新一轮免费居家检测剂 下周起可预约

世界新闻网

3/04/2022

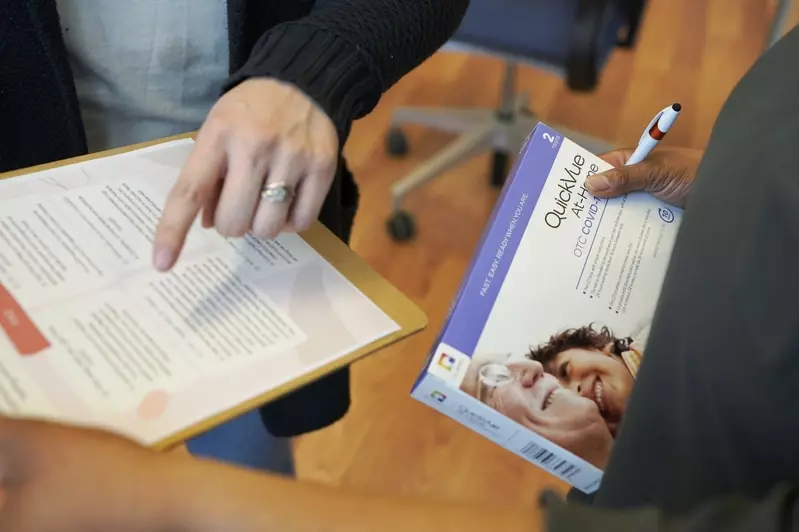

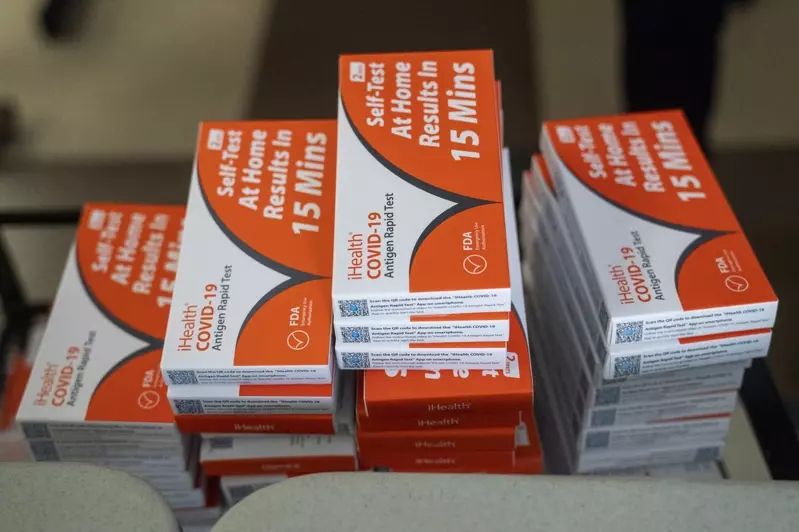

有线电视新闻网(CNN)报导,美国人从下周起,可再次订购联邦政府提供的免费居家新冠检测剂。

拜登总统日前在国情咨文中宣布:「你们可再订另一批检测剂。下周开始到Covidtest.gov网站,就能拿到更多检测剂。」

联邦政府1月开始提供免费快筛抗原检测剂,美国家庭可在网页上登记,或拨打800-232-0233预约;每户住址最多可领取四剂新冠检测剂。

Covidtest.gov网站指出,美国家庭从下周起可再额外预约四剂。

去年12月Omicron变种病毒肆虐美国,拜登宣布要免费邮寄5亿剂检测剂给美国人;不过白宫发言人穆诺斯(Kevin Munoz)表示,美国人总共订不到3亿剂。

白宫原本表示,美国民众登记后,约需7至12天配送期。

根据约翰霍普金斯大学数据,自美国2020年1月爆发新冠疫情后,逾95万2000名美国人染疫病殁,约有7910万人确诊。

「我们别再依两党歧见来看待新冠肺炎,而是以其本质看待:糟透的疾病。」拜登在推文中表示:「我们别再把彼此当成敌人看待,而是以本质看待彼此:美国同胞。」

两名联邦政府官员告诉CNN,白宫2日将宣布因应新冠疫情的下一步新策略,估计未来生活可受到更少疫情影响,但同时也做好准备,未来可能再出现新变种病毒。

气温太低 试剂易结冻…政府寄发新冠检测剂恐失准

世界新闻网

02/05/2022

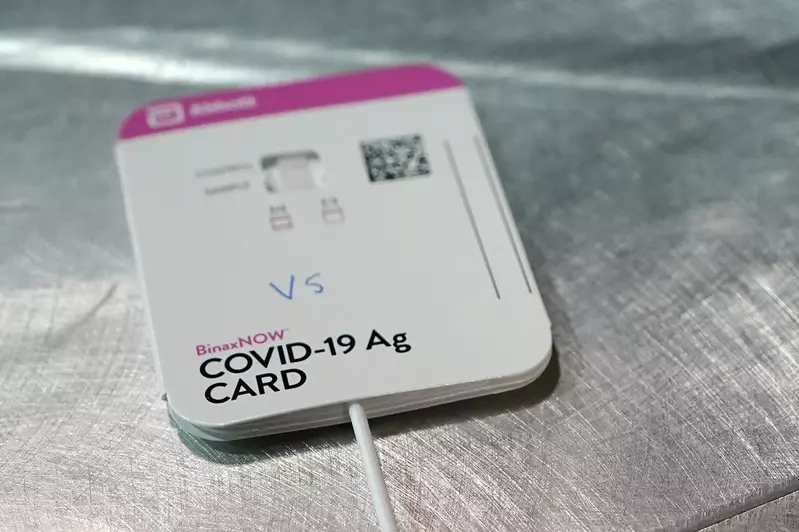

今日美国报(USA Today)报导,美国不少地区近来面临严寒侵袭与冬季风暴,同一时间联邦政府免费发送的居家病毒检测剂可望寄达,气候因素恐将使得检测结果失准。

