Fairfax County’s Unaffordable Housing Program

Arthur G. Purves | Bacon’s Rebellion

3/31/2022

If you live in Fairfax County and are over 50, you may have received from the county a five-page 120-question survey to “…inform the county’s … Future Aging Plan.” Here’s the Fairfax County Taxpayers Alliance Future Aging Plan: stop taxing us out of our homes.

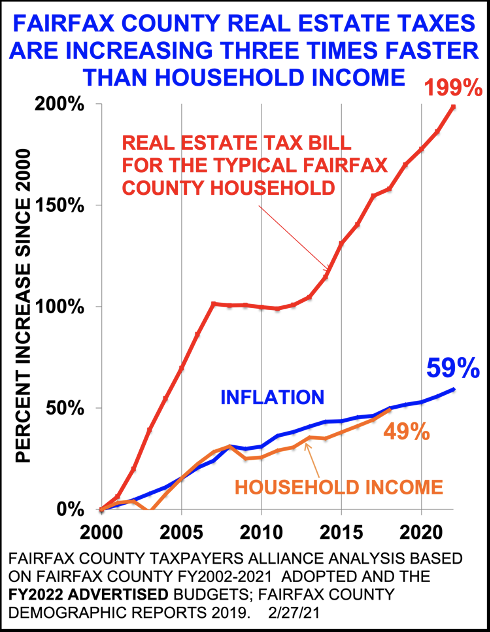

For 20 years, county supervisors have been increasing real estate taxes three times faster than household income. Real estate taxes are the supervisors’ “Unaffordable Housing Program.” The supervisors do have an “Affordable Housing Program,” but with a waiting list so long that they’re afraid to disclose it. Their Unaffordable Housing Program, however, has no waiting list: Homeowners get a tax hike July 28.

Healthcare Certification and ESL Programs

Assessments increased almost 10%. Many people think that if assessments increase, real estate taxes must increase, too. This is false. Supervisors can prevent a tax hike by lowering the tax rate 10 cents. However, if they keep the rate unchanged, they get an extra $250 million. That’s a quarter of billion dollars.

The supervisors want that money to give 37,000 county and school employees 6% and 7% raises, because of “recruitment and retention issues.” For the past two decades the average raises for all county and school employees have been higher than inflation. Most employees would probably lose pay and benefits if they went to the private sector.

Except for police, the supervisors have provided no data about retention. What’s the impact of mask and vaccine mandates? Administrivia? Or, in the schools, student behavior? What’s the impact of the anti-police rhetoric?

What do our taxes buy us?

A county administration that cannot attract business: commercial real estate tax revenues are stagnant.

A school system that, because of its flawed reading and arithmetic curriculum, provides no upward mobility for low-income children and mediocre achievement for whites.

A school system that uses history to attack the Constitution. As Governor Youngkin has repeatedly said, we need to teach honest history. But the goal of CRT is to dissolve the Senate, end the electoral college, and become a pure democracy. Pure democracy leads to tyranny. Vladimir Putin was elected president by a 71% majority. Hitler and Mussolini’s parties won popular elections. Is that what we want from our taxes?

To prevent a tax increase the supervisors can lower the real estate rate by 10 cents. We predict they’ll lower it by only 5 cents.

The supervisors have provided no evidence to back up their claim that recruitment and retention justify a quarter of a billion dollars of raises. Until they do, the Taxpayers Alliance recommends that the supervisors lower the tax rate 10 cents.

Also, union contributions to supervisor political campaigns are a conflict of interest, as unions sit on both sides of the bargaining table. We therefore recommend an end to union contributions to supervisor political campaigns.

Arthur G. Purves is president of the Fairfax County Taxpayers Alliance. This article was first published online by Bacon’s Rebellion.

Fairfax County Notice of Proposed Real Property Tax Increase

3/10/2022

In accordance with Virginia Code Section 58.1-3321, notice is hereby given that the Board of Supervisors of Fairfax County, Virginia, will meet in the Board Auditorium of the Fairfax County Government Center, 12000 Government Center Parkway, Fairfax, Virginia, on April 12, 2022 at 3:00 P.M. At that meeting, the Board of Supervisors shall consider the matters described below.

The Fairfax County Executive has proposed the advertisement of a real estate tax rate of $1.14 per $100 of assessed value. No numerical change in the Real Estate tax is being proposed; however, the total assessed value of existing property has increased. It should be noted that the total increase in assessed value of existing properties is expected to be 7.72 percent, including an increase of 9.57 percent for residential real property and an increase of 2.27 percent for non-residential real property. As a result, most property owners will experience an increase in their real estate tax bill. The tax rate being proposed remains the same as FY 2022. Nevertheless, because the average value of real property in Fairfax County has appreciated by at least one percent, Virginia Code Section 58.1-3321 requires Fairfax County to publish the following notice.

