The US Is Officially A Banana Republic: The Top 1% Now Own More Wealth Than The Entire Middle Class

By Tyler Durden

10/11/2021

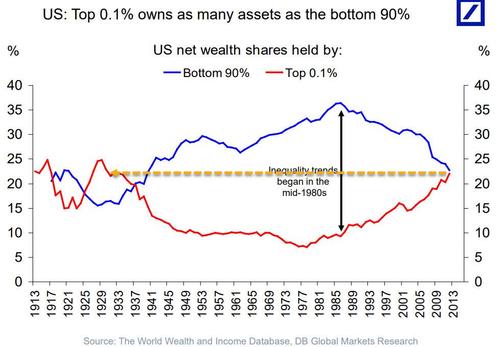

In some ways, we sympathize with Neel Kashkari’s fake “concern” about the unprecedented wealth inequality that has emerged in the US in recent years and which has resulted in a slow, methodical and relentless destruction of the US middle class … or rather make that precedented because there was another time when the top 0.1% had amassed as much wealth and it was just before the Great Depression.

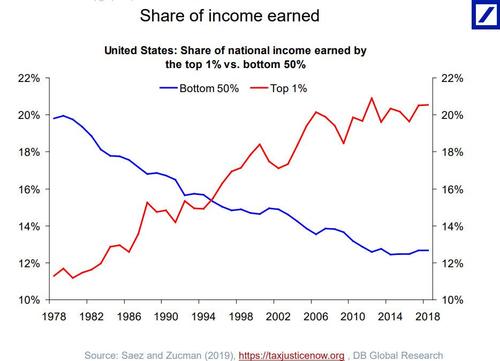

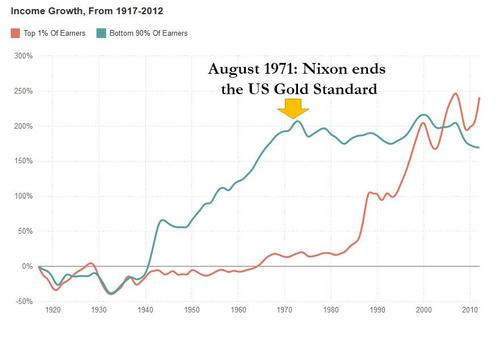

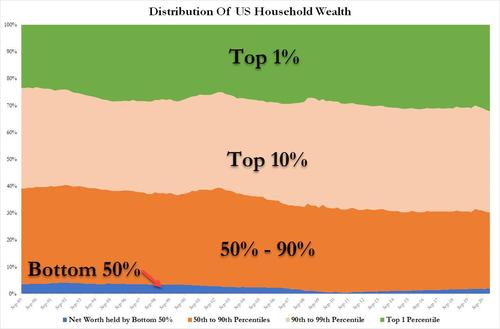

After all, who hasn’t seen charts such as these showing the tremendous divergence in income earned by America’s Top 1% at the expense of the middle and lower classes:

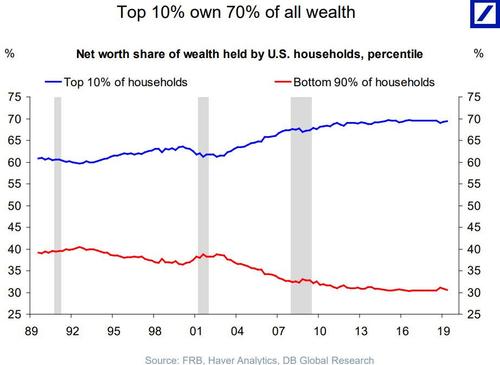

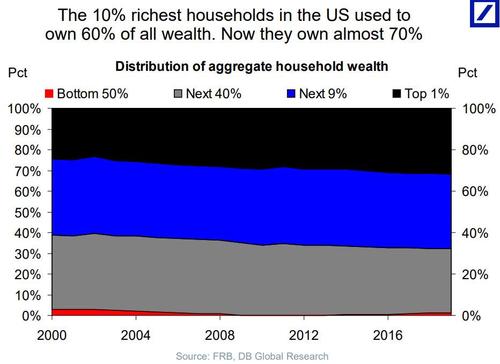

Or that the top 10% now own 70% of all the US wealth, the same as the middle and lower classes combined…

… up 10% from the 60% of wealth they controlled at the start of the century.

