潘朵拉文档:创投公司挤走中产阶级买房机会且压榨租客

世界新闻网

12/15/2021

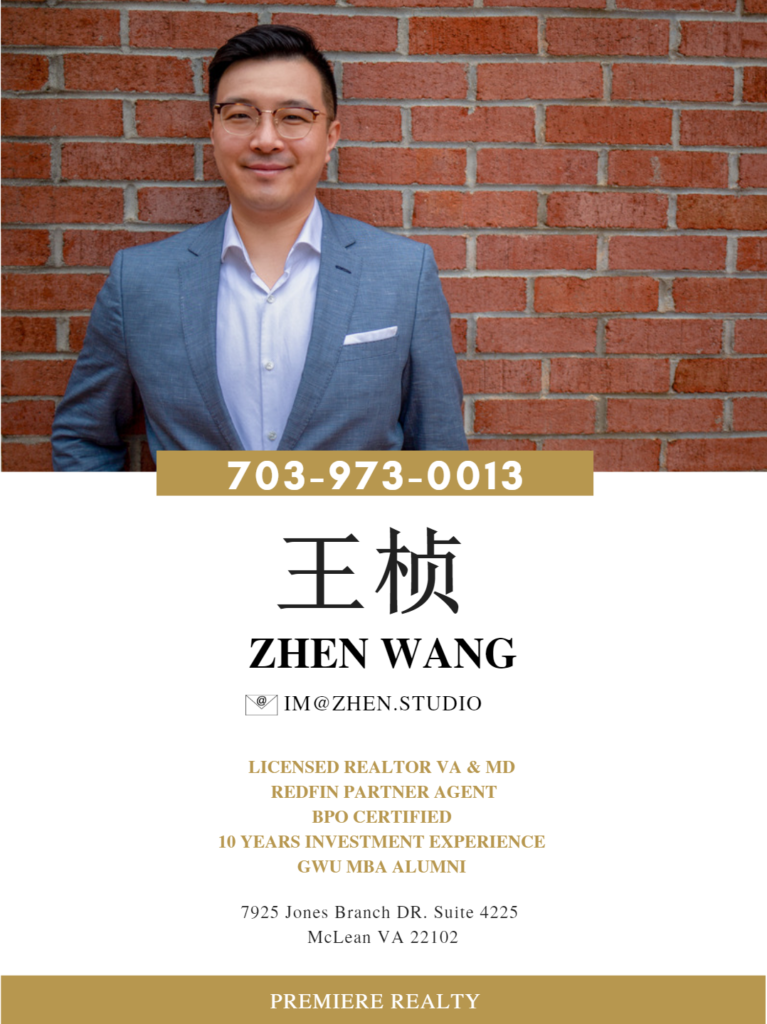

华盛顿邮报15日报导,国际调查记者联盟(International Consortium of Investigative Journalists,ICIJ)公布的「潘朵拉文档」(Pandora Papers)调查报告披露,掌握十多亿资产的创投公司凭着富可敌国的财力,在房屋市场挤走渴望买下生平第一栋房子的中产阶级民众,创投公司大手笔收购房屋后做为出租之用,却以不公平手段调涨房租、巧立名目收取各种费用,压榨房客。

报导举例指出,座落于田纳西州纳许维尔(Nashville)郊区的坦米苏巷(Tammy Sue Lane),社区里并没有豪宅,有着乙烯基塑料片外墙壁板(vinyl siding)的住宅屋龄平均15年,房价则在20万元以下。对于某些民众来说,这些房子代表着人生中买房愿望第一次实现,巷里的屋主职业包括有狱警、清洁工以及电工。

然而,某些全世界最有钱的超级富人,却通过投资手段买走了坦米苏巷的房子。

报导指出,过去6年间,坦米苏巷32栋住宅里,有19栋被资产高达十亿元的创投公司「进步住家」(Progress Residential)买走,全球金融以空前规模流入美国郊区房地产市场由此可见一斑。

成立不到10年的「进步住家」创投公司,如今已成为拥有全美数量最多独栋式住家(single-family houses)的机构之一,也是数万户家庭的房东。

根据报导,「进步住家」创投公司利用电脑演算公式搜索,加上快狠准的全现金出价,一个月最高可买下2000栋民宅,公司高层主管曾说,这种高效率的买房操作,有利于买不起入门等级房屋(entry-level homes)的民众能够租到房子。

根据最新曝光档案内容,以及数十名「进步住家」创投公司房客及前任员工的访问,「进步住家」创投公司的经营模式却被踢爆为全球富豪谋取巨大利益,在房屋市场竞价导致中产阶级民众买不到房子,对于房客则频频祭出不公平的房租调涨手段,巧立名目收取各种费用,物业管理品质低劣。

坦米苏巷的租屋族、亚马逊网站(Amazon)仓储员工维多莉亚‧贝兹(Victoria Bates)受访时便说,投资公司的手段「毫无人性」。她说,就连基本维修要求,「进步住家」通常都无法做到,热水器漏水花了好几个月才终于修好,却对房客收取各种昂贵的费用。

「进步住家」创投公司发表声明回应表示,房租与收费标准都符合业界标准,并「遵守最高的道德规范与法律规定」。

「潘朵拉文档」披露,「进步住家」创投公司的成立与位于纽约的博盛投资公司(Pretium Partners)有关。博盛在2008年美国房市危机期间,大举进入美国房地产市场,趁着低价收购数万栋民宅,然后把房子租给金融风暴底下失去房子或无力缴交房贷的民众。

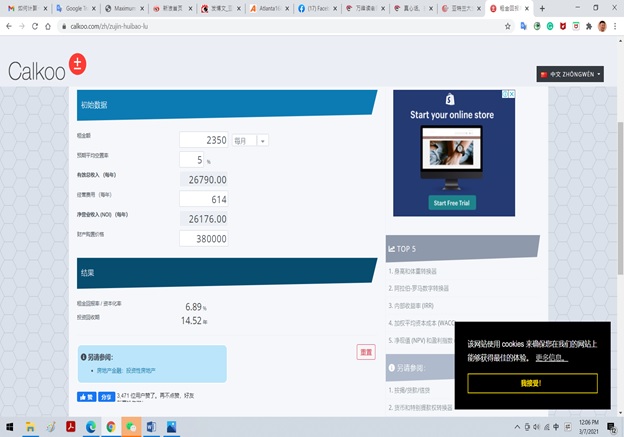

根据博盛投资公司2012年寄给投资客,长达238页的资金募集邀请计划,征求投资200万元以上,每年获利上看15%至20%。博盛投资公司共计向全球各地富人募得10多亿元,「进步住家」创投公司因此诞生。

How a billion dollar housing bet upended a Tennessee neighborhood

Pandora Papers show a Wall Street plan to cash in on the foreclosure crisis by pouring money into rental homes, part of an unprecedented flow of global finance into US suburbs that has left stressed tenants in its wake.

By Spencer Woodman, Margot Gibbs and Peter Whoriskey

Image: Salwan Georges/The Washington Post

December 15, 2021

La Vergne, TENN. — The homes on Tammy Sue Lane aren’t fancy. Modest in size and clad in vinyl siding, the houses were priced below $200,000 when most were built about 15 years ago, and for many families in suburban Nashville, they represented a first chance at homeownership.

A corrections officer bought one, and so did a housekeeper and an electrician.

Then some of the world’s wealthiest people bought in.

Over the past six years, 19 of the 32 homes on Tammy Sue Lane have been purchased by a billion-dollar investment venture, part of an unprecedented flow of global finance into the American suburbs. Less than 10 years old, the company has amassed one of the nation’s largest portfolios of single-family houses, renting them to families who cannot afford to buy the “entry level” homes.

The venture, Progress Residential, acquires as many as 2,000 houses a month with a computerized property-search algorithm and rapid all-cash offers. Progress executives boast that the company’s efficient management practices have been a boon to their tenants.

But according to previously undisclosed documents and dozens of interviews with renters and former employees, Progress Residential has been ringing up substantial profits for wealthy investors around the world while outbidding middle-class home buyers and subjecting tenants to what they allege are unfair rent hikes, shoddy maintenance and excessive fees.

“There’s just no human decency,” said Victoria Bates, an Amazon warehouse worker who lives on Tammy Sue Lane with her husband and 10-year-old daughter. Bates said the company regularly failed to fulfill ordinary maintenance requests. While the company said it “addressed” within five days most of the 37 work orders she submitted, Bates said most of the time it didn’t fix what was needed: It took several months for the company to repair a leaky water heater, she said.

Meanwhile, Bates said, the firm levies a profusion of fees that “take advantage of regular people working paycheck to paycheck.”

In a statement, Progress Residential defended its operations, including the treatment of tenants, saying that its rents and fees are in line with industry standards and market rates. Pretium officials said they adhered to the federal eviction moratorium.

“All of our entities conduct business according to the highest ethical and legal standards,” the company said.

Behind Progress Residential is Pretium Partners, a New York-based investment firm whose business plan and investors are revealed in the Pandora Papers, a trove of offshore financial records obtained by the International Consortium of Investigative Journalists (ICIJ) and shared with The Washington Post.