佛罗里达大学(University of Florida)流行病学家辛蒂·普林斯(Cindy Prins)指出,绝大多数居家病毒检测组制造厂商都建议,检测剂应储藏于华氏温度35度以上的环境,因为检测组合当中的液体试剂容易冻结,如果结冰将使得检测精准度变差。

联邦政府将为前往COVIDTests.gov网站登记的民众免费寄发居家病毒检测剂,高达10亿份检测组将通过美国邮政总局(U.S. Postal Service)寄出。

某些地区连续几天温度接近冰点,收到的免费病毒检测剂是否准确度已不可靠?专家分析,关键在于检测剂暴露于低温环境的时间长短。

华盛顿大学医学院(University of Washington School of Medicine)医学及病理学实验室主任巴尔德(Geoffrey Baird)说,如果检测剂内含液体试剂曾经结冰,检测结果可能产生误差。

巴尔德说,如果检测组曾经放置室外几个小时,检测结果或许还可以接受,只是精准度略差,但如果检测组放在邮箱里长达一天以上,最好改采核酸检测(PCR tests)。

他举例说,如果居家病毒检测剂在华氏25度天候底下,放在邮箱里隔了一夜,在这种情况下便应该使用另一套新的检测组。

巴尔德说,液体试剂经过冷冻之后就出现变化了,为了安全起见,最好使用另一套新的检测组。

国家卫生研究院(National Institutes of Health)公布研究报告指出,抗原检测(antigen tests)长时间曝露于华氏36度以下低温或华氏86度以上高温,检测结果将会失准,例如出现伪阴性的检测结果。

普林斯指出,民众接到居家病毒检测组已经寄达的电邮通知时,应该马上从邮箱将包裹取回,放在室内。她说,如果拿到冰冷的包裹,放在室内便可让液体试剂恢复到室内温度,不要把包裹立即拿去晒太阳,以免导致温度过高。