Yet we find Kashkari’s “jaw-dropping” virtue signalling proposal to grant the Fed wealth redistribution power not only laughable but absolutely terrifying: after all it was the Fed’s ZIRP and QE that was behind the greatest wealth redistribution in the past decade…

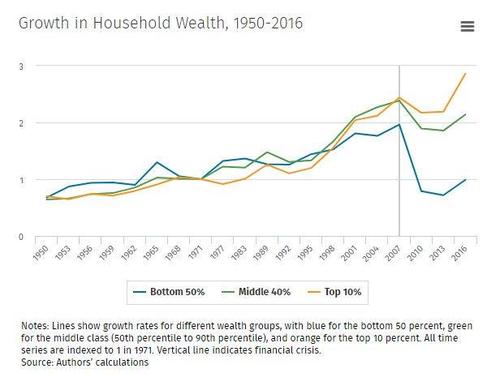

… a redistribution that started almost 50 years ago, when Nixon decided to end the Fed’s biggest nemesis – the US gold standard – launching an unprecedented increase in income growth for the “Top 1%”, even as the income of the “Bottom 90%” has remained unchanged ever since 1971.

For those confused, Rabobank’s Michael Every put it best: of course the Fed can redistribute wealth but “that redistribution has been from the poor and middle-class to the rich, not the other way round.“

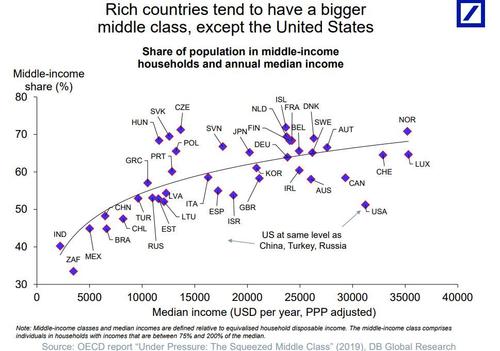

Unfortunately, as we showed back in November 2019, it may already be too late to fix the US: as the following stunning chart shows, the US is already effectively a banana republic if one defines such a nation as one which has a small but ultrapowerful and unaccountable kleptocracy which gets richer year after year by stealing from the rapidly shrinking middle class.

Here is the problem: while the US has one one of the highest median incomes in the entire world, with only three countries boasting a higher income, it is who gets to collect this money that is the major problem, because as the chart also shows, with just a 50% share of the population in middle-income households, the US is now in the same category as such “banana republics” as Turkey, China and, drumroll, Russia.

What is just as stunning: according to the OECD, more than half of the countries in question have a more vibrant middle class than the US.

Alas, since November 2019 it has only gotten worse… much worse because as a result of the unprecedented wealth redistribution unleashed by the covid pandemic, America’s has truly cemented its banana republic status as the wealth of the top 1% exploded as a direct result of the Fed pumping trillions into the stock market and levitating asset values, while the lower and middle classes stagnated.

Two weeks ago, when discussing the latest US record household net worth number, which hit an all time high of $142 trillion or up $31 trillion since Covid, we showed that it would be great if this wealth increase was spread evenly across most Americans, but unfortunately, most Americans have not benefited from recent gains in wealth.

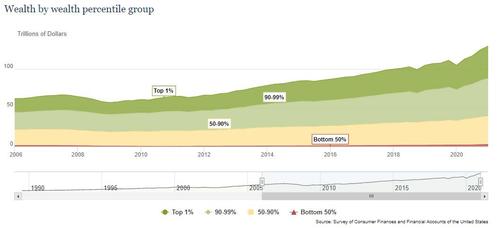

Indeed, the latest data as of Q1 shows that the top 1% accounts for over $41.5 trillion of total household net worth, with the number rising to over $90 trillion for just the top 10%. Meanwhile, the bottom half of the US population has virtually no assets at all. On a percentage basis, just the Top 1% now own a record 32.1% share of total US net worth, or $45.6 trillion. In other words, the richest Americans have never owned a greater share of US household income than they do, largely thanks to the Fed. Meanwhile, the bottom 50% own just 2% of all net worth, or a paltry $2.8 trillion. They do own most of the debt though…

And the saddest chart of all: the wealth of the bottom 50% is virtually unchanged since 2006, while the net worth of the Top 1% has risen by 132% from $17.9 trillion to $41.5 trillion.

