be reviewed.

Feedback from this initiative will be used to refine and strengthen strategic plans, consider reforms, and execute reports pursuant to President Biden’s Executive Order 14012. Changes and or process improvements, based on this feedback, will be at the sole discretion of DHS.

For more information on USCIS and its programs, please visit uscis.gov or follow us on Twitter, Instagram, YouTube, Facebook, and LinkedIn.

Last Reviewed/Updated: 04/19/2021

Phony Immigration Attorney Who Filed Hundreds of Fraudulent Asylum Applications Sentenced to More Than 20 Years in Federal Prison

Release Date 04/13/2021

TAMPA, Fla.— Senior U.S. District Judge Virginia M. Hernandez Covington today sentenced Elvis Harold Reyes (56, Brandon, Florida) to 20 years and 9 months in federal prison for mail fraud and aggravated identity theft in connection with a scheme where he posed as an immigration attorney and filed hundreds of fraudulent asylum applications. The Court deferred consideration of victim restitution to a later date.

Reyes had pleaded guilty on December 15, 2020.

According to court documents, Reyes, who owned and operated EHR Ministries Inc., portrayed himself as an immigration attorney. He is not and has never been a licensed attorney. Reyes targeted undocumented immigrants from Spanish-speaking countries who were seeking Florida driver licenses and work authorization. Reyes gave false, inaccurate, and incomplete legal and immigration advice to victims in order to induce them to retain his services and those of EHR Ministries.

Victims retained and paid Reyes to represent them in immigration-related matters before U.S. Citizenship and Immigration Services (USCIS) and other agencies. Reyes filed fraudulent immigration applications in the victims’ names, seeking asylum relief and withholding-of-removal protections provided for under the United Nations Convention Against Torture. In doing so, Reyes falsified answers to questions in the asylum applications—fabricating stories about threats, persecution, and the applicants’ fear of returning to their native countries. Reyes did not inform the victims of the answers that he had provided on their behalf. He also did not inform the victims about the legal, administrative, and other immigration-related consequences that might follow from filing for asylum relief or for Convention Against Torture protection.

Reyes filed more than 225 fraudulent applications, intending to cause victim loss of more than $1 million. His victims’ actual losses exceeded $411,000. Reyes spent the criminal proceeds on, among other things, travel, luxury shopping, spas, jewelry, beautification/anti-aging procedures, and an allowance for his girlfriend.

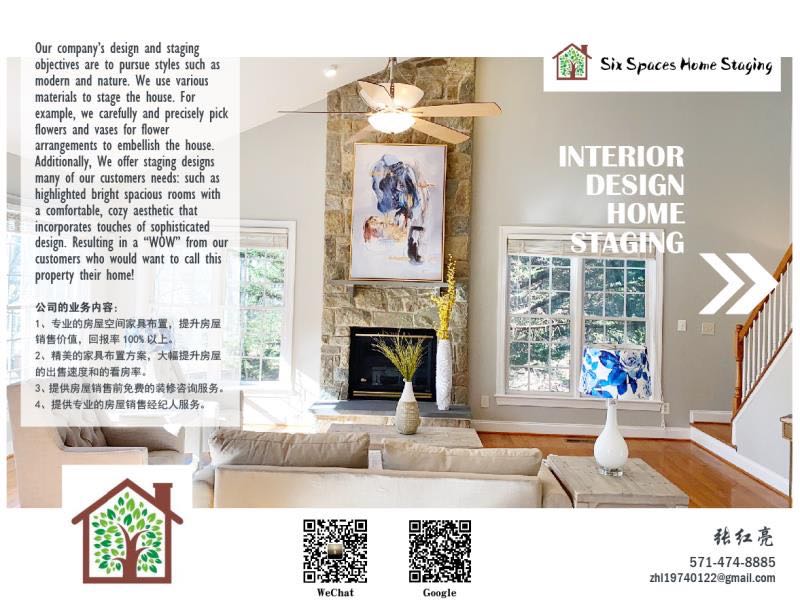

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

Reyes threatened aggrieved victims who confronted him by claiming that he could have them deported. And, when investigative reporting revealed Reyes’s scheme, he attempted to obstruct justice by having a friend wipe his computers.

“Posing as an immigration attorney, Reyes targeted hundreds of vulnerable people in the Tampa community with his immigration scam,” said USCIS Tampa District Director Michael Borgen. “USCIS is committed to finding and stopping those who want to cheat the immigration system, and preserving it for those who qualify for immigration benefits.”

“This criminal defrauded hundreds of victims who thought they were starting a path to legal citizenship,” said HSI Tampa Assistant Special in Charge Michael Cochran. “Identity and benefit fraud are crimes that threaten the national security and public safety of the U.S. by creating vulnerabilities to our legal immigration system. Thanks to HSI special agents, and our partners with U.S. Citizenship and Immigration Services and Hillsborough County Sheriff’s Office, he will now be held accountable for his crimes.”