巴尔德说,收到的居家检测组包裹若是冰冷的,最好放置室内等待至少四、五个小时才使用。

免费新冠家用快筛检测剂 1月19日起上网预订

世界新闻网

01/14/2022

拜登政府14日宣布,从1月19日 (周三) 起,美国居民可以预订「免费新冠居家快筛检测剂」(Free at-home COVID-19 tests)。每户可上官网 (COVIDTests.gov)下单,领取最多四套快筛剂。政府单位也将开通一组电话号码,服务那些无法上网的民众。白宫指出,下单的居家快筛剂一般会在7至12天内抵达。这也意味着,民众若在19日下单,最快也要等到1月底才能拿得快筛剂。

Jan 14, 2022

Yahoo Finance’s Anjalee Khemlani details the latest about the coronavirus pandemic and how Americans get receive free home test kits for COVID-19 after an announcement from President Biden.

预订免费居家快筛剂的民众,必须在下单时提供姓名及电子信箱,届时可通过电邮信箱追踪快筛剂订单。操作这项计划的国家数字中心 (U.S. Digital Service) 表示,已经准备好了。为了运输畅通,美国邮政署(USPS)也准备好运送快筛剂,并计划聘用7000名临时工协助运行计划。截至1月14日为止,拜登政府已购入5亿份居家快筛剂,免费提供给美国居民,白宫也计划在接下来几周,开始提供高品质的免费口罩。白宫12日也承诺,每月将免费提供各500万套新冠病毒快筛与核酸(PCR)检测试剂给全国K-12学校,保障学校开放及面授教课的安全。

居家检测盒 健保每人每月免费8套…月底联邦推新网站 发5亿套

世界新闻网

01/11/2022

拜登政府10日宣布,从15日起,私人医疗保险公司每月须为每位投保消费者提供最多八套新冠病毒居家检测盒;美联社报导分析,疫情升温令民众备感挫折之际,拜登政府这项措施旨在降低成本,且让病毒检测变得更加简便。

Jan 11, 2022

Starting Saturday, private health insurers will be required to cover up to eight home COVID-19 tests per month for people on their plans. The Biden administration announced the change Monday as it looks to lower costs and make testing for the virus more convenient amid rising frustrations.

Under the new policy, first detailed to the AP, Americans will be able to either purchase home testing kits for free under their insurance or submit receipts for the tests for reimbursement, up to the monthly per-person limit. A family of four, for instance, could be reimbursed for up to 32 tests per month. PCR tests and rapid tests ordered or administered by a health provider will continue to be fully covered by insurance with no limit.

「这是我们整体策略的环节之一,希望尽快让民众免费取得使用方便的居家检测盒。」卫生部长贝西拉(Xavier Becerra)发表声明指出:「我们要求私人保险公司必须承担投保民众的居家检测开销,等于扩大民众在有需要的时候取得免费检测的能力。」

根据拜登政府新规,民众可以通过私人保险免费购买居家病毒检测盒,或者提供购买病毒检测盒的收据向保险公司申请费用报销(reimburse),只要数量不超过每月限制即可。以四口之家为例,每个月最高可申请报销32个病毒检测盒。

核酸检测(PCR)以及医疗机构规定并进行的快筛,全数费用则将由保险公司承担,没有上限。

年底假期期间,许多民众为与亲人团圆而出远门,由于正值Omicron变种病毒迅速扩散之际,市售居家病毒快筛检测盒严重缺货,拜登总统因此受到舆论检讨。美联社报导,拜登政府现正设法通过提高供应量及降低价格,让病毒居家检测盒变得取得容易。

‘Bit more hope’ | Pearland father among 200 million Americans whose insurance will cover cost of 8 at-home COVID tests

报导指出,到了本月底,联邦政府还将推出新网站,通过电子邮件开始发送5亿份居家病毒检测盒;在目前确诊案例增加速度最快的几个地区,联邦政府也将加快脚步设立新冠病毒快筛紧急检测站。