The plan sought to exploit the 2008 U.S. housing crash, which forced millions of homeowners into foreclosure and left a glut of cheap houses for sale. The financiers’ plan called for buying up tens of thousands of these properties at depressed prices and renting them to families who had lost their homes or, because of tightened lending practices, could no longer qualify for a mortgage.

The venture would ‘capitalize on the severe distress in the residential real estate market in the United States,’ according to the pitch memo.

To raise money for the project, Pretium Partners sent confidential invitations to people wealthy enough to put up at least $2 million. Executives projected annualized returns of 15 to 20 percent, according to a 238-page solicitation to investors in 2012. In total, Pretium Partners raised more than $1 billion, and the resulting real estate venture became Progress Residential.

The venture would “capitalize on the severe distress in the residential real estate market in the United States,” according to the pitch memo. The homes would be rented to families “who have been displaced by foreclosure or are otherwise unable to obtain financing despite being able to afford a home purchase.”

Among those who profited from America’s housing crash, according to the documents, was a Cayman Islands trust funded by one of Canada’s most powerful political donors, Stephen Bronfman, an heir to the billion-dollar Seagram spirits fortune. Another was Vikrant Bhargava, who co-founded an online gambling company that debuted on the London Stock Exchange valued at $8.5 billion. Pretium made legal arrangements so such foreign investors would have limited exposure to U.S. taxes, according to tax experts.

While the documents do not identify most of the other investors, they show that an outsize share of the potential profit was earmarked for Donald R. Mullen Jr., founder and chief executive of Pretium Partners, and others in the firm.

Mullen is well known in financial circles for his tenure at Goldman Sachs, where he helped oversee that firm’s lucrative bet against U.S. housing and mortgage markets ahead of the 2008 crisis. That bet, a strategy popularly known as “the big short,” allowed Goldman to profit as markets plummeted.

With the Progress Residential venture, Mullen bet in the other direction — that the houses it was buying would increase in value. By 2019, according to a press release at the time, the venture had nearly doubled investors’ equity.

While those kinds of profits have inspired admiration on Wall Street, the reaction has been different on Tammy Sue Lane and in other Sun Belt subdivisions where Progress Residential and similar firms are devouring the housing supply and outbidding families. Rutherford County, where Tammy Sue Lane is located, ranked as the fifth-least affordable U.S. county for home buyers when considering wages in the area, according to the real estate data firm ATTOM Data Solutions.

Rob Mitchell, the county property assessor, says nearly 1 in 10 homes there is now owned by a real estate investment trust, and these investments are jacking up house prices.

These ventures are “equity-mining our community — removing generational wealth for an entire demographic of people,” said Mitchell, a Republican elected official. “For the average person starting out wanting to start their family, the choice is no longer: Can I purchase a house? It’s instead: Can I afford to rent a house?”

While buying up block after block, Progress also has been accused of aggressively evicting tenants. Congress is investigating whether Progress and other major rental firms violated a national moratorium on evictions during the pandemic. Sen. Sherrod Brown (D-Ohio), chairman of the Senate Banking Committee, has requested that Progress explain why its pandemic-era eviction filings appear to have fallen more heavily on majority-Black communities.

More than 3,000 people across the nation have joined a Facebook group for tenants called Victims of Progress Residential. The site is an eruption of tenant complaints — about evictions, but also lost security deposits, costly fees, calls that go unanswered, an array of maintenance issues — that echo those of Progress renters in Rutherford County.

“They’re preying on all these people,” said Cindy Hicks, a hospital revenue specialist who lives in a Progress home near Tammy Sue Lane. Hicks said that when she was late on rent the company was quick to file for eviction and charged her a related fee of hundreds of dollars even after she paid up.

“Because of the customer service, we hope to be moving out soon,” said Odera Okafor, an IT worker who lives on Tammy Sue Lane with his wife and 12-year-old child. In just a few years, he said, he’s had repeated problems with an air-conditioning unit that froze and plumbing issues.

“I can’t tell you who is behind Progress Residential. All we can tell you is it’s been bad,” said Ashley Baltimore, a delivery driver who, with her husband, rents one of the company’s houses on Tammy Sue Lane for $2,020 a month. That’s up more than 30 percent from when they moved in in 2016, roughly in line with the area’s rapidly rising rates.

In a statement, Pretium Partners said it treats tenants fairly and promptly responds to their complaints. The company said the tenants who complained to The Post and ICIJ constituted a very small portion of its 200,000 residents.

“Pretium is dedicated to being a part of the solution to our nation’s housing crisis through unparalleled efforts to support our residents and communities,” the firm said.

The allegations of mistreatment “lack underlying evidence and are based on unsubstantiated or anonymous claims,” the company said, adding that they are not representative of the experience most tenants have in the company’s more than 70,000 houses. The company said the eviction case against Hicks had been dismissed; that while the maintenance issues at Okafor’s house required “persistent work,” he’d been given a $300 credit; and that “repeated and timely visits were made to Ms. Bates’ home to address maintenance issues.”

“As it is impossible for us to engage constructively under such one-sided circumstances, we instead reiterate Pretium’s commitment to providing high-quality, affordable housing and dependable service for households that choose to rent.”

Mullen did not respond to requests for an interview made through Pretium.

Bhargava said that he was only vaguely aware of his investment, which was made by his Singapore-based family trust.

Bronfman, who, along with his billionaire father Charles, invested tens of millions of dollars in a Cayman Islands entity known as the Kolber Trust, had no involvement in the original decision to invest in Pretium, said Zeno Santache, chief financial officer of Bronfman’s private equity firm, Claridge Inc.

“Stephen Bronfman and his corporations don’t control the Kolber Trust,” he said in an interview, referring to the Caribbean entity. “We have no idea what their investments are.”

Cashing in on the American Dream

For decades, the majority of homes in places like Tammy Sue Lane were owned by their occupants, providing financial stability to millions of families.

Enthusiasm for individual homeownership in the United States was so strong before the housing crash that much of government policy was aimed at expanding it to as many families as possible. By 2005, the U.S. homeownership rate had risen to as high as 69 percent, according to figures from the Federal Reserve.

At that time, proposals to buy up thousands of homes were spurned by investors who feared being seen as “trampling on the homeownership dream,” said Brett Christophers, a geographer at Uppsala University in Sweden who has studied the phenomenon.

The housing crisis, though, weakened the grip of the middle class on homeownership. Easy credit and Wall Street’s appetite for risky mortgages had created a bubble in the markets, and when it popped, millions of families paid a price. In 2008 alone, lenders foreclosed on the loans for more than 3 million homes. Home prices sank.

The economic wreckage led conservative economists to argue that U.S. government policy to expand homeownership had been misguided, and that many families had been encouraged to buy homes they couldn’t afford. That ideological push, plus a glut of cheap houses and new technology simplifying the management of thousands of properties, prompted several investment groups to take the plunge into massive house-rental ventures, Christophers said.

These new corporate landlords present serious competition for aspiring home buyers like the Baltimores. The couple has been seeking for years to buy an affordable house for themselves and their three children, now 11, 7 and 6. They want what many families want: good schools and a quiet neighborhood.

Global investors, it turns out, were shopping for the same.

The Progress business plan specified that the fund preferred homes built in the last 15 years and priced between $70,000 and $190,000.

“The common characteristics … will be suburban locations, family oriented neighborhoods, low crime rates and close proximity to good schools and employment opportunities,” according to the solicitation to investors.

The Nashville area is rich with such housing. La Vergne, an outer suburb on the shores of a scenic reservoir, has seen its population more than quadruple since 1990, growing to more than 35,000 residents. On Tammy Sue Lane and some other streets in La Vergne, the landscape still looks freshly cleared — if a yard has trees, they’re often spindly.

“These funds have really concentrated on suburban areas that have seen a lot of growth, places where people are moving,” said David Szakonyi, co-founder of the Anti-Corruption Data Collective, which analyzed thousands of Progress’s house purchases around the country, finding heavy concentrations in Sun Belt suburbs. “These are homes for people in entry-level jobs, recently out of college, or making lower wages and looking for a single-family home for their families.”

While the Baltimores and Progress Residential have been looking at the same kind of houses, the investment venture holds significant advantages when it comes to sealing a deal.

One is speed.

Within 15 minutes of a house appearing on the Multiple Listing Service real estate database, the company’s computers assess whether it should be flagged for review by the company’s acquisition team, Chaz Mueller, then Progress Residential’s CEO, said in an interview on the “Leading Voices in Real Estate” podcast earlier this year.

Within two hours of the listing, Progress can make an offer.

The company is buying “close to 2,000 homes this month,” Mueller said on the podcast, “and we expect that to increase.”

Another advantage: Progress chooses houses strictly on the numbers, while a family’s decision is more complex.

Mueller contrasted the company’s methods to those of families that might, under pressure, overpay for a home. Progress is “completely not emotional,” Mueller said. “We’re very financially oriented and not emotional about everything we do on this acquisition process.”

Progress’s most significant advantage, however, may be its ability to make all-cash offers, and quickly. A typical buyer must borrow money, and the financing arrangements can add uncertainty and delays.

All those advantages pay off for investors: In an analysis of more than 70,000 sales of single-family dwellings, university researchers showed that investors paid about 10 percent less than an individual buyer for a similar house.