All of which brings us to the latest update from the Fed on Household Wealth distribution published on Friday and covering the second quarter of 2021, and which revealed yet another jawdropping fact about America’s full transformation into a banana republic.

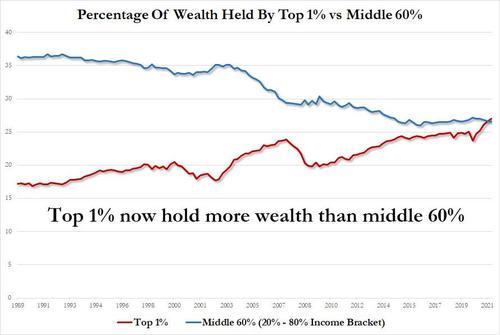

According to the Fed data, which breaks down the distribution of wealth according to income quintile (or 20% bucket) with a special carve out for the top 1%, the middle 60% of US households by income (those in the 20% to 80% income range) – a measure economists use as a definition of the middle class – saw their combined assets drop from 26.7% to 26.6% of national wealth as of June, the lowest in Federal Reserve data, while for the first time the super rich had a bigger share, at 27%.

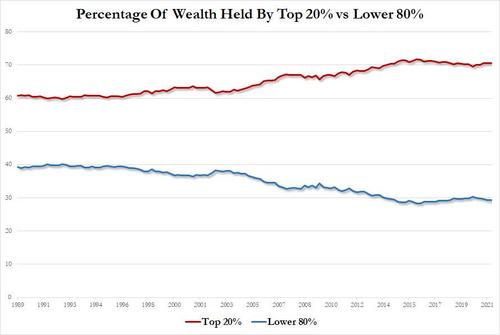

While especially true for the top 1%, it is all the rich that have benefited at the expense of the extinction of the US middle class – as the next chart shows, over the past 30 years, 10 percentage points of American wealth has shifted to the top 20% of earners, who now hold 70% of the total. The bottom 80% are left with less than 30%.

Some context: while “middle class” is a fluid concept, many economists use income to define the group. The 77.5 million families in the middle 60% make about $27,000 to $141,000 annually, based on Census Bureau data. As Bloomberg notes, their share in three main categories of assets – real estate, equities and private businesses – slumped in one generation. That made their lives more precarious, with fewer financial reserves to fall back on when they lose their jobs.

On the other end, the top 1% represents those 1.3 million households out of a total of almost 130 million, who roughly make more than $500,000 a year. The concentration of wealth in the hands of a fraction of the population is at the core of some of the country’s major political battles. It was also made possible entirely by the Fed, which as Stanley Druckenmiller said back in May echoing what we have said since our inception back in 2009, has been the single “greatest engine of wealth inequality” in history (to which we would also add the end of the gold standard under Nixon).

“If the economic system isn’t working for the clear majority of the population, it will eventually lose political support,” Nathan Sheets, newly appointed chief economist at Citigroup Inc., said by email. “This observation is motivating many of the economic reforms that the Biden Administration is putting forward.”

And while Joe Biden is seeking to “bolster” working- and middle-class families with a $3.5 trillion package before Congress that includes assistance with child care, education and health care paid for with tax increases on high-income individuals, what he will do is make the rich even richer as the Fed will have to monetize all those trillions in new debt, boosting risk asset prices even higher, and while the middle class spends any one-time fiscal stimulus merely to cover soaring costs of everyday items like rent and gas, it is the top 1% who will benefit the most again as they stock portfolios hit new all time highs.

It’s not just stocks that have benefited the super rich: housing has too. While a generation ago, the middle class held more than 44% of real estate assets in the country, it is now down to 38%. The pandemic generated a boom in housing values that has benefited most those who owned real estate in the first place. It also led to soaring rents this year, which hurt those who can’t afford a house. The self-feeding loop was yet another source of wealth transfer for the wealthier.

So the next time someone abuses the popular phrase “they hate us for our [fill in the blank]”, perhaps it’s time to counter that “they” may not “hate” us at all, but rather are making fun of what has quietly and slowly but surely become the world’s biggest banana republic?

And it has not Russia, nor China, nor any other foreign enemy to blame except one: the Federal Reserve Bank of the United States.

美国股市动荡,适于做空,如何操作?