美联社分析,费用由保险公司承担的病毒检测盒,将让民众省下可观花费,联邦政府则希望当居家病毒检测盒变得更加普遍之后,病毒传播速度将可因此趋缓,进而达到让学童早日返回校园上课、民众得以安全群聚等目标。

白宫发言人莎奇(Jen Psaki)10日在新闻简报会上表示,联邦政府为民众免费提供的病毒检测盒,未来几周就会寄送到府。

她说,根据联邦政府与包商签订契约,病毒检测盒配送作业时间必须迅速确实,「第一批最快可望下周便可寄达」。

Jan 11, 2022

Americans will be able to either purchase home testing kits for free under their insurance or submit receipts for the tests for reimbursement, up to the monthly per-person limit.

莎奇说,未来两周内包商将把所有病毒检测盒寄出,民众到了月底便可以在网上预订后续的检测盒;她指出:「更多细节将于网站上公布,我们本周也将成立电话服务专线。」

大量民众检举诈骗 新冠病毒免费快筛公司遭调查

世界新闻网

01/11/2022

新闻周刊(Newsweek)报导,以「新冠病毒管制中心」(Center for Covid Control)为名的私人公司,号称在全美各地设有300个据点,为民众提供免费、当天可获得结果的快筛检测,但美国经营改善协会(Better Business Bureau,BBB)在收到大批民众的诈骗检举之后,已经启动调查。「新冠病毒管制中心」在美国经营改善协会的评分,如今已降为代表极为差劲的「F」。

Dec 28, 2021

“They want you to fill out paperwork that [has] your name, your address, your birthday, all of your health insurance information,” said Liz Coyle with Georgia Watch.

「新冠病毒管制中心」网站写道,合作实验室领有执照且获美国疾病管制暨预防中心(CDC)认证,却未说明实验室名称。「新冠病毒管制中心」的推特帐号成立于2021年3月,追踪粉丝仅82名, Instagram帐号以「免费病毒检测」(freecovidtest)关键词发文,但网友回应多半是指责「造假」(fake)或「诈骗」(scam)。

美国经营改善协会网站则有民众投诉指出,前往「新冠病毒管制中心」接受病毒检测之后,从来不曾收到检测结果,这家公司成立目的疑似专门用来行骗。有民众写道,三周半之前接受检测,迄今未收到结果,也有民众指出,接到的检测结果日期根本不正确,「对这家公司感到高度怀疑」。

美国经营改善协会网站明尼苏达州及北达科他州办公室发言人说,已经与芝加哥及威斯康辛州的办公室联手,针对「新冠病毒管制中心」公司展开调查。

Beware of fake COVID-testing sites. You should not be charged or asked for personal information like your social security number, said the Better Business Bureau.

31岁明尼阿波里斯(Minneapolis)妇人克莉丝汀娜‧韦伯(Christina Weber)日前接受今日美国报(USA Today)访问时说,到「新冠病毒管制中心」公司的社群媒体帐号留言,抱怨迟迟没有收到检测报告之后,便收到电邮通知说检测结果为阴性,但她在前往「新冠病毒管制中心」检测地点接受病毒检测的同一天,还到另一个检测站接受检测,后者出炉结果为阳性。

韦伯说:「我很生气,也担心他们如果一直发送造假的阴性检测结果,可能害死人。」

纽约爆多宗加密货币投资骗局 华男遭骗数十万元

世界新闻网

12/27/2021

布碌仑(布鲁克林)班森贺华社日前又发生与加密货币投资骗局相关的案件,至少两名华人中招,且损失金额巨大;据警方数据,一名华男因轻信陌生人的话,将39万元积蓄放入对方推荐的交易户口中,不久后钱全部不翼而飞,至今讨不回来。

市警62分局纪录显示,报住在23大道交88街的64岁华男于本月16日到警局报案,他在11月26日网络上结识一名男子;对方不断游说投资加密货币已成为现在最赚钱的方法,推荐他开始投资,而自己能从中协助。