The investors “have cash and the power to negotiate,” said Professor Abdullah Yavas, one of the researchers and the academic director of the Graaskamp Center for Real Estate at the University of Wisconsin. “They’re going to get a better price.”

That’s tough news for families such as the Baltimores. In May 2016, the couple had arranged to buy a house in nearby Smyrna when their financial arrangements fell through. The Tennessee Housing Development Agency said they made too much money to qualify for down payment assistance, while lenders said they made too little to qualify for financing, the Baltimores said.

They’ve bought everything up, and that limits the opportunities for anyone else trying to buy a house.— Ashley Baltimore

With that, they moved into a house on Tammy Sue Lane — as renters. The plan was to wait a few years, save up some money and try again. Their rapidly climbing rent payment has left less to put away for a down payment. Meanwhile, local house prices are soaring.

When they were looking to buy, “there were more houses for sale,” Ashley Baltimore said. “Now those houses have been taken over by Progress. They’ve bought everything up, and that limits the opportunities for anyone else trying to buy a house. We’re still going to try.”

An executive at Pretium Partners dismissed the idea that owning and renting are significantly different. Whether they’re renters or homeowners, people still must make a monthly payment — for rent or for a mortgage, Dana Hamilton, Pretium Partners’ head of real estate, said on the real estate podcast.

“I laugh because when people try and distinguish owning a home from renting a home, the reality is most people don’t own a home — they rent the home from the bank,” Hamilton said. “From the outside, it really looks the same.”

One key difference unacknowledged in her remark, however, is that a family’s monthly mortgage payments can build equity in the home; rent payments have no such benefit.

Hamilton said in the podcast interview that Pretium chief Mullen deserves praise for anticipating the needs of a wave of millennials who don’t have the means to buy a house. “He basically saw a generation coming and said, ‘How are we going to house them?,’ ” she said.

A large investment group, she said, “is in the very best position to provide residents with a living experience that they simply can’t provide for themselves at a cost that they can actually afford.”

A billion-dollar bet

The Pandora Papers contain Mullen’s first pitch to investors. It set out how they could achieve big returns, while minimizing taxes, by buying houses at discounted prices in the wake of the foreclosure crisis. In the near term, investors would enjoy healthy yields from the booming rental market, the pitch said; eventually, as housing prices rose, they could sell at a huge profit.

An analysis by the ICIJ and The Post shows that Pretium’s investors did indeed see substantial gains from their bets on renters on Tammy Sue Lane and elsewhere.

In April 2013, a Bahamas-based firm controlled by Bhargava’s Singapore trust agreed to invest in Pretium. The former online gambling executive’s trust eventually contributed $6.6 million. By September 2018, the overall value of the investment had increased to $9.4 million, according to account statements in the Pandora Papers.

In a written statement, Bhargava said the investment had achieved a 10.35 percent “internal rate of return” — a common annualized performance measurement used by the fund — by the time the trust exited the venture in 2019. By comparison, the average annual return in stocks, as measured by the S&P 500 Index, has run about 10 percent historically.

According to an expert who reviewed the Pretium fund’s offering documents, the fund used a series of complex legal arrangements to aggressively shield profits from U.S. taxes.

First, money from foreign investors flowed into a partnership in the Cayman Islands, where it didn’t trigger the need to file U.S. tax returns, said Reuven Avi-Yonah, a law professor at the University of Michigan specializing in international taxation.

The Cayman Islands partnership then sent the money to a “domestically controlled” entity in Delaware, allowing investors to avoid steep taxes imposed on foreigners who profit from the sale of U.S. real estate, Avi-Yonah said.

The Delaware entity, in turn, invested the money in real estate investment trusts (REITs), which serve as legal owner of the rental houses. REITs are not required to pay taxes on earnings from rental income.

Asked about the tax arrangements, Pretium Partners said that “our investment vehicles are structured and managed in accordance with industry best practices.”

In a statement to ICIJ and The Post, Bhargava said he has fully complied with relevant tax laws. Bhargava said the trustees managing his family trust chose to invest in Pretium and that he has not had access to the proceeds. He said trustees were unaware of the taxes the Pretium fund may have paid in the U.S. In Britain, where he lives, he said he is not required to pay taxes on income outside the territory because he is a “non-domiciled resident.” And in Singapore, where Bhargava’s Pretium investment ultimately was held, there generally is no tax on profits from the sale of investments.

For Mullen, Pretium’s founder, the legal arrangements provided tax benefits, too. Like other private equity ventures, Progress is designed to return to its executives a share of profits out of proportion to their original investment, which in this case was $25 million.

ICIJ and The Post could not determine exactly how much Mullen has made from the fund, partly because his earnings depend on the level of investor returns, according to the investment pitch. If the venture achieves 17.5 percent, the middle of its projected return, the payday for Mullen and other fund managers could be more than $1 billion, according to Emmanuel Yimfor, assistant professor of finance at Michigan University’s Ross School of Business, who reviewed the documents.

If other investors saw returns similar to Bhargava’s roughly 10 percent, the Pretium managers would still see substantial earnings — around $230 million, according to Yimfor.

This outsize share of the profits is essentially compensation for managing the fund, but it is not taxed as regular income. Instead, such profits, known as “carried interest,” are taxed at the much lower capital gains rate.

The carried interest tax break has long been controversial. According to the Congressional Budget Office, it deprives the U.S. Treasury of more than $1 billion a year in lost tax collections.

Harvesting fees, at renters’ expense

Even as the investors piled up substantial gains, Progress Residential was treating some tenants unfairly, according to several former employees.

“I feel terrible about working there,” said Meghan Cook, who handled service calls from the Nashville area, including Rutherford County. “No one should be treated the way they treated their residents.”

The company often forced tenants to pay for home repairs even when the damage should have been covered by the company, she said. “There was no ‘We’re sorry this happened,’ ” Cook said. “They had no compassion. It was ‘Pay it or you’re going to be evicted.’”

Cook said she resigned in July 2020 and later worked for a different corporate landlord, where she said she encountered similar problems. She has since switched careers.

In response to Cook’s account, Progress said, “we categorically reject this unfounded assertion, which is completely false and grossly misleading.”

Four other former employees said Progress often refused to relinquish security deposits, even when a tenant left a house in good shape. The company said the employees’ claims are factually inaccurate, adding that “it is impossible for us to respond to vague and unsubstantiated claims.”

Progress also embeds an array of fees and penalties in the provisions of the leases tenants sign. In a lease on Tammy Sue Lane, for example, tenants are required to pay: 10 percent of the rent if the payments is more than five days late; $7.95 a month for a firm picked by Progress to collect utility payments; $9.95 a month for failing to buy renter’s insurance; and a $35 “convenience fee” each time rent is paid with a credit card.

If the company sends out a maintenance crew, Progress charges a $75 fee unless Progress determines the repair to be its own responsibility. If the company files an eviction case, Progress charges tenants a $200 “eviction administration” fee, according to the lease.

The standard lease the firm uses across the country “is about as punitive as we’ve seen from the larger private equity landlords,” said Lindsey Siegel, director of housing advocacy at Atlanta Legal Aid Society, which often helps Progress Residential tenants. “The leases are just another way to make money.”

The firm said its fees “adhere to basic industry standards, and, in many cases, are much lower than the fees charged by smaller landlords, who have fewer resources and tighter bottom lines.”

Pandemic evictions

Tenant complaints about Progress Residential drew relatively little attention until the coronavirus pandemic. Then, in September 2020, the Centers for Disease Control and Prevention issued an order protecting tenants across the country from eviction if they provided a signed statement to their landlord affirming that they could not pay the rent.

Citing reports that Pretium Partners and other landlords continued to evict tenants during the moratorium, congressional committees in June opened inquiries.

Pretium Partners filed to evict more than 1,200 of its renters in the first half of this year, before sharply curbing the practice once the congressional review began, according to the Private Equity Stakeholder Project, a nonprofit organization that monitors financial firms. In Rutherford County alone, the company filed evictions against 121 households during the moratorium and obtained eviction orders for at least 51 of them, according to an analysis by the Toronto Star, a reporting partner of The Post and ICIJ.

Progress has not been cited with violating the eviction prohibition. The company said it has “always complied with the CDC moratorium — no resident covered by a valid CDC declaration has ever been evicted from our homes for non-payment of rent.” It also said that the Private Equity Stakeholder Project “is pursuing a decidedly biased agenda.”

“During the COVID-19 crisis, Pretium has facilitated over $60 million in assistance for thousands of residents, including rent forgiveness and relocation assistance,” Pretium said in a statement.

Valerie and Mark Gitt are among those Progress sought to evict during the CDC moratorium, which lasted to August of this year.

Mark Gitt, 58, does quality-control inspections for plumbing in hotels and other big projects. Valerie Gitt, 54, is a former paralegal who is disabled with a spinal ailment. The couple shared their home with Valerie’s 82-year-old mother, who had been diagnosed with lung cancer.

After Mark was laid off early in the pandemic, Valerie told Progress that they might have a hard time paying the $1,600 monthly rent, she said.