(免费讲座 – Oct 11, Mon, 9PM EST)

请扫描海报上二维码:

或直接点击 Zoom 报名链接:

https://zoom.us/webinar/register/6316336221018/WN_yvmcDteARpGx4yjf2g3mww

Tel: 551-580-4856 | Email: F.WINNIE.S@GMAIL.COM

诚招美国和加拿大法律服务代理

因公司发展需要,诚招美国和加拿大法律服务代理。

要求:

懂英语、或西班牙语、或法语。

能合法工作有社安号或工号。

无需改行, 可以兼职。

大学生和有销售经验优先考虑。

自雇生意公司发美国报税1099,加拿大T4A

有意了解详情, 请扫码加微信, 非诚勿扰!

三名经济学家分享2021年诺贝尔经济学奖

文 / 潘万莉

10/11/2021

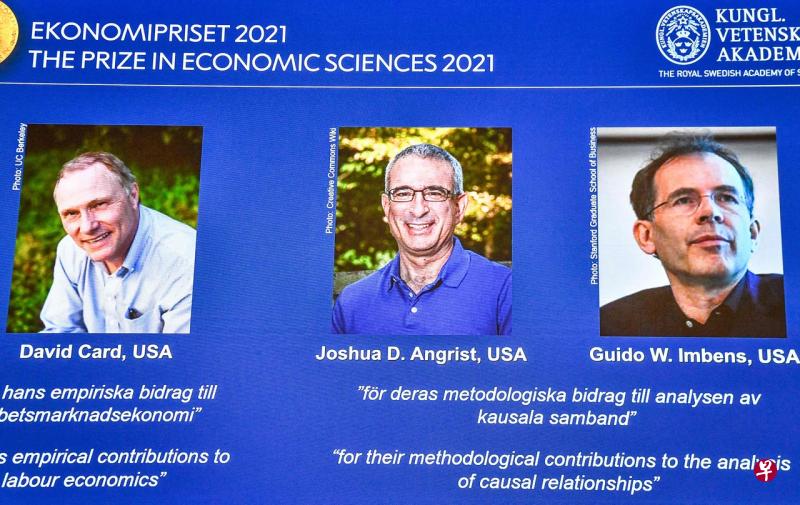

(早报讯)瑞典皇家科学院周一(10月11日)在斯德哥尔摩宣布,将2021年诺贝尔经济学奖授予三名经济学家卡德(David Card)、安格里斯特(Joshua Angrist)和因本斯(Guido Imbens),以表彰他们在劳动经济学与实证方法研究领域作出的突出贡献。

三位获奖者研究的关键,是把全球贫困问题分解为更小、更精确的问题。例如,为了找到提高儿童健康水平的方法,可以针对教育方法、医疗卫生系统、获得信贷的途径等方面设计实验,证实干预效用。

Three economists win Nobel for their research on how real life events impact society

By SCOTT HORSLEY

10/11/2021

Jacquelyn Martin/AP

Three U.S.-based economists will share this year’s Nobel Memorial Prize in Economic Sciences for their innovative work with “natural experiments” – events or policy changes in real life that allow researchers to analyze their impact on society.

David Card of the University of California at Berkeley will receive half the prize, worth 10 million Swedish kronor, or about $1.1 million, the Royal Swedish Academy of Sciences said on Monday. Joshua Angrist of the Masschusetts Institute of Technology and Guido Imbens of Stanford University will share the other half.

Controlled experiments are common in science and medicine: they allow, for example, to test new drugs by carefully selecting participants and controlling vital aspects to ensure objectivity.

But they are harder in social sciences where it can often be impractical or unethical to conduct randomized trials – unless a real-life event or policy change happens that allow researchers to conduct what are called “natural experiments.”

“Natural experiments are everywhere,” said Eva Mork, a member of the prize committee. “Thanks to the contributions of the laureates, we researchers are today able to answer key questions for economic and social policy. And thereby the laureates work has greatly benefited society at large.”

Claudio Bresciani/TT News Agency/AFP via Getty Images

The impact of the minimum wage

Card was recognized in part for his groundbreaking work in the early 1990s with the late Princeton economist Alan Krueger, which challenged conventional wisdom about minimum wages.

Economists had long assumed that there was a tradeoff between higher wages and jobs. If the minimum wage went up, it was thought, some workers would get higher pay but others would be laid off.

But when Card and Krueger looked at the actual effect of higher wages on fast food workers, they found no significant drop in employment.