华男表示,对方帮他设立一个叫「比特币钱包」(Crypto Wallet)的交易帐户,原本没有行动,但在对方再三保证下便投入资本;他将39万元积蓄放入户口中,几日后检查时发现余额归零,急得他马上联系对方,但已惨遭拉黑。

第二起案件中,报住在西1街交17大道的40岁华女,于本月1日在微信上结识一名自称居住在旧金山的男子,两人几周以来传信息聊天,直到对方透露自己是名投资顾问,可帮助其通过投资加密货币赚钱。

华女深信不疑,将一笔10万8000元的款额电汇给对方,同时在一个名为CKCOIN的应用程序开了一个帐户;可不久后该帐户遭封锁,她联系对方时,男子表示需再注入3万元资金才能激活。

这时受害者相信自己已遇上骗徒,未继续汇钱,而是将数据交给警局处理;这两起案件被骗的数额都很大,目前警方已介入调查,但始终没有进展。

当地警员曾表示,手机和网络诈骗在华社最为频繁发生,损失的数额从几百块到数十万元不等,警方多次提醒也未能起到防范作用。

在社区安全讲座中,警员提到很多骗徒采用「杀猪盘」手法与受害者套近乎,获取信任后游说他们进行投资,结果一步步让其掉入陷阱中;要谨记「天下没有白吃的午餐」,如果对方提出的建议很诱人,说明有问题,民众若无法自行判断,一定要求助身边的人再三确认。

经中间人兑换本票 华人被跳票逾50万元

世界新闻网

12/14/2021

布碌仑(布鲁克林)近日有数名华人因买房或其他之需而通过中间人兑换银行本票(Cashier’s Check),不料却遭遇跳票,其中仅通过同一个中间人兑换的银行本票就有51万元被跳票。

数名受害者日前到美国亚裔社团联合总会求助,据陈氏夫妇讲述,因要购置房产,所有通过朋友介绍认识了以现金兑换银行本票的中间人张某,在将5万元现金交给对方后,于11月24日拿到本票,但因第二天是感恩节,他们在26日才前往银行,但不料再查帐户时发现跳票。

受害者石先生表示,他也是通过中间人张先生兑换了近2万元本票,然后在感恩节前后通过银行的ATM机存入,随后也遭跳票。

中间人张先生也场,他表示,自己至多从中赚取一个百分点,此次他是通过一名居住在新泽西州李堡(Fort Lee)的一华裔男子去当地银行兑换的本票。

张先生说,为保险起见,他还专门安排了一名司机带着45万元现金亲至李堡的银行,当面看着那名华裔男子将钱兑成本票并清点清楚后,才带着本票回到布碌仑。

据张先生称,在跳票后的第二天他即请律师前往银行查问,被告知那名男子随后又持身分证件回到银行要求撤销本票,导致这些本票跳票。

律师斯科拉里(Lisa Scolari)对此表示,受害者被骗后应第一时间向警方报案,另外因这些本票是跨州兑换,该案已涉及违反联邦法律,受害者还应尽快向联邦调查局(FBI)等部门举报。

斯科拉里还表示,若这些本票为真,银行不可能停止支付,因每张本票是由银行担保、以银行自有资金开具并由出纳员签署;因此不存在购买者第二天持证件又返回要求银行撤销的现象,除非这些本票为假才会跳票。

亚总会会长陈善庄表示,该案受害者至少有十几名,有的个人损失高达11万元,共计金额已经超过了50万元;但至今部分受害者选择不报警,怕税务局查税;但骗徒正是利用了这一点,他呼吁更多受害者站出来,配合调查。