“They said, ‘Oh, we’re going to work with you. We’re going to help you. Just pay what you can,’ ” Valerie said.

The couple said they made partial payments as their finances allowed. But in late September 2020, Progress filed court papers seeking their eviction.

They weren’t alone. When Valerie arrived for an October court hearing, there were several other Progress tenants in the courtroom. The judge set a separate date for her case.

On Dec. 15, a judge ordered the Gitts to be evicted.

A few weeks into January, Progress obtained a “writ of possession” ordering the sheriff to remove the couple from their home. A deputy sheriff showed up soon after to warn them they would be forced out if they didn’t leave voluntarily.

About this time, the Gitts discovered that to benefit from the eviction moratorium, they needed to file CDC paperwork with Progress, Valerie said. No one had told her about this requirement, she said.

The family signed the paperwork on Jan. 21 and Valerie sent a pleading email to Progress: “Please don’t evict us, we are doing the best we can.”

Progress said that when it received the Gitts’ paperwork it “promptly” dropped the case and told the Gitts that the eviction would be reversed.

But Valerie said she was never told the eviction order had been cancelled. Otherwise, she said, they would have stayed in their home.

In late January, the Gitts said, they left under the assumption that they were about to be forced out.

Meanwhile, they said, Progress is asking them to pay $28,000 in back rent and fees.

“We paid them what we could. But they treated us like scum,” Valerie said. “Something needs to be done about how they treated people.”

Contributors: Robert Cribb, Marco Chown Oved, Agustin Armendariz

捡便宜 Zillow德州达福区房屋脱售 逾七成赔钱卖

世界新闻网

12/08/2021

网络房地产经纪商Zillow利用人工智能系统「翻屋」(house flipping),「企业内线」最新公布的资讯指出,Zillow在达福地区抢标到的房子,竟然有76%最后以低于买价的金额脱手。

达拉斯「凯勒威廉斯地产」(Keller Williams)的经纪人亚当奈尔森(Adam Nelson)指出,有一位客户房子上市出售,他出的价钱比卖方的要价多出1万元,但Zillow的竞标价是多出2万元,所以那栋房子被Zillow抢走了。北德州许多传统房地产经纪人认为,Zillow总是以远高于市场的价格买房装修,这种趋势岂能长久?除了Zillow之外,Redfin和Opendoor也是在北德州极为活跃的网络地产商。

果不其然,Zillow在10月中旬宣布暂时不再购屋,要先把手头的房子脱手。根据企业内线刚发布的数据,Zillow在10月份最后一周于达福地区出售的168栋房子中,有128栋的卖价低于当初的买价,也就是赔本脱手。目前Zillow在达福地区,仍有大约400栋房屋待售。

Zillow的买房人工智能系统「Zillow Offers」,利用电脑程序给房子估价,卖方只要在公司的网站上打进资讯,系统会直接算出估价,然后给卖方出价。显然这种方式不准确,估计Zillow在这波高买低卖中已亏损了3亿元。奈尔森指出,最近他替客户在Richland Hills卖掉一栋房子,成交的价格竟然比Zillow所给的估价低了5万4000元,可见Zillow的估价有多么离谱。

另外,网络地产公司给经纪人的佣金比较低,造成经纪人没兴趣介绍买家,使得Zillow翻修完毕上市求售时,常常会久久不能售出。奥斯汀的经纪人保罗华瑞兹(Paul Juarez)指出,奥斯汀的房市火热,房屋一上市通常几天内就成交,但Zillow求售的房屋,经常超过60天还找不到买家。他又指出,因为Zillow目前正在贱价求售,所以他天天都在注意Zillow的上市屋,希望能捡到便宜。

Zillow selling off homes as it shutters house-flipping business

By Heidi Groover

12/03/2021

About a month after announcing it would shutter its failed home-flipping business, Zillow says it has sold or is in the process of selling about half the homes it planned to offload.

The Seattle-based real estate company announced early last month it planned to close down Zillow Offers, its attempt at an algorithm-driven version of home-flipping known as iBuying.

After months of upbeat comments about the business, Zillow executives said they had faced longer than expected timelines to fix up and resell homes and the company’s algorithm had failed to accurately predict prices. Zillow planned to lay off 25% of its staff as a result.

Share prices sank in the days after the announcement, and the company now faces two shareholder lawsuits in federal court.

On Thursday, following an announcement that Zillow planned a stock buyback, shares jumped about 8% in late trading, Bloomberg reported. The share price remains down about 60% from the start of the year. Zillow plans to buy back up to $750 million in stock, about 5.5% of its current market cap.

Because buybacks leave fewer shares on the market, they can drive up stock prices. That also benefits company executives whose pay is tied to stock price.

Zillow finished the third quarter with 9,790 homes in inventory and 8,172 under contract. The company said Thursday it “has sold, is under contract to sell or has reached agreement on disposition terms for more than 50% of the homes it expected to resell during the entire wind-down process.”

Zillow Offers did not buy and sell homes in Seattle, but was active in Portland and other cities. Zillow last month sold 2,000 homes in 20 markets to an investment firm that planned to rent the homes out, the Wall Street Journal reported.

In the third quarter, Zillow wrote down about $304 million worth of homes it expected to sell at a loss and projected additional losses of $240 million to $265 million in the fourth quarter. As of Sept. 30, the company had $2.9 billion in debt related to Zillow Offers.

At the time, the company predicted its Homes segment, which includes Zillow Offers, would bring in between $1.7 billion and $2.1 billion in revenue during the final three months of the year. Zillow has now revised that upward to a range of $2.3 billion to $2.9 billion.

Employee layoffs began soon after the announcement last month, including at least 47 people so far in Washington state. Zillow said Thursday it expects the “net impact” of shutting down Zillow Offers “to be at least cash-flow neutral.”

Zillow’s home-buying debacle shows how hard it is to use AI to value real estate

By Rachel Metz

11/09/2021

In February, Zillow appeared so confident in its ability to use artificial intelligence to estimate the value of homes that it announced a new option: for certain homes, its so-called “Zestimate” would also represent an initial cash offer from the company to purchase the property.

The move, touted by a company exec at the time as “an exciting advancement,” was intended to streamline the process for homeowners considering selling to Zillow as part of its home-flipping business. Zillow promoted this option as a way to make it convenient to sell a home while minimizing interactions with others during the pandemic. Just eight months later, however, the company is shutting down that business, Zillow Offers, entirely.

The decision, announced last week, marks a stunning defeat for Zillow. The real estate listing company took a $304 million inventory write-down in the third quarter, which it blamed on having recently purchased homes for prices that are higher than it thinks it can sell them. The company saw its stock plunge and it now plans to cut 2,000 jobs, or 25% of its staff.

The fallout from this business venture doesn’t just point to the challenges in buying and selling homes for profit, however. It also highlights how hard it is to use AI to help make expensive, real-world decisions, particularly in an ever-changing market that can be hard to predict months or even weeks out, and with prices that can be based as much on feel as on clear data points. Zillow CEO and cofounder Rich Barton explained the shuttering of Zillow Offers by citing “unpredictability in forecasting home prices” that “far exceeds” what the company had expected.

The “iBuyer” model used by Zillow and other other real estate companies entails purchasing homes directly from sellers and then re-listing them after doing minor work. For Zillow, one of the first steps in its decision to purchase any home is the “Zestimate” — a machine-learning-assisted estimate of a home’s market value that is calculated by taking into account oodles of data about the property gathered from sources including tax and property records, homeowner-submitted details such as the addition of a bathroom or bedroom, and pictures of the house. Rival platforms such as Redfin have their own estimates that take similar data into account.

“The Zestimate, facts you provided, and comparable homes nearby are used to calculate an estimated sale price,” Zillow explained on its Zillow Offers webpage to homeowners who may be interested in selling their property to the company. (The page now notes the company is “winding down” the service, and isn’t making new offers on homes.) After that estimate, the page explained, Zillow conducts an in-person evaluation of a property, determines the amount it deems necessary for repairs before it could resell the house, and then makes a final offer. Zillow has bought tens of thousands of homes since the launch of Zillow Offers, but has sold many fewer than it snapped up: according to its quarterly results, it purchased 27,000 homes from April 2018 through September 2021, and sold nearly 17,000.

Zillow declined a request for an interview with Krishna Rao, the company’s vice president of analytics. In a statement, Zillow spokesperson Viet Shelton told CNN Business the company used the Zestimate for Zillow Offers “the same way we encourage the public to use it: as a starting point.”

“The challenge we faced in Zillow Offers was the ability to accurately forecast the future price of inventory three to six months out, in a market where there were larger and more rapid changes in home values than ever before,” Shelton said.

Indeed, since Zillow entered the home-flipping business in 2018, real estate markets have changed in wildly unpredictable ways. The pandemic led to a temporary housing market freeze, followed by a supply and demand imbalance that caused an unprecedented rise in home prices. This may only have complicated the company’s decision to include the Zestimate — which Zillow points out is not an appraisal, but a “computer-generated estimate of the value of the home today, given the available data” — as part of the Zillow Offers process in more than 20 cities.