Fairfax County, Virginia proposes to increase property tax levies.

- Assessment Increase: Total assessed value of real property, excluding additional assessments due to new construction or improvements to property, exceeds last year’s total assessed value of real property by 7.72 percent.

- Lowered Rate Necessary to Offset Increased Assessment: The tax rate which would levy the same amount of real estate tax as last year, when multiplied by the new total assessed value of real estate with the exclusions mentioned above, would be $1.0583 per $100 of assessed value. This rate will be known as the “lowered tax rate”.

- Effective Rate Increase: Fairfax County, Virginia, proposes to adopt a tax rate of $1.14 per $100 of assessed value. The difference between the lowered tax rate and the proposed rate would be $0.0817 per $100, or 7.72 percent. This difference will be known as the “effective tax rate increase”.Individual property taxes may, however, increase at a percentage greater than or less than the above percentage.

- Proposed Total Budget Increase: Based on the proposed real property tax rate and changes in other revenues, the total budget of Fairfax County, Virginia, will exceed last year’s by 6.48 percent [1].

A public hearing on this issue will be held at 3:00 P.M. on April 12, 2022 in the Board Auditorium of the Fairfax County Government Center at 12000 Government Center Parkway.

All persons wishing to present their views on these subjects may sign up to be placed on the Speakers List at www.fairfaxcounty.gov/bosclerk/speakers-form, call the Office of the Clerk to the Board at 703-324-3151, or appear and be heard. Copies of the full text of proposed ordinances, plans and amendments, as applicable, as well as other documents relating to the aforementioned subjects, are on file and may be examined at the Office of the Clerk to the Board of Supervisors, Suite 552 of the Fairfax County Government Center, 12000 Government Center Parkway, Fairfax, Virginia.

Fairfax County supports the Americans with Disabilities Act by making reasonable accommodations for persons with disabilities. Open captioning will be provided in the Board Auditorium. For sign language interpreters or other accommodations, please call the Clerk’s Office, 703-324-3151, TTY 711 (Virginia Relay Center) no later than 48 hours before the public hearing. Assistive listening devices will be available at the meeting.

The Board will conduct a separate hearing on the FY 2023 Advertised Budget Plan which will commence on April 12, 2022 at 4:00 PM and on April 13 and April 14 at 1:00PM.

Copies of the FY 2023 Advertised Budget Plan and the Advertised Capital Improvement Program for Fiscal Years 2023-2027 (With Future Fiscal Years to 2032) are available on the Internet at https://www.fairfaxcounty.gov/budget/.

A Copy – Teste:

_________________________

Jill G. Cooper, Clerk

Board of Supervisors

_________________________

[1]: The total budget increase is based on all revenues received by the General Fund of Fairfax County. Projected FY 2023 disbursements reflect an increase of 1.78 percent over the FY 2022 level.

Fairfax County board passes 5-cent tax on plastic shopping bags

InsideNoVa Staff

9/16/2021

The Fairfax County Board of Supervisors this week voted 9-1 to approve a 5-cent tax on plastic bags at grocery stores, convenience stores and drugstores.

The tax will go into effect Jan. 1, 2022.

Supervisor Pat Herrity of the Springfield district cast the only dissenting vote.

The Virginia General Assembly approved legislation in 2020 allowing localities to impose a 5-cent tax on disposable plastic bags at grocery, convenience and drug stores, with some exceptions.

The state code requires retailers to collect the tax proceeds in a similar manner to sales and meals taxes. Through Dec. 31, 2022, retailers can keep 2 cents from the tax collected on each bag, with the retailers’ share dropping to 1 cent starting Jan. 1, 2023.

Revenues from such taxes must be for specific activities like environmental cleanup, pollution mitigation and providing reusable bags to people on federal food support programs, according to a staff report to the Fairfax County Board of Supervisors prepared by Fairfax County Executive Bryan Hill.

The Virginia Department of Taxation created a fiscal impact statement with the legislation that said the tax could generate between $20.8 million and $24.9 million in revenue statewide based on similar taxes in Montgomery County, Md., and Washington, D.C.

Hill’s report said that Montgomery County, which has about 1 million residents, received about $2.61 million in revenue in 2017. Hill’s report noted that the revenue would decline over time as customers start using reusable bags, although it will take several years.

He wrote that it would be difficult to estimate potential revenues because Virginia’s legislation applies only to certain retailers while Montgomery County’s applies to virtually all and doesn’t have certain exemptions.