They reached this conclusion by comparing fast food restaurants in New Jersey, which raised its minimum wage, with restaurants in neighboring Pennsylvania, which did not.

Brandon Bell/Getty Images

Studying cause-and-effect in real life

Meanwhile, Angrist and Imbens were recognized for methodological research that helps tease out cause and effect from these accidental case studies.

During the pandemic, natural experiments have allowed researchers to study the effects of mask mandates, social distancing policies, and supplemental unemployment benefits.

Imbens said he was “stunned” to get the congratulatory wake-up call at about 2 a.m. in California.

“I was absolutely thrilled to hear the news,” Imbens told reporters. “In particular hearing that I got to share this with Josh Angrist and David Card, who are both very good friends of mine.”

He noted that Angrist was best man at his wedding.

Imbens said he had no idea how he would spend his share of the prize money.

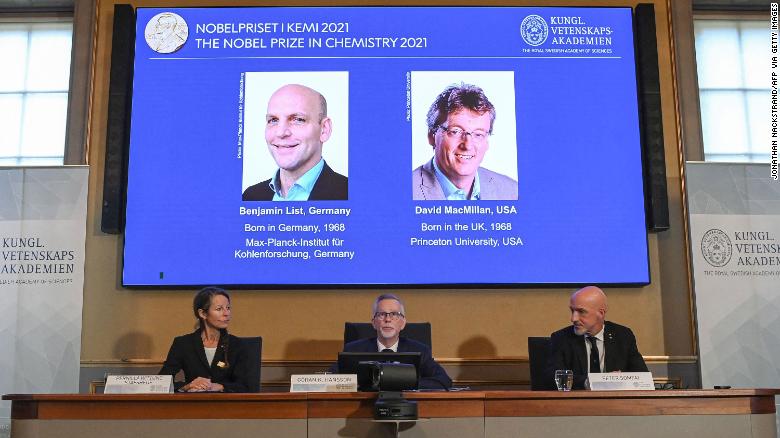

美德两学者夺诺贝尔化学奖

文 / 潘万莉

10/06/2021

(早报讯)瑞典皇家科学院周三(10月6日)宣布,将2021年诺贝尔化学奖授予德国化学家本亚明·利斯特和美国科学家大卫·麦克米兰,以表彰他们在发展不对称有机催化中的贡献。

53岁的利斯特曾在柏林自由大学攻读化学,并于1997年在法兰克福大学取得博士学位。他测试一种名为“脯胺酸”(proline)的氨基酸,检验是否能够催化化学反应,果然有效发挥作用。此发现有助于不对称有机催化的发展。

53岁的麦克米兰则是美国普林斯顿大学的化学教授,2010年至2015年还曾担任化学系系主任。麦克米兰曾经研究能够容易被水分破坏的金属催化剂,成功使用简单的有机分子,研发出一种更耐用的催化剂。

麦克米兰在格拉斯哥大学获得化学学士学位。1990年,他离开英国,在加州大学尔湾分校奥弗曼教授的指导下进行博士研究。

本届诺贝尔颁奖典礼以实体、线上混合的方式进行,获奖者将获得奖牌、证书以及1000万瑞典克朗(约154万新元)奖金。

Nobel Prize in chemistry awarded for ‘simple’ yet ‘ingenious’ discovery

By Rob Picheta and Katie Hunt, CNN

10/06/2021

The Nobel Prize in chemistry has been awarded to Benjamin List and David W.C. MacMillan, two scientists honored for creating “an ingenious tool for building molecules” that has helped develop new drugs and make chemistry greener.

The pair were announced as the prize winners in Stockholm, Sweden, on Wednesday, for the development of asymmetric organocatalysis. Their discoveries “initiated a totally new way of thinking for how to put together chemical molecules,” said Pernilla Wittung-Stafshede, a member of the chemistry Nobel committee.”

This new toolbox is used widely today, for example in drug discovery, and in fine chemicals production and is already benefiting humankind greatly,” Wittung-Stafshede added.

List, a German scientist who is professor at and director of the Max Planck Institute for Coal Research, and Scotland-born chemist MacMillan, now a US-based professor at Princeton University, worked independently of each other but share the prize, the third Nobel award to be handed out this week.