Artificial intelligence can look at far more information, far more quickly, than a single human could when considering a fair price for a home, weighing factors like comparable home sales in an area, how many people are looking in a specific neighborhood and so on. Still, “you can have a real estate agent look at a house and in one second pick out one critical factor of the valuation that just doesn’t exist as ones and zeroes in any database,” said Mike DelPrete, a real estate technology strategist and scholar-in-residence at the University of Colorado Boulder.

A key part of Zillow

The Zestimate has been a key part of Zillow’s brand since the company first launched its website in 2006. The term is featured prominently on millions of Zillow’s home listings; it’s trademarked by the company; and it’s mentioned 61 times in its IPO paperwork from 2011.”Three times a week, we create more than 500,000 unique valuation models, built atop 3.2 terabytes of data, to generate current Zestimates on more than 70 million US homes,” the company wrote in a securities filing in 2011. More than 10 years later, the company publishes Zestimates for more than 100 million US homes.If you’re looking up homes on Zillow’s website or app, the Zestimate is featured prominently in each listing, whether the home is for sale or not. If the house is currently for sale, a red dot is shown next to the words “House for sale,” and the Zestimate, if it’s available for that home, will appear on the same line.

Though the company points out that the Zestimate is not a home appraisal, the feature’s accuracy has been called into question over the years. For example, it became the subject of a lawsuit brought by homeowners in 2017. (That suit was dismissed.)

Zillow has spent years improving the Zestimate, going so far as to run a multi-year data science competition to improve the accuracy of the algorithm behind it. The company awarded a three-person team the $1 million prize in early 2019.

The Zestimate currently has a median error rate of 1.9% for homes that are on the market, Shelton said, meaning Zillow’s estimates for half the homes on the market come within 1.9% of the actual selling price. That percentage of error is much higher — 6.9%, according to Shelton — for off-market homes. Being off by as little as 1.9% on a property with a Zestimate of $500,000 is still nearly $10,000; that figure multiplies over many, many homes in different cities across the United States.

An art, not just a science

It’s one thing to build a model on a website that’s often reasonably accurate. It’s another to then try to use that model in the real world to make very costly bets — and do so at scale, according to Nima Shahbazi, a member of the team that won the Zestimate algorithm competition and CEO of Mindle.AI, which helps companies use AI to make predictions. For instance, if any homes Zillow purchased had hidden problems — such as a missed crack in the foundation — the Zestimate would not be able to predict those issues, he said.

“There are many different parts between a very decent model and deploying the model into production that can go wrong,” he said.

Zillow was using the Zestimate to help it make purchasing decisions for homes it hoped to make a profit off of over time. But Nikhil Malik, an assistant professor of marketing at the University of Southern California, said algorithms tend to be good at making fine-grained, short-term predictions, such as for predicting stock prices a second in advance. But there simply isn’t enough data for an algorithm to learn about longer busts and booms, according to Malik, who researches algorithmic pricing and has studied the Zestimate in particular.

There are also many unquantifiable aspects of putting a price tag on a home, DelPrete noted, such as the value of living in the same neighborhood you grew up in or down the street from your parents. These can vary from person to person, which makes it even harder to outsource a home valuation process to a computer.

“It’s a good tool for what it is,” DelPrete said of the Zestimate, but it’s a mistake to think it can be used to accurately predict house prices now or in the future. He sees it as “almost a toy,” meant more for piquing your curiosity when looking up your home or your neighbor’s home online.

“If you want to do iBuying and you’re going to make thousands of offers every day you have to be really good at valuing homes, not only today but three to six months in the future,” he said. “And that’s an art and a science.”

房价太难料 Zillow蒙受巨亏 退出房屋交易业务

来源:美国中文网

11/02/2021

以估算房屋价值而闻名的房地产网站Zillow周二表示,在严重亏损的情况下,它将退出快速买卖房屋的业务,并计划解雇其近25%的员工。

这一宣布是一次重大的战略撤退,也是对Zillow首席执行官巴顿(Richard Barton)的一记重拳,他在16年前创建了该公司,并长期以来一直在努力将Zillow这个资讯网站转型为一个交易平台。去年,巴顿预测Zillow Offers可以创造200亿元的收入,这是通过一种被称为iBuying的做法对房屋进行即时买卖的操作。简单来说,iBuying是公司依靠技术手段,确定基于市场的现金报价,即时买下房屋的操作。

周二,Zillow表示该部门一直是巨额亏损的来源,并使公司的整体底线无法预测。Zillow Offers在截至9月的三个月内损失了超过4.2亿元,与该公司在之前12个月内的总收入大致相同。该公司拥有8000名员工。

巴顿在一份声明中说:”我们已经确定,房价的不可预测性远远超过了我们的预期。”

巴顿在周二下午与分析师举行的电话会议上说,这一决定对他来说”很重要”。巴顿说:”我们可以把目前的损失归咎于偶发的市场事件。但如果料定未来不会再发生不可预测的事件,那就太天真了。”

该公司在第三季度总共损失了近3.3亿元,这比华尔街分析师预测的要差得多。该公司在一年前的同一时期实现了4000万元的利润。

Zillow的股票已经从2月份近200元的高点下跌了50%以上,当时随着房地产市场的升温,它还是投资者的宠儿。周二,该股在发布财报前下跌了11.5%,至约85.50元,盘后交易中又下跌了7.5%。

三年前,该公司宣布计划采用其定价估算来购买和出售房屋。现在,Zillow持有数千套房屋,其价值低于该公司的买入价。

上个月,Zillow宣布它将暂时停止购买新房。当时,它把问题归咎于缺乏工人来修复和翻新所购买的房屋。但在周二,巴顿表示,使用其算法来买卖房屋并没有产生预测的利润。该公司现在正寻求抛售剩余的7000套房屋。

《纽约时报》评论称该公司似乎低估了持有房屋的风险。该公司此前还试图迅速将其房屋交易业务提高到每月5,000笔,这是巴顿设定的目标,而当时的住房市场库存已经很低,并开始降温。

Zillow, facing big losses, quits flipping houses and will lay off a quarter of its staff.

By Stephen Gandel

11/02/2021

Zillow, the real estate website known for estimating house values, said on Tuesday that it would exit the business of rapidly buying and selling houses amid heavy losses and that it planned to let go about nearly 25 percent of its employees.

The announcement was a major strategic retreat and a black eye for Richard Barton, Zillow’s chief executive, who founded the company 16 years ago and has long talked about transitioning Zillow’s popular website into a marketplace. Last year, Mr. Barton predicted Zillow Offers, which made instant offers on homes in a practice known as iBuying, could generate $20 billion a year.

On Tuesday, Zillow, which said it has 8,000 employees, said the division had been the source of huge losses and had made the company’s overall bottom line unpredictable. Zillow Offers lost more than $420 million in the three months ending in September, roughly the same amount that the company had earned in total during the prior 12 months.

“We’ve determined the unpredictability in forecasting home prices far exceeds what we anticipated,” Mr. Barton said in a statement accompanying its quarterly financials.

Mr. Barton, speaking on a conference call with analysts on Tuesday afternoon, said the decision had “weighed heavily” on him. “We could blame the current losses on exogenous market events,” Mr. Barton said. “But it would be naïve to predict that unpredictable events won’t happen in the future.”

In all the company lost nearly $330 million in the third quarter, which was far worse than Wall Street analysts had predicted. The company made a $40 million profit in the same period a year ago.

Shares of Zillow have fallen more than 50 percent from a high of nearly $200 in February, when it was still a darling of investors as the housing market heated up. The stock dropped 11.5 percent on Tuesday to about $85.50 before it released its financials, and a further 7.5 percent in after-hours trading. (Even so, Zillow’s shares are worth double what they were at the beginning of the pandemic.)

Three years ago, the company announced plans to employ its pricing estimates to buy and sell houses. Now, Zillow is sitting on thousands of houses worth less than what the company paid for them. Last month, Zillow announced it would temporarily stop buying new homes. At the time, it blamed a lack of workers to fix up and sell the houses it had bought. But on Tuesday, Mr. Barton said using its algorithm to buy and sell houses had not produced predictable profits. It is now looking to offload its remaining 7,000 houses.

It appears the company underestimated the risk of holding houses in between transactions, which was a departure from the low-risk, high-margin ad business. And it tried to quickly ramp up its home-flipping business to 5,000 transactions a month, which Mr. Barton set as a goal, in a housing market that was already low on inventory and was starting to cool off.

Zillow’s stumble also raises questions about its core product, which is built around its value estimates. Aaron Edelheit, who began buying houses in the wake of the Great Recession, tweeted his thanks to Zillow for paying “such an extremely high price” for one of his properties this summer. “It appeared they were panic buying,” Mr. Edelheit, who is leaving the real estate market to focus on cannabis, told The New York Times’s DealBook newsletter. “I didn’t get it. I should have shorted the stock.”