Earlier this year, Prince William County supervisors began drafting a similar plastic bag tax but decided to wait until after the fiscal 2022 budget was passed.

Fairfax County, Vienna Real Estate Taxes Over Last 40 Years

By David Swink

7/10/2021

This FCTA board member has lived in the same southwest Vienna rambler since Dec 1975 — with no improvements made which would alter its accessed value for tax purposes. So my home can serve as a baseline for judging the actual growth of real estate taxes in both Fairfax County and Town of Vienna for the period from 1976 onward.

We’re all familiar with FCTA’s graph of Fairfax County real estate tax increases since FY2000. But here is raw data going back another 25 years — in actual dollars (not noting inflation).

A column is provided showing the County real estate tax percent increase from the previous year. Another column shows Vienna’s real estate tax as a percentage of the county’s, to see if Vienna’s numbers track with those of the county. So what does one notice? Even without a graph, one can deduce the following:

- Both Fairfax County and Vienna taxes “took off” after year 2000, leveled during the Great Recession, and are now back on full throttle.

- The Vienna percentage is fairly consistently in the low-to-mid 20’s, and thus seems more tied to county increases than to actual need.

- Oddly, the raw tax increase (not adjusted for inflation) from 1976 to 2013 is precisely a factor of 6.18 for both the county and Vienna.

BOS Chairman Year Fx Co Tax Yr-Yr Vienna Tax Vn/Fx

Jack Herrity-R 1976 $821.72 - $170.01 20.69%

" 1977 $857.91 +4.44% $177.50 20.69%

" 1978 $872.97 +1.76% $175.66 20.12%

" 1979 $884.27 +1.29% $178.00 20.13%

" 1980 $980.98 +10.94% $197.47 20.13%

" 1981 $1077.23 +9.81% $235.42 21.85%

" 1982 $1164.02 +8.06% $261.31 22.45%

" 1983 $1164.02 0 $261.31 22.45%

" 1984 $1217.13 +4.56% $275.10 22.60%

" 1985 $1216.67 -0.04% $288.85 23.74%

" 1986 $1232.69 +1.32% $292.19 23.70%

" 1987 $1354.12 +9.85% $318.01 23.48%

Audrey Moore-D 1988 $1554.41 +14.79% $358.71 23.08%

" 1989 $1752.93 +14.79% $412.45 23.53%

" 1990 $1913.03 +9.13% $482.57 25.23%

" 1991 $1779.11 -7.00% $464.81 26.13%

Tom Davis-R 1992 $1826.46 +2.66% $471.23 25.80%

" 1993 $1824.27 -0.12% $471.23 25.83%

" 1994 $1824.27 0 $471.23 25.83%

Kate Hanley-D 1995 $1886.98 +3.44% $487.43 25.80%

" 1996 $2000.07 +5.99% $487.43 24.37%

" 1997 $1998.44 -0.08% $503.67 25.20%

" 1998 $1998.44 0 $503.67 25.20%

" 1999 $1998.44 0 $503.67 25.20%

" 2000 $2123.17 +6.24% $534.67 25.18%

" 2001 $2441.63 +15.00% $595.04 24.37%

" 2002 $2955.38 +21.04% $695.52 23.53%

" 2003 $3185.20 +7.78% $754.46 23.69%

Gerry Connolly-D 2004 $3413.19 +7.16% $799.73 23.43%

" 2005 $3753.75 +9.98% $825.00 21.98%

" 2006 $4281.44 +14.07% $894.73 20.90%

" 2007 $4281.44 0 $959.12 22.40%

" 2008 $4425.59 +3.37% $1004.77 22.70%

Sharon Bulova-D 2009 $4396.65 -0.65% $958.76 21.81%

" 2010 $4294.60 -2.32% $950.56 22.13%

" 2011 $4690.11 +9.21% $1045.56 22.29%

" 2012 $4658.44 -0.68% $1029.02 22.09%

" 2013 $5080.52 +9.06% $1051.02 20.69%

" 2014 $5547.46 +9.19% $1139.88 20.55%

" 2015 $5783.11 +4.25% $1165.95 20.16%

" 2016 $6243.39 +7.96% $1212.57 19.42%

" 2017 $6422.76 +2.87% $1244.72 19.38%

" 2018 $6837.56 +6.46% $1299.92 19.01%

" 2019 $6984.07 +2.14% $1327.77 19.01%

Jeff McKay-D 2020 $7159.35 +2.51% $1361.09 19.01%

" 2021 $7452.66 +4.10% $1413.05 18.96%

Numbers for future years will be added to the table as they become available. Also, information such as the political make-up of the Fairfax County Board of Supervisors for each period may be added. Enjoy.

— David Swink, FCTA board member / Updated 2021-07-10