“It is appalling that Elvis Reyes was preying on vulnerable individuals living in fear within our county,” said Hillsborough County Sheriff Chad Chronister. “I am proud of our detectives, who thoroughly investigated claims made by each victim, and our diligent efforts to reach undocumented members of our community through both English and Spanish PSAs, encouraging them to come forward if they were taken advantage of by Mr. Reyes. I am confident that these efforts ultimately helped lead to a conviction.”

This case was investigated by the Department of Homeland Security, Homeland Security Investigations, U.S. Citizenship and Immigration Services, and the Hillsborough County Sheriff’s Office. It was prosecuted by Assistant United States Attorney Frank Murray.

For more information on USCIS and its programs, please visit uscis.gov or follow us on Twitter, Instagram, YouTube, Facebook, and LinkedIn.

Last Reviewed/Updated: 04/13/2021

F-1 Students Seeking Optional Practical Training Can Now File Form I-765 Online

Release Date 04/12/2021

WASHINGTON—U.S. Citizenship and Immigration Services today announced that F-1 students seeking optional practical training (OPT) can now file Form I-765, Application for Employment Authorization, online if they are filing under one of these categories:

- (c)(3)(A) – Pre-Completion OPT;

- (c)(3)(B) – Post-Completion OPT; and

- (c)(3)(C) – 24-Month Extension of OPT for science, technology, engineering and mathematics (STEM) students.

OPT is temporary employment that is directly related to an F-1 student’s major area of study. Eligible students can apply to receive up to 12 months of OPT employment authorization before completing their academic studies (pre-completion) and/or after completing their academic studies (post-completion). Eligible F-1 students who receive STEM degrees may apply for a 24-month extension of their post-completion OPT.

“USCIS remains committed to maximizing our online filing capabilities,” said Senior Official Performing the Duties of USCIS Director Tracy Renaud. “The I-765 online filing option allows eligible students to file forms online in a more user-friendly fashion and increases efficiencies for adjudicators.”

The option to file Form I-765 online is only available to F-1 students filing Form I-765 for OPT. If an applicant submits Form I-765 online to request employment authorization on or after April 15, but is eligible for a different employment authorization category, USCIS will deny the application and retain the fee. As USCIS continues to transition to paperless operations, the agency will work to expand online filing for Form I-765 to additional categories.

Online filing allows applicants to submit forms electronically, check the status of their case anytime from anywhere, and receive notices from USCIS online instead of waiting for them in the mail. USCIS is using innovation and technology to meet the needs of applicants, petitioners and employees. Regardless of the paper or electronic format of an application or petition, USCIS is committed to ensuring a secure and efficient process for all.

Individuals can file 11 USCIS forms online, which can all be found on the Forms Available to File Online page. To file these forms online, individuals must first create a USCIS online account at myaccount.uscis.gov. This free account allows them to:

- Submit their forms;

- Pay their fees;

- Track the status of their case;

- Communicate with USCIS through a secure inbox; and

- Respond to Requests for Evidence.

USCIS continues to accept the latest paper version of these forms by mail.

For more information on USCIS and its programs, please visit uscis.gov or follow us on Twitter, Instagram, YouTube, Facebook and LinkedIn.

Last Reviewed/Updated: 04/12/2021

DHS Withdraws ‘Affidavit of Support’ Proposed Rule

Release Date 03/19/2021

The Department of Homeland Security (DHS) today announced the withdrawal of the affidavit of support proposed rule, consistent with DHS’s commitment to reduce barriers within the legal immigration system that placed increased burdens on American families wishing to sponsor individuals immigrating to the U.S.

The Oct. 2, 2020, proposed rule would have changed the evidentiary requirements for U.S. citizens, U.S. nationals, and lawful permanent residents wishing to sponsor an individual immigrating to the U.S. by completing an affidavit of support under Section 213A of the Immigration and Nationality Act (INA) on behalf of the intending immigrant.

Consistent with President Biden’s Executive Order (EO) 14012, Restoring Faith in Our Legal Immigration Systems and Strengthening Integration and Inclusion Efforts for New Americans, DHS and USCIS are committed to eliminating barriers that prevent legal immigrants from accessing government services available to them.

The affidavit of support proposed rule would have imposed higher qualifying and evidentiary requirements, including production of tax returns, banking information and credit reports. Moreover, these requirements would have placed new, costly burdens, estimated at $2.4 billion over the next decade, on U.S. citizens, U.S. nationals, and lawful permanent residents signing an affidavit of support on behalf of intending immigrants.