北美法律公益讲座安排

时间:周二到周五 晚间

5:30-7:00(西部时间)8:30-9:30(东部时间)

周二:如何准备遗嘱材料(遗嘱workshop)

周三:数据泄露和个人身份保护&事业机会说明会

周四:家庭法和婚姻法(周律师)

周五:人身伤害和索赔(朱律师)

Zoom:6045004698,密码:请私信或群里@我

另外:周三6:30(西部时间)

专题:99%华人移民不知道的法律问题(粤语专场)

Zoom 95190929213,密码:私信或群里@我

Zillow’s iBuying flop: Company listed nearly two-thirds of homes below purchase price

Firm is pausing buying for rest of 2021

TRD Staff

11/01/2021

Questions over the profitability of Zillow’s iBuying practices in the increasingly competitive space appear to be close to the operation’s troubles detailed in an Insider analysis.

Insider examined the company’s listings on October 27 in five markets: Dallas, Houston, Phoenix, Atlanta and Minneapolis. The outlet found almost 64 percent of the homes were listed for sale for less than Zillow paid for them, with a median difference of $16,000.

Of the 963 listings Insider reviewed, 616 were being listed for less than Zillow’s purchase price. The problematic listings were particularly noticeable in Phoenix and Dallas, where 93 and 81 percent of listings, respectively, were below Zillow’s purchase prices, respectively.

Across the five cities, only Atlanta saw the problem occur less than 60 percent of the time; the low listings accounted for about 28 percent in Zillow’s largest metro of inventory. The cities make up nearly a third of Zillow’s entire inventory.

Oct 14, 2021

Zillow Business Model – How they have been disrupting the real estate market since 2006. How does Zillow make money, and what is the impact of their iBuying business on the real estate price inflation across the United States? Find it all out in this video.

Insider’s analysis came less than two weeks after Zillow temporarily shut down its iBuying program. The company claimed to be “beyond operational capacity,” stuck with a backlog of properties.

The pause marked the second time in two years Zillow has ceased its home-buying operation since its launch in 2018. Ongoing labor shortages and volatile material prices slowing down repairs and renovations of purchased properties likely contributed to its recent backlog of pending property sales.

Zillow Offers allows homeowners to receive an offer on their home through Zillow’s proprietary technology, which can allow for a quick offer and sale. After the transaction, the property receives minor repairs before it’s put back on the market.

Zillow reported making $1.5 billion in revenue from its iBuying business during the first half of 2021. Insider reports Zillow CEO Rich Barton has said the company could hit $20 billion in revenue from iBuying annually in three years.

The four largest iBuying companies combined to purchase 15,000 homes in the second quarter. Zillow has aspirations to surpass that figure, however, and purchase 20,000 homes on an annual basis by 2024.

Zillow will announce its third-quarter earnings on Nov. 2, potentially shedding light on the success and failures of its iBuying business.

Zillow炒房失利 近半上市房屋削价求售

世界新闻网

10/31/2021

面对美国史上增长速度最快的房地产价格,房地产商Zillow决定加强炒房(home flipping)业务;然而,这项策略让Zillow在今年第三季得标买下的物业数量创下有史以来最多的纪录,使他们不得不停止出价。

在Zillow处理需要整修再出售的物业之际,他们同时面临了一个不利的现实:房价上涨放缓,意味他们将亏本出售许多房屋。

根据YipitData的调查,Zillow 9月推出的上市房屋数量创下历史新高,却以2018年11月以来最低的加价幅度出售。事实上,在第三季,Zillow将近一半的美国上市房屋都削价求售,代表库存量过多迫使他们降低售价。

这个现象已经出现在房价不断飙涨的亚特兰大和凤凰城,Zillow凤凰城约250笔上市房屋目前的定价已比Zillow当初收购这些房屋时的价格低6%。

波德科罗拉多大学(University of Colorado Boulder)房地产科技策略家德尔普雷特(Mike DelPrete)说:「过去几个月来,我看到Zillow每一项主要指针都不合理,像是他们对市场做出的反应晚了两到三个月。」

根据德尔普雷特的分析,Zillow的主要竞争对手Opendoor虽然在凤凰城的房屋销售价差也开始缩小,但成交价仍持续高于收购价。Opendoor在亚特兰大的销售情况也十分出色,他们以高于收购价6.5%的定价挂牌出售房屋,相较Zillow的价差只有1.3%。

Zillow 10月18日表示,由于正在处理积压的物业,将暂停收购新物业,消息让Zillow股价下跌9.4%。尽管Zillow股价已回升,但分析师大多对其炒房策略的失误不以为然,并指出Zillow追溯到2018年的炒房业务至今尚未获利。

RBC Capital Markets分析师艾利克森(Brad Erickson)说:「他们可能有些措手不及,但或许不会太在意,在这个阶段,赚钱并非最主要的目的。」

Zillow和Opendoor都使用一种名为iBuying的高科技炒房软件算法来预测房价走势,每季收购成千上万笔物业。专家表示,这是一个复杂的过程,必须计算得非常精确才能获利。

Zillow和Opendoor向客户推销使用其服务的便利性,他们收取的费用取代了传统的房地产经纪人佣金。

Zillow’s flips flop, hurting profits but benefitting some homeowners

By Hannah Frishberg

10/31/2021

The streets aren’t being easy on Zillow, which is reportedly losing money on homes it bought to flip, but are instead proving flops.

The real estate company has paused its home buying operation, Zillow Offers, after an algorithmic tweaking to make higher home offers failed to keep up with the real estate market, Bloomberg reported this week. This resulted in Zillow overpaying for homes it couldn’t resell even for the sale price, let alone a profit, Bloomberg reported.

The failed buying spree has benefited some homeowners, who sold houses to the company at rates which turned out to be overmarket. These winners of the real estate fumble include seller Abidemi Bolatiwa, who sold his Phoenix four-bedroom to the company for $531,300 in late September, saving money on a Zillow convenience fee cheaper than what a traditional agent commission would have cost, according to Bloomberg. Zillow listed the property for $505,900 10 days later, but it didn’t sell, so the company cut the price to $494,900.

After a real estate agent made him a lower offer than Zillow, Richard Flor of the Phoenix suburb Tolleson, Arizona decided to sell to the company this summer. Zillow paid him approximately $412,000 and charged only a 1 percent fee on the sale of his three-bedroom, three-bathroom rental property. Two weeks later, after making light repairs, Zillow listed the property for $387,000 — $3,000 less than what the agent had offered.

On Oct. 18, Zillow announced it would stop making home buying offers, thus pausing the home-flipping program which has failed to turn a profit since being started in 2018.

“Prices turned on them and they got a little bit flat-footed and they were probably a little too aggressive on the bidding,” RBC Capital Markets analyst Brad Erickson explained to Bloomberg, regarding where Zillow’s market strategy failed. While a loss, though, the failure won’t hurt the company too badly. “They probably don’t care so much. It’s not as important at this stage of the game to make money,” Erickson added.

Zillow’s zeal to outbid for houses backfires in flipping fumble

Patrick Clark and Noah Buhayal | Bloomberg

10/27/2021

Faced with the fastest-growing real estate prices in US history, Zillow Group has tweaked algorithms to enhance home flipping operations to offer higher offers.

It ended up with so many successful bids that I had to stop offering new offers for the property. Now, after buying more homes than ever in the third quarter, the company is tackling the unprocessed portion of homes that need to be repaired and sold in the face of unpleasant reality. The slowdown in price increases has cost many homes.

According to a YipitData survey, Zillow launched a record number of homes on the market in September, listing properties with the lowest markup since November 2018. According to Yipit, in the third quarter, prices fell by almost half of the US listing, indicating that inventories are lower than expected.

The shift is on display in places such as Atlanta and Phoenix, two markets where home prices are skyrocketing. Zillow’s approximately 250 active list in Phoenix is now on average 6% cheaper than the company paid for homes.

According to data compiled by Mike Delprete, a real estate technology strategist and scholar at the University of Colorado at Boulder, this represents a $ 29,000 discount on typical real estate.

“All the key indicators from Zillow over the last few months are totally meaningless,” said Del Prete. “It’s like making a decision a couple of months behind the market.”

Zillow’s newly discovered aggression was good for people like Abidemi Bolatiwa who were watching the process run in real time. According to real estate records, he sold his four-bedroom home in Phoenix to Zillow in late September for $ 531,300, paying a convenient fee that was cheaper than traditional agency fees.

Mr. Volatiwa also Opendoor Technologies, That would have paid him about $ 504,000. Ten days after Zillow bought the home, the property went public for $ 505,900. When it didn’t sell, the company cut another $ 11,000 to $ 494,900.

According to DelPrete’s analysis, Zillow’s biggest competitor, Opendoor, continues to sell more homes than it buys, while home sales in Phoenix are declining. It also performs well in Atlanta, where Opendoor lists homes with a premium of 6.5% of the purchase price compared to Zillow’s 1.3% spread.

Zillow representatives declined to comment.

The company said on October 18th: It will stop making new offers to buy a home Reduce your share by 9.4% while processing the backlog. However, analysts most often shrugged off operational stumbling blocks and stocks recovered from these losses. The home flipping business dating back to 2018 is not yet profitable.

“Prices turned them on, they were a bit flatfoot, and probably a little too aggressive about bidding,” said Brad Ericsson, an analyst at RBC Capital Markets. “They probably don’t care so much. Making money isn’t that important at this stage of the game.”

Zillow and Opendoor are practicing a high-tech spin of home flipping called iBuying. Both companies use software-based algorithms to predict changes in home prices. They charge a fee instead of a typical real estate agent’s fee and pitch to their customers about the convenience of the service. Buying thousands of homes every quarter is a complex process and requires a lot of precision to do it right.