In 2000, the two researchers uncovered a third kind of catalyst — a substance which brings about a chemical reaction — called asymmetric organocatalysis. Scientists had previously believed that there were just two types of catalysts: metals and enzymes. Enzymes contain hundreds of amino acids or proteins, but the winners were able to demonstrate that a single organic molecule can act as a catalyst.

“This concept for catalysis is as simple as it is ingenious, and the fact is that many people have wondered why we didn’t think of it earlier,” said Johan Åqvist, chair of the Nobel Committee for Chemistry.

The new catalysts have been used in a number of ways in the past two decades, including for creating new pharmaceuticals and building molecules that capture light in solar cells. The committee credited them with “bringing the greatest benefit to humankind.”

The work of List and MacMillan has helped develop a drug to treat high blood pressure and streamline the production of drugs like paroxetine (Seroxat), which treats depression, and oseltamivir — better known as Tamiflu — which is used to treat respiratory infections.”

I hope I live up to this recognition and continue discovering amazing things,” List told reporters after being announced as a winner.

List said he was having a coffee with his wife when he got the call from the Nobel Committee. “Sweden appears on my phone, and I look at her, she looks at me and I run out of the coffee shop to the street and, you know, that was amazing. It was very special. I will never forget,” he said.

‘Fantastically important’

The organocatalysis process developed by the winners is called “asymmetric” because they were able to pinpoint which molecule to use as a catalyst. During chemical construction, a situation often arises where two molecules can form, which — just like our hands — are each other’s mirror image, the Nobel Committee explained. Chemists often just want one of these mirror images, particularly when producing pharmaceuticals, but it has been difficult to find efficient methods for doing this.”

This is a fantastically important piece of chemistry and these two are undoubtedly leaders in that field,” Phillip Broadwith, business editor of Chemistry World magazine, told CNN after the announcement was made.”

This is very fundamental chemistry,” Broadwith added. “In its essence, it’s about making molecules and it’s about making them more efficiently, using less energy and without metal catalysts, which are problematic if they end up in pharmaceuticals.”

H.N. Cheng, the president of the American Chemical Society, said the award was a “fitting recognition” for “a major accomplishment.”

“As chemists we love to do reactions and reactions are a key part of our work, and the reactions frequently are unfortunately not as desired — they can be slow, they can be nonspecific they may not go the way we wanted,” he told CNN. “Catalysis is one way whereby we can actually help the reaction and make reactions go better or generate new reactions that could not be done before.”

Cheng likened it to making food. “If you’re cooking a dish, you’re actually doing a chemical reaction. So say it takes 10 minutes to produce a steak. If I can do it in 10 seconds, that’d be much better. Customers would like it, the chef would like it. And that’s exactly what catalysis is doing now. The cooking is much better, much faster, much cheaper.”

On Monday, David Julius and Ardem Patapoutian won the Nobel Prize in physiology and medicine for their discoveries of receptors for temperature and touch. And on Tuesday, they were joined by three winners of the prize for physics — Syukuro Manabe, Klaus Hasselmann and Giorgio Parisi.

All male lineup

Wednesday’s award adds two further Nobel laureates. But for the second time in three years, no women were recognized in the scientific awards.”

We don’t have any direct discussions with other committees about who wins the prize, but we do have discussions about how to support and increase women and it’s also important to support geographic diversity,” said Claes Gustafsson, a professor in medical biochemistry at the University of Gothenburg and a member of the Royal Swedish Academy of Science.”

We are inviting more women to be nominators and so on. It’s a long and strategic work,” he told CNN. “We were very happy to have two women (win the chemistry prize) last year and for sure we will have many women in the years to come. It’s a very high priority for us.”

In 2019, the Nobel Committee asked nominators to consider diversity in gender, geography and field, but that year only men were among the winners for the science Nobels. In 2020, three women in science were given Nobel recognition.

Emmanuelle Charpentier and Jennifer Doudna jointly won the 2020 Nobel Prize in chemistry, while Andrea Ghez was one of three winners of the physics prize.

The prizes for literature and peace will be announced later this week, before the economics award concludes the annual festivities on Monday.

诚招美国和加拿大法律服务代理

因公司发展需要,诚招美国和加拿大法律服务代理。

要求:

懂英语、或西班牙语、或法语。

能合法工作有社安号或工号。

无需改行, 可以兼职。

大学生和有销售经验优先考虑。

自雇生意公司发美国报税1099,加拿大T4A

有意了解详情, 请扫码加微信, 非诚勿扰!