藉耶稣基督之名圈钱 德州诈骗客被判关到死

世界新闻网

11/04/2021

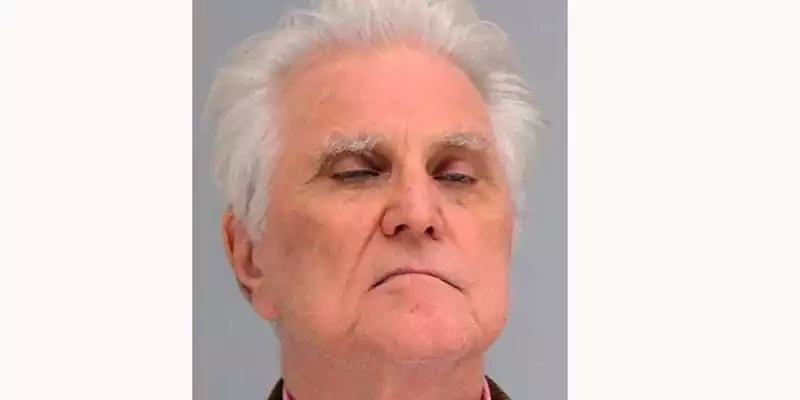

北德州一名基督教广播电台节目主持人,经营庞氏骗局(Ponzi scheme)大约十年后露馅,他于1日(周一)被法官判处第三个终身监禁。

现年80岁的威廉嘉勒格(William Gallagher),其实从2019年3月被捕后一直都待在监牢中,他因为同样的诈欺行为已被达拉斯法院判处25年徒刑,德州法院也已判了他30年。2019年8月,泰伦特县(Tarrant County) 法院对他提诉,这次的审判庭是为福和市一带的受害者讨回公道。

嘉勒格在一家基督教广播电台担任主持人,他每次节目收尾时,总说「星期天教堂见」(See you in church on Sunday),这成了听众百听不厌的口头禅,他还出版理财的书籍,譬如有一本名叫「耶稣基督,金钱大师」(Jesus Christ, Money Master)。他所成立的嘉勒格财务集团(Gallagher Financial Group)在电视台做广告,有许多年长者相信他是虔诚的基督徒,绝对不会骗他们的钱。

泰伦特县检察官办公室年长者财务诈欺小组(Elder Financial Fraud team)的组长萝莉瓦内尔(Lori Varnell)指出,这是她执法多年来所看到的最恶劣案例,嘉勒格在各教会的周日集会中与教友接触,这些已退休人士把钱交给他投资,少的有几万元,多的有60万元,最后却血本无归,有些人必须卖房,有的人跟子女讨钱过生活,有些人重回职场上班赚钱,他们损失的金钱总数达3200万元。

1920年代,查尔斯庞济(Charles Ponzi)在波士顿为他的投资公司做广告,宣称有丰厚的报酬率又没有风险,他把新投资人的钱拿来付老投资人的年度利息,经过几年名声越来越大,收到的资金越来越多,但庞氏骗局终究有爆发的一日,投资人失去资本,诈骗者入狱服刑,这种骗术如今就是以他为名。

Zelle scammers bilk bank customers out of thousands — how to avoid them

By Paul Wagenseil

9/03/2021

Scams involving Zelle payment service still happening

Two Chicago-area women say scammers bilked them out of $3,500 each by conning them over the phone and then using the Zelle mobile-payment system to withdraw money from their Bank of America accounts.

“It’s really distressing,” one of the women, Nausheen Brooks, told TV station WLS. “You save your hard-earned money to just be taken away from you.”

The scammers texted Brooks and the other woman, Darlene Chelsey, pretending to be Bank of America and asking them to verify purchases. Both women denied making the purchases in question, and then were called by persons claiming to be bank representatives. The scammers used what appeared to be legitimate Bank of America phone numbers.

The women were each told that there had been Zelle withdrawals from their accounts, but that the problems could quickly be fixed if they used their own mobile banking apps to transfer the money back to themselves.

Six Spaces Home Staging

Contact: Hongliang Zhang

Tel: 571-474-8885

Email: zhl19740122@gmail.com

Brooks and Chelsey both did so, and the money disappeared. It seems that both their Zelle accounts had already been taken over by the scammers.

“They definitely had access to the account if the money was wired to herself,” Bogdan Bodezatu, a threat researcher with Bitdefender, told WLS. He added that the scammers may have gotten access to the accounts due to data breaches at other websites, which can compromise reused passwords.