Rich Barton, CEO of Zillow, emphasizes that it is important to make competitive offers to reach the scale needed to make a profit in the business. He lamented in an August call with investors that soaring home prices have widened the spread between the cost of Zillow buying and repairing homes and the cost of selling real estate. rice field. As a result, the company, which purchased 3,800 units in the second quarter, has set a goal of purchasing 5,000 units a month by 2024 and is offering more offers.

“We saw a rapid increase in conversions throughout the quarter as we improved the strength of our offers,” he said.

Zillow and Opendoor are practicing a high-tech spin of home flipping called iBuying. Both companies use software-based algorithms to predict changes in home prices.

Richard Flor talked to a realtor this summer about listing a three-bedroom, three-bathroom rental for about $ 390,000 in the western suburbs of Phoenix, Tolleson, Arizona. Instead, he sold it to Zillow in September for about $ 412,000 and paid 1% of the service.

He then saw Zillow make a minor repair and relist the house for $ 387,000 two weeks later.

“I was wondering,’How do they make money,’” Flor said. “Maybe they know what I don’t know.”

Here’s why Zillow won’t be buying any more homes to renovate and resell this year

By JOE HERNANDEZ

10/20/2021

Al Bello/Getty Images

The real estate website Zillow announced it would stop buying and renovating homes through the end of the year as it works through a backlog of properties and it deals with worker and supply shortages.

“We’re operating within a labor- and supply-constrained economy inside a competitive real estate market, especially in the construction, renovation and closing spaces,” Jeremy Wacksman, Zillow’s chief operating officer, said in a statement.

“We have not been exempt from these market and capacity issues and we now have an operational backlog for renovations and closings,” he added.

Through its Zillow Offers program, the company buys homes directly from sellers, completes the necessary upgrades and lists them for sale. This lets sellers avoid having to do repairs or set up showings themselves, the company says.

Zillow, which is known for its online real estate listings, told shareholders that it purchased 3,805 homes through the program in the second quarter of this year, a major increase over previous years.

Zillow Offers, which launched in 2019, sold 2,086 homes and made a gross profit of $71 million over the same period.

The company announced on Monday that it wouldn’t sign any new contracts to buy homes through the end of 2021. Zillow said that it would still market and sell homes through the program and that it would also continue to buy houses with contracts that have already been signed but have yet to close.

The construction industry was one of many that were hit hard by the COVID-19 pandemic, which saw the cost of building materials soar. Meanwhile, the demand for homes — as well as their price tags — has surged.

While the astronomical prices of wood have decreased from their recent highs, other materials such as steel and piping remain costly or in short supply. On top of that, there is a serious shortage of construction workers.

Both the construction of new homes and the authorization of building permits fell in September compared with the previous month, according to the U.S. Census Bureau.

In an interview with Marketplace Morning Report last month, Associated Builders and Contractors economist Anirban Basu said the coronavirus was still causing problems in the housing industry. “The spread of the delta variant globally has increased supply chain issues. It means higher prices for inputs; it raises the cost of delivering construction services,” Basu said.

Zillow slams the brakes on home buying as it struggles to manage its backlog of inventory

By Anna Bahney, CNN Business

10/18/2021

Zillow will stop buying homes through Zillow Offers for the rest of the year, as the company’s iBuying program goes from full speed to full stop.

The company announced on Monday it would not contract to buy any more homes in 2021 in order to work through the backlog of homes it has already bought.

The “iBuyer” model used by Zillow and other real estate companies entails purchasing homes directly from sellers, and then re-listing the properties after doing minor work. But thanks to the current shortage on labor and materials, Zillow can’t close, renovate and resell the homes fast enough.

“We’re operating within a labor- and supply-constrained economy inside a competitive real estate market, especially in the construction, renovation and closing spaces,” said Jeremy Wacksman, Zillow’s chief operating officer, in a statement.

“Pausing new contracts will enable us to focus on sellers already under contract with us and our current home inventory,” said Wacksman.

Zillow will still market and sell the homes it has acquired through Zillow Offers, which has been on a purchasing tear this year. It bought 3,805 homes in the second quarter — a record high for the company and more than double the number of homes bought in the first quarter, according to a note to company shareholders.

Zillow, known for its online real estate listings, introduced an iBuyer program, Zillow Offers, in 2018 and now operates in 25 cities. Like other iBuyers — such as Opendoor, RedfinNow and Offerpad — Zillow Offers uses data and algorithms about the property and the market to make a cash offer on an off-market home, and buys directly from the homeowner.

IBuyers appeal to home sellers because closings can take place anywhere from 7 to 90 days after the contract is signed and can provide some certainty and control over the sale of their home without the hassle of finding an agent and prepping the house for market. According to Zillow, the fee to the seller for Zillow Offers averages 5%, but can vary based on market conditions.

Home purchases by iBuyers now account for about 1% of the market, according to a report from Zillow. The share is still a tiny part of the whole market, but shows tremendous growth over the past few years as the iBuyer share in some cities, like Phoenix, Atlanta or Charlotte, North Carolina, now tops 5%.

Zillow wasn’t alone among iBuyers in buying a lot of homes this year. IBuyers bought more houses, at higher prices, in the second quarter of this year than in any other quarter, according to research from Mike DelPrete, an independent real estate technology strategist and scholar in residence at the University of Colorado Boulder. That has surprised some skeptics who did not think the iBuyer model would be appealing to home sellers in a hot market.

His research suggests that sellers are drawn to the certainty and ease of iBuying and the market conditions fueled its growth.

Zillow’s move to halt purchases is surprising, he said, particularly because it is so sudden.

“iBuyers have access to a tremendous amount of data, they can see months into the future and plan their inventory,” said DelPrete. “So the fact that Zillow didn’t see this coming and wasn’t able to make adjustments before it had to resort to an iBuying lockdown is pretty surprising.”

This shift, he said, demonstrates how difficult this business model is to scale up. Large iBuyers need to be skilled at both managing billions of dollars in capital, but also the logistical specifics of prepping a home for sale, down to drywall and painting and closing deals.

“There is only so much that technology can do,” said DelPrete. “At the end of the day you need people to process a lot of transactions.”

However, the halt appears to be a Zillow-specific problem, not an iBuyer industry problem, DelPrete said.

“Zillow just kept barreling down and now they’ve hit this wall,” he said.

This is not the situation a growth-focused company wants to be in, he said.

“If you’re trying to be number one in the market, slamming on the brakes is one of the worst things you can do,” said DelPrete. “You want to make some adjustments before you get to that point — slow down, switch gears. This is not the preferred outcome for Zillow.”

Opendoor, the leading iBuyer ahead of Zillow at a distant second, said in a statement it is still open for business.

‘Insatiable demand’ for warehouse space continues in NJ

Rents surge to record high as developers scour state for booming logistics industry

By JON HURDLE

10/16/2021

Rents surged and vacancies dropped to a record low for warehouses and other industrial buildings in north and central New Jersey from June to September, a new report said Wednesday, as demand from e-commerce continued to fuel the state’s red-hot market for logistics space.

The asking price for industrial rents rose 15.6% to a record $10.72 per square foot while vacancies fell to 3.4% from 3.8% only three months earlier. For warehouses, which account for about three-quarters of the overall industrial market, the vacancy rate was even lower, at 2.9%, according to the report from Newmark, a commercial real estate company.

As in the first half of 2021, the growth was again driven by very strong demand from logistics companies for space to store and distribute an avalanche of goods ordered online.

“Insatiable demand from ecommerce, corresponding with a long-term shift in consumer spending habits towards online spending and away from traditional retail stores remains a key driver of leasing activity,” the report said.

Demand for logistics space has been strong for five years but was fueled further over the past year by online shopping during the pandemic. It has also been driven by the state’s proximity to Port Newark-Elizabeth where one of the nation’s largest volumes of consumer imports enters the country, and by New Jersey’s position at the heart of the populous Northeast market.

While the boom has created thousands of jobs, including some 50,000 at Amazon alone, it has also sparked protests and lawsuits in some communities where residents fear that local roads will be choked by new truck traffic, and that remaining rural enclaves will be occupied by giant warehouses that may cover a million square feet or more.

In the Legislature, public concern that warehouses affect areas beyond the towns where they are built has also spawned a bill co-sponsored by Senate President Steve Sweeney (D-Gloucester) that would require towns facing a warehouse application to alert neighboring municipalities and try to win their support for the project.

Numbers show big-time growth

The new data shows the boom is only accelerating. Industrial space under construction, almost all of which was for warehouses, rose to 13.9 million square feet in the latest quarter from 13.4 million in the second quarter of 2021. Despite a supply shortage, the amount of industrial space leased in the first three quarters of this year, 28 million square feet, exceeded that for all of 2020.

In another key indicator of the strength of demand, net absorption — the difference between the amount of industrial property that became occupied during the quarter, and that which became vacant — jumped to 4.7 million square feet in the latest quarter from 3.1 million square feet in the previous three months.