Last Reviewed/Updated: 03/19/2021

Source: https://www.uscis.gov/news/alerts/dhs-withdraws-affidavit-of-support-proposed-rule

Landlords are getting squeezed between tenants and lenders

By ANNE D’INNOCENZIO

NEW YORK (AP) — When it comes to sympathetic figures, landlords aren’t exactly at the top of the list. But they, too, have fallen on hard times, demonstrating how the coronavirus outbreak spares almost no one.

Take Shad Elia, who owns 24 single-family apartment units in the Boston area. He says government stimulus benefits allowed his hard-hit tenants to continue to pay the rent. But now that the aid has expired, with Congress unlikely to pass a new package before Election Day, they are falling behind.

Heading into a New England winter, Elia is worried about such expenses as heat and snowplowing in addition to the regular year-round costs, like fixing appliances and leaky faucets.

Elia wonders how much longer his lenders will cut him slack.

“We still have a mortgage. We still have expenses on these properties,” he said. “But there comes a point where we will exhaust whatever reserves we have. At some point, we will fall behind on our payments. They can’t expect landlords to provide subsidized housing.”

The stakes are particularly high for small landlords, whether they own commercial properties, such as storefronts, or residential properties such as apartments. Many are borrowing money from relatives or dipping into their personal savings to meet their mortgage payments.

The big residential and commercial landlords have more options. For instance, the nation’s biggest mall owner, Simon Property Group, is in talks to buy J.C. Penney, a move that would prevent the department store chain from going under and causing Simon to lose one of its biggest tenants. At the same time, Simon is suing the Gap for $107 million in back rent.

Michael Hamilton, a Los Angeles-based real estate partner at the law firm O’Melveny & Myers, said he expects to see more retail and other commercial landlords going to court to collect back rent as they get squeezed between lenders and tenants.

Residential landlords are also fighting back against a Trump administration eviction moratorium that protects certain tenants through the end of 2020. At least 26 lawsuits have been filed by property owners around the country in places such as Tennessee, Georgia and Ohio, many of them claiming the moratorium unfairly strains landlords’ finances and violates their rights.

Apartment dwellers and other residential tenants in the U.S. owe roughly $25 billion in back rent, and that will reach nearly $70 billion by year’s end, according to an estimate in August by Moody’s Analytics.

An estimated 30 million to 40 million people in the U.S. could be at risk of eviction in the next several months, according to an August report by the Aspen Institute, a nonprofit organization.

Jessica Elizabeth Michelle, 37, a single mother with a 7-month-old baby, represents a growing number of renters who are afraid of being homeless once the moratorium on evictions ends.

The San Francisco resident saw her income of $6,000 a month as an event planner evaporate when COVID-19 hit. Supplemental aid from the federal government and the city helped her pay her monthly rent of $2,400 through September. But all that has dried up, except for the unemployment checks that total less than $2,000 a month.

For her October rent, she handed $1,000 to her landlord. She said her landlord has been supportive but has made it clear he has bills to pay, too.

“I never had an issue of paying rent up until now. I cry all night long. It’s terrifying,” Michelle said. “I don’t know what to do. My career was ripped out from under me. It’s gotten to the point of where it’s like, ‘Am I going to be homeless?’ I have no idea.’”

Some landlords are trying to work with their commercial or residential tenants, giving them a break on the rent or more flexible lease terms. But the crisis is costing them.

Analytics firm Trepp, which tracks a type of real estate loan taken out by owners of commercial properties such as offices, apartments, hotels and shopping centers, found that hotels have a nearly 23% rate of delinquency, or 30 days overdue, on their loans, while the retail industry has a 14.9% delinquency rate as of August.

The apartment rental market has so far navigated the crisis well, with a delinquency rate of 3%, according to Trepp. That’s in part because of the eviction moratorium, along with extra unemployment benefits from Washington that have since expired.

“There are bad actors, but the majority of landlords are struggling and are trying to work with a bad situation,” said Andreanecia M. Morris, executive director of HousingNOLA, a public-private partnership that pushes for more affordable housing in the New Orleans area.

Morris, who works with both landlords and tenants, said that government money wasn’t adequate to help tenants pay their rent, particularly in expensive cities. She is calling for comprehensive rental assistance.

She fears that residential landlords will see their properties foreclosed on next year, and the holdings will be bought by big corporations, which are not as invested in the neighborhoods.

Gary Zaremba, who owns and and manages 350 apartment units spread out over 100 buildings in Dayton, Ohio, said he has been working with struggling tenants — many of them hourly workers in restaurants and stores — and directs them to social service agencies for additional help.

But he is nervous about what’s next, especially with winter approaching and the prospect of restaurants shutting down and putting his tenants out of work. He has a small mortgage on the buildings he owns but still has to pay property taxes and fix things like broken windows or leaky plumbing.

“As a landlord, I have to navigate a global pandemic on my own,” Zaremba said, “and it’s confusing.”