How to avoid Zelle scams

Avoiding Zelle scams is like avoiding many other online scams. Create strong, unique passwords for any account that involves money, especially banking accounts, and use one of the best password managers to keep all of them straight.

Don’t trust anyone who calls or texts you and wants you to perform a financial transaction, even if that person appears to be from your bank. Instead, call the bank yourself using a number that you look up.

Don’t give out one-time-use verification codes to anyone, even if they claim to be from your bank. And again, never reuse passwords for sensitive accounts.

Years of Zelle scams

Sadly, this is not a new occurrence. Zelle-based scams have been happening for years — we first wrote about them in April 2018.

The earliest scams involved crooks getting people to pay for non-existent items through Zelle, then discovering they couldn’t get their money back because unlike with a credit-card, the money is withdrawn immediately from your bank account.

Later, people who’d never even signed up for Zelle were scammed out of thousands of dollars by crooks who set up accounts in their names and drained their bank accounts.

That’s because Zelle is owned by seven of the largest U.S. banks, including Bank of America, and used by hundreds more banks. Anyone who has an account with those banks is eligible for a Zelle account, and many banks build Zelle right into their own mobile apps.

These most recent scams seem to involve persons whose accounts have already been hijacked, perhaps through password reuse. (If you use a password on more than one account, then a compromise of any one of those accounts compromises them all.)

Why Zelle is vulnerable

The real problem is that Zelle uses email addresses and phone numbers to identify account holders, and neither was ever designed to be foolproof. Both email addresses and phone numbers can be easily “spoofed” by cheap software.

Many banks do text a one-time code to customers to verify certain transactions, yet not only can text messages be intercepted, but scammers can con customers into revealing texted codes.

Another issue is that Zelle has direct access to bank accounts. Venmo, which is not affiliated with the banks, makes users create a separate account that is linked to a credit card or into which the users deposit money. This creates a buffer between Venmo transactions and their bank accounts.

We’ve reached out to Zelle to ask if the company has made any security improvements in the past three years, and whether Zelle would consider setting up a “staging” account to act as a buffer, similar to the way Venmo operates. We’ll update this story when we receive a response.

In the meantime, one thing does appear to have changed: Both Brooks and Chelsey had their $3,500 losses covered by Bank of America. That’s a better outcome than some of the earliest Zelle scam stories, in which the victims were essentially told by the banks that they should have read the fine print.

That fine print, by the way, still says that the bank isn’t legally liable if you transfer money via Zelle to the wrong people.

Update: Zelle responds

In response to our inquiries, Zelle provided this statement.

“Phishing Scam: This is an example of a phishing scam where the scammer spoofed the Bank of America phone number and attempted to convince the individual to provide their personal information, not a breach of Bank of America or Zelle security.

We’d like to remind consumers that your bank will never call you to ask for sensitive information and they would not ask a customer to transfer funds between accounts in order to prevent fraud. Hang up and call your bank at the phone number listed on the back of your bank-issued debit card or on the bank’s official website if you must provide information over the phone.

In-App Notifications: When consumers send money using Zelle within their mobile or online banking experience, they are sending money directly from their bank account to another person’s bank account, typically within minutes when both users are already enrolled.

When sending money there is a final prompt requiring the sender to confirm the mobile number or email address being used and that it belongs to the intended recipient. This prompt provides the first name of the person who the mobile number or email is enrolled to and an alert that the payment cannot be cancelled once sent.

Consumer education: Zelle is working to address an acute need for financial education. Through our Pay It Safe initiatives, we have partnered with organizations to offer free financial education to consumers through modern banking courses and consumer protection resources.

Through a strategic partnership with EVERFI — the leading social impact education technology company — we have reached more than 60k students in 47 states. Results show that high school students achieved a 39% average knowledge gain after taking the Zelle Money Moves: Modern Banking & Identity Protection course.

In addition, we are working with Cybercrime Support Network to spread awareness and educate consumers and small businesses on avoiding financial fraud and scams.”