“It’s remarkable to me that it keeps going up,” said Tim Evans, director of research at New Jersey Future, a nonprofit that advocates for “smart growth.” He said the warehouse boom can’t be fully explained by the surge in online shopping during the pandemic, and may have also been fueled by an increase in the volume of imported goods arriving at Port Newark-Elizabeth from Asia since the Panama Canal was widened to accommodate bigger ships in 2016.

Evans predicted that the continued high demand for warehouse space will result in both vacant and previously developed land being obtained for an industry that wants to be as close to the port as it can. That process may involve “second-generation” redevelopment of sites that first held factories, then became office parks, and would now be occupied by warehouses.

“As factories close to the port get used up, they might start buying second-generation redevelopment sites like office parks,” he said.

The report said there’s a “widening imbalance” between supply and demand, especially in sub-markets where available land is limited. They include the Meadowlands, where rents jumped 28.5% in the latest quarter compared with a year earlier. The report predicted that the sharply higher rents there will spur developers to redevelop land or reuse existing buildings.

Major transactions included 840,000 square feet leased to Peloton, the fitness equipment maker, at Linden; 511,000 square feet in Warren County to Alan Ritchey, a logistics provider, and 326,000 square feet in the Meadowlands taken by TJ Maxx, a clothing retailer.

In the warehouse sector specifically, the highest asking rent among 21 local markets was $14.73 per square foot in the Meadowlands, followed by $14 in the market around New Jersey Turnpike Exit 12 where the vacancy rate was virtually nonexistent at 0.1%.

No end in sight

There’s no sign that high rents and low vacancy rates will let up any time soon, given continuing high demand from logistics companies, the report said. It forecast that developers will continue to encounter rising construction costs, shipping delays and labor shortages.

“In the coming months, robust demand from ecommerce and logistics companies is expected to maintain a record low vacancy rate, driving further growth in warehouse rents,” it said.

Micah Rasmussen, a Rider University professor who led a successful campaign against a planned warehouse in Upper Freehold earlier this year, said people should consider whether New Jersey is getting over-developed — in light of the ongoing warehouse boom and the devastating flooding caused by Tropical Storm Ida.

“I think the shortcomings of our over-development became much clearer to a lot of people during Ida,” he said. “We need to rethink what we’re doing, and given what’s happening in the market, it seems like the perfect time for us to do that.”

In N.J., the fall housing market is starting to look better for buyers

BY ALICIA SMITH

10/08/2021

The red hot residential real estate market is beginning to cool slightly, and this trend is expected to continue for the remainder of the year.

Low interest rates, low inventory, and buyers looking to leave urban areas, such as New York City, for more space in the suburbs, were largely driven by cheap interest rate rates and low stock levels in New Jersey City.

However, according to Jeffrey Otteau, a real estate economist and president of the Otteaux Group, the home buying demand is running at slowed pace in New Jersey four months later.

He explained that Its not that it’s collapsing, he said. It’s normalizing.

According to Otteau’s data, contract sales were down statewide by 12 percent in June, 22 percent on July, 16 percent, and 22 cents in August for the first three weeks of September.

Sales are lowering, according to him, because home prices have risen so much that they are unaffordable even with low interest rates. And urban flight in the middle of the epidemic, which brought city-dwellers who wanted more room to the suburbs, has ended.

Migration from the city to the suburbs is now reversing as cities renown, Otteau said. As employers are advising workers to return to the office, were starting to see housing shift back in toward the city.

According to Otteau’s data, contract sales in Hudson County have risen by 35% every year to date, according to him.

And according to New Jersey Realtors August report, closed sales in Hudson County were up 17.1% in August alone, despite closed doors falling by 10% statewide.

Irene Barnaby of Compass in downtown Jersey City said she’s seeing buyers who were renting in the area and want to profit from low interest rates, international buyers, and some of the situations when people who fled Hudson County” traffic now want back.

One couple she worked with sold their three-bedroom apartment in downtown Jersey City and moved to Maplewood in May 2020. They called her about 6 months ago and stated they sold their Maplewood house and were returning to Jersey City.

They missed the vibrancy and being in the center of the action, and having access to New York City, Barnaby stated.

People who are buying in Hudson County still want space, she added. The majority of people are searching for two or more bedrooms and want some sort of outdoor space. She said, “One-bedrooms are difficult to sell,” and she remarked.

Another factor slowing home sales overall is that home prices rose 12% in 2020 and are on the verge of risen 17 percent this year, according to Otteau, stating that prices grew an average of about 3% for each of the previous 7 years.

House prices can only rise as fast as salaries, he said. Banks won’t lend buyers enough money to afford a house after ten years of that (faster than salary growth). There must be a correction to follow, if home prices rise faster than salaries.

Otteau predicts a price increase of 5% in 2022 and regress of 5 percent in the 2023.

However, he said, it’s still a good moment to purchase. He explained, “You’re going to get a lower interest rate now than in the future,” he added.

According to Reuters, American Federal Reserve policymakers may be able to raise interest rates next year.

According to Otteau’s statistics, the highest segment of the housing market is homes in the $1 million to $2.5 million sales range, which is responsible for approximately 45 percent of sales, followed by the $600,000 to $1 millions sales spectrum, with 30 percent sales.

Those buyers are chasing up and, in the process of purchasing, they’re also increasing the inventory of homes on the market because they sell their existing homes.

People were concerned about job security, so they didn’t want to take on a larger mortgage, Otteau said, because trade-up buyers were not selling last year. They were concerned that strangers gathered across their houses in the middle of a health crisis.

However, the trade-up market hasn’t completely exploded.

Missy Iemmello, office manager for Weichert Realtors in Morris Plains, whose 120 agents work in the Morris, Sussex, Warren, Bergen, and Essex counties, said in September that she saw a rise in inventory that quickly slowed.

We were all delighted. We believed they’ve been anticipating this year, Iemmello added. Then it was simply a short blimp, all of oh, this was subsequently merely en route to victory.

Hurricane Ida, according to Iemmello, stopped the trend.

People got water where they never had water before, she explained. I believe we should see inventory numbers increase in the following weeks.

Frustrated House Hunters Are Giving up on Buying Only to Face an Expensive Rental Market

By Aly J. Yale

9/22/2021

Cramped in a one-bedroom, new parents Kristina and David Mahon were desperate to buy a larger home. But after scouring the Pompano Beach, Florida market for nearly a year (and losing out on 20 houses in the process), the pair eventually gave up.

Now, the couple — with a 10-month old baby in tow, no less — are renting, a decision Kristina says they felt “forced” into.

“I feel like I’m wasting money for something that’s not mine,” Kristina says. The rental“options were very limited, and the prices were on the high side of what we were comfortable spending on a rental.”

The Mahons’ is a common storyline these days, according to those in the industry. Burned-out house hunters are tired of bidding wars, rising prices and dwindling options and are bowing out of the purchase market, opting to rent instead.

“It’s common given the current market and environment that we are in,” says Kaley Tuning, the Native Realty agent who worked with the Mahons. “It just becomes frustrating for the everyday buyer. I’ve had buyers bid upwards of $40,000 over asking price and still get outbid.”

Unfortunately, the pivot to renting isn’t always easy. While the move may afford frustrated buyers time to wait out the competitive housing market, it often means entering an equally hot rental scene — one where rising rents and dwindling supply are growing concerns.

According to Realtor.com, median national rents grew a whopping 11.5% between August 2020 and August 2021. And rent applications? Those are up as much as 95% in some cities, according to apartment listing platform RentCafe.

For hopeful homeowners, it’s made for a unique catch-22 that’s as frustrating as it is costly.

Rents are on the rise

It’s no secret the housing market’s been hot this year. The purchase market has boomed in nearly every corner of the nation since last spring. Home prices are up 17% over the year, and inventory, while improving, is still near record lows.

The rental picture has been more mixed, though. At the start of the pandemic, vacancies in big cities rose and prices dropped, while demand for suburban rentals skyrocketed. Now, rents are bouncing back across the country, reaching well above pre-pandemic levels in many areas.

According to Realtor.com, the typical rent now clocks in at $1,633 per month — $169 more than this time last year and almost $200 more than 2019’s numbers. And in nearly half of the country’s biggest cities? Monthly starter home payments are more affordable than average rents.

The hot housing market has a lot to do with this spike in rent costs. With rising home prices and limited for-sale listings, more and more buyers are stepping back. This puts pressure on rental inventory and drives up rents.

As Lisa Harris, an agent at RE/MAX Center in Braselton, Georgia, explains, “Fewer homes listed for sale and much higher prices for them have kept many want-to-be buyers in their rental units, taxing the rental supply.”

The pandemic plays a role, too. Eviction bans have kept many non-paying renters in place, tying up units for much of the last year. While the CDC’s eviction moratorium was shot down late last month, the experience has made many landlords warier than ever.

“Not only have the prices increased, but the demand on tenant screening seems to be getting much more stringent,” Harris says. “Landlords are seeking tenants with higher credit scores, higher deposits, no pets, a clean criminal history and more.”

The trickle-down of higher rents

Alex Lashner, like the Mahons, has experienced the difficult rental market firsthand. She even had to expand her rental search to account for price increases and is now looking as far as 90 minutes from her office just to stay